Alexander Farnsworth/iStock Editorial via Getty Images

Fool me once, shame on you. Fool me twice, shame on me.

Once bitten, twice shy. Caveat emptor. Whatever phrase you prefer, the world of SPAC mergers is one that many investors have waded into with disastrous results, including myself – once. Then, I swore off them.

You would be hard-pressed to find a SPAC trading above its merger price now. One of the main reasons is the complex capital structure, which floods the market with shares. I’ll converse how this relates to SoundHound AI (NASDAQ:SOUN) below.

But first, let’s check out the company.

What does SoundHound AI do?

SoundHound AI deals in conversational intelligence. Its products include Smart Answering, Smart Ordering, and Dynamic Interaction. The technology is incredible and a quantum leap from voice recognition currently used by many companies.

For instance, if you have recently filled a prescription over the phone, or dealt with an automated customer service, the phrases it understands are pretty limited – “yes,” “no,” and “main menu.” And most of us end up yelling “operator” to get to a human for anything important.

But the future looks different. SoundHound’s demo shows that a customer at a fast-food-type restaurant can create a complex order smoothly in real time. “Give me two cheeseburgers, no onion, a diet coke, and medium fries. Make that a small fry. What deserts do you have”? And the kiosk understands, updates, and offers options.

The implications for business efficiency and profitability are staggering.

In another example, vehicle software created with SoundHound tech can answer complex questions about the vehicle status and locate landmarks, charging stations, restaurants, etc.

SoundHound earns revenue through royalties and subscriptions on this software. It also has a monetization scheme for fees and advertising (i.e., the software recommends a restaurant the user dines in; there would be a revenue-sharing agreement).

There is little doubt that voice recognition AI software will be widely used. But SoundHound has some pretty big competition. Some companies you may have heard of (Amazon (AMZN), Alphabet (GOOG)(GOOGL), and Microsoft (MSFT), among many others) are also developing voice recognition software.

How are SoundHound’s financials?

SoundHound reported $28.7 million in revenue through Q3 and expects to earn $16 million to $20 million in Q4 for 46.7 million in 2023, using the mid-point of guidance. This would be an impressive 50% growth in sales from 2022.

SoundHound has $99.5 million in cash and receivables as of Q3 against just $21 million in current liabilities. But this is where the good news ends.

The company financed operations this year using $105 million in proceeds from stock issuance and $85 million in long-term debt. The debt doesn’t mature until 2027, so this isn’t an immediate concern. But working capital is.

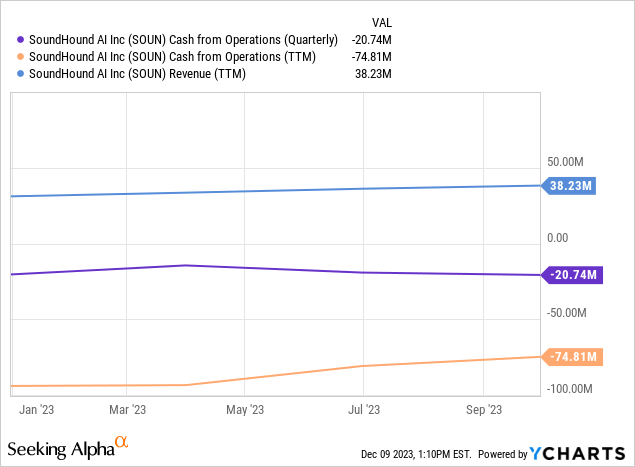

The company lost $74.8 million in cash from operations (CFO) in the trailing twelve months (TTMs). As shown below, the trend isn’t encouraging.

This is typical of a company in this stage of development. The company should spend money on research and development (R&D), sales, and even discounting the product to execute a land and enlarge strategy. But it puts shareholders in a rough spot.

The company will need capital soon. This means issuing more debt in a high-interest rate environment or diluting shareholders with equity financing.

The company touts its improving adjusted EBITDA (only a $32 million loss through Q3), but cash from operations is a more accurate gauge of a company’s cash burn rate.

In short, it isn’t yet dire, but financing will likely be needed at some point in 2024.

Is SoundHound stock a buy now?

Reasons for optimism:

SoundHound’s stock could easily catch a hype wave. The technology is impressive and easy to grasp. AI is a popular space, and the $2 price tag can multiply quickly. There is also a 12% short interest, which could bring about a spike if the stock becomes popular.

The company could also attract attention as a potential M&A (mergers and acquisitions) target. SoundHound needs capital, and another company may pick to buy the technology rather than evolve it internally. However, the $518 million market cap on less than $50 million expected sales this year could demonstrate too much for many suitors.

Reasons for caution:

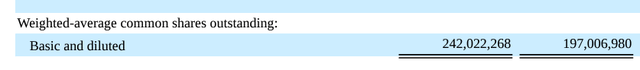

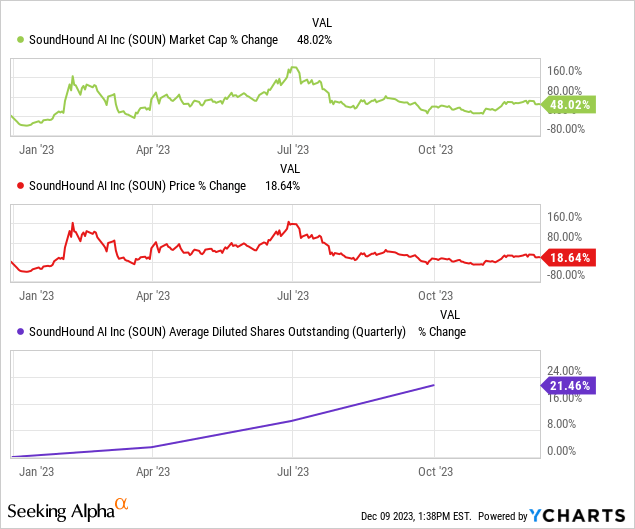

45 million. That’s how many more weighted average shares were outstanding in Q3 2023 over the prior year, as shown below from the company’s 10-Q.

SoundHound 10-Q filing

This is a 23% boost. If you wonder why SPACs consistently falter to furnish investors with gains, take a look at the chart below.

The orange line represents the ridiculous boost in shares outstanding.

Why does this happen? This happens because SoundHound (admire most SPACs) went public with a complex equity structure that includes convertible preferred stock and other unfavorable items to regular investors.

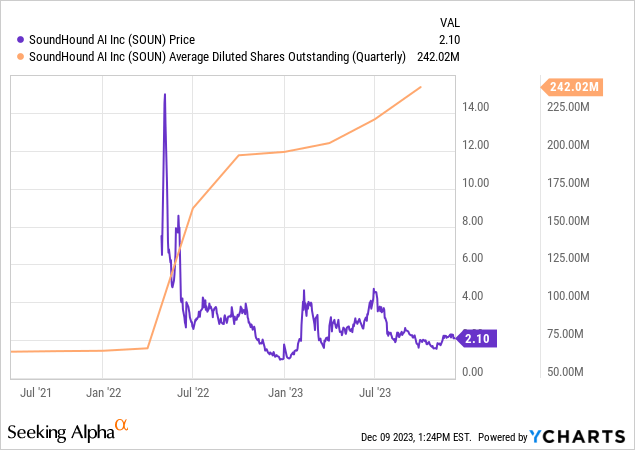

Let’s look at it another way. In 2023, the market cap of SoundHound has increased 48% – awesome! But investors have only seen a 19% boost in the stock price – not so awesome. In fact, it lags the market. This is a direct result of dilution, as shown below.

The green line is the market cap, the red line is the share price, and the purple line shows the share count boost.

The company also uses stock-based compensation (SBC) extensively, and its recent $25 million acquisition will be paid for with 80% stock in 2024.

Competition, capital requirements, and dilution make SoundHound AI a high-risk investment. Those with a high-risk, high-reward mindset could do well, but buyer beware of the dangers.