Nikada

China has been a widow-maker for the last three years. Major ETFs tracking mainland shares are down 50% or more as the country’s authoritative regime, led by President Xi Jinping, continues to pressure one industry after another.

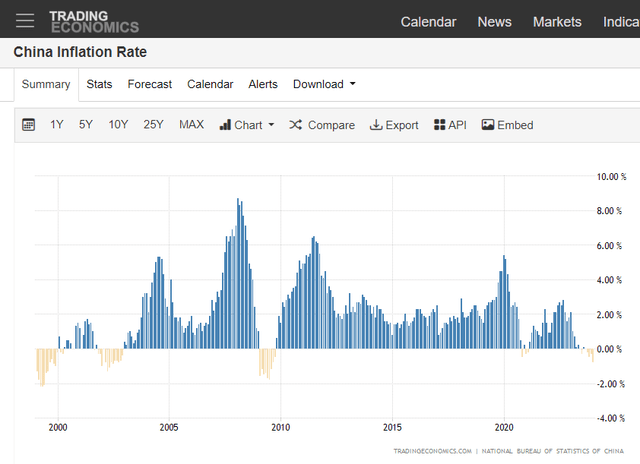

Just last week, it was reported that China’s CPI inflation rate plunged to levels not seen in more than 14 years. At -0.8% YoY, worse than the -0.5% consensus forecast, it was the fourth consecutive monthly drop in the annual CPI rate, marking the longest such stretch since 2009.

Is it finally time to give China a look? After all, the nation’s stocks trade under 10 times earnings while free cash flow among some of the biggest Chinese companies is stout.

I have a hold rating on the WisdomTree China ex-State-Owned Enterprises Fund (NASDAQ:CXSE). I see inklings that a capitulation bottom is nearing, and I very much like the valuation, but this is a time when investors should look to the chart and momentum for clues on a true positive inflection.

China CPI Underscores Soft Consumption Trends

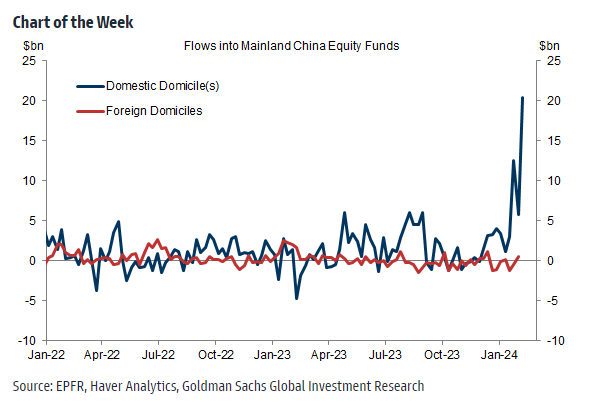

Mainland China equity funds saw very large inflows (approximately 9% of AUM) from domestic buyers, suggesting continued “National Team” support for the equity market -GS

Goldman Sachs

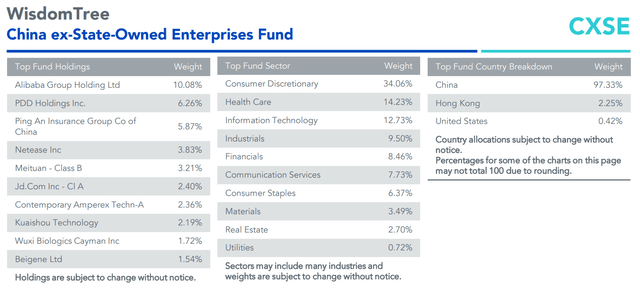

According to WisdomTree, CXSE seeks to track the investment results of Chinese companies that are not state-owned enterprises, which is defined as government ownership of greater than 20%. The ETF can be used by investors to gain exposure to targeted Chinese equity from firms excluding state-owned enterprises. The issuer notes that CXSE may complement Chinese market exposure while neutralizing companies potentially influenced by government decisions.

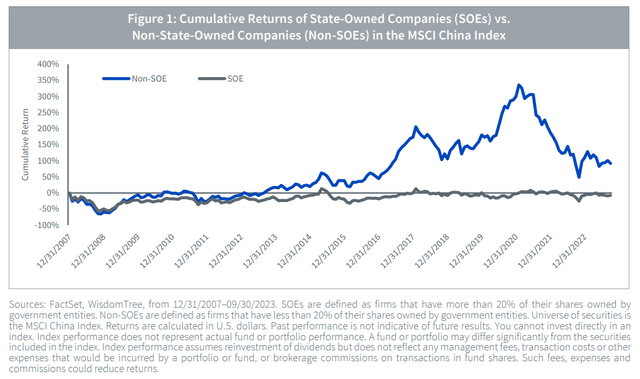

By excluding SOEs, the fund aims to reduce exposure to government rule and potential inefficiencies associated with state ownership. This could appeal to investors seeking a more market-oriented and potentially dynamic investment in Chinese equities. SOEs typically show weaker performance due to corporate governance issues while WisdomTree’s research suggests that over a cumulative period, non-SOEs consistently outperform SOEs.

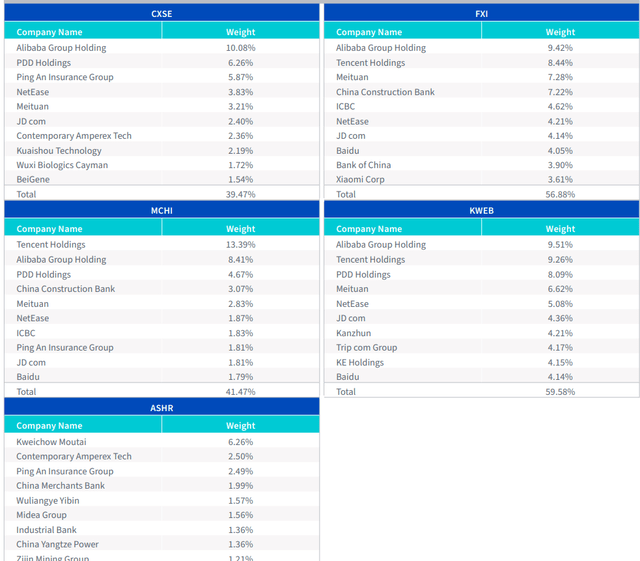

By removing SOEs shifts exposure away from “old China” sectors like Energy, Materials, and Financials to “new China” sectors like Information Technology, Communication Services, and consumer areas, the goal is for CXSE to outperform other broad China funds such as the iShares MSCI China ETF (MCHI), iShares China Large-Cap ETF (FXI), Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR), and iShares MSCI China A ETF (CNYA).

CXSE is a small ETF, though, which is understandable following yearslong underperformance to US stocks. The fund’s assets under management are just $408 million as of February 9, 2024, and it pays a dividend yield above that of the S&P 500, but below the total ex-US market, at 1.9%. Share-price momentum has been exceptionally weak over recent months, leading to a poor F ETF momentum grade by Seeking Alpha.

Still, its annual expense ratio is rather low at just 0.32% and liquidity metrics are mixed when assessing its 90-day average volume and the fund’s 30-day median bid/ask spread, though I encourage investors to use limit orders when trading CXSE given how wide the bid/ask spread typically is (20 basis points).

The two-star, silver-rated portfolio by Morningstar plots along the very top of the style box, indicating that it is primarily a large-cap allocation. There is more growth than value, but just 5% of CXSE is considered mid-cap. The ETF’s forward price-to-earnings ratio, per WisdomTree, is just 13.2x today while its price-to-sales ratio is likewise modest at 1.14x.

Sentiment is incredibly poor regarding China stocks right now. The term “uninvestable” is perhaps most associated with the country’s equities. In fact, according to a recent survey by Goldman Sachs, as reported in the Financial Times, more than 40% of respondents attending a session on China stocks believed the country was “uninvestable.” It came just a day after the country’s vice-premier called for “more forceful and effective measures to stabilize the market and boost confidence.”

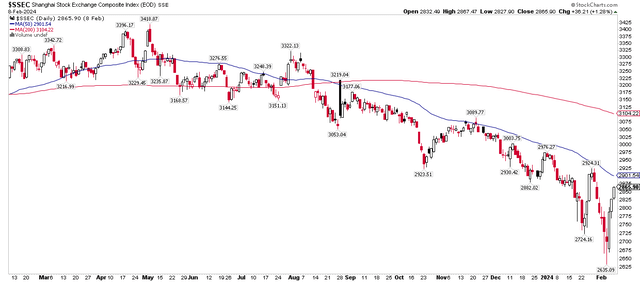

What makes now an interesting time to consider getting long in China is that there were signs of a capitulation bottom early last week. Not too long ago, I wrote about how India continues to be a spot to be in EM Asia, but something changed in the days after that outlook. A strong bottom was notched when assessing the daily chart of the Shanghai Composite. Notice in the chart below that the embattled index touched its lowest level in five years on Monday, February 5 at 2635. It then settled ahead of the Chinese New Year week at 2866 last week – a remarkable 9% reversal. The SSEC remains under its falling 50-day and 200-day moving averages, however.

Shanghai Composite Prints A Significant Low on February 5

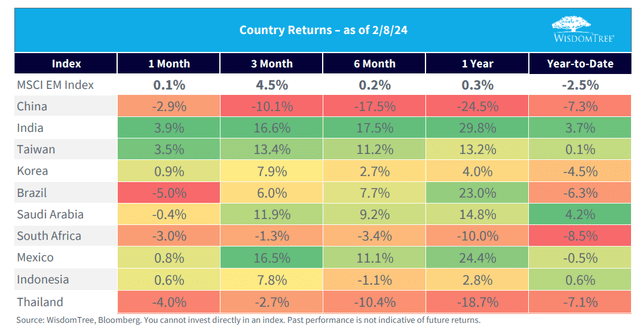

Amid hopeful signs of a longer-lasting low, China has performed poorly over multiple timeframes. WisdomTree’s EM Monitor reveals a steep 10% decline in the last three months (as global equities have powered higher), an 18% drop in the last six months, and a nearly 25% haircut over the past year. India, meanwhile, has attracted major sums of capital considering its near-term momentum and long-term appealing demographic factors.

Are Long-Suffering China Investors About To See a Turnaround?

Homing in on China, non-state-owned enterprises have historically outperformed the MSCI China Index, though returns since early 2021 have been dreadful as shares of major companies have suffered.

Long-Term Return Trends Favor China Non-SOE Stocks

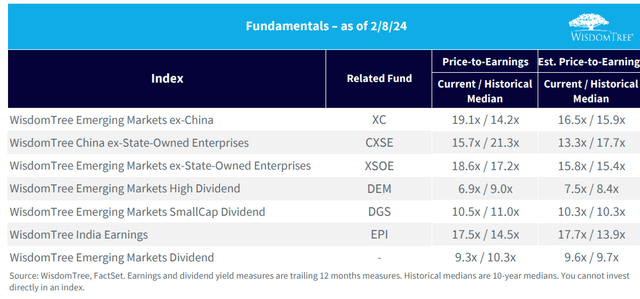

On valuation and fundamentals, CXSE trades at a significant discount to the broader EM index. It is also cheaper than the WisdomTree Emerging Markets ex-State Owned Enterprises ETF (XSOE).

EM ETF Fundamentals

CXSE owns some of the most familiar Chinese stocks to global investors. Alibaba (BABA) and PDD Holdings (PDD) are the largest constituents. What many analysts overlook right now is how much free cash flow some of these firms generate.

Take BABA for example – its current trailing 12-month FCF yield is a whopping 12%, according to Seeking Alpha. PDD has a levered FCF margin of a stunning 36%.

The point here is that should there be any signs that China is on the mend – both economically and politically – then there’s serious capital available to be returned to shareholders. Keep in mind that, especially in EM, when things simply go from ‘terrible’ to just ‘bad,’ then major returns can take place.

Overall, Consumer Discretionary is the biggest sector weight in CXSE, so much will depend on improved consumption and retail spending activity in the world’s second-largest economy.

CXSE: Top Holdings, Sector Weights, Country Breakdown

Comparing China ETFs: Top Holdings

The Bottom Line

I like CXSE from a future growth perspective and the technicals appear more promising given the capitulation-like move earlier this month. Amid downright awful sentiment, and the term “uninvestable” being tossed around, the stage could be set for CXSE outperformance. Still, I would like to see further improved momentum before issuing a buy rating. I hope to revisit the fund later this year to see if the situation has taken a positive shift.