Funtay/iStock via Getty Images

Southern Copper (NYSE:SCCO) operates as a prominent copper miner with operations spanning Mexico and Peru. Their remarkable competitive edge lies in remarkably low cash costs and substantial reserves. This company provides a gateway to the promising upward trend in copper prices while simultaneously expanding its dividend payouts.

Despite some potential for advocate upside, I hold the belief that Southern Copper Corp is presently a sell, with lofty expectations already factored into its current share price.

Southern Copper’s Position

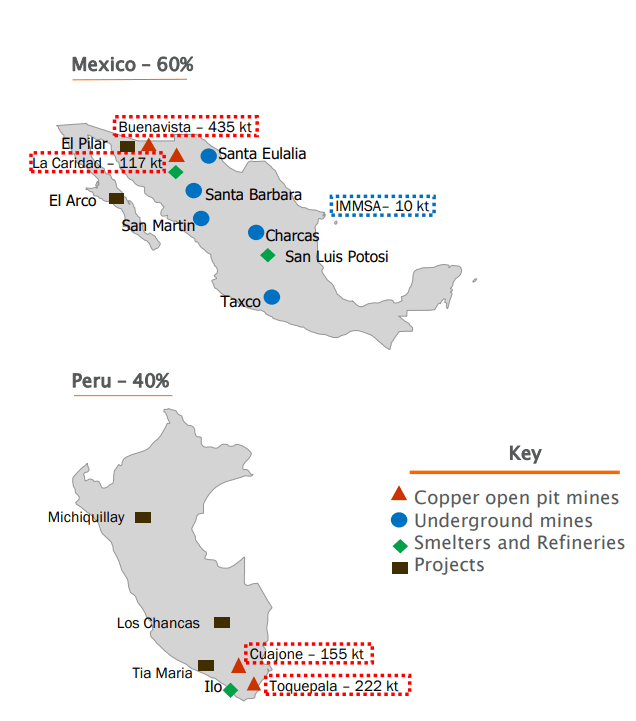

Southern Copper, takes fifth place in World’s top copper producers at 918 kt in 2022. They’re owned by Mexican conglomerate Grupo Mexico for 88.9%, which also operates in railway transportation and construction. They function a selection of great mines with very low cash costs both in both Mexico and Peru.

Mines Overview (Southern Copper)

With three-fourths of their total revenue sourced from copper, they boast one of the highest EBITDA margins among competitors, standing at 52.95%. This substantial margin is notably higher than their more diversified competitors.

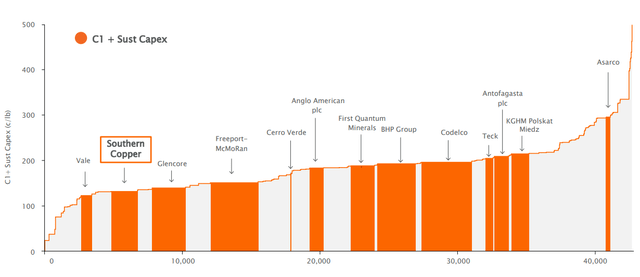

Competitive Advantage

Southern Copper stands out due to its remarkably low cash costs, reporting $0.67/lb and $0.78/lb in 2021 and 2022, respectively. These notably low costs partially protect the company from the impacts of fluctuating copper prices, fostering ongoing business expansion. With the highest copper reserves among listed companies, they expect nearly seven decades of continued mining operations. This already ensures their moat, since the barrier to entry in the copper sector is huge.

It has taken on average over 16 years to proceed minnig projects from discovery to first production. –S&P Global

To exploit these extensive reserves, Southern Copper is strategically planning a substantial expansion in capital expenditures. Their foresight involves doubling the current average capex cost of $0.9B over the next decade. This initiative aims for an impressive 80% enhance in production by 2032.

Even excluding the favorable copper fundamentals, this initiative alone positions the company for a potential twofold enhance in value over the next decade, alongside accruing dividends. Nevertheless, given the inherent uncertainty in projections, this is far from guaranteed.

Copper Cost Curve 2022 (Southern Copper)

My Copper Thesis

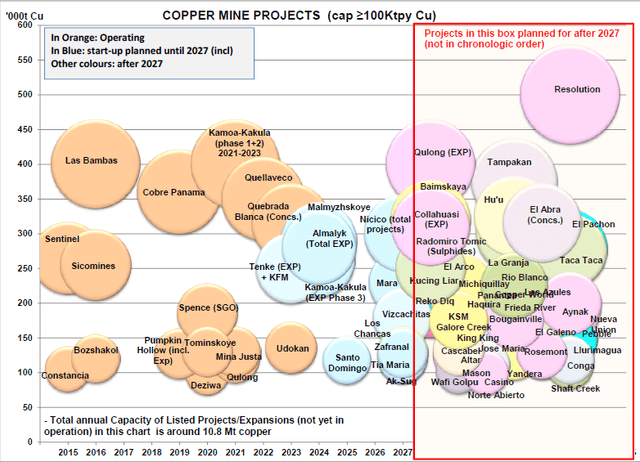

Assessing Southern Copper’s investment potential hinges on evaluating copper’s viability as an investment. They’re not alone in forecasting higher capital expenditures ahead. The directory outlines significant copper mine projects with annual production capacities exceeding 100,000 tonnes, collectively adding around 10 million tonnes to annual production. Additionally, numerous smaller projects are currently under development or evaluation (World Copper Factbook 2023).

Copper Mines In Development (ICSG Directory of Copper Mines and Plants)

Forecasts for sustained high copper prices should be approached cautiously due to the emergence of unknown technologies. During crises, innovative extraction methods tend to swiftly evolve, and higher copper prices incentivize mining companies to explore more complex sites. This exploration could quickly enlarge accessible copper reserves (Springer Link).

Positive Industry Tailwind

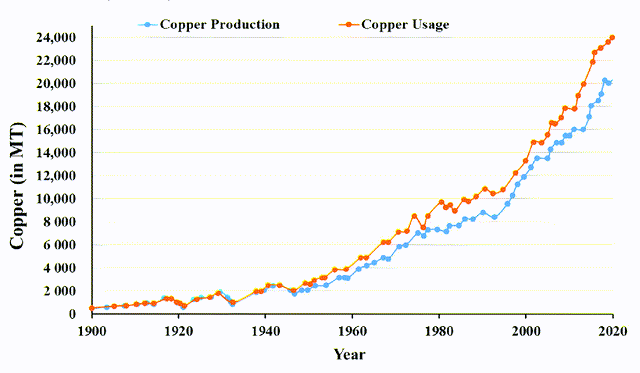

Refined copper usage, starting from under 500 thousand tonnes in 1900, surged to 26.1 million metric tonnes by 2022, reflecting a consistent compound annual growth rate of 3.3% over this period.

World Copper Production and Usage: 1900-2020 (ResearchGate)

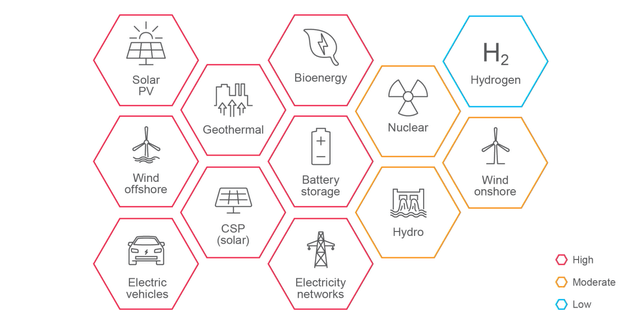

Copper’s demand is poised for substantial growth amid the global shift towards clean energy, driven by net-zero emission goals (Copper Alliance). Additionally, the incorporation of technological innovations, which heavily depend on copper’s supply, advocate ensures its continuous relevance and demand.

Copper’s indispensable role spans across various applications. In a 3MW copper windfarm, around 4.7 tons of copper are used. Solar panels need about 5.5 tonnes per MW (Copper Development Associaton). Electric cars necessitate roughly 83 kilograms of copper, with half of it going to the batteries (Copper Alliance). In energy storage, a lithium-ion battery has roughly 200 kilograms of copper per MW.

Presence of Copper in Energy Transition Technologies (S&P Global)

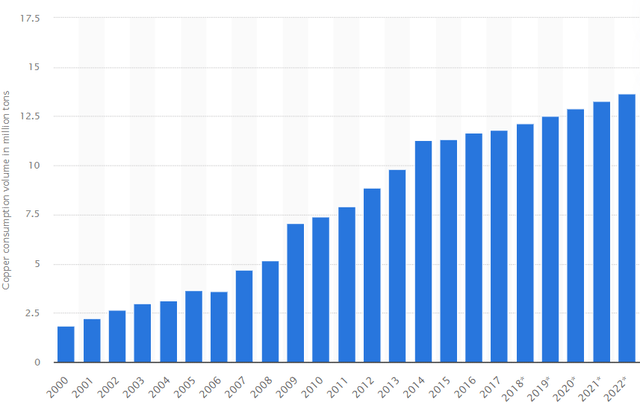

The anticipated surge in copper demand is unlikely to stem primarily from renewables or electric vehicles. Instead, the burgeoning demand is expected to be propelled by industrializing nations incorporating copper into their development paths for electrification, especially in the realm of consumer products. China’s historical trends demonstrate this, and India is set to follow a similar path. Yet, a decrease in China’s copper consumption would enormously hit copper prices.

Copper consumption volume in China from 2000 to 2022 (Statista)

Supply Gap

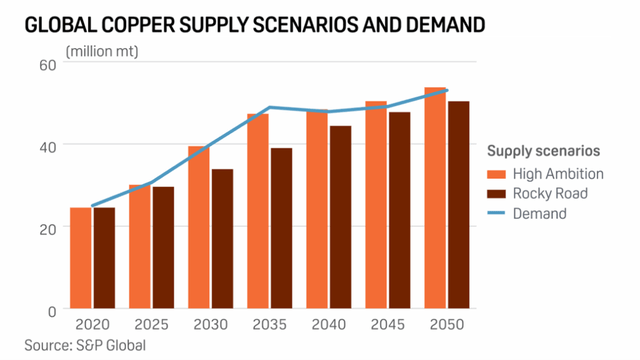

There are many different predictions on how much refined copper demand will grow. There’s a perception that the rate of copper discovery will not keep pace with investments in copper exploration. But because of the cyclical nature of copper, some expect the demand to outweigh supply, causing copper prices to surge as well as Southern Copper’s margins.

Rocky Road Scenario (The Assay )

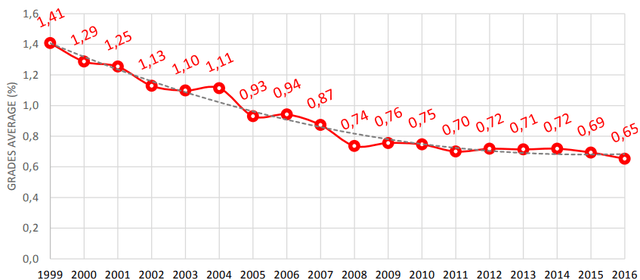

Moreover, established copper mines are grappling with resource depletion and declining ore grades, adding complexity to production forecasts. In Chile, ore grades have exhibited a refuse, notably dropping from an average mining grade of 1.41 in 1999 to 0.66 in 2022 (Cochilco). This, coupled with rising labor and energy expenses, has been driving up their overall maintenance costs and is projected to persist in the long run.

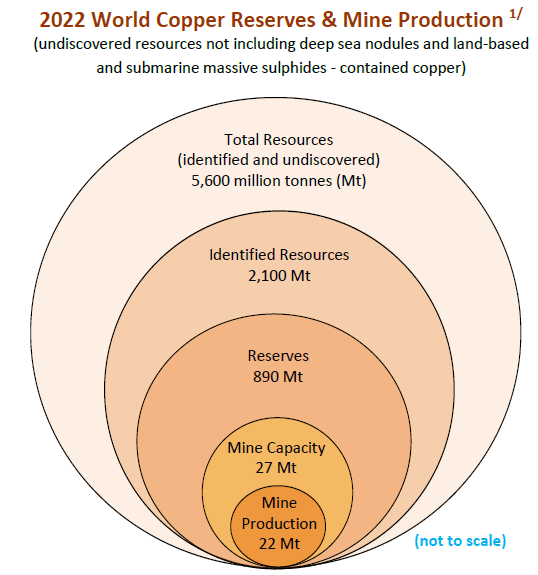

Since there’s a prevalent concern about an impending copper shortage, let’s contextualize this. According to the US Geological Survey, a non-profit, undiscovered copper resources are estimated at 5,600 million tonnes, while current mine production stands at 22 million tonnes. This represents merely 0.39% of the total resources, excluding deep sea nodules, land-based, and submarine massive sulphides—resources that contain copper. Consider that in the past decade, the surge in copper prices has propelled copper exploration budgets to unprecedented levels.

World Copper Reserves (ICSG, USGS)

Peru and Mexico Risk

Despite increased demand for copper produced from ore in recent years, increases in reserves have grown, and there is more identified copper available to the world than at any other time in history. – ICSG

The mining industry is no stranger to turbulence, facing potential issues such as accidents, strikes, and legal entanglements. However, these challenges are mitigated by their strategic diversification across multiple mines, which aids in managing and balancing these risks. A notable portion of the risk arises from their operations being based in Peru and Mexico. In the case of Peru, which contributes 11% to global supply, unrest led to a six-week shutdown last year due to inadequate security measures for workers (Reuters).

According to Aswath Damodaran‘s research on assessing country risk premium globally, considering political, economic, and legal factors, he recommends a return premium of 2.4% for Peru and 2.9% for Mexico. We’ll blend these premiums into our fair valuation.

Fitch assigns Mexico a BBB- rating, with both Southern Copper and its main stakeholder, Grupo Mexico, holding a BBB+ rating, primarily influenced by their operational countries. Grupo Mexico’s current 0.3x Net Debt/EBITDA ratio signifies minimal debt risk.

Tax increases remain a persistent possibility, often utilized to encourage companies to align with better ESG criteria. Southern Copper currently stands at the 25th position out of 228 within their industry, showcasing commendable performance in this regard. Another risk involves the possibility of a recession leading to reduced copper prices, potentially resulting in a dividend cut.

Copper Scenarios Impact on Dividend

To evaluate the viability of investing in a cyclical miner operating in developing countries, determining its intrinsic value requires a careful assessment of future cash flows. Given the reliance on copper prices, the analysis will encompass diverse valuations corresponding to varying scenarios of copper’s price fluctuations.

Under the premise that molybdenum, zinc, and silver align their trajectories with copper, assessing potential outcomes becomes imperative. At a copper price of $3.8/lbs, sales surge to $9.8 billion, boasting a formidable EBITDA margin of 52%. Conversely, a plummet to $2.5/lbs slashes the EBITDA margin to 24%, advocate plummeting to 5% at $2.0/lbs. While these extremes seem unlikely in the near term, their plausibility hinges entirely on the volatile nature of copper prices.

The recent dividend payouts, exceeding $2.71 billion over the last twelve months, raise concerns as they almost exceed a 100% payout ratio, indicating an unsustainable trend.

In a plausible scenario, envisioning a copper price of $3.0/lbs, EBITDA dips to $2.58 billion, correlating to a 34% ratio. This adjustment reverberates in the net income, estimated at $1.25 billion.

Factoring a still relatively high 75% payout ratio, the potential dividend narrows to $0.94 billion, yielding 1.66%. Such projections suggest that even a modest 21% drop in copper prices could catalyze this significant shift. Moreover, considering the company’s intentions for escalated capital expenditure over the next decade, sustaining such substantial dividend payments seems increasingly unlikely.

Rosy Valuation

To value Southern Copper as a dividend stock, we’ll base the valuation on average copper prices and dividend yields. Here’s how exorbitant current prices seem for Southern Copper, illustrating what I believe is factored into the current share price of $71:

Beginning with a presumed 75% payout ratio initiating at $2.63 per share, this assumption predicates a steady copper price range hovering between $4 and $5 per pound. This bullish scenario involves maintaining a consistent 5% annual growth in dividend yield over the forthcoming decade. This anticipated growth, fueled by capital expenditure, is somehow envisioned not to disrupt dividend payments.

The cornerstone in this model revolves around estimating the dividend yield at which the market will evaluate Southern Copper. This assessment is intertwined with the Federal Reserve’s actions, yet my preference is to position myself resiliently against fluctuations in interest rates. Setting a 10% required return alongside an anticipated 3% dividend yield from the market would make us reach at the current valuation.

Let me reiterate the boldness of these assumptions…

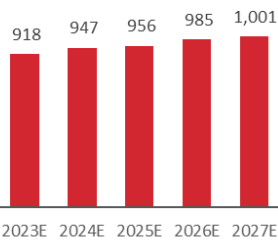

We’re assuming consistently elevated copper prices, disregarding the cyclicality inherent in an industry known for its significant fluctuations. There’s no additional expected return factored in for operating in regions admire Peru and Mexico, despite the inherent challenges. To accomplish an expected dividend yield of 3%, it would necessitate exceptionally low rates from the Federal Reserve. Their forecasted production growth rate stands at a modest 1.7% annually over the upcoming five years. Any catalyst driving accelerated growth is anticipated to surface only after 2027.

Projected Copper Production (Southern Copper)

Conclusion

Southern Copper, a remarkable player in the copper mining sector, holds a strategic position guaranteed to capitalize on the promising future of copper. For this investment, a minimum discount rate of 13% is necessary. I will be reevaluating the stock when their EBITDA margins halve, as historical trends unveil that copper miners tend to yield lower returns in periods of elevated EBITDA margins.

The potential upside here lies in even higher copper prices, which could be potentially caused by the Federal Reserve’s rate lowering and a subsequent inflation spike. However, considering the current valuation, the limited potential for gains doesn’t defend the considerable downside risk. This lack of a substantial margin of safety becomes apparent, especially with high copper prices factored in at $4 per pound, alongside a book value per share resting at $10.

While I remain optimistic about the future of copper, I expect temporary disruptions that may create more favorable entry opportunities compared to the current scenario. The likelihood of future distortions in copper prices within the next decade is certain, presenting potentially better entry points than the present. Consider investing when both copper prices and market sentiment are at their lowest for optimal returns.