Delmaine Donson

Summary

Following my coverage of Sprinklr (NYSE:CXM), which I recommended a buy rating as I believed CXM was able to accelerate its growth back to 20% CAGR, my view was supported by the fact that CXM’s subscription billing growth and RPO metrics were indicating the underlying growth strength. This post is to provide an update on my thoughts on the business and stock. I reiterate my buy rating for CXM, as I view the weakness in growth as a non-structural impairment that should not weigh on growth over the long term. The market focus on near-term growth has provided long-term investors with another opportunity to buy the business, as I expect growth to inflect back to 20% post-GTM restructuring. As CXM shows that it can achieve that, it makes sense for valuation to revert to 4.2x, as this was where CXM was trading at pre-earnings.

Investment thesis

A couple of weeks ago, CXM released its 3Q24 earnings results, which I thought were in line with my expectations that CXM is set to continue accelerating growth back to its 20% CAGR. CXM reported revenue beat consensus by 3%, growing 18.5%, which was an acceleration vs. 2Q24 by 50 bps. The strength of subscription revenue growth was also well sustained, >20%, coming in at 22% this quarter. Importantly, leading growth indicators like subscription billings continued to grow 20% y/y. The strong revenue performance also led to better-than-guided profitability, wherein non-GAAP EBIT saw $27.4 million, implying a 14.7% EBIT margin vs. the 9% guidance.

Clearly, the business fundamentals and growth momentum are strong, and I would’ve expected the stock price to react positively. However, I might have underestimated the impact of the weak macro environment. During the call, the management highlighted the challenges with renewals caused by key customers’ seat downsizing and other macro factors that are affecting the growth of revenue for FY25. Although the dynamics of renewal may seem more customer-specific, I think the market’s concern is that if the macro environment keeps getting worse, this negative trend could affect more CXM customers, which means growth could turn weaker than expected in the near term (which is somewhat implied in management’s guidance). Also, management has stated their intention to re-orient the go-to-market [GTM] focus through changes to incentives and quotas so that it is more balanced and helps CCaaS and the core suites. In a typical scenario (the macro environment is fine), I would not pay so much attention to how the GTM will impact the near-term results if the restructuring is beneficial for long-term growth. But this is not the case today. Management’s decision to restructure its GTM strategy comes when its forward-looking statements have raised concerns about growth in the near term. In light of these near-term uncertainties, management is expecting a 10% increase in revenue for FY25, which is significantly lower than my initial projections of 18% growth and the consensus forecast of 16%.

The way I read the situation is that the weak FY25 growth is largely self-inflicted rather than a structural impairment of growth. Remember that management specifically highlighted that more of the growth headwind in FY25 stems from restructuring in GTM? I understand the bear concerns that restructuring in GTM typically leads to growth disruption, and on top of the macro weakness, this led to highly uncertain near-term growth that could result in negative stock sentiment. The fact that the share price dropped from $17 to $12 is suggestive that the market pays a lot of attention to near-term performance. I remain bullish about CXM, as the long-term equity story has not been impaired at all. As clients update their older voice-first channels and use a unified platform to analyze marketing and sales interactions, I still believe there is a significant opportunity to tackle the CCaaS space. I also think that bookings should increase steadily over the next two to three quarters as CXM reaps the benefit of its investment in new partner types (such as referral partners and business process outsourcing partners). As the market sees these leading growth indicators pick up, it should improve stock sentiment.

Valuation

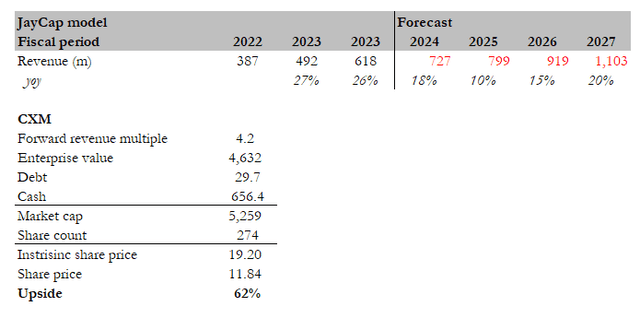

Own calculation

The best part about this share price movement is that it provided long-term investors, like me, another opportunity to invest at an attractive price. My previous model had a price target of $17, and indeed, the share price reached my target price as the market recognized the long-term story of CXM. In my new model, my focus has shifted to FY27, as we are now in CY2024. My FY24 has shifted up a little to reflect the revised guidance, and I have also extended the timeline for CXM recovery to 20% revenue growth to FY27 (from FY26). While I believe the impact of the change in GTM strategy is mostly isolated to FY25, I am taking a conservative approach by assuming FY26 will be modestly impacted as well. As such, I am assuming CXM to reach 20% growth in FY27 (1 year later than my previous assumption that growth will reach 20% in FY26). If we look at the CXM valuation chart (forward revenue), pre-earnings, valuation has trended back to ~4.2x forward revenue, which I take as the market recognizing CXM’s long-term growth story. If my assumptions are right, in that the near-term growth weakness is not due to structural weaknesses, then it only makes sense that CXM trades back to 4.2x as growth accelerates back to 20% (in FY27). Therefore, I am sticking with my view that CXM deserves to trade at 4.2x forward revenue. This leads to my target share price of $19.20.

Risk

The downside risk is that the macro weakness continues for an extended period of time and CXM’s change in GTM strategy faces multiple hiccups. These would lead to multiple periods of weak growth in the near-to-medium term, further pushing out the delay for growth to accelerate back to 20%. Weak growth could also continue to pressure valuation, delaying the timing of recovery back to CXM’s historical valuation (4.2x forward revenue).

Conclusion

I reiterate my buy rating for CXM. My belief is that the current growth weakness is not structural but rather a self-inflicted one that should be beneficial for long-term growth. Because of this dynamic, I think the valuation has become attractive once again after the stock has hit my previous target price. Suppose CXM was to accelerate growth back to 20% as I expected, it only makes sense for the market to rerate valuation multiples back to pre-earnings level – where the stock narrative did not include the GTM-restructuring impacts. Incorporating the 10% FY25 growth guide, I have conservatively pushed back my assumption for CXM to reach 20% growth from FY26 to FY27. At 4.2x forward revenue, which translates to a target share price of $19.20.