cemagraphics

The S&P500 (SPY) has made a new high for the year of 4609, exceeding July’s peak of 4607. This is not something I expected when I proposed a large bounce could evolve from 4103, but the price action of the rally has been telling a bullish story and I have listened. Last week’s article concluded, “continuation to evaluate 4607 looks probable and this likely breaks.” It also highlighted 4537 as a key level to hold (and trade against). The low of the week was 4546.

As I have said before, prediction is only one part of technical analysis. Whether or not a forecast will play out as expected has ever changing odds influenced by price action and key inflection points. This week’s article will again outline specific conditions to either stay bullish, or to flip bearish. Various technical analysis techniques will be applied to multiple timeframes in a top-down process which also considers the major market drivers. The aim is to furnish an actionable guide with directional bias, important levels, and expectations for future price action.

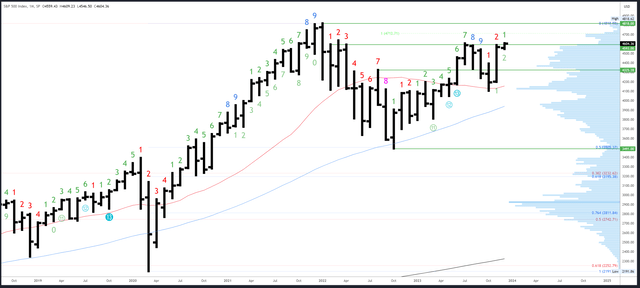

S&P 500 Monthly

The December bar is following through as it should after the bullish action in November.

There is absolutely nothing bearish about the monthly chart at the moment, but there are ways this could change. A reversal could set up with a rejected rally and a December close back below the November high of 4587 and near the lows of the monthly range. This isn’t a high probability scenario given the context of the 2023 annual bar, but is something to monitor nevertheless.

The key resistance area of 4593-4607 is being tested. The all-time high of 4818 is the next major level.

November’s high of 4587 will be important going forward as mentioned earlier. Initial uphold is 4541 at the September high, but this is minor. Real uphold comes in a lot lower at 4393 and 4325-35.

The September bar completed a Demark upside exhaustion count. This has had its effect and there will be a long expect for the next monthly signal. December is bar 1 (of a possible 9) in a new upside exhaustion count.

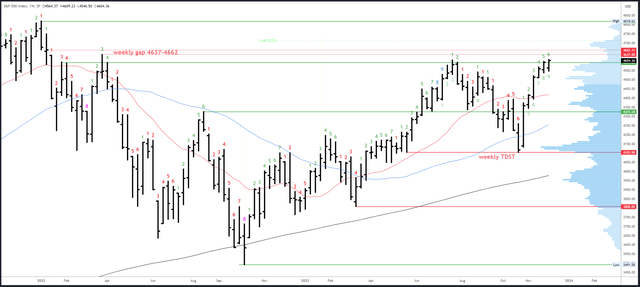

S&P 500 Weekly

This week’s bar held a higher low, made a new 2023 and closed near the high of the week. It’s easy to deduce it is bullish and there should be continuation next week.

Saying that, the small range and lack of progress (both the high and the close this week were 10 points above the high and close of the previous week) does suggest momentum loss. Moreover, there has been no weekly consolidation below the 4607 resistance which suggests the breakout could lack impetus.

The weekly gap at 4637-4662 is the next area of interest above 4607. 4712 is a measured proceed (where the current rally is equal to the October-December ’22 initial rally).

4537 remains key uphold.

An upside Demark exhaustion count will be on bar 7 (of a possible 9) next week. Reactions are generally seen on bars 8 or 9.

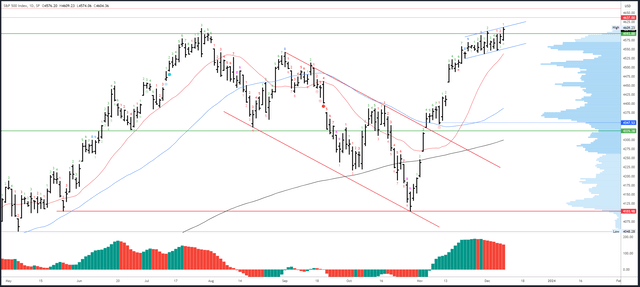

S&P 500 Daily

The daily chart provides us with more detail and some potentially important information.

Firstly, there was a bearish reaction to new rally highs on 29th November and the 1st December. Strength was sold.

Secondly, momentum loss is evident and there is divergence on Friday’s high. This can be deduced from the price action but I have included an indicator on the bottom of the chart to make it clear.

While none of this is bearish, it does suggest the breakout above 4607 is suspect and a reversal could evolve.

Resistance points all come from the monthly/weekly charts.

4607 is an important level, but is not an inflection point and daily closes either side of it won’t signal a huge shift in bias.

Near-term uphold is 4565 at the gap from 6th December and the pre-market NFP low. This week’s 4546 double bottom is vulnerable given the weak close on the 6th December, and I expect this level to be re-visited and broken at some stage. 4537 remains important, with 4487 the next key level below. The 20dma could also be in play on a dip as it is currently at 4537 and rising 13 points a day.

Given the choppy conditions, Demark exhaustion counts keep getting aborted in their early stages. A new upside count will be on bar 2 (or a possible 9) on Monday which means no reaction is expected next week.

Drivers / Events Next Week

Friday’s strong jobs report could continue to influence the early part of next week. The numbers uphold the view of a soft landing for the economy, but also “higher for longer” rates. How long can stocks, yields and the US dollar all rally together appreciate they did on Friday?

CPI is due out on Tuesday and a month-on-month reading of 0.0% is expected to take the year-on-year down to 3.1%. Markets could be very cautious of any stronger readings given wage growth ticked up to 0.4% and unemployment fell to 3.7%. Last week also saw UoM Consumer Sentiment jump from 61.3 to 69.4.

The FOMC meeting is on Wednesday and while no hike is expected, there will surely be some pushback on rate cut expectations given the recent data. Recent attempts at sounding hawkish have been ignored but perhaps the market takes more notice given the increased risk of a second inflationary wave.

There are rate meetings from the ECB, BoE and SNB on Thursday as well as data on Retail Sales and Unemployment Claims.

Probable Moves Next Week(s)

Next week’s call is more of a challenge than usual. For a start, Friday’s proceed was inconclusive – it spent less than 15 minutes at new 2023 highs above 4607 and then closed back below at 4604. Hardly a convincing breakout. There are also subtle signs of momentum loss and evidence of distribution, but these could be easily erased next week and the overall context remains bullish.

The macro backdrop doesn’t help conviction either. NFP was good news for the economy but bad news for rate cut expectations which creates a mixed picture for stocks. Next week’s busy calendar complicates the situation advance.

To facilitate the situation, I will again use inflection points and price action as a guide to probable moves.

The S&P500 remains bullish in the near-term as long as it stays over Friday’s pre-market 4563 low. A strong close above 4609 would project 4637, and advance positive action (holding previous session lows and strong closes) could keep the rally going all the way to 4712 towards the end of the year.

A sustained break of 4537 is unlikely and is needed to create a bearish bias. It could even suggest the top is in, although it would take a close below 4487 to be more certain. This could guide to 4335 and potentially lower.

There are reasons to be sceptical of the break-out and I personally wouldn’t chase the rally. Better opportunities will set up, either after a convincing bullish proceed above 4609, or after a dip near 4563. There may even be a brief spike below 4537 to clear the way for a “Santa Rally” after Christmas. Now that would be a gift.