Luis Alvarez/DigitalVision via Getty Images

I have covered several voice AI stocks or companies applying artificial intelligence in conversations before but SoundHound AI (NASDAQ:SOUN) is different. The reason is not only because Nvidia (NASDAQ:NVDA) invested around $3.7 million in the company which has grown revenues at an accelerated pace while making progress on the profitability front.

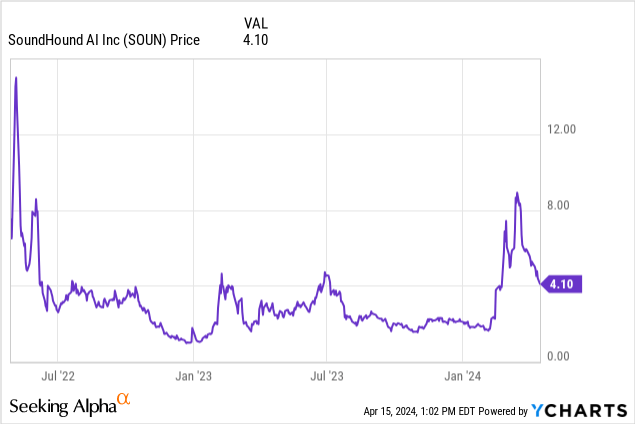

News about the semiconductor giant taking a 0.6% stake in the $1.35 billion company catalyzed its stocks above $8 as shown below but it was trading at around $4 at the time of writing, and this thesis aims to show that this constitutes a buying opportunity.

To start with, it is important to understand why Nvidia, a giant producer of advanced GPU chips put money into a company that develops conversational AI solutions for customers from automotive, IoT, and other industry verticals.

Understanding Nvidia’s Interest in SoundHound

First, with its CUDA (Compute Unified Device Architecture) which provides the software layer that AI model developers in any industry can use to rapidly optimize returns on investment or ROI, the semiconductor giant is much more than a chip maker.

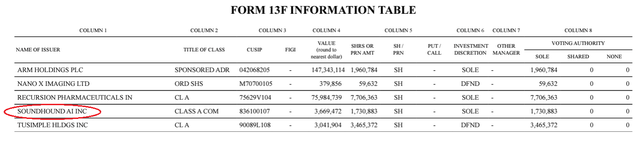

From this perspective, its investment in Recursive Pharmaceuticals (RXRX), Nano X Imaging (NNOX) which develops imaging devices for digital X-rays, and SoundHound as per the extract below seems to be geared at stimulating the demand for its technology.

Another precision is that with Nvidia, it is mostly about Generative (Gen AI) and GPU (graphics processing unit) accelerated silicon, not traditional flavors of artificial intelligence like machine language making use of conventional CPU (compute processing units) chips produced by the like of Intel (INTC). The reason is that after the success known by OpenAI’s ChatGPT, many companies have been scrambling, either to invest in Gen AI or repackage old technology as new in an attempt to lure investors and customers alike.

Zeroing on SoundHound, it was “able to swiftly integrate multiple Gen AI models within a matter of weeks” to introduce its Chat AI product for automotive in April last year use as pictured below.

Now, between the development of a product and its actual adoption by customers to generate revenues, there is normally a time lag, and marketing efforts are required. However, for SoundHound, things seem to have been far easier as seen by its fourth quarter 2023 (Q4) revenues increasing by 80% YoY with operating costs decreasing by 30.5%. This tends to show natural demand or one that is not motivated by high sales and marketing expenses.

The Revenue Growth Differentiator and Improving on Profitability

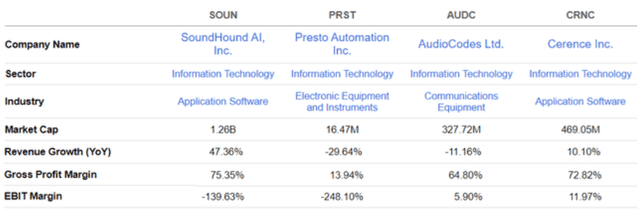

Going into details, it rapidly integrated Gen AI into its technology stack to transform the conversational or voice AI experience to become real-time and multi-lingual, thereby facilitating their integration with existing navigational systems already used by automobile OEMs. This ability to come up with the right product at the right time, not only helped to avoid a revenue slump in the second and third quarters but was able to boost growth to 47.36% YoY in FY-2023. This is higher than peers which also diversified into Gen AI as per the comparison table below while its gross margins remaining above 75% tend to show minimal changes to its Houndify platform to achieve growth objectives.

Comparison with peers (seekingalpha.com)

However, the company’s EBIT margins of nearly -140% show that it remains heavily loss-making it crucial to assess whether it can break even in the eventuality of having to scale investment rapidly in case competitors start shining.

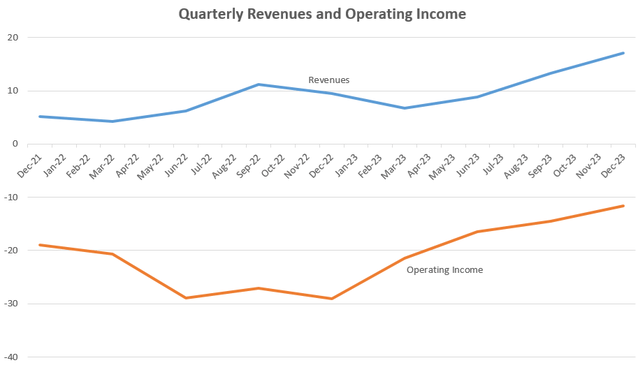

In this respect, looking at growth sustainability, this performance (80%) comes on the back of growth averaging 52% during the last twelve quarters (3 years). Looking at profitability, progress has been made as per the orange chart, with operating loss shrunk to $11.6 million in Q4. According to the management, the company will be profitable by the end of 2025, and, based on $100 million of sales, up from the $46 million achieved in 2023 and $70 million expected in 2024.

Moreover, sales (blue chart) remain on an upward trajectory signifying that as long as the company continues to keep operating costs under control, it can achieve break-even status.

Charts built using data from (www.seekingalpha.com)

Therefore, it deserves to be valued better.

Valuing SoundHound based on its better Time-to-Market while highlighting Risks

The problem is it already trades at a trailing price-to-sales of 19.84x which is above the median for the IT sector by nearly 590%, but, given it has positively disrupted sales through Gen AI relative to peers needs to be considered. In other words, its product is so attractive that customers are knocking at its door instead of it having to approach them.

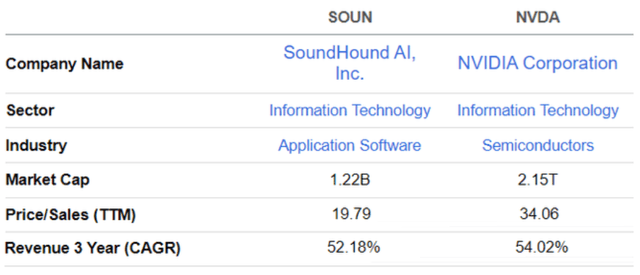

This sounds like Nvidia itself enjoying a near-monopolistic situation but as a software play, SoundHound was able to launch its Chat AI only 5 months after the advent of ChatGPT in November 2022. By comparison, it took the semiconductor giant one year from the time it announced its flagship H100 in March 2022, before launching it. Therefore, with a time to market at least two times faster than Nvidia itself, SoundHound’s trailing price-to-sales of 19.79x should be at least equivalent to Nvidia’s 34.06x. Adjusting accordingly, I have a target of $6.86 (34.06/19.79 x 3.99) based on the share price of $3.99.

Now, this target is based on comparing two companies that operate in two different industries as shown below but form part of the same sector, and have the same three-year CAGR growth. On top, they are now connected with Nvidia’s stake. Tellingly, while Nvidia has been investing in venture capital for startups, this is its first-ever 13F form or a quarterly report filed to the Securities and Exchange Commission for U.S. equity holdings.

Comparison of metrics, SoundHound AI and Nvidia (seekingalpha.com)

Now, this target is below Wall Street’s average price of $7.15 but is still a fair one given the risks.

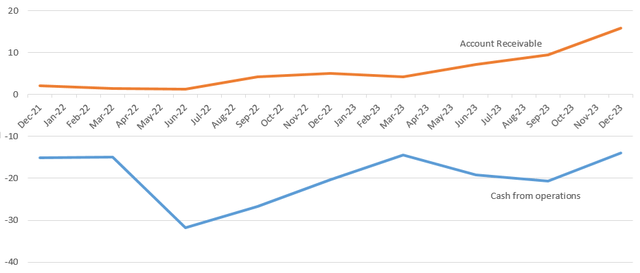

First, this is a company using more cash in operations than generating money. As a result, it is having to issue equities each quarter totaling $93.4 million in 2023. This is a lot and mainly accounts for the cash balance of $200 million on February 29 at the time of Q4’s earnings call. This includes the $95.3 million of cash and equivalents held in the balance sheet at the end of December.

The problem here is if it continues to use cash at such a rate and the royalty fees it charges to customers do not flow in the cash flow statement rapidly enough, the company will have to seek debt financing. Worst, if the share price suffers from volatility as was the case when Capybara Research started short-selling the stock, it would have to issue even more equity meaning more share dilution. Also, in case Nvidia decides to divest, the share price may drop.

Justifying the Buy Thesis

However, SoftBank Group (OTCPK:SFTBY) also invested in SoundHound at the end of last year. Therefore, for those who are prepared to take the risks, the balance sheet shows that the account receivables have been rising rapidly as per the orange chart below, and stood at $15.8 million at the end of the last fiscal year. These receivables increased mainly because a very large customer extended its contract to 2037.

Digging deeper, these revenues consist of voiced-enable royalty products forming part of SoundHound’s first pillar of growth for which there is a lag from the time the customer is billed till the cash is obtained. Still, progress has been made on operating cash flow as shown by the blue chart below, which was reduced to –$13.9 million at the end of Q4.

Charts are built using data from (seekingalpha.com)

Along the same lines, the company could see an improvement in cash generation for the second growth pillar, where revenue is obtained from voice-enabled subscription services for restaurants, personal care, and other verticals after the quality of service has been now augmented through AI.

In conclusion, this thesis has made a case for investing in SoundHound based on Nvidia’s stake, which differentiates it from other conversational AI companies. The criteria for why it was selected appear to be its ability to have profited rapidly from Gen AI to boost revenues. As for alternative investments, some may invest in its supply chain, namely TSMC (TSM) to which it outsources the production of GPU chips, or Microchip (MCHP) which packs GPUs in servers to be sold to hyperscalers like Amazon’s (AMZN) AWS which in turn builds AI infrastructure to support Gen AI applications.

These represent trillions of dollars of investment.

Thus, if the promises made by AI take time to materialize and investor patience runs out, the focus will increasingly shift to ROI or return on investment, benefiting companies like SoundHound which have been able to rapidly leverage AI infrastructures. Now some will argue that giants like Microsoft (MSFT) and Google (GOOG) also have voice AI technologies that can be further enhanced through Gen AI. Knowing their scale of operations, they may transform their text-to-speech voice generators into commoditized solutions posing a threat to SoundHound. There is also Apple (AAPL) with its iPhone and IOS ecosystem.

However, to be realistic, more than one year after the launch of ChatGPT and despite the enormous amounts spent, we are still waiting for the emergence of a killer app while SoundHound is already commercializing its Chat AI while spending less than $500K in Capex for FY-2023. This points to a nimble business model that can adapt rapidly to competitive threats. Finally, it can also grow inorganically as evidenced by the SYNQ3 acquisition for voice AI ordering in international food chains.