Seibel Photography LLC/iStock Editorial via Getty Images

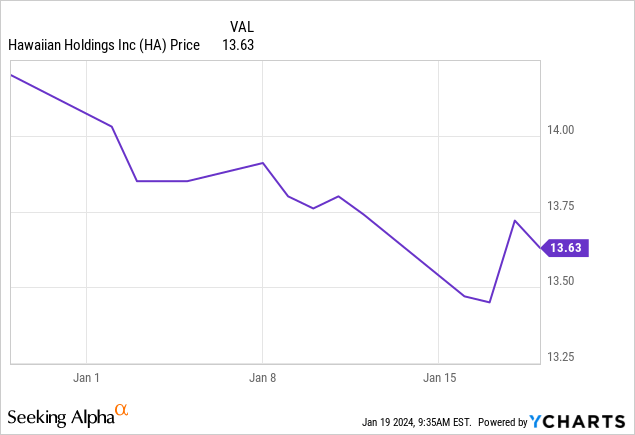

Alaska Air Group (NYSE:ALK) and Hawaiian Holdings (NASDAQ:NASDAQ:HA) announced their merger December 3rd, 2023. Alaska Air Group’s shares experienced a quick drop that appears to have been recovered and sent Hawaiian Holdings’ shares soaring. HA shareholders will receive $18.00 in cash if the merger is ultimately completed. That’s a premium of 270 percent over Hawaiian’s closing stock price before the announcement. The deal is expected to close in 12-18 months, which also means 30% upside from the current share price of $13.63.

Alaska Air Group has a market cap of $4.5 billion, its target is much smaller at $712 million. In terms of Enterprise Value, the two are much closer, with Alaska at around $6 billion and Hawaiian at $1.7 billion.

Important context: Spirit Airlines (SAVE) was being acquired by competitor JetBlue (JBLU). But this deal just got shot down by the presiding judge. I wrote about why it was blocked here. There are essential read-throughs, though. HA went down only minimally on the Spirit deal getting blocked, and I think that’s not enough.

SAVE traded at a spread of $16 (over 100% upside before the court decision) and could close within a month. HA trades at $13.63 with a spread of ~$4.42, which indicates the market doesn’t see as many problems with this deal as it did with SAVE. Initially, the market assigned the SAVE deal a much smaller spread as well, though.

From the background to the merger:

The Hawaiian Board also noted (1) the limited universe of potential buyers of Hawaiian; (2) competition law considerations for each such buyer; and (3) the larger regulatory landscape, including the recent efforts by the Department of Justice to prevent or unwind significant transactions and relationships in the airline industry. The representatives of Barclays provided their perspective that it was unlikely, in the near term, that a third party would have both the interest and the financial or other capacity to acquire Hawaiian. After considering these factors, the Hawaiian Board determined not to contact other parties, at this time, regarding their interest in acquiring Hawaiian.

Interestingly, this wasn’t the most competitive process, and they still got a 270% premium on the share price. The board is aware of the acquisition process at SAVE, as is their acquirer, and is going ahead with it anyway. This also suggests they believe this is one of the few companies that would be allowed to acquire them.

In addition, the Executive Committee discussed trading in our senior secured notes, which were trading at approximately 78 percent of par value, and our ability to repay or refinance those notes. Our senior secured notes are collateralized by our loyalty program and intellectual property and mature in January 2026. The representatives of Barclays offered their perspective that a spread of this magnitude between the trading price and the par value of secured debt may be indicative of concern among investors about a company’s ability to repay its obligations.

I think the bonds imply some risk, but these are notes that mature in January of 2026 and yield only 5.75%. The short-term yield is very high, and you can get 4.2% on the 2 years. One of the largest investment grade bond ETF iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) trades at a yield to maturity of 5.07%. It has a duration of around 8, which means it has a lot more interest rate risk than the HA bonds. It makes sense to me that the HA bonds are trading at a discount to par. Yet, the 22% discount is significant enough that I’d agree the market is anticipating some potential for trouble. Even if it isn’t imminent default, a successful refinancing (at higher rates) would substantially limit the company’s options further down the road.

Judging by the merger agreement, the Hawaiian board consistently paid attention to the terms of Alaska’s obligation to seek regulatory approvals for the acquisition. Ultimately, Alaska has to expend its “reasonable best efforts” to get the deal over the line, and there’s a termination fee of $100 million. According to the merger agreement, Alaska isn’t required to sell assets to appease regulators (though it could always do so). Both parties aren’t supposed to be entering into alliances or making deals likely to hurt their chances with regulators.

“Reasonable best efforts” is a legal standard and describes how much effort a party must exert to fulfill its obligations. The interpretation is subjective, but it is a less stringent standard than best efforts but more strict than reasonable best efforts or commercial best efforts.

The market doesn’t seem to be concerned about the Spirit block, which I’m chalking up to the conclusion to the decision:

The Court rules that the proposed acquisition violates Section 7 of the Clayton Act. Spirit is a small airline. But there are those who love it. To those dedicated customers of Spirit, this one’s for you. Why? Because the Clayton Act, a 109-year-old statute requires this result –- a statute that continues to deliver for the American people.

The market may interpret this decision as a decision where customers who aren’t well-off and relying on an ULCC are protected.

But here is a key paragraph from the decision (emphasis mine):

Throughout the trial, the government invoked the experience of the average Spirit consumer: a college student in Boston hoping to visit her parents in San Juan, Puerto Rico; a large Boston family planning a vacation to Miami that can only afford the trip at Spirit’s prices. It is this large category consumers, those who must rely on Spirit, that this merger would harm; the Defendant Airlines, though exceedingly well represented, simply cannot demonstrate that these consumers would avoid harm. Even if other ULCCs entered former Spirit routes at an unprecedented rate of growth (which, given the current restraints on airline growth, is unlikely), their entry is unlikely to be sufficient to protect every consumer, in every relevant market from harm.

The judge agrees here with the government that a subset of customers must rely on Spirit. He isn’t convinced by the airlines that these consumers won’t be negatively affected. He is convinced, which is also in the ruling, that the merger is pro-competitive as a package. But his view is that it hurts a subset of customers and thus doesn’t pass Clayton in his interpretation. Is it possible that Islanders would be dependent on a specific carrier? The problem with this ruling is that these subsets can often be found.

This ruling against the merger of JetBlue and Spirit Airlines is a potential game-changer in antitrust law. Despite JetBlue’s argument of a pro-competitive effect and potential for increased competition against the Big Four airlines, the court’s decision heavily weighed the potential harm to a specific subset of consumers within certain markets who rely on Spirit’s low-cost offerings. The ruling’s emphasis on consumer harm, even when offset by larger advantages to other consumers, sets a precedent that could influence future antitrust cases. It lowers the threshold for successfully blocking mergers and fewer companies will even try faced with such a standard.

Specifically, with the Alaska-Hawaiian merger (which will be the 5th largest airline), I think the market under-reacted to this news. This should be a reasonable short-term short position up to February 7 to see if this ruling will be interpreted differently. I’d want to be out before too long because HSR expires around February 7. If the HSR waiting period expires without government action, this could get a huge bump given the wide spread.