SOPA Images/LightRocket via Getty Images

Elevator Pitch

My rating for South32 Limited (OTCPK:SOUHY) [S32:AU] is a Hold. With my prior update written on September 15, 2023, I touched on SOUHY’s distribution of excess capital to shareholders and the restructuring of the company’s portfolio.

I turn my attention to South32’s latest 1H FY 2024 (YE June 30, 2024) financial results’ announcement in the current write-up. SOUHY’s recent interim results came in below the sell side analysts’ expectations, and the company has chosen to terminate its share repurchase plan. On the flip side, South32 might see an earnings recovery in the second half of the fiscal year, and its current valuations are undemanding. My decision is to lower my rating for SOUHY from a Buy to a Hold in view of these positive and negative factors.

Investors can deal in South32’s shares on the Australian Securities Exchange and the OTC (Over-The-Counter) market. South32’s OTC shares are reasonably liquid, with a 10-day average daily trading value of $2 million (source: S&P Capital IQ). The company’s Australia-listed shares have even better liquidity, with a mean daily trading value of $25 million for the last 10 trading days. Interactive Brokers is one of the US brokerages that can allow their clients to buy and sell South32’s Australian shares.

Recent Interim Financial Performance Fell Short Of Expectations

On February 15, 2024 (Australian time), South32 released its financial results’ announcement for the first half of fiscal 2024 (July 1, 2023, to December 31, 2023). The company’s 1H FY 2024 performance was worse than what the market had anticipated. Note that even though South32 is an Australian company, it reports its financials in US dollars.

Top line for SOUHY decreased by -15% YoY from $3,696 million for 1H FY 2023 to $3,133 million in 1H FY 2024. The company’s most recent interim revenue was -6% lower than the sell side’s consensus estimate of $3,350 million (source: S&P Capital IQ).

South32’s normalized net profit dropped by -93% YoY to $40 million for the latest interim financial period. The company’s actual 1H FY 2024 normalized net income was a significant -79% below the analysts’ consensus forecast of $191 million as per S&P Capital IQ data.

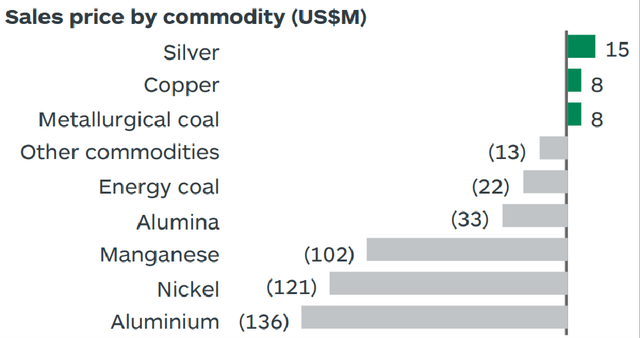

SOUHY’s Sales Price Changes For Different Commodities

South32’s 1H FY 2024 Earnings Presentation Slides

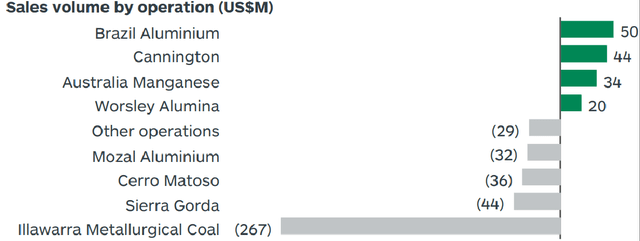

South32’s Sales Volume Changes For Its Various Projects

South32’s 1H FY 2024 Earnings Presentation Slides

The two charts presented above help to explain why SOUHY suffered from such a substantial earnings miss in 1H FY 2024. Firstly, South32’s selling prices for most of the commodities in its portfolio declined YoY for the first half of FY 2024, as demand for commodities in general weakened due to challenging global economic conditions. Secondly, SOUHY’s Illawarra Metallurgical Coal asset witnessed a significant drop in sales volume for the latest interim period, which the company attributed to “planned longwa.

ll moves” in its 1H FY 2024 results announcement.

Share Repurchase Program Cancellation Was A Disappointment

South32 revealed in the company’s 1H FY 2024 earnings announcement that it had “taken the decision to cancel our on-market share buy-back, which was due to expire on 1 March 2024.” Earlier, the company disclosed it had $158 million remaining from its share repurchase authorization as of September 1, 2023, when it reported its full-year FY 2023 results.

I previously noted in my mid-September 2023 article that better-than-expected “capital return in the form of buybacks and dividends” might be a catalyst for South32. Therefore, it is disappointing that SOUHY has chosen to discontinue its share repurchases.

At its 1H FY 2023 results briefing, SOUHY explained that it had cancelled its share repurchase plan after considering the company’s “weaker margins and the growth in our net debt position.” The company’s comments are consistent with its financial metrics. South32’s normalized EBIT margin contracted by -15.2 percentage points YoY to 6.1% in 1H FY 2024. Separately, the company’s net debt increased from $483 million as of June 30, 2023, to $1,091 million at the end of calendar year 2023.

Furthermore, South32’s share buyback program cancellation has negative read-throughs for its cash flow outlook. The company highlighted at its latest interim earnings call that “when you look at forecasted cash flows based on today’s numbers, you don’t have the same free cash flow coming through.” On the same day of its earnings release, SOUHY also disclosed that it has secured “final investment approval for the Taylor deposit, the first development at our Hermosa project in Arizona.” This is an example of projects which will incur meaningful capital expenditures and limit South32’s capacity to allocate capital to share buybacks. As a reference, the company’s capital expenditures increased by +40% YoY to $584 million for 1H FY 2024.

Consider 2H Earnings Prospects And Undemanding Valuations

SOUHY’s below-expectations 1H FY 2024 earnings and its share buyback plan cancellation would have left investors disappointed. But there are positives relating to South32 that shouldn’t be ignored.

One key positive is that South32 could potentially achieve a meaningful earnings rebound in 2H FY 2024. In the preceding section, I noted that the company’s free cash flow outlook is unfavorable, taking into account capital expenditure needs. But SOUHY’s net income might rise for the second half of fiscal 2024 taking into account the commodity price outlook and the company’s guidance.

World Bank has forecasted that its commodity price index’s decline will narrow significantly, from -24% last year to just -4% this year. Separately, South32 guided for “a 7% increase in Group payable copper equivalent production” and “lowered” or unchanged operating expenses for most of its projects for 2H FY 2024 in its recent interim results announcement. A major driver of higher production is that Illawarra Metallurgical Coal asset’s production is expected to normalize in the second half of the current fiscal year, with “longwall moves” having been completed.

The other key positive is that South32’s valuations are appealing.

An analyst noted at SOUHY’s 1H FY 2024 earnings briefing that share repurchases will be “very accretive at current (price) levels” for the company. South32 agreed with this analyst and mentioned that at the recent quarter results call that “we think that our share price at the moment is undervalued.” As detailed in the preceding section, there are financial constraints (e.g. debt, capital expenditures etc.) that limit South32’s ability to conduct share buybacks now.

South32’s average normalized net profit for the FY 2018-2023 financial period was $1,087 million. Assuming that the company’s earnings revert to the historical mean at some point in the future, South32’s implied P/E ratio based on historical average earnings is an attractive 8.3 times.

Concluding Thoughts

I have a Hold rating for South32 now after reviewing its latest interim results and disclosures. On the positive side of things, an earnings turnaround in 2H FY 2024 is likely, and both management and the sell side think that South32 is trading at a discount to fair value. On the negative side of things, it is highly probable that South32 will put share buybacks on hold indefinitely, until its free cash flow prospects improve.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.