JohnFScott

Investment thesis

Starbucks (NASDAQ:SBUX) holds a dominant position in the growing and attractive coffee market. Yet, the company is facing significant near-term headwinds across geographies, resulting in disappointing Q2 results. This has sparked discussions among investors about whether the stock’s decline presents a buying opportunity. However, several factors may still suggest potential downside risks. These include: (1) consecutive downward revisions to short-term guidance, with EPS for FY24E now expected to be flat to low-single-digits compared to the +15% to +20% in Q1; (2) significant EPS miss of -15% in Q2, the worst performance in the recent past; and (3) management comments that the near-term will remain choppy across geographies, with expectations of Q3 results still posing challenges. While corrective actions are being taken, these are expected to take time to yield results, particularly given the soft macro backdrop and impact on discretionary consumption in key markets such as the US and China (comps guidance of low-single-digit decline to flat and single-digit decline, respectively). Although Starbucks’ long-term strategic plan, “Triple Shot Reinvention”, is sound, it may also require time to fully realize its benefits. Looking further ahead, I believe the brand will maintain relevance in the specialty coffee segment and unlock value in new markets. However, in the immediate future, without a clear catalyst, I believe the market will remain on the sidelines. Until investors have better visibility on progress and an improvement in the consumption environment, these factors may prevent a re-rating from materializing.

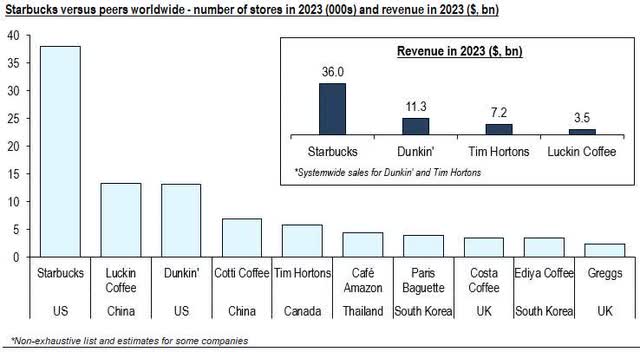

The largest retailer of specialty coffee in the world

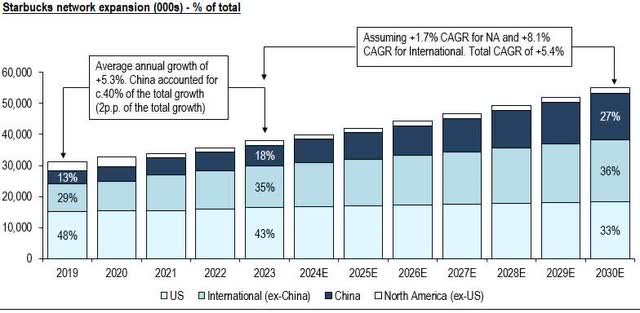

Starbucks is the largest retailer of specialty coffee in the world, offering an array of teas and assorted beverages (74% of sales), as well as a variety of food items (22% of sales) sold through company-operated stores. The company also distributes its coffee and tea products and licenses its trademarks through other channels, including licensed stores, grocery and foodservice, facilitated by a Global Alliance with Nestlé. The network encompasses 38,951 stores (52% company-operated and 48% licensed) across 86 markets, with the United States and China being the most relevant countries (43% and 18% of the network, respectively), while all other regions account for less than 5% of the total network.

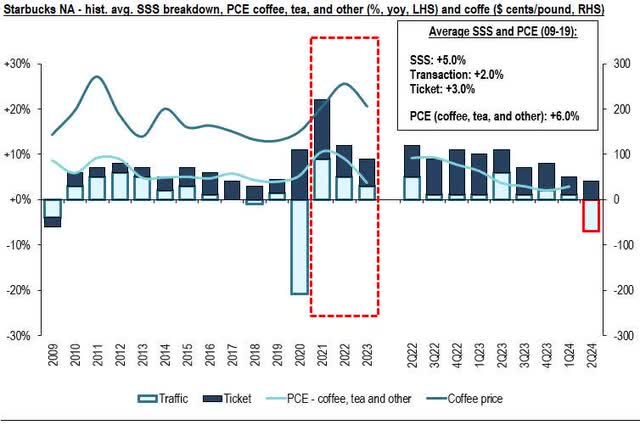

From 2010 to 2019, the company has managed to drive low-double-digit top-line growth (+10.5%), which was largely driven by the expansion of its network (+6.6%), and a balanced increase in both traffic and ticket (+2.7% and +2.4%, respectively). Moreover, its key division, North America (NA), has demonstrated a combination of pricing power and brand appeal, with pricing/mix increasing on average by +3.2% (versus an average CPI of +1.8%), while traffic increasing by +2.5%. As a result, this has contributed to sustained margin expansion, with the gross margin in the NA division expanding by approximately +1,000bps during the period (+910bps at the consolidated level). As a result, Starbucks improved its return on invested capital over time, from c.29% in 2010 to c.34% in 2023 (accounting for operating leases starting in 2019). This improvement was driven by enhanced profitability (from 7.8% to 11.6%) and efficiency (3.7X to 2.9X), the latter partly impacted by COVID and the lower maturity curve of new stores added to the network.

Image created by author with company data and own estimates Image created by author with data from company

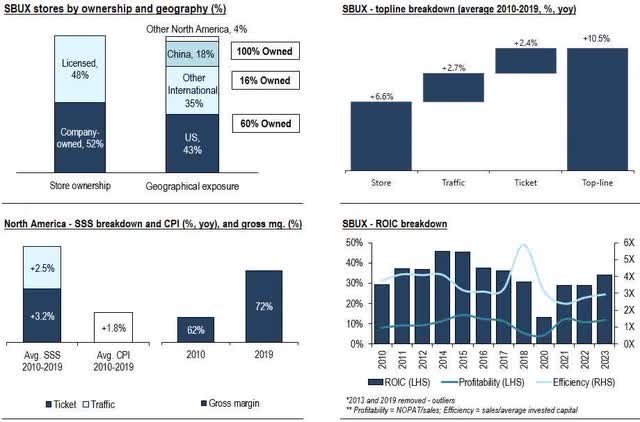

EPS miss in 2Q24 evidenced near-term headwinds

Starbucks reported weak 2Q24 results, with an EPS miss of -15%, the worst performance in the recent past. Management attributed this downturn to several factors: (1) a slowdown in U.S. same-store sales; (2) choppy recovery in China; and (3) softness in the operations in the Middle East. Consequently, the company revised its FY24E guidance for the third consecutive time, now anticipating flat to low-single-digit earnings growth compared to the previous +15% to +20% in 1Q24.

Furthermore, the outlook for FY23-25E has become gradually uncertain, with consensus estimates now pointing to median top-line and EPS growth below the current guidance (+7.3% and +12.8% versus the ranges of +10% to +12% and +15% to +20%, respectively). Following the earnings result, the average consensus EPS for the next three fiscal years declined by -13%, with the consensus shifting towards a more cautious stance, which is reflected in an increased proportion of “Neutral” ratings. Moreover, Howard Schultz, former chief of Starbucks, emphasized that the company’s remedy should start domestically (US), which he suggested largely contributed to the underperformance.

As a result, the stock was down -16% during the earnings release and is now down -18% YTD, which compares to +12% for the SP&500 and +2% for the S&P500 Consumer Discretionary sector.

Image created by author with data from company and Seeking Alpha Image created by author with data from Seeking Alpha

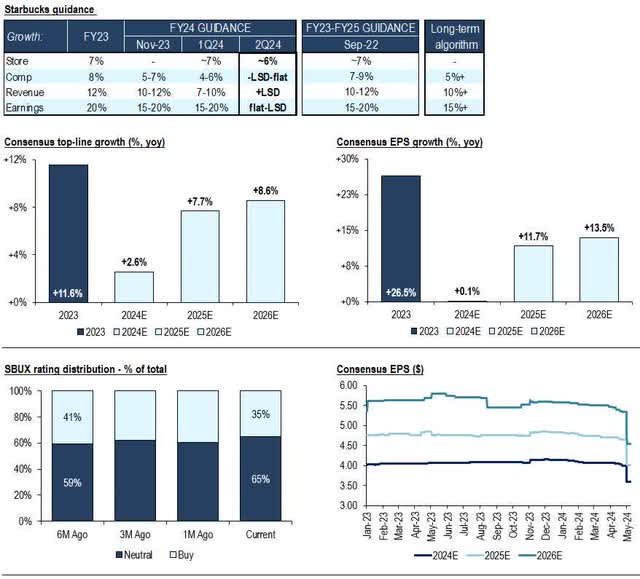

This has raised concerns about Starbucks’ competitive edge in the U.S.

The weak Q2 results led investors to question the sustainability of Starbucks’ competitive edge, particularly in the US, given the lackluster performance in the region. Moreover, consecutive price increases raised concerns whether the company’s products had become too expensive for the average consumer, especially amidst a period of soft consumption and persistent inflation in food away from home (+4.1% yoy in April), contrasted with moderating inflation in food at home (+1.1% yoy in April). This could potentially dampen the consumption of discretionary items outside home.

As a result of the pandemic, commodity prices experienced a significant rise, with coffee prices following suit, increasing by +36% yoy in 2021 (averaging +14% yoy from 2021 to 2023). In tandem, food away from home inflation also surged, increasing by an average of +7% yoy during the same period. Consequently, Starbucks increased its pricing/mix during the period (averaging +9% yoy from 2021 to 2023) to mitigate the impact of higher input costs. This market dynamic benefited for most of the period until mid/end of 2021, as robust savings rates and real disposable income supported consumption of discretionary items. Personal consumption expenditures on coffee/tea rose by +11% yoy in 2021, and in parallel, Starbucks traffic increased by an average of +7% yoy (also benefiting from a lower comparison base). However, with persistent inflationary pressures and dwindling savings rates, the burden of price hikes began to weigh more heavily on consumers. Consequently, traffic trends moderated towards the end of 2021, resulting in a significant decline of -7% yoy (the largest decline in a single quarter over the recent past) in 2Q24. This aligns with management comments in Q2, saying that

“many customers are being more exacting about where and how they choose to spend their money, particularly with stimulus savings mostly spent”.

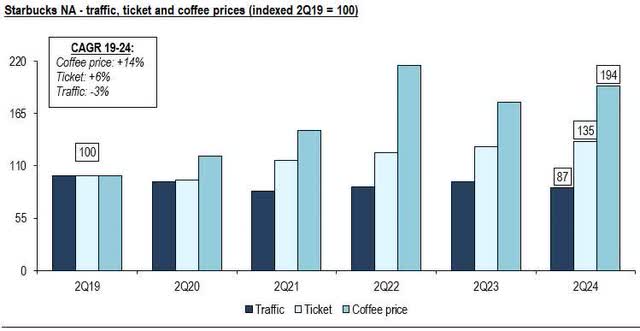

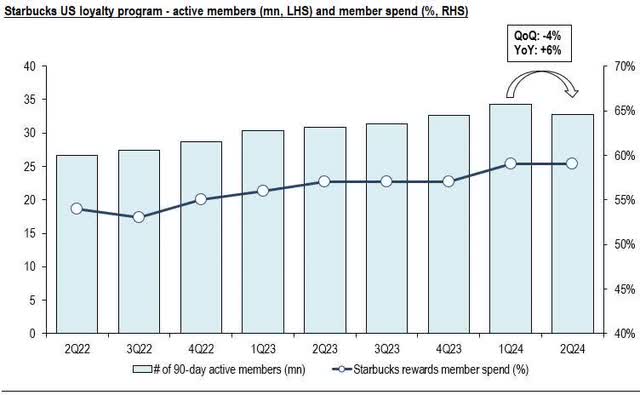

In an exercise, assuming 2Q19 as a pre-pandemic baseline, we observe that from the initial period until 2Q24, Starbucks increased prices at a CAGR19-24 of +6%, which compares to a +14% CAGR19-24 for coffee prices. Disregarding the impact of hedges, inventory build-up, and differences in the benchmark used in the analysis, it may suggest that the company still needs to catch up in pricing. Furthermore, the analysis also suggests that traffic remains ~-13% below the pre-pandemic baseline, although it was in recovery until before the 2Q24, when the significant decline occurred. Notably, however, data from Starbucks’ US loyalty program reveals that despite a -4% qoq decline in the number of 90-day active members, there was a +6% yoy increase. Additionally, the percentage of spend by Starbucks rewards (SR) members remained resilient.

This aligns with management’s comment in 2Q24 that the decline versus the previous quarter was largely due to “more occasional members”, a more cautious consumer who represents the lower end of the 90-day active member benchmark, and that

“the decline in occasional customers was most noticeable in the afternoons and evenings”.

Yet, over 60% of the morning business in the US comes from the Starbucks Rewards members and approximately half of the Starbucks business happens in the mornings, hence suggesting that despite the price increases, “more loyal” users are still frequenting Starbucks locations at peak times. In fact, management commented that they aim to unlock peak capacity during morning demand, given Starbucks Rewards members overwhelmingly order through the Starbucks app, but often opt not to complete their orders due to long wait times or product availability issues. This reinforces the perspective that Starbucks may not be encountering an issue with brand appeal, at least among its more loyal customer base, as demand within this demographic seems to persist.

Image created by author with data from U.S. Bureau of Labor Statistics and U.S. Bureau of Economic Analysis Image created by author with data from company, U.S. Bureau of Labor Statistics, U.S. Bureau of Economic Analysis, and International Monetary Fund Image created by author with company data and International Monetary Fund Image created by author with company data

While competition in China has intensified

During the quarter, management commented that macro pressures resulted in traffic contraction in the quarter, while performance was also impacted by a decline in the occasional customer in the afternoons and evenings. Yet, management commented in Q2 that:

“Starbucks remains the Chinese consumers’ first choice and away from home coffee across city tier and age group. Our morning daypart in China registered growth fueled by coffee routines we’ve cultivated. Mornings are now larger than before the pandemic”.

At a broader level, Starbucks is facing stiff competition in China amidst a sluggish macro recovery. The competition is multifaceted, with new entrants, local peers changing their business models to fuel strong network expansion, increasing segmentation, and an intensifying promotional landscape.

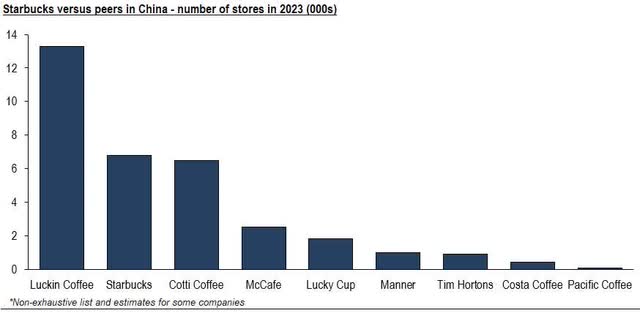

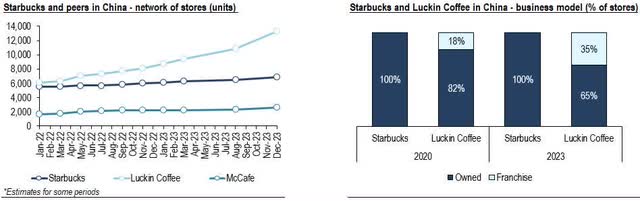

Although Starbucks holds a leading position in the coffee retail, it ranked second in China in 2023 in terms of unit count (current with 7,093 stores in the country), with Luckin Coffee (OTCPK:LKNCY) as the market leader with 18,590 stores and Cotti Coffee, founded by two former Luckin executives, quickly gaining ground with 6,000-7,000 stores. Local brands have partly achieved this significant store expansion through the concept of “partnership stores” (similar to a franchised model), enabling rapid growth. In contrast, foreign operators have predominantly pursued a company-owned business model (i.e., 100% of Starbucks in China are company-owned), which is more capital intensive and slows the potential expansion. As reference, Luckin Coffee transitioned from 82% company-owned stores in 2020 to 65% in 2023, indicating a shift towards franchising. Cotti Coffee, established in 2022, has also rapidly expanded its network to approximately c.7,000 stores, leveraging the franchising model.

Image created by author with company data and own estimates Image created by author with company data and own estimates

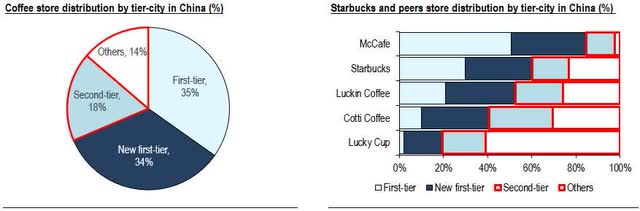

Additionally, foreign companies have traditionally relied on their expansion efforts in China’s first-tier cities. However, as competition increased, there’s a gradual shift towards smaller/inner cities, often called second/third-tier cities across the country. Despite this trend, first/new-first-tier regions still account for the majority of coffee store network in China, accounting for approximately 69% of the total, with over 60% of Starbucks stores located in these areas. In contrast, local brands exhibit a somewhat different distribution of store network, with Luckin Coffee having approximately 52% of its stores in first-tier cities and Cotti Coffee with 41%.

Notably, Starbucks CEO Laxman Narasimhan commented during the 2Q24 earnings result that one of the key elements of the strategy in China is to

“increase the percentage of new store openings in lower-tier markets and new county cities where we see stronger new store economics”.

This strategy may become increasingly important moving forward, as early market entrants in lower-tier cities may establish a presence that serves as a barrier to entry due to the economics supporting fewer stores, consequently reducing competition. This aligns with the CEO comments that they see in lower-tier markets and new county cities stronger new store economics.

Image created by author with data from Zhaimen Canyan and Avery Consulting

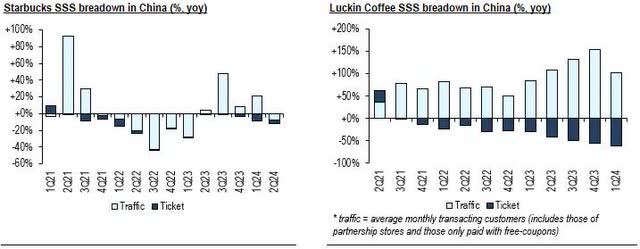

Competition in the Chinese coffee market has also been spurred by company segmentation and a highly promotional environment. Starbucks maintains a focus on premium products, supported by an aspirational approach and an emphasis on guest experience. In contrast, Luckin Coffee has relied on promotions and continuous innovation, while Cotti Coffee targets a younger audience with low-price points, leveraging social media.

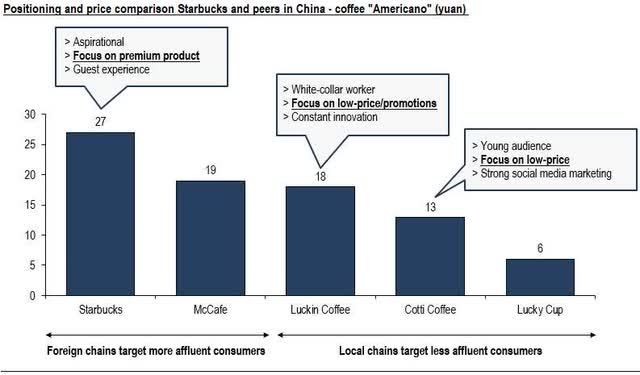

As a result, pricing strategies among the main peers vary significantly. Starbucks positions itself at the top-end, catering more affluent consumers, while local chains adopt a lower pricing strategy to target a broader, more price-sensitive audience. This dynamic has intensified competition within the coffee market in China. For instance, comparing same-store data between Starbucks and Luckin Coffee since the beginning of 2021, indicates that the local chain has consistently driven more sustained traffic than Starbucks. Yet, this growth has come at the expense of ticket, underscoring the promotional environment in the region. In fact, Starbucks CEO also mentioned in Q2 that they are seeing fierce competition among value players, and that growth is taking place in the mass coffee and tea segment areas of the China business. Despite this, Starbucks chooses not to participate in this segment, as they believe it could harm their premium brand, where they perceive significant competitive advantages, especially once the operating environment normalizes.

Image created by author with data from Daxue Consulting and Ele.me mid-2023 Image created by author with company data

Management is implementing short-term corrective actions

In light of the events, management discussed in Q2 that despite ongoing cautious consumer behavior, which may persist longer, they remain confident that they can implement corrective measures to address near-term headwinds, particularly in the US business:

- First, according to management, Starbucks is currently having a challenge meeting their peak morning demand. Moreover, they mentioned in Q2 that

“more than 60% of our morning business in the U.S. comes from Starbucks Rewards members who overwhelmingly order with a Starbucks app”, and that “customers often place items in their carts but sometimes opt not to complete their orders due to long wait times or product availability issues”.

As a result, they commented that they are working with the Toyota Production System Support Center to help unlock peak capacity during the morning demand, and are increasing investments in supply chain to improve product availability. Additionally, they are piloting overnight service, doubling business during traditionally closed hours, and targeting a $2 billion business over the next five years. Lastly, management is also looking to enhance offerings during weekends as they see the potential to enhance guest experience, especially within families and kids.

- Secondly, they are ramping up execution to help drive more frequent product innovations, both within the core and beyond. As per management,

“63% of our beverage sales in the quarter were cold, up 1% from a year ago driven by innovation”.

In my view, this could also help drive engagement with the more occasional customer. In Q2, they discussed a strong pipeline of innovation for the summer and mentioned efforts to halve their average product development cycle, currently ranging 12 to 18 months.

- Thirdly, management also commented on back-end work within the Starbucks app as a way to enhance connection with the more occasional and non-Starbucks Rewards customers. This would be achieved by offering more value options for this demographic within the Starbucks app. As such, beginning in May, they mentioned that they are introducing exclusive offers in the app. Moreover, in July, they mentioned that

“will begin opening the Starbucks app for all while making MOP available in more places outside our app”.

Consequently, this should also help showcase the value they offer and increase brand awareness.

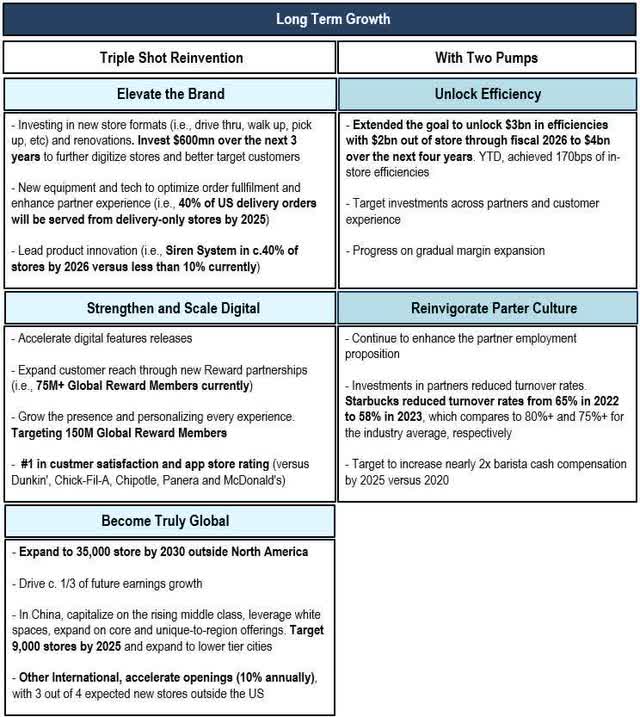

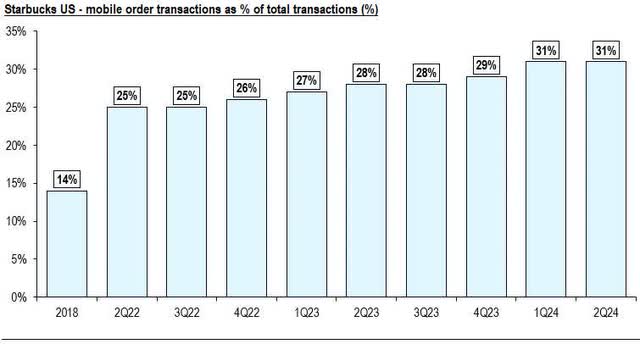

Advancing in their “Triple Shot Reinvention” long-term strategic plan

Management announced its Reinvention Strategic plan in Q2 of FY22, with subsequent updates made in November 2023. This multifaceted plan targets three core areas: (1) elevating the brand; (2) strengthening and scaling digital; and (3) becoming a truly global brand. Moreover, the plan is anchored by the “Two Pumps” strategy, which emphasizes efficiencies and revitalizes partner culture. As a result, the CEO Laxman Narasimhan underwent a 6-month immersion period to become fully engrained in the company’s culture prior to assuming the role in April 2023.

Image created by author with data from Starbucks Investor Update 2024 Proxy

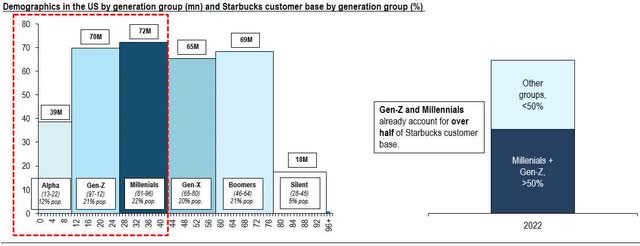

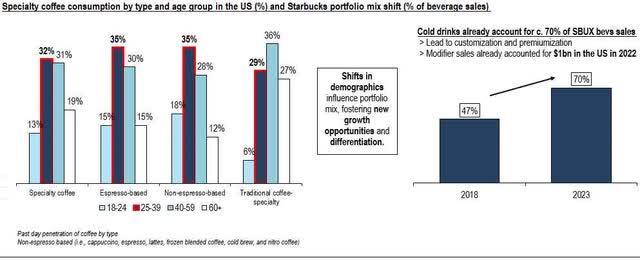

It’s worth noting that Starbucks is undergoing significant changes in its customer demographics. As of 2022, Millennials and Gen-Z accounted for over 50% of the customer base in the US. In tandem, this trend aligns with broader demographic changes in the country, where these generations already represent the largest proportion of the population (c. 180mn people). In turn, this demographic is expected to gradually increase as older generations mature, a trend that can help drive new beverage categories given the preference for innovation within coffee beverages, particularly cold drinks. As a result, following the COVID, there has been a noticeable shift in Starbuck’s product mix toward cold beverages, which accounted for ~70% of the product mix in 2023, compared to ~47% in 2018. This shift has created new opportunities for customization, with modifier sales reaching $1bn in the US in 2022. Moreover, there’s been a change in how transactions are conducted, with an increase in Mobile Order & Pay (MOP) as a percentage of transactions, which increased from 14% in 2018 to 31% in 2Q24. In my view, this trend should contribute to further enhance engagement with customers, and help Starbucks achieve their target of 150mn global reward members. Also, opening the Starbucks app for all users in July, addresses the existing gap in reaching non-Starbucks Rewards members. This strategy enhances the value proposition for occasional customers and enhances the ability to convert them into SR members.

Image created by author with data from the U.S. Census Bureau, Pew Research Center, and company data Image create by author with data from Starbucks 2024 Investor Day Proxy, Starbucks 2022 Investor Day, and National Coffee Association Report 2022 Image created by author with company data

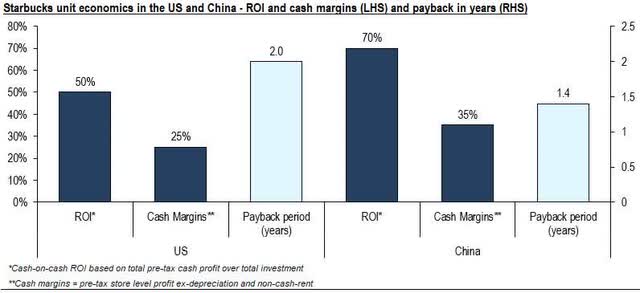

As previously highlighted, store expansion has been a key driver of top-line growth over the years. Looking ahead, Starbucks’ long-term guidance still indicates that roughly half of the projected top-line growth of 10%+ will come from new units. Moreover, management expects reaching 55,000 stores by FY30E (versus 38,038 in FY23), with 35,000 units located outside North America (versus 20,228 in FY23). Using FY23 as a baseline, this translates into a CAGR of +5.4% for the total network,+1.7% for the North America division, and +8.1% for the International division. Furthermore, while the long-term unit expansion potential in China is not entirely clear, the current path indicates that the country will eventually close the gap with the US. The current short-term guidance suggests ~+12% unit growth in China, which is above the +5.4% long-term growth for the total network. In addition, management sees a vast white space opportunity in the country, with roughly 3,000 county-level cities versus 800+ coverage in FY23. Assuming the short-term guidance for growth in China, the country would account for 27% of the total network by FY30E (versus 33% for the US), up from 18% in FY23. Additionally, despite the current macro backdrop in the US and China, management remains confident that, alongside the robust pipeline of new store openings, Starbucks will maintain stores with strong unit economics. These stores, characterized by high average unit volumes (AUVs) and return on investment (ROI) and cash margins, are expected to continue generating strong returns and high incrementally.

Image created by author with data from Starbucks Investor Update 2024 Proxy and own estimates Image created by author with data from Starbucks 2022/2020 Investor Day

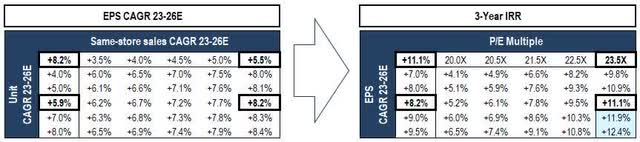

Valuation: SBUX shares are trading at a large discount

Starbucks operates in the consumer discretionary industry, which is highly cyclical. As a result, a significant percentage of value lies in perpetuity (70%+ of the valuation). The easing cycle of monetary policy to tackle the negative effects of COVID on the macro front has distorted historical data. Lower interest rates contributed to higher valuation and multiples, leading to periods of erratic peaks in the time series. In order to adjust for that, I opted to consider the median of the last three years to capture more normalized valuation levels. Consequently, based on EV/EBITDA (LTM) and P/E (LTM) multiples, SBUX shares are trading at 13.9X and 20.8X, respectively. This compares to historical averages of 18.7X and 27.3X (-26%/-24% discount, respectively), and even falls below -1 standard deviation at 16.2X and 22.6X (-14%/-8%, respectively).

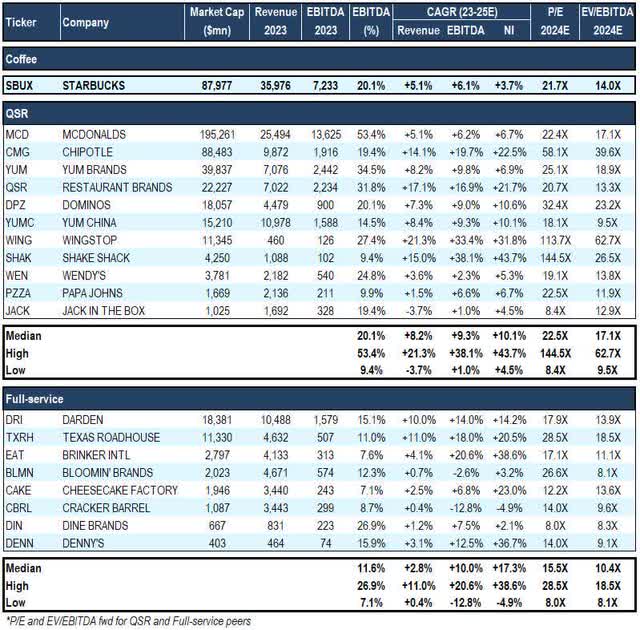

Image created by author with data from FactSet and own estimates

Alternatively, Starbucks shares trade at a discount when compared to peers across various segments of the restaurant industry. In this analysis, I compared Starbucks’ operating metrics and multiples to those of companies within the Quick Service Restaurant (QSR) industry (McDonald’s (MCD), Chipotle (CMG), YUM Brands (YUM), Restaurant Brands (QSR), Domino’s (DPZ), Yum! China (YUMC), Wingstop (WING), Shake Shack (SHAK), Wendy’s (WEN), Papa John’s (PZZA), and Jack in the Box (JACK)) and companies in the full-service restaurant industry (Darden (DRI), Texas Roadhouse (TXRH), Brinker International (EAT), Bloomin’ Brands (BLMN), The Cheesecake Factory (CAKE), Cracker Barrel (CBRL), Dine Brands (DIN), and Denny’s (DENN)). When compared against peers in the QSR industry, Starbucks is trading below the median on both 2024E P/E and EV/EBITDA (-4% and -18%, respectively). Despite ranking within the median of the group in terms of margins, Starbucks’ growth expectations for top-line, operating income, and net income are below the median for peers, which can partly explain the multiple discount. When compared to full-service peers, Starbucks trades at a premium on both 2024E P/E and EV/EBITDA multiples, notwithstanding lower growth expectations. The difference versus the full peer group may be partially explained by Starbucks’ structurally higher margin profile (c.+850bps margin versus the group’s median), and to a certain extent, its global scale (+2.4X the revenue of the largest peer in the group).

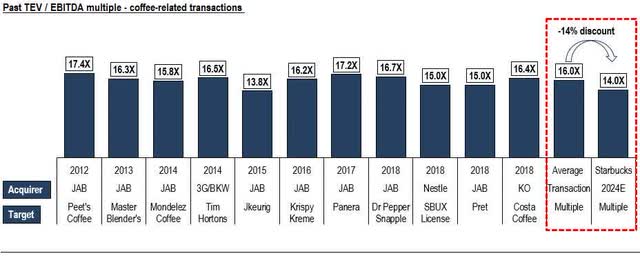

Furthermore, when analyzing multiples from the perspective of coffee-related transactions before the pandemic, a sample of eleven transactions spanning from 2012 to 2018 showed that transactions multiples, based on TEV/EBITDA, ranged from 13.8X to 17.4X, with an average of 16.0X. This contrasts with Starbucks’ projected 2024E EV/EBITDA of 14.0X, representing a -14% discount. While these multiples may imply a transaction premium, they still indicate a 14% premium compared to Starbucks’ current trading multiple.

With that, after conducting these several analyses, it becomes evident that SBUX shares are trading at a discount across different perspectives.

Image created by author with data from Seeking Alpha and Factset Image created by author with data from public filings and P. Square estimates

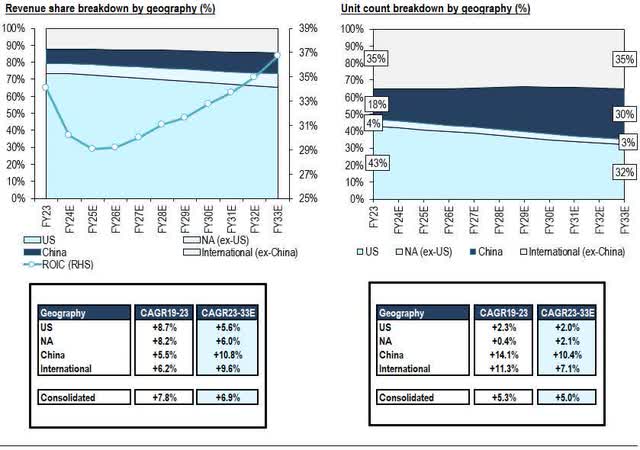

Methodology incorporates DCF and multiple valuation

In my Starbucks valuation methodology, I considered a DCF (10-year forecast) and exit EV/EBITDA multiple to account for expectations of growth. The methodology encompasses a blend where I assigned 50% weigh on the output of the DCF and 50% weight on the output of the multiple. Regarding the DCF, my model incorporates a perpetuity growth rate of +4.0% (combination of CPI in the US and real GDP growth), and a cost of capital of 8.5% (9.8% cost of equity, 3.8% cost of debt, 30.0% tax rate, and 4.5% risk-free rate). For the multiple valuation, I decided to use an exit EV/EBITDA multiple of 15.0X, which is a -20% discount versus the median of the last three years in order to adjust for lower growth in the future. The DCF estimates in FY33E also imply an EV/EBITDA of 15.0X, which is fully aligned with the multiple valuation portion of the methodology. With that, the model indicates a 12-month price of $90.00, which translates into a +16% potential upside versus the current price of Starbucks shares (as of May 17).

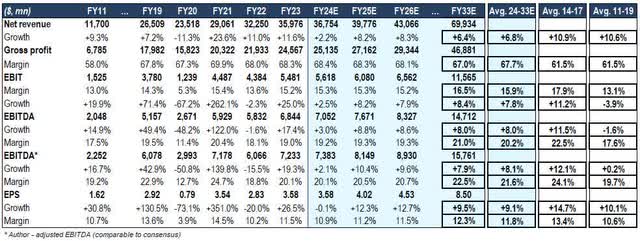

The DCF model aims to capture a scenario where estimates fall below the long-term guidance for both top-line (10%+) and EPS (15%+), reflecting a more conservative outlook due to near-term uncertainties and consecutive changes in medium-term guidance. This situation somewhat limits the visibility of the long-term trajectory for top-line and margins. The model estimates top-line growing at a CAGR23-33E of +6.9%, with some operating leverage reflected in EBIT growth at +7.8%, and EPS at +9.0% (including both earnings growth and share buybacks). Regarding margins, the model incorporates a decline in gross margins compared to the FY23 baseline of 68.3%, with gross margin projected to reach 67.0% by FY33E to reflect a more competitive landscape, including new entrants (-80bps versus 2019). The margin expansion is mainly driven by operating leverage and efficiency improvements pursued by management, with EBIT margin expected to reach 16.5% by FY33E, which is +130bps above the FY23 baseline (+220bps versus FY19). In terms of top-line, the CAGR23-33E at +6.9% contrasts with a CAGR19-23 of +7.8%, which is largely due to stronger growth in China (+10.8%) and International markets (+9.6%), but lower growth in NA (+6.0%). This reflects the untapped potential outside the US (+5.6%), primarily driven by robust unit growth in the coming years. As a result, while the model accounts for guidance regarding unit expansion at the consolidated level (~+5.0%), the distribution across the regions is expected to gradually shift, with China and International markets catching up with the US.

Moreover, the estimates for FY24-26E closely align the consensus, with top-line and EPS essentially fully aligned, while average EBITDA being +0.9% above. Also, the specialty coffee industry is projected to sustain high-single-digit to low-teen growth in the foreseeable future. Therefore, the estimates at the consolidated level consider some degree of market share loss, while also factoring in a more competitive landscape over the long-term.

Image created by author with company data and own estimates Image created by author with company data and own estimates Image created by author with company data and own estimates

Valuation range shows downside risks

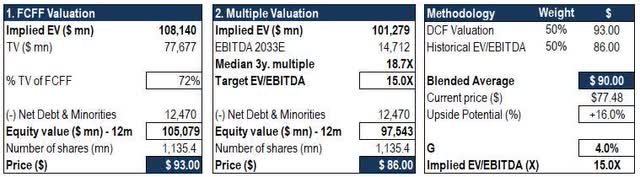

Both Starbucks and the S&P500 have exhibited an average annual return of 11% over the past decade. To gauge the downside risk of the model’s estimates, I conducted a sensitivity analysis on key estimates within the next three years, aiming to assess the sensitivity of Starbucks’ return compared to that of the S&P500. All else equal, assuming a CAGR23-26E of +5.9% for unit growth and +5.5% for same-store sales, the projected CAGR23-26E EPS would be +8.2%. With a P/E multiple of 23.5X (-14% discount versus the median for the last three years), this equates to an annual return of +11.1%, closely mirroring the historical market return. Thus, any EPS growth below the +8.2% coupled with a P/E multiple of 23.5X or lower would result in a return below the market’s historical performance, assuming the market delivers its historical return. Given the successive downward revisions to short-term guidance, a scenario with an EPS CAGR23-26E below +8.2% may appear feasible, while the uncertain near-term outlook may limit any multiple re-rating.

With that, despite the 12-month upside potential of +16.0%, without a clear catalyst in the near-term, the market may remain on the sidelines until there is a normalization of the operating environment. Management’s indication of margin pressure easing only by Q4 adds to the uncertainty, with the potential risk for additional earnings revisions also possible. It might be prudent to wait until after Q3, when better visibility could emerge, before considering this investment opportunity.

Image created by author with company data and own estimates

Risks

A key upside risk concerns the potential for management to exceed expectations with their short-term corrective measures, resulting in stronger growth and margins, ahead of consensus expectations. Moreover, considering Starbucks has a solid free cash flow position, there are upside risks if the market decides to incorporate a lower cost of capital in the foreseeable future. This would be the result of the easing cycle of monetary policy. On the other hand, a persistent inflationary macro backdrop could result in sustained softness in consumer spending, which in turn would slow the recovery process and present downside risks. This scenario might prompt consumers to gravitate towards cheaper alternatives, resulting in potential market share loss. Moreover, consecutive price increases could impact brand reputation and lead to customer attrition once the operating environment normalizes. The company is also undergoing boycotts in the Middle East region as a result of comments related to the Israel-Hamas conflict. Although this region represents a small portion of their overall business, negative impacts on brand image and results may persist, while it could also extend to other geographies. Furthermore, the company is encountering customer pushback over its legal disputes with Starbucks Workers United and the National Labor Relations Board. These conflicts could further tarnish the company’s reputation and impact negatively the operating results.

Concluding thoughts

The current macro headwinds highlighted in this note should continue to pose challenges for Starbucks amidst its strategy overhaul. While management is implementing corrective measures and undergoing significant changes to unlock long-term potential, the results of these efforts are expected to take time to materialize. Although the stock is trading near its 52-week lows, investors are questioning whether now is the opportune moment to invest in the stock. While I believe that the company will remain relevant in the specialty coffee industry in the long-term, current trends may still present some downside risks, suggesting that a more favorable opportunity to consider investing in the stock may arise in the future. Consequently, without a clear catalyst in the near-term and with expectations of ongoing short-term challenges, the market may remain cautious. These factors may prevent any immediate re-rating from materializing.