Damir Khabirov/iStock via Getty Images

Investment Overview – The Pros & Cons Of SpringWorks

Back in November last year I shared a note on Seeking Alpha discussing SpringWorks Therapeutics (NASDAQ:SWTX), on the day the company received FDA approval for its oral gamma secretase inhibitor Ogsiveo (nirogacestat), for the treatment of adult patients with desmoid tumors.

The Mayo Clinic describes desmoid tumors as follows:

Desmoid tumors are noncancerous growths that occur in the connective tissue. Desmoid tumors most often occur in the abdomen, arms and legs. Another term for desmoid tumors is aggressive fibromatosis.

Some desmoid tumors are slow growing and don’t require immediate treatment. Others grow quickly and are treated with surgery, radiation therapy, chemotherapy or other drugs.

Desmoid tumors aren’t considered cancers because they don’t spread to other areas of the body. But they can be very aggressive, acting more like cancers and growing into nearby structures and organs. For this reason, people with desmoid tumors are often cared for by cancer doctors.

Ogsiveo was approved based on results from a pivotal study, results of which were summarised by the Food and Drug Agency in its approval press release as follows:

The pivotal clinical trial demonstrated that Ogsiveo provided clinically meaningful and statistically significant improvement in progression-free survival compared to placebo. Additionally, the objective response rate was also statistically different between the two arms with a response rate of 41% in the Ogsiveo arm and 8% in the placebo arm. The progression-free survival results were also supported by an assessment of patient-reported pain favoring the Ogsiveo arm.

Ogsiveo is the first therapy approved to treat desmoid tumors. I gave SpringWorks a “hold” recommendation back in November based on a few negative factors which I will summarize below, however the stock price has risen by an impressive 68% since my note, and I will also contemplate some reasons to be optimistic.

Market opportunity – with no prior approved therapies, it was difficult to establish the market opportunity for Ogsiveo.

SpringWorks says that 5.5k-7k patients are actively managing desmoid tumors in the US today, with ~1k-1.5k new patients diagnosed annually. Ogsiveo costs ~$29k for a 30-day supply, which translates to an annual cost of ~$348k, and a market opportunity of ~$2.2bn. Analysts have suggested the drug could achieve peak revenues of ~$544m. With its current market cap of $3.1bn, arguably SpringWorks’ valuation could be considered high relative to the market opportunity.

Safety Profile – there are risks associated with taking Ogsiveo – according to Drugs.com, 84% of patients in clinical studies experienced cases of diarrhea, with 16% reporting grade 3 events (categorised as “severe and undesirable”).

Ogsiveo can potentially affect female fertility and the menstrual cycle, and caused liver toxicity, with ALT or AST elevations observed in 30% and 33% of patients. Also, according to drugs.com:

New non-melanoma skin cancers can occur in patients treated with Ogsiveo; trials have reported an incidence rate of 2.9% for cutaneous squamous cell carcinoma and 1.4% for basal cell carcinoma. Regular skin cancer checks should be conducted before starting treatment and throughout treatment.

Financials – in 2023, SpringWorks reported $5.5m of revenues from Ogsiveo, but the company spent $198m on SG&A and $150.5m on R&D, resulting in a net loss for the year of $(325m), following on from net losses of $(277.4m) in 2022, and $(174m) in 2021.

On a more positive note, however, SpringWorks reported a cash position of $663m as of the end of 2023, giving it a lengthy funding runway of at least two years based on current cash burn, which could be partially offset by rising Ogsiveo revenues.

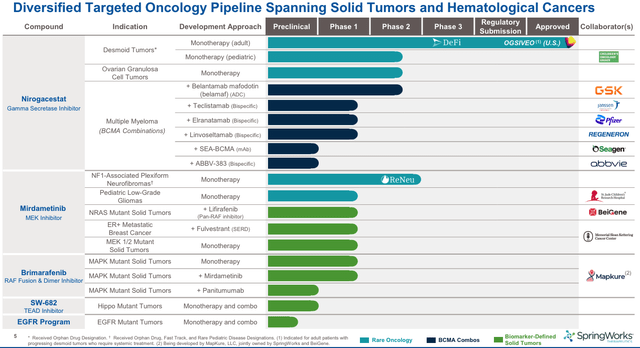

Additionally, as we can see below, the company is running many more studies of nirogacestat – the underlying ingredient in Ogsiveo – and is also running clinical studies of two other drug candidates, alongside multiple “Big Pharma” partners, and developing two further programs, currently at the preclinical stage.

SpringWorks pipeline (investor presentation)

Looking Ahead – Can The Company Build Around First FDA Approval (& Rising Share Price)?

As mentioned in my previous note, analysts at TD Cowen had forecast $3m of Ogsiveo revenues in 2023, therefore SpringWorks actually outperformed expectations in that sense, although earnings per share of $(1.45) were worse than expected. SpringWorks will announce Q1 2024 revenues on May 3, and consensus revenue expectations are for ~$12m, with EPS of $(1.07) – actual results ought to provide an important measure of overall performance. Management says that Ogsiveo:

…has been reimbursed by payers representing over 98% of commercial lives, as well as by Medicare and Medicaid, with coverage aligned to the FDA-approved label.

The company has submitted a Marketing Authorization Application (“MAA”) for Ogsiveo to the European Medicines Agency (“EMA”), which, if approved, could open up a market opportunity similar in size to the US.

A secondary target for nirogacestat as a monotherapy is in Ovarian Granulosa Cell Tumors (“OvGCT”). This represents 5-7% of all ovarian cancers, the company’s research suggests, and there are no currently approved drugs in this indication. According to SpringWorks’ 2023 annual report / 10K submission:

In September 2022, we announced that the first patient had been dosed in a Phase 2 trial evaluating nirogacestat as a monotherapy in adult patients with recurrent ovarian GCT, and in May 2023, we announced full enrollment of the trial. We expect to report initial data from the trial in the second half of 2024.

This ought to represent an intriguing catalyst for the second half of 2024, management’s research shared in a recent investor presentation suggests OvCGT has a prevalence of 10k-15k patients, with an estimated incidence in the US of 1k – 1.5k new cases per annum.

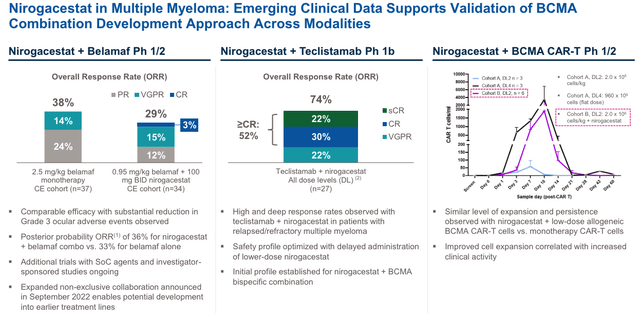

Meanwhile, SpringWorks is exploring whether nirogacestat could be used alongside B-cell maturation antigen (“BCMA”) directed therapies, such as Johnson & Johnson’s (JNJ) Tecvayli, Pfizer’s (PFE) Elrexfio, GSK’s (GSK) Blenrep, an antibody developed by antibody drug conjugate specialist Seagen – now part of Pfizer, and AbbVie’s (ABBV) candidate ABBV-383 – in multiple myeloma – a double-digit billion, ~90k patient market.

nirogacestat in MM – clinical data (investor presentation)

As we can see above, SpringWorks appears to have generated some encouraging data – alongside Blenrep, for example, a combo generated more Complete Responses (“CRs”) in patients than the monotherapy, and alongside Tecvayli, an overall response rate (“ORR”) of 74% was achieved, with multiple CRs. In combo with a CAR-T therapy, nirogacestat may help increase clinical activity. Whether this data will be enough to win over Big Pharma partners remains to be seen, however.

In summary, there may be more to nirogacestat than treatment of desmoid tumors, and there will be several more important data readouts to consider this year and next. It is difficult to state with confidence that any of these opportunities will result in a commercial opportunity, but as mentioned, the Phase 2 OvGCT” provides a tantalising near-term catalyst, while progress in MM would significantly enhance the potential market opportunity.

Mirdametinib in NF1-Associated Plexiform Neurofibromas

Mitigating any single asset risk at SpringWorks is mirdametinib, an inhibitor of MEK1 and MEK2 proteins – according to SpingWorks:

MEK proteins occupy a pivotal position in the MAPK pathway, a key signaling network that regulates cell growth and survival and plays a central role in multiple oncology and rare disease indications.

The target indication here is Neurofibromatosis Type 1 (“NF-1”) – a genetic condition that causes tumors to grow along patient’s nerves, causing a variety of potential complications, such as heart defects, learning difficulties, behavioural challenges, and physical deformities.

In November last year, SpringWorks presented positive topline data from a 114-patient Phase 2b study involving adult and pediatric cohorts, which achieved a confirmed ORR of 52% in pediatric patients and 41% in adult patients. The company says that “deep and durable responses” were observed across multiple secondary endpoints, and the median duration of treatment was 22 months in both the pediatric and adult cohorts. From a safety perspective:

Mirdametinib was generally well tolerated in the ReNeu trial, with the majority of adverse events (“AES”) being Grade 1 or Grade 2. The most frequently reported AEs were rash, diarrhea, and vomiting in the pediatric cohort and rash, diarrhea, and nausea in the adult cohort. Twenty-five percent of pediatric patients and 16% of adult patients experienced a Grade 3 or higher treatment-related AE.

The current standard of care in NF-1 treatment is AstraZeneca’s (AZN) koselugo, which earned $331m of revenues last year, and has been approved since 2020. SpringWorks’ contention is that mirdamentinib is the superior drug, and its market research suggests that 96% of physicians agree – with the caveat that such research was likely weighted towards such an outcome.

Nevertheless, SpringWorks says it expects to file its New Drug Application (“NDA”) with the FDA for mirdametinib this quarter, and may receive a priority review voucher (“PRV”) if the drug is approved, which it can use to shorten the FDA review period from 10 months, to six, for future NDAs, or sell on the open market to another Pharma company, likely for a triple-digit million sum.

Similarly to nirogacestat, SpringWorks is evaluating mirdametinib in various oncology indications, this time in solid tumors, and in collaboration with medical centres, and the Pharma Beigene. It is difficult to assess how successful such studies may be, but the NF-1 opportunity certainly provides another intriguing catalyst for investors to ponder.

Finally, SpringWorks is testing brimarafenib, an RAF fusion and dimer inhibitor, in MAPK mutant solid tumors, as a monotherapy, in combo with mirdametinib, and in combo with Amgen’s (AMGN) Vectibix. Early data has shown an 18% ORR for the monotherapy, and disease control rate (“DCR”) of 79%.

Analysis – With Multiple Opportunities In Play, Is SpringWorks A Potential “Buy”, “Sell”, or “Hold” Opportunity?

After reviewing SpringWorks’ recent progress, there is certainly a lot to unpack. Early sales data from Ogsiveo has been relatively encouraging, and we will learn more when Q1 2024 updates are shared on May 3. Strong outperformance may lift the share price, but this ought to be balanced against the heavy losses the company is making.

A label expansion would certainly be welcome, as would an approval in Europe, and both scenarios are in play, offering near term upside opportunities for investors, although outcomes are uncertain, as is the peak revenue opportunity.

Worthy of note is potential competition in the form of recently launched biotech Immunome, which has paid $50m for the rights to Ayala Pharmaceutical’s Phase 3 stage oral gamma secretase inhibitor AL102, a potential rival in the desmoid tumor space. Immunome claims that AL102 has a superior safety and efficacy profile to Ogsiveo, touting an ORR of 75%.

Until AL102 makes it into the commercial setting (assuming it secures approval), SpringWorks maintains an important first-mover advantage, however, and the company could have a second approved drug on the market in 2025, if its NDA for mirdametinib is accepted and approved – some slight safety concerns aside, this feels like a likely scenario, although competition versus koselugo in commercial markets may restrict the drug’s earning power. A PRC award could provide an additional $100m windfall.

In oncology, I would personally be less sure of success for either nirogacestat or mirdametinib, however the Brimarafenib programs are also in play, plus there are two more programs likely to be entering clinical studies soon, and funding in place to support them, for the next two years, at least.

The key question is whether all of SpringWorks drug programs – commercial, soon-to-be-commercial, and even preclinical – adds up to a market cap valuation of $3.1bn, or exceeds it, or falls short, and after a detailed review of the company, I still find it hard to answer this question.

Clearly, I underestimated the upside potential of the company when awarding it a “hold” recommendation in November last year (depending on your interpretation of a “hold” call). Investors backing the company then would have realised a ~70% return on their investment.

Looking ahead, however, I am inclined to issue another “hold” call, as there is a substantial amount of uncertainty still to negotiate, and the commercial rewards are also highly uncertain. I can envisage two scenarios, one in which Ogsiveo is approved in Europe and in OvGCT, and secures an approval for mirdametinib, opening up a +$500m peak revenue opportunity, and with one or two the oncology programs also progressing, in this scenario I believe SpringWorks’ market cap could rise to over $5bn, and the company may well become an acquisition target for Big Pharma.

Conversely, if Ogsiveo underperforms commercially, attention will be drawn to the substantial SG&A spend and losses, and even if approved, mirdametinib may not find a market worth more than ~$50m per annum. If neither drug makes headway in oncology studies, either as monotherapy or in combo with other drugs, management may find themselves scratching their heads as to how to make its business commercially viable, amid potential competition in both of its key markets.

As such, with the future of SpringWorks seemingly finely poised, although I lean slightly towards a “buy” recommendation, with two years of funding in place and so many opportunities in play, I will stop short of providing a rating upgrade and maintain my “hold” recommendation.