Smith Collection/Gado/Archive Photos via Getty Images

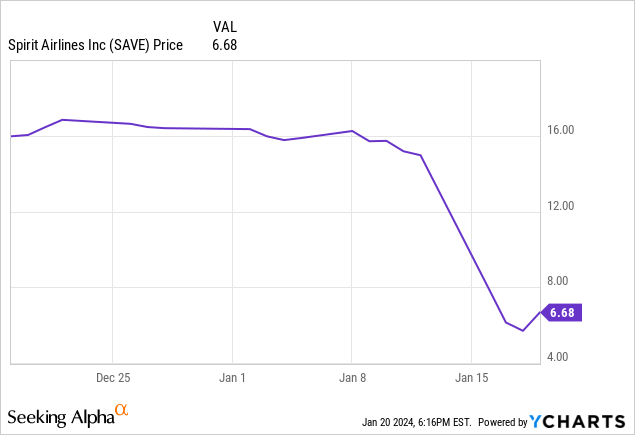

Last week, some Wall Street analysts and members of the media were using Spirit Airlines (NYSE:SAVE) and “bankruptcy” in the same sentence after Judge Young’s decision to permanently enjoin their merger with JetBlue Airways (JBLU). The parties appealed the decision on Friday. While I personally think Ch.11 bankruptcy is the best option to keep Spirit Airlines operating as an airline, the company most likely will use the typical distressed company approach and fight to stay out of court. Either approach will most likely have a negative impact on shareholders. I rate SAVE a long-term “sell”.

Using the term “bankruptcy” in Seeking Alpha articles about companies that have not already filed for bankruptcy is a very sensitive issue with Seeking Alpha’s management. I understand the sensitivity, but there were a number of Wall Street airline analysts who made comments in notes last week that discussed Spirit Airlines and Ch.11 bankruptcy. Looking at Spirit Airlines from multiple angles, including the risk of some future Ch.11 filing, is important for investors to understand.

Those who automatically dismiss any discussion or even any coverage of bankruptcy concerns should look at the yields on the 1% 5/15/26 convertible notes (CUSIP:848577AB8) last week. The price of the notes dropped to as low as 27.25 – yield of over 67%. Late Friday the price was back up to 39 – 47% yield. Those are extremely distressed yields. I am not asserting Spirit Airlines will be filing for bankruptcy in the immediate future. I do, however, feel that coverage and discussion about Ch.11 bankruptcy is appropriate and automatically dismissing the issue is irresponsible.

(SAVE closed at $7.29 post-market on January 20)

Appeal

As some expected (hoped) on Friday Spirit Airlines and JetBlue Airways filed an appeal of Judge William Young’s merger injunction order (text of his Finding of Fact and Conclusion of Law):

Please take notice that the defendants JetBlue Airways Corporation and Spirit Airlines, Inc. hereby appeal to the United States Court of Appeals for the First Circuit from the Final Judgment and Order Entering Permanent Injunction entered in this action on January 17, 2024 (Dkt. 463) and all orders underlying and incorporated in that judgment, including but not limited to this Court’s January 16, 2024, Findings of Fact and Conclusions of Law (Dkt. 461)

These appeals often can take a long time. I would assume that both companies will continue to conduct their own operations as if they are going to get the Court of Appeals to overturn the ruling, but they could assume that they will not win and operate their businesses as if they are going to remain completely independent. Their approaches to future operations, especially financing, could be different depending upon which approach they take.

Why Would Anyone Even Mention Bankruptcy?

There are a number of reasons why the word “bankruptcy” was tossed around last week. The two major reasons are that they are burning cash, and they have a huge debt maturity in September 2025.

Their $1.11 billion 8.0% secured notes (CUSIP:G83518AA1) mature September 20, 2025. That is a massive amount of debt to roll over. The 8% notes were issued in 2020 when interest rates in general were much lower. Fitch last October lowered their rating on these notes to “B” with a negative outlook and that was even before the merger injunction decision was handed down. These secured notes traded as low as 43 last week and closed at about 62 late on Friday. Remember these are secured short-term notes – not some high-risk unsecured long-term notes. The credit market seems to have very serious concerns about getting full payment/recovery.

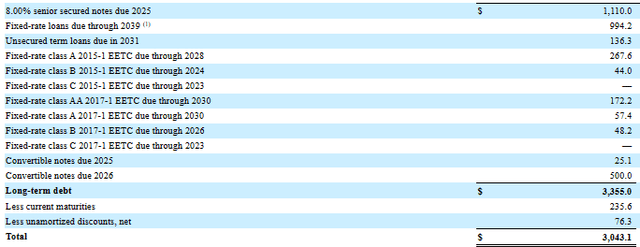

Long-Term Debt

Of course, there would be fewer worries about the maturing 8% notes if Spirit had strong positive cash flow from operations. They don’t. Just the reverse. They burned $63.9 million cash in the first nine months of 2023 after burning $89 million cash from operations in 2022.

As of September 30, 2023, Spirit had a total of $4.165 billion, including the $1.11 billion 8% notes, and contractual obligations due in 2024/25. This total also includes $1.475 billion for flight equipment. These contractual obligations could also be a serious challenge for Spirit, in my opinion.

Typical Ch.11 Bankruptcy Outcomes

Usually, there are three different outcomes of a Ch.11 bankruptcy filing. The first is a reorganization plan is negotiated that usually reduces or even eliminates prior debt/liabilities and a new operating company emerges from bankruptcy. Chesapeake Energy’s (CHK) 2020 bankruptcy is an example.

The second outcome is a complete liquidation of assets, and the company is “wound up”. This is the required approach in most countries other than the U.S. Currently, Yellow Corp. (OTC:YELLQ) is in the process of completely liquidating. This is an unusual bankruptcy case because YELLQ shareholders may get a meaningful recovery and shareholders might even be better off because they filed for bankruptcy instead of operating with continued losses.

The third outcome is a combination of the first and second. A company sells/liquidates some of its major assets/operations and then exits as an operating company under a negotiated plan. Rite Aid (OTC:RADCQ) is an example of this approach. They sold a major asset, Elixir for $575 million, and are liquidating many of their stores. They are currently negotiating a plan that would allow them to exit bankruptcy as an operating company with their remaining stores.

Helane Becker who is an airlines analyst at Cowen seems to feel that the #2 outcome – liquidation – is the more likely outcome than a merger with another airline according to media reports. I think the timing of a Ch.11 filing would determine if the outcome is #1, #2, or #3 for Spirit Airlines.

Avoiding Expensive DIP Financing

An often overlooked item by investors during a bankruptcy process is DIP financing. Borrowing money under a DIP is usually a very expensive way to raise cash. When many companies finally file for Ch.11 bankruptcy, they need to raise additional cash immediately to pay for operating expenses, which often means they need immediate DIP financing.

The interest rates on DIP loans are often high and there are high fees. In addition, some pre-bankruptcy debt, such as a revolver, is rolled up into this expensive DIP financing. For example, bankrupt EBIX, Inc. (OTC:EBIXQ) received DIP financing in December with an interest rate of SOFR+10% (this is just one of the potential interest rates – there is a complex interest rates matrix under the DIP) with a 3% upfront fee and a 2% exit fee. Part of Rite Aid’s DIP is not as expensive. The term loan part of their rolled-up DIP is SOFR+7.5%, which is more expensive than their rolled-up pre-petition term loan of SOFR+3.0%.

Besides being expensive, DIP loan covenants/terms usually control the entire bankruptcy process or at least have a major impact. The DIP lenders are often in the driver’s seat during the bankruptcy process instead of the company’s management and other creditors.

An interesting example of a company that filed for Ch.11 bankruptcy fairly quickly when energy prices dropped was Ultra Petroleum. They had enough cash/liquidity so they did not need DIP financing and negotiated a reorganization plan that included a rights offer to raise additional cash. Because energy prices eventually rose significantly during the bankruptcy process Ultra Petroleum shareholders were not wiped out under that plan. However, after Covid-19 hit and energy prices plunged, Ultra Petroleum again filed for Ch.11 (Ch.22) and shareholders were then wiped out.

What Does Spirit Airlines Gain by Filing for Ch.11?

Under a reorganization plan Spirit could get rid of most of their debt. This is the KEY reason to file for Ch.11 bankruptcy. The elimination of most of their interest payments would greatly improve the cash flow of the new company. Holders of debt might get the new equity for their claims depending upon their claim class priority. It is important to remember, however, that secured debt holders can’t be forced, in most cases, to receive new equity for their secured claim and would have the right instead to credit bid for their collateral assets securing their debt.

Another major advantage of filing for Ch.11 is that they could reject any unprofitable leases or contracts and sell unwanted assets under section 365. A rights offer to raise needed new cash to strengthen long-term finances of the new company is also a potential option under a reorganization plan. Since there are the same potential issues that resulted in the judge blocking their merger, I think it is unlikely another airline would merge with Spirit Airlines as part of a reorganization plan.

If they file before burning too much cash, they could avoid needing DIP financing. This is critical, in my opinion, because as I covered above DIP financing is very expensive and often hinders the flexibility when negotiating a reorganization plan.

A Ch.11 bankruptcy might be best, in my opinion, for Spirit Airlines to continue to operate, but I am not sure if that is the best option for SAVE shareholders. Often shareholders get little or no recovery under Ch.11 reorganization plans, but there are exceptions.

Alternatives to Bankruptcy

I am actually expecting Spirit Airlines to take the typical approach taken by most distressed companies – they fight to avoid bankruptcy at all costs, which too often puts them in terrible financial and operating conditions when they eventually do file.

Using a combination of equity and new longer-dated debt in exchange for the 8% notes is a potential out-of-court restructuring tool that Spirit might use. These exchange offers are often not successful and just are short-term Band-Aids. $1.11 billion is a lot of notes and makes for a very difficult exchange offer. The 8% notes are already secured so they can’t use the common tool of giving secured notes in exchange for unsecured notes. Notes with much higher interest rates combined with some equity option could result in getting some investors to exchange their 2025 notes for longer-dated notes. If an exchange offer includes a significant amount of equity, there could be dilution for SAVE shareholders. Any exchange offer is not going to be easy, in my opinion. In addition, some credit rating agencies consider certain exchange offers “defaults”. This happened to Rite Aid. (I covered this issue in a prior RADCQ article.)

Taking the AMC Entertainment (AMC) approach is another potential option. Currently, there are 240 million shares authorized and 109,167,560 shares outstanding. They could sell a large number of new shares to raise cash but SAVE is not a meme stock so a stock sale, which significantly dilutes current SAVE shareholders, might greatly depress the stock price.

Using sale-leasebacks could raise additional short-term cash, but that also means increased lease payments going forward. These lease payments put a lot of pressure on future cash flow. This approach just kicks the financial problems down the road.

Timing of Aircraft Sale-Leaseback Transactions

I am not sure if the recent sale-leaseback of 25 aircraft in late December and early January were remotely related to the proposed merger, but they could have been a hedge against a negative decision on the merger. Management looks brilliant now for doing those transactions to raise cash. I give management credit for the timing. Now management can include the $419 million net cash from the transaction when they talk about their current liquidity position. If those sale-leaseback deals were announced after the merger court ruling it would make Spirit look bad. People would have said that Spirit is in very serious financial trouble and needs to raise cash immediately by doing asset sales via sale-leaseback deals. The problem, however, is going forward there will be higher cash outflows to pay for leasing these 25 aircraft.

Without these recent large sale-leaseback deals and without the $300 million available under their revolving credit facility, management’s claim of $1.3 billion liquidity asserted in their January 19 update would be much lower. Their liquidity position would have looked rather weak.

Conclusion

As many SAVE investors already know, the company has had some operating problems over the last two years. Even if they are able to somewhat improve operating results in the near future, the $1.11 billion 8% note maturity is a problem that will be difficult to resolve without some major financial restructuring in or out of court. I think that a Ch.11 filing in the future is a viable option to keep Spirit Airlines operating. Others may disagree, but an out-of-court financial restructuring is often very difficult to achieve.

Hoping that the Court of Appeals reverses a lower judge’s ruling is just that – hope. Judge Young’s decision seemed very rational in my opinion and I have serious doubts the higher court would reverse. Many may disagree with his actual decision, but there do not seem to be “holes” in his analysis and conclusions that could cause a higher court to reverse. For all these reasons I rate SAVE a long-term “sell”.