ChainGangPictures

Investors in the airline industry remember what Warren Buffett usually says when he talks about airline stocks:

I have an 800 (free call) number now that I call if I get the urge to buy an airline stock. I call at two in the morning and I say: ‘My name is Warren and I’m an aeroholic.’ And then they talk me down.”

Probably no one more than Spirit (NYSE:SAVE) shareholders is thinking about calling this number after a judge decided to block its merger with JetBlue (JBLU). This analyst includes himself in the list. Not only Spirit shareholders have this kind of thought, but any investor who holds shares in airlines is currently thinking about what went wrong at the beginning of 2024. Delta (DAL) posted a profit in Q4 and positive guidance for FY’24 with forward PE at around 7x, but that wasn’t enough for Wall Street, and airlines collapsed after the announcement. Boeing (BA) has its own issues after the accident with an Alaska Airlines (ALK) 737-MAX 8 and some serious allegations about quality control in its factories and that of suppliers.

Particularly, I believe it’s fine to invest in airlines, as long as one is mindful of the cyclicality of the industry and that it’s not a big chunk of one’s portfolio. I deemed that a bottom was achieved around October and November of last year and started small positions in the major airlines, including a speculative one in Spirit that I highlighted in my previous article. This article will extend further my previous analysis, going deeper into Spirit’s cash flow and whether Spirit will be able to keep itself alive until the profits I forecasted in my previous article come true. The pendulum swung fast for Spirit as analysts are now talking about Chapter 11 and its valuation is now below the pandemic bottom of 2020 highlighting that investors are afraid if Spirit remains a going concern. This article, by reviewing and forecasting Spirit’s cash flow until FY’25, will claim that this airline is not facing an impossible challenge in terms of refinancing debt and cash flow generation. I believe Spirit will be able to keep its liquidity position, refinance its upcoming FY’25 debt maturity of $1.1 billion, and live to see its profits come back.

Terminating The Merger Agreement

The recent decision to block Spirit and JetBlue merger will likely have serious effects on other airlines as well. Simply put, an acquisition or a merger seems almost impossible right now after this decision – including the offer that Alaska made for Hawaiian Holdings (HA). Spirit seems to have three options now: To continue as a standalone business, enter talks with Frontier Airlines (ULCC) for a merger (which may also be blocked, but since those are both low-cost carriers the DOJ may not be so tough on it) and file for Chapter 11 (or 7).

Although Spirit and JetBlue have already filed an appeal, I’ll evaluate Spirit’s case in the same fashion as my previous article: that of a standalone company. If the appeal is accepted, that’s great for investors and the upside is huge. However, I have no special insight into legal cases and I’ll refrain from considering this hypothesis in my analysis. This means, in practical terms, the following, as per Spirit’s latest 10-Q:

Upon the termination of the Merger Agreement for failure to obtain antitrust regulatory clearance, JetBlue will be required to pay ((i)) to Spirit, $70.0 million, and ((ii)) to the Spirit stockholders, the excess of (A) $400.0 million minus (B) the sum of the Approval Prepayment Amount and all Additional Prepayment Amounts previously paid by JetBlue to the Spirit stockholders.

Out of those $400 million for shareholders, pretty much everything has already been paid out, so I’d expect only a marginal dividend left or none at all. The $70 million will be paid to Spirit and, as crazy as it seems, now amounts to close to 10% of its Market Cap and boosts its short-term liquidity by almost 8% versus its 3Q’23 10-Q. On an interesting note, when the merger was announced, Spirit was valued at around $22 a share ($2.4 billion in Market Cap) and JetBlue was trading at around $8 a share ($2.7 billion in Market Cap), and now they walk away being valued at $800 million in the case of Spirit and $1.7 billion for JetBlue.

Assessing Short-Term Cash Flow

If Spirit has been dumped by investors, currently trades at $700 million and I’ve forecasted $300 million of Net Income by FY’25, is it a screaming buy or it won’t survive to see those profits? I’ll get into the details of its cash flow , but first I’ll do a quick recap of my Net Income forecast for those who haven’t read my first article since Net Income is a key component of our cash flow analysis.

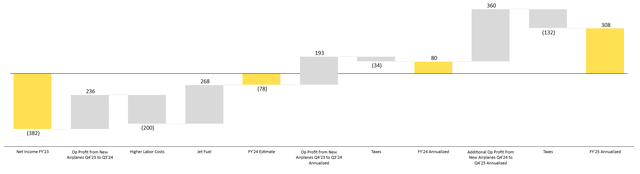

Spirit Estimated Net Income Walk (in millions) (Author)

My expectation of Net Income is driven by 1) increased profitability of its airplanes as future deliveries of the A320/21neo are more fuel efficient and have higher seat capacity than current airplanes in Spirit’s fleet, 2) lower Jet Fuel compared to what we saw in 2022 and the first half of 2023 and 3) higher labor costs due to the new pilots contract. Note that I still expect a loss for Spirit in FY’24 and the FY’25 I projected is annualized (i.e. the potential of its fleet in a full year, even with the airplanes delivered throughout the year). My FY’25 considered in the cash flow below is $200 million, which is what I would expect Spirit to actually earn in FY’25.

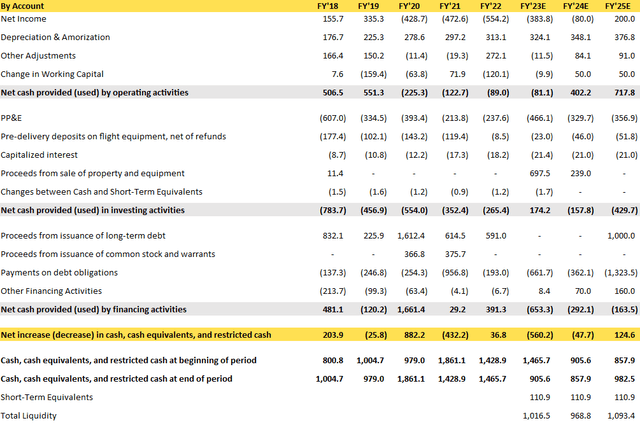

When reviewing the details of Spirit’s cash flow, it’s possible to see that this is not a company in distress as its recent stock price movement would suggest. Table below showcases the historic Spirit’s cash flow from FY’18 to FY’22 and includes my forecast for FY’23 to FY’25. Prior to the pandemic, Spirit had consistent cash flow from Operations (CFO), but high expenses in PP&E (airplane purchases and other capital expenditures) were financed through a mix of CFO and debt. What I expect is that Spirit will be back to CFO positive in FY’24, mainly driven by its Net Income recovery (although not yet positive). This will significantly support its continued investment in fleet expansion and put less pressure on debt maturities.

Cash Flow Forecast until FY’25 (Author, Spirit IR)

Cash Flow from Operations: As mentioned in my previous article, I expect Spirit to come back to Net Income positive during the second half of FY’24 and FY’25 showing full-year positive earnings. When reviewing the other accounts, I have not found anything to be worried about. Depreciation & Amortization will continue its trend as Spirit adds more planes to its fleet. Other adjustments and change in working capital have some spikes in different years, but they usually tend towards an average of being positive to CFO. The working capital dynamic for an airline is usually different than for industries as it’s usually a higher source of liquidity given the lack of inventories and the fact that accounts receivable is converted to cash usually before a flight takes place and it’s required to pay for fuel and airport fees.

Cash Flow from Investing Activities: In this section of the cash flow, we have more moving pieces to analyze. First, the two sale-leaseback that Spirit conducted in December and January are reflected here in the proceeds from sale of property and equipment. The total amount received was considered in this line and the payment of lease obligations related to these aircraft in payments on debt obligations in cash flow from financing activities. In general, my rationale for PP&E and pre-delivery deposits on flight equipment was to keep it an average of the prior years because I expect Spirit to do more sale-leaseback in the future once it receives the new planes instead of purchasing and holding them on the balance sheet. That would be a move to protect liquidity and transfer the one-time purchase amount from PP&E to a monthly leasing bill in the P&L. Spirit currently owns close to 50% of its planes and leases the remaining, which is the average around the world. There is some room for error in this analysis as PP&E could be higher than expected if Spirit decides to take more debt to finance the outright purchase or if lessors aren’t interested in entering sale-leaseback with Spirit.

Cash Flow from Financing Activities: Finally, we get to the debt maturity analysis, which has been center-stage in the recent news as Spirit faces a $1.1 billion maturity in FY’25. First, I included the debt obligations highlighted in Spirit’s 10-Q for FY’24 and FY’25. Then, on other financing activities, I considered the $70 million break-up fee from JetBlue in Q3’24 and $160 million as compensation paid by RTX Corporation (RTX) for the faulty Pratt & Whitney engines. The $160 million was calculated based on the $3 billion accrual that RTX made to deal with the P&W engines. The report claims that 80% of the $3 billion will go to customers and that 600 to 700 engines will be recalled. As of last August, Spirit had 13 of the 200 engines scheduled for accelerated inspection. Since Spirit has been receiving these planes constantly every year, I’d expect this ratio to hold for the total engines to be recalled, meaning that they would be entitled to around 6.5% of the $2.4 billion that goes to customers. This is a simple calculation that is prone to error, but it’s the best we have for forecasting purposes and amounts to $160 million that could be paid sometime during FY’24 or FY’25. Given these additional liquidity sources (without counting the revolving credit facility that Spirit has for $300 million), the increased CFO that I’m forecasting for FY’24 and FY’25 will likely require Spirit to raise less than what it needs to pay for debt maturities in FY’25 (I projected $1 billion in FY’25). That would keep Spirit’s liquidity position in the same place it is today. However, in the same way that I can’t anticipate business strategy in terms of airplane purchase in cash flow from investing activities, management could decide to raise more debt (if possible) to finance more purchases or simply increase its liquidity position.

Risks

What I tried to assess in this article is the main risk currently facing Spirit: bankruptcy. Bankruptcy will likely wipe out shareholders and make bondholders the new owners of the company, so investors who buy Spirit shares need to be aware of this huge downside. My conclusion is that Spirit isn’t heading towards bankruptcy as it will be able to maintain its liquidity in a good position, but my analysis could simply be wrong and the company will face a tougher liquidity position in the coming quarters. As a countercheck, my net income forecast is materially different from what Citi forecasts for FY’25. If that scenario holds, then Spirit could be headed to a Chapter 11 or Chapter 7 and investors could be wiped out (bar a new takeover or merger proposal).

Final Thoughts

In sum, my conclusion when evaluating Spirit’s cash flow is that the task of refinancing its debt and keeping a comfortable liquidity position is not impossible. Positive net income driven by higher demand, lower jet fuel prices and bigger and more efficient airplanes is just around the corner. Thus, my conclusion that Spirit could be valued on a standalone basis between $2.4 billion and $3.6 billion (8x to 12x forward PE of $300 million) still holds given the cash flow forecast just described.