SweetBunFactory

Semiconductors continue their surge in 2024 thanks to continued A.I. enthusiasm.

Semiconductors were the star sector performer in 2023 and the strong momentum continues into 2024 as a favorable industry backdrop continues to lift investor sentiment in this area.

Wall Street Analysts have forecasted that 2023 most likely was the cyclical trough in terms of fundamentals and industry revenues bottom out after an 8-10% annual drop. This set the stage for a very strong 2H 2023 rally in the ETF as industry revenues were projected to rise again in 2024 in the high single digit profile according to Wall Street consensus. While the near-term upside has been consumed with momentum trading near a 70 RSI level, the long-term prospects for semiconductors continues to be bright. Over the long term when the U.S. goes through economic expansion (positive GDP), semiconductors as an industry tends to match or exceed Nasdaq-100 performance.

In this article, we’ll discuss the industry forces to watch and follow as we trade at record highs for this industry.

SOXX ETF at all time highs (TradingView)

Industry Catalysts for Semiconductors

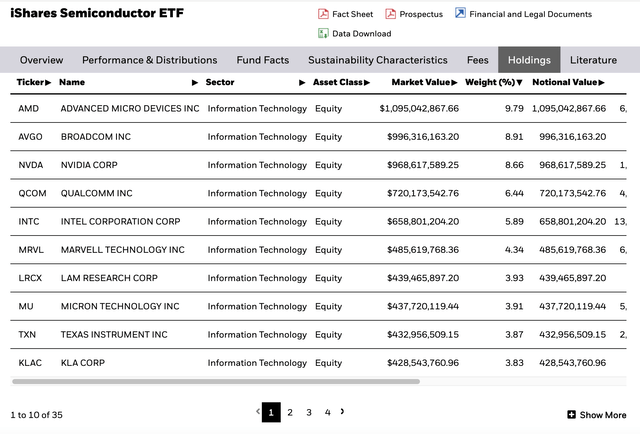

To understand the iShares Semiconductor ETF (NASDAQ:SOXX), we take a look at the weighting composition for its top 10 major constituents, which together add up to over 50% of the ETF’s weight.

Within this sector ETF, AMD (AMD) and Nvidia (NVDA) are the most well-known retail favorites. In the background representing the “picks & shovels” to the semiconductor industry’s A.I. rush are Broadcom (AVGO), Applied Materials (AMAT), and Lam Research (LRCX).

Nearly all names in this top 10 list have a favorable fundamental outlook as the secular tailwinds for A.I applications become stronger. The only company that reported subdued outlooks from this list over the past quarter was Texas Instruments (TXN) as they discussed very weak China demand in their industrial segment. I will write company specific articles on several of them in the future as this note is focused on the industry perspective.

Over the last 10 years, the semiconductor industry has seen a super cycle as it is the core of innovation with the tech sector, strong new industry verticals that drive growth such as A.I & Machine Learning, and more prudent inventory management as companies use previous corrective cycles to build strong models to manage backlogs.

In 2023, JPM estimates that semiconductor industry revenue is projected to be 8-10% lower year over year, which marks an industry trough after a 3% growth year in 2022. On a Y/Y basis, industry volumes have fallen about 20% but this has been offset by increased average selling prices of 12%. Wall Street now sees 2024 being a year where the industry sees resumption of revenue growth in the high single digit profile where areas such as memory, smartphones, and PC begin a bottoming process while Data Centers, Cloud Computing, and AI verticals continue their current favorable demand tailwinds.

Important to watch are the biggest clients of the Semiconductor industry as they represent the health of the Capital Expenditure Spending market. Certain companies are large buyers of Semiconductor products, services, and offers, and include Oracle (ORCL), Google (GOOGL) (GOOG), Meta (META), Amazon (AMZN), and Apple (AAPL) as these companies ramp up their A.I. infrastructure for the end consumer market.

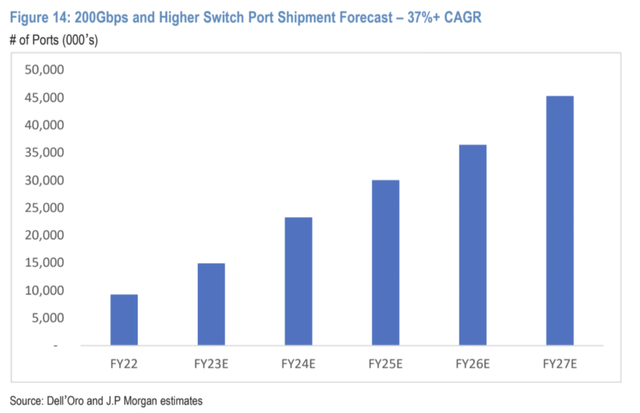

Within the SOXX ETF, Broadcom focuses on network switching and routing, which is the building blocks of A.I. computation. Broadcom’s expertise in networking infrastructure has helped the company exceed expectations in their latest quarter. The firm’s Tomahawk 3 product is a major driver of the semiconductor 200/400G upgrade cycle which counts major clients such as Google, Meta, and Microsoft as they expand their Capex plans. At 9% of the SOXX ETF, Broadcom’s strong fundamentals has helped to lift the SOXX to its current all-time highs. We can see below that the demand for 200G and Switching Port shipments are rising at a rapid clip, which will benefit Broadcom.

Other major SOXX Components such as NVDA have also fared very well as the demand for NVDA’s GPU and H100 chips are forecasted to continue to be strong. A.I. computing intensive applications that rely on deep learning models will for now heavily rely on chips produced by NVDA and AMD, solidifying their market positioning as suppliers to A.I. innovation.

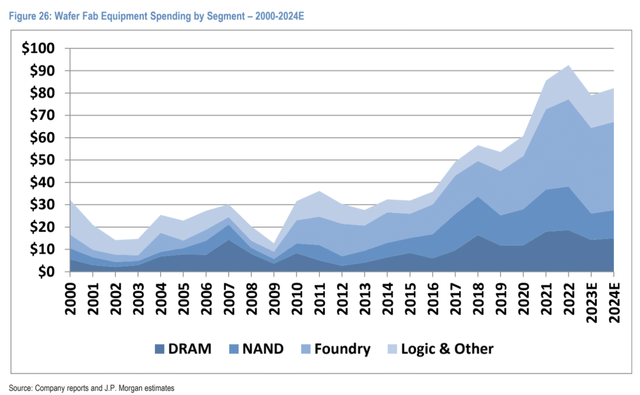

Wafer Equipment Spend (JPM Estimates)

Within the Capex Spending environment, we can also see from the above chart that the importance of Logic and Foundry has increased as a percentage of Wafer Fab Equipment spending relative to DRAM and NAND. This is constructive for the industry as Foundry/Logic is relatively less cyclical than memory-oriented sub-sectors such as DRAM and NAND. The increase in Wafer Fab Equipment spending in less cyclical sub-sectors has made Lam Research and Applied Materials experience a less pronounced downturn during the inventory buildup of memory chips over the past 2 years. A strong outlook in LRCX and AMAT is constructive for the SOXX ETF as they are first to signal whether any industry upswing or downswing materializes due to their positioning in the semiconductor supply chain.

Risks, Thoughts on Entry

Presently, the fundamental risk to SOXX ETF is that if the Capex Spending environment slows down among the Big Tech firms Meta, Apple, Google, and Microsoft, then we will see the outlooks of companies within the ETF being impacted. But as of now, we are not yet seeing any material slowdown in Capex Spending. In fact, we are most likely seeing an increase in capex spending with Microsoft, and also Google as it retains its most valuable A.I. employees to build out innovation and prevent them from being poached by Open A.I.

The largest near-term risk is primarily technical in that investors may be over-positioned in the sector as nearly all names in the SOXX ETF exhibit an overbought reading of 70 RSI (which represents potential overheating within momentum).

This is not to say that the outlook has turned negative, only that today’s levels already represent strong investor enthusiasm and that better entry points are likely available looking out further ahead.

With industry fundamentals improving in the context of investors chasing this theme, I believe the outlook ahead continues to be bright but would rate the Sector SOXX ETF a Hold here as patience is likely to reward investors who want to enjoy the benefits provided by the SOXX ETF’s secular trends at better levels.