Wong Yu Liang/Moment via Getty Images

By Seema Shah, Chief Global Strategist

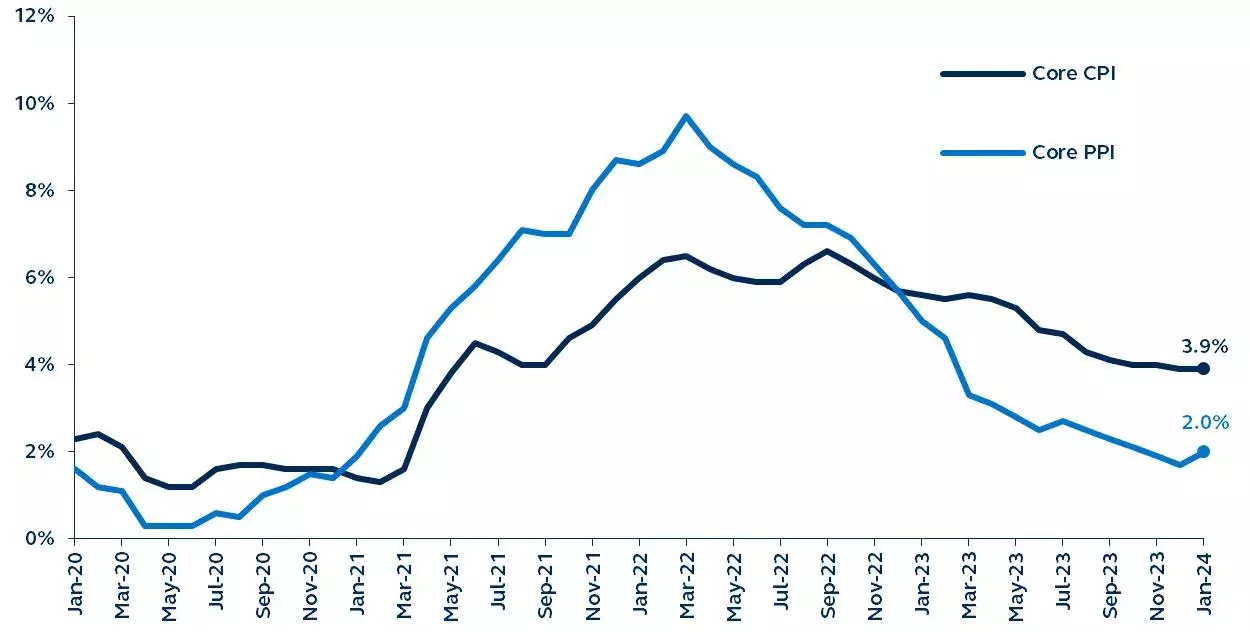

The January Consumer Price Index (CPI) and Producer Price Index (PPI) inflation reports both came in hotter than expected – underscoring the challenge of reaching the Fed’s 2% inflation target.

Policymakers have repeatedly noted the need for additional evidence of sustained disinflation before they will cut rates.

As a result, the market’s expectations are beginning to fall in line, with their anticipation of numerous rate cuts adjusting to a more moderate expectation of three to four cuts starting around mid-year.

Core Consumer Price Index and Core Producer Price Index

January 2020–present

Source: Bureau of Labor Statistics, Bloomberg, Principal Asset Management. Data as of February 16, 2024.

Since the start of 2024, markets have been gradually realizing that the Goldilocks combination of an economic soft landing and aggressive Federal Reserve (Fed) policy rate cuts is unrealistic.

The two inflation reports this week, the January Consumer Price Index (CPI) and Producer Price Index (PPI) reports, both drove home the point that inflation’s last mile toward the Fed’s 2% target will prove bumpy, frustrating, and tricky.

The latest U.S. CPI print showed that annual core inflation failed to decline, flatlining at 3.9% in January.

The sticky inflation narrative was further reinforced by the stronger-than-expected January PPI print, which was fueled by a sizable jump in the cost of services – delivering a final heavy blow to the market’s “smooth and easy” disinflation narrative.

Certainly, the continued strength of economic data – as reflected across a number of activity indicators, particularly the January jobs report – implies that price pressures are unlikely to erode rapidly.

The Fed has emphasized the need for additional evidence of sustained disinflation before they can cut policy rates. Neither of this week’s inflation reports have ticked that box.

As such, a March cut and maybe even a May cut are off the table. Market pricing has now shifted away from expecting seven to eight rate cuts this year to a more realistic three to four cuts, starting around mid-year – finally in line with our own view.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.