hocus-focus/iStock Unreleased via Getty Images

Despite a cautiously optimistic market that is energized by the AI boom, investors should maintain tremendous caution around richly valued growth stocks. I’ve moved more of my portfolio toward cash and value-oriented plays since the start of the year and locked in gains on many of my growth positions.

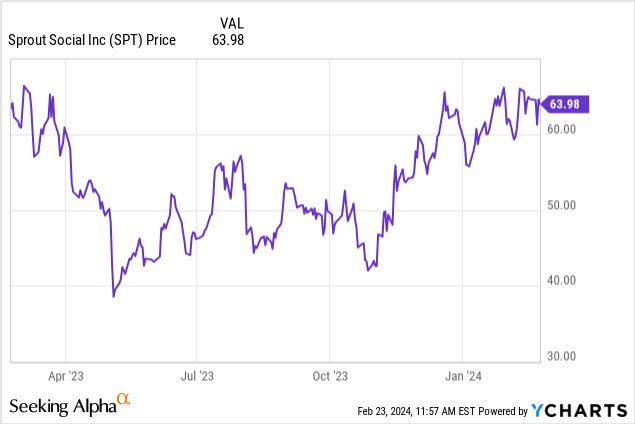

Sprout Social (NASDAQ:SPT) is one stock that bears close watching. This social media management platform has rallied more than 50% since the start of November and is up nearly 10% already this year. The company’s recent Q4 earnings print and FY24 guidance didn’t dent the company’s momentum, either.

I last wrote an article on Sprout Social with a hold rating in November, when the stock was still trading in the mid-$40s. Now, with the stock sitting materially higher and with revenue expected to decelerate somewhat heading into this year, I’m once again downgrading this position to sell and encouraging investors to lock in their gains.

There’s no doubt that Sprout Social continues to be a fast-growing player with a self-reported TAM of over $120 billion. The company has already hit profitability from a pro forma operating margin standpoint despite its small scale. We also like the fact that Sprout Social is platform-agnostic, designed to work with all social media platforms that businesses choose to advertise on.

Yet at the same time, we have to be mindful of a number of risks:

- Sprout Social is purpose-built for social media managers, and the current macro landscape is unfavorable for this niche. Companies are slashing their sales and marketing budgets – both for advertising spend as well as the G&A headcount that supports it. While social media management as a core company function will continue to see secular tailwinds, we’ll likely see retrenchment as companies tighten their belts.

- DIY competition. Sprout Social’s tools are useful but not groundbreaking. Managing social media posts and running analytics on campaign performance can be done with in-house tools, or with more general-purpose competitors like HubSpot (HUBS).

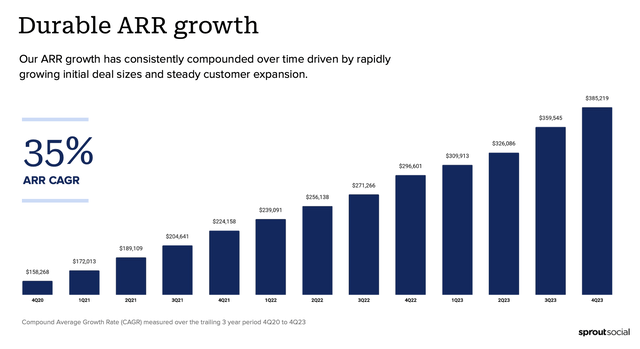

- ARR slowdown. To what extent has Sprout Social already reached saturation in some market segments? Sprout Social’s ARR adds are showing a sequential slowdown as the company scales.

By far, however, the biggest argument against investing in Sprout Social is its valuation. At current share prices near $64, Sprout Social trades at a market cap of $3.59 billion. After we net off the $98.1 million of cash against $55.0 million of debt on Sprout Social’s latest balance sheet, the company’s resulting enterprise value is $3.55 billion.

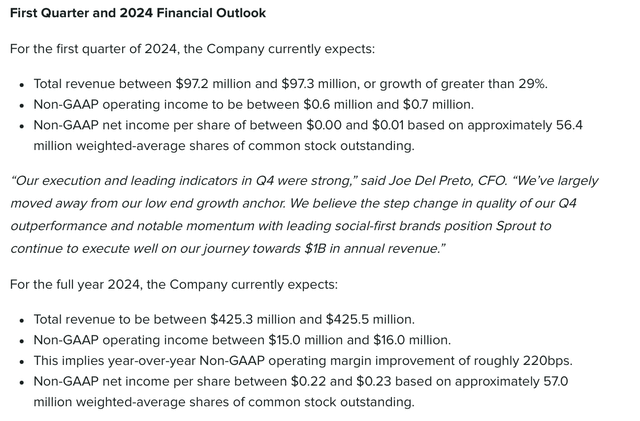

Meanwhile, for the current fiscal year FY24, Sprout Social is guiding to $425.3-$425.5 million in revenue, representing 27% y/y growth, as well as 220bps of operating margin expansion:

Sprout Social outlook (Sprout Social Q4 earnings release)

Against this revenue outlook, Sprout Social trades at 8.4x EV/FY24 revenue. In pandemic-era times, paying a high single-digit revenue multiple for a ~30% growth stock was normal – but in the era of ~5% interest rates, this multiple sticks out like a sore thumb, especially for a company that is facing an adverse macro climate (sales and marketing staffers are being laid off in droves).

Though I can’t dispute that Sprout Social has seen strong execution so far, the stock has become a commonplace “high price for good performance” type of play, and I don’t think there’s much upside left from here. Lock in gains and move to the sidelines.

Q4 download

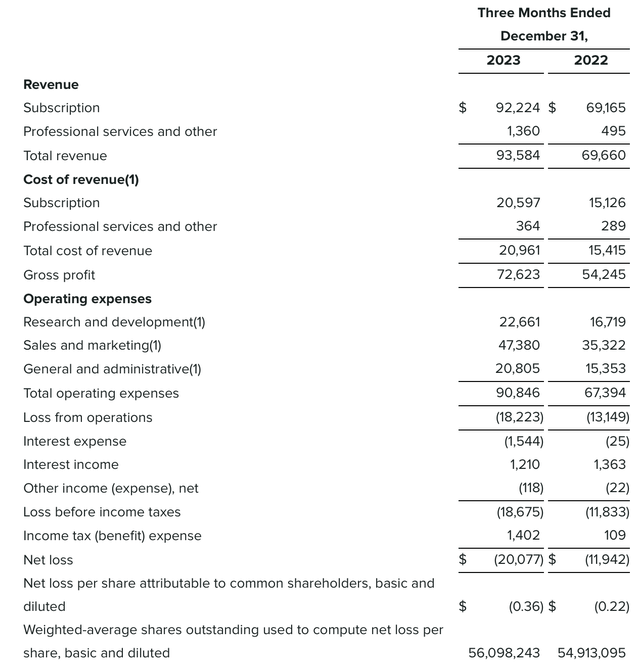

Let’s now go through Sprout Social’s latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Sprout Social Q4 results (Sprout Social Q4 earnings release)

Revenue grew 34% y/y to $93.6 million, ahead of Wall Street’s expectations of $91.0 million (+31% y/y) by a respectable three-point margin. Note that while revenue did accelerate three points versus 31% y/y growth in Q3, the company is expecting growth to decelerate back down to 29% y/y in Q1.

Management noted a strong quarter for go-to-market execution. Per CEO Justyn Howard’s remarks on the Q4 earnings call:

We’re entering 2024 with notable momentum and an expanding scope of growth opportunities. Earlier this month, we were rated as the number one best software product by G2 across the entire software industry, adding to leadership across all of the major categories in which we compete. We believe our product leadership and outstanding execution have Sprout position for a breakout year as we define category leadership.

During Q4, we saw continued record new business ACVs and total ACV growth of 43% year-over-year. We added record net new organic 10K and 50K customers, and our premium product attach rate is now 30%, with premium product ARR growing greater than 50% year-over-year. We added record net new ARR, a record increase in deferred revenue, and step change increase in RPO and CRPO.

New RPO, or total contract value bookings, was nearly 80% higher than any quarter in our history. New CRPO bookings increased nearly 3x year-over-year. Our focus strategy is yielding powerful results.”

As a reminder, Sprout Social is focused on moving upmarket to the enterprise. The company notes that low-end, “non core” ARR is now less than $800k. Conversely, single customers generating over $50k in ARR grew 37% y/y. Big customer wins in the quarter included X.com (formerly known as Twitter), Brown-Forman, DHL, and the U.S. Chamber of Commerce.

Yet we do note a sequential slowdown in ARR adds. ARR in Q4 grew 30% y/y to $385.2 million, adding $26 million in net-new ARR in the quarter: versus $33 million in Q3. We note that Q4 tends to be a big quarter for software company bookings, as customers look to exhaust their IT budgets for the year.

Sprout Socia ARR trends (Sprout Social Q4 earnings release)

From a profitability standpoint, Sprout Social’s pro forma operating margins expanded slightly to 1.8%, from 0.8% in the year-ago quarter.

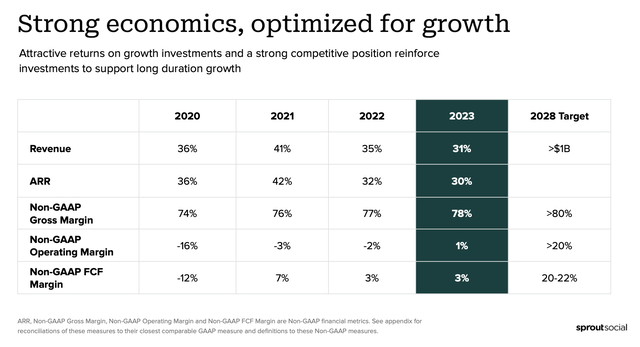

Sprout Social long-term model (Sprout Social Q4 earnings release)

As shown in the chart below, Sprout Social’s long-term growth plan calls for over $1 billion revenue by 2028 (requiring a minimum of a 24% growth CAGR through 2028) and hitting a 20%+ pro forma operating margin by then.

Key takeaways

At >8x forward revenue, I see many better opportunities to invest in the software industry (names I’m particularly enthusiastic on at the moment include Okta (OKTA), Asana (ASAN), and Appian (APPN). Sell Sprout Social here and lock in gains before they erode.