Maksym Kapliuk/iStock via Getty Images

U.K. based international bank Standard Chartered (OTCPK:SCBFF) is a share I let go from my portfolio last year. I do not see any fundamental problems with the bank (which has a long history and is solidly in the black) but see no compelling reason to invest even at the current valuation. In the banking sector, I think there are other banks with a more focused, proven strategy and consistent delivery that also trade at cheap-looking valuations right now.

I last covered the bank with my September 2023 note Standard Chartered: Doing Well But No Bargain. Since then, the shares have fallen 19%. The current valuation looks undemanding but given the questionable outlook for banking in the next several years depending on the global economic performance, I maintain my “sell” rating.

Global Footprint and Developing Markets Expertise

With a long history of trading in a wide variety of developing markets, Standard Chartered is well-positioned in frontier markets where it has widespread brand recognition and long-established operations.

I see its key strengths as a well-known brand, geographic reach, existing customer base and also juicy profit margins partly thanks to its cherry-picking of markets in which to operate.

Uneven Track Record of Delivery

The diversification of the company’s businesses is also a weakness in my opinion as it reduces the critical mass that Standard Chartered has in many markets. In the first half, for example, the return on tangible equity was 12.1%. Compare that to the 16.6% achieved by UK-focused peer Lloyds. That is just a snapshot and inevitably reflects a variety of factors, but running a highly regulated businesses on a medium scale in lots of markets inevitably involves higher costs than a large business in just one or two markets, although on the upside it could provide some insulation against a market-specific downturn.

My bigger issue with Standard Chartered is its track record of never quite living up to its potential. The conceptual sell of a bank with wide developing markets expertise has existed for decades already. Yet the shares are 3% lower than they were five years ago and around 30% below where they stood at the start of 2000.

I do not see that as mere misfortune but get the feeling that managing a large organisation spread across a range of markets, some of them challenging, is prone to rolling failure or disappointment somewhere in its global reach, sucking up management time on firefighting rather than really delivering on a powerful commercial strategy at scale. Witness competitors like Citi (C) rolling up sizeable parts of their global operations and indeed Standard Chartered in 2022 exited five African markets and reduced its footprint in two others (despite its tagline boasting that the bank is “here for good”: clearly, in some cases, it isn’t).

Bull Factors

Simply doing what it does as a bank with its existing customer base is in fact a sizeable opportunity and I expect it to remain that way. While I am not especially excited by Standard Chartered, the fact is that last year it reported post-tax profits of $2.9bn, on revenue of $16.3bn. That is an 18% net profit margin. This is a lucrative business with a long runway and simply not messing that up is already the key opportunity in my opinion.

I think there is a sizeable mobile money opportunity in many of the markets that Standard Chartered services. For now, though, I doubt it or indeed many other banks are best-placed to exploit it. Instead, in Africa for example, the running seems to be being made by mobile providers like Airtel Africa.

China might be an opportunity in the way that one could have said at various points in the past century that China might be an opportunity for Standard Chartered. The Chartered Bank that was a forerunner of the current company opened a branch in Shanghai in 1858 and while the banking environment has ebbed and flowed in China since then, cracking the China market is hardly a novel idea in general or for Standard Chartered specifically. China is a strategic priority for the bank right now and in theory its long presence and local expertise work to its advantage, while I reckon its non-local status work against it (to wit, the travails of HSBC (HSBC) in recent years. But I think the question when assessing how big this opportunity is what right to win Standard Chartered has in China. I do not see it as having meaningful competitive advantages over international rivals like HSBC and arguably it is at a disadvantage to state-owned local banks.

Some Risks

In line with other banks, both UK-based and those from other countries, I see the main risk right now for Standard Chartered as being an economic slowdown driving up bad loans and hurting profits.

For now, the evidence on this is mixed and opinions vary widely. But with most developing economies reporting slow or negative (Germany) growth, interest rates higher than consumers have been used to, geopolitical tensions aplenty and bankruptcies rising rapidly, I remain bearish on the global economic outlook. That may or may not come from within Standard Chartered’s markets but ultimately I think it would affect them through contagion. If the U.S. goes into recession, it could only be bad for the Hong Kong economy for example. Hong Kong itself – a key Standard Chartered market – has already been struggling to recover from a challenging few years. While its GDP grew 3.2% last year, that was below expectations. My own visit to Hong Kong this month revealed clear signs of reversals in part of the property market, with some rents reduced and properties sitting on the market unrented in some cases for months.

In its third quarter results, there was some evidence suggesting that this is impacting Standard Chartered. The bank reported a credit impairment charge of $294m, 27% higher than in the prior year quarter. That included a China Commercial Real Estate (CRE) charge of $186m. With the Chinese property market continuing to be at risk of further defaults (the recent collapse of Chinese developer Evergrande (OTCPK:EGRNQ) illustrates this), I see an ongoing risk from defaults.

Its China exposure is also a risk for Standard Chartered in my view. “Seizing the China Opportunity” is one of the bank’s strategic aims. The company remains upbeat on this and at the half-year mark said, “Our leading indicators this year support this optimism with new to bank affluent client onboarding being double last year’s level in China and three times higher in Hong Kong.”

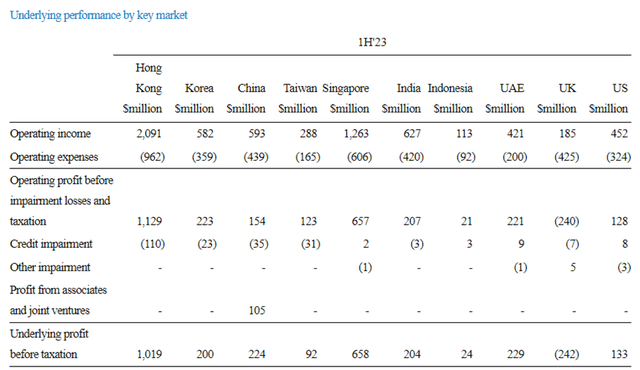

Asia is by far the company’s profit driver, generating 83% of underlying pre-tax profit in the first half. Within that, though, China is far smaller than Hong Kong and Singapore when it came to operating income – and with less attractive economics due to higher operating expenses relative to operating income.

Company interim results announcement

Valuation

Trading on a P/E ratio of 7 and a price-to-book ratio of 0.45, the company definitely appears to be cheap at first glance.

Having said that, Standard Chartered has looked cheap before, only to disappoint (though it is up 80% from its September 2020 price).

Given the move down in price since my last article on the name I see an argument for moving from a “sell” to “hold” rating. However, ongoing uncertainty in the short-to medium-term outlook for the banking sector means I think things could get worse from here. So I maintain my “sell” rating.

However, there are a number of possible upsides that could prove me wrong in the course of time. One is if the global economy does not perform as weakly as I expect over the next two or three years. I think that would lift banking stocks in general, including Standard Chartered. Similarly I think concerns about the China property market are weighing on the share price but if that market looks set to return to better health it could benefit Standard Chartered shares.

Conclusion

Standard Chartered is highly profitable and trades on a low multiple of earnings. its price-to-book value ratio is also attractive.

Long experience in international markets and a current strategy focusing on that are appealing. But I do not see Standard Chartered as a best-in-class bank based on its past performance and remain concerned about how it may fare in a financial downturn.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.