Owners of some of the latest Chinese electric cars to enter Britain are facing expensive premiums and in some cases are ‘almost uninsurable’ for drivers.

It comes after various reports of Range Rover owners struggling to find affordable cover for their vehicles, which is linked to the fact the luxury SUVs are being targeted by organised criminal gangs who are stealing them to order for illegal overseas exports.

However, the insurance woes faced by owners of Chinese EVs hasn’t been triggered by their vulnerability to theft; instead, it’s a lack of available parts and expertise to repair them that has seen premiums soar in recent months.

A report by automotive title Auto Express found that drivers of BYD and ORA GRW vehicles are facing extremely steep quotes for cover because only a few insurance providers will underwrite them due to the difficultly to fix them.

Insurance premiums for some of the latest Chinese EVs to hit UK roads (like the BYD Seal pictured) have sky-rocketed in recent months

The motoring magazine highlights the BYD Seal – a sporty electric saloon model that costs from £45,695 in Britain – as one example where owners are facing major difficulties finding cover at an affordable price – or at all.

Auto Express said it had searched leading comparison sites and were only offered three ‘very high quotes’, with the majority of mainstream insurers refusing to provide a price.

We ran our own quotation search using Compare the Market to find out how much it would cost to cover a Seal for a 40-year-old male living in Lincolnshire who keeps the car on a driveway at their property and covers 10,000 miles a year for social, domestic and commuting needs.

The quote was for a sales exec with over 20 years of no claims bonus wanting fully-comprehensive cover.

The cheapest quote was £758 while the most expensive was £4,782. A selection of major providers also refused to quote at all.

This is Money contacted BYD – which stands for Build Your Dreams – about the problems faced by owners.

A spokesman told us: ‘We are aware that some customers may be experiencing issues when insuring their new BYD car.

‘We are taking this matter very seriously and are working with the relevant parties to find a long-term solution.

‘We are committed to being open and transparent with third-party repairers and insurance companies and have made sure that all the required data is available and easily accessible.

‘For example, BYD has a robust supply of replacement parts; Thatcham Research tested our supply network and we were able to deliver 90 per cent of parts within 48 hours.

‘As a result, we are now starting to see more insurance companies providing competitive quotes across our model range.’

This is Money ran an insurance quotes for a BYD Seal for a 40-year-old male with 20+ years no claims bonus. The cheapest was £758 while the most expensive was £4,782

A spokesperson for the Chinese car maker told us: ‘We are aware that some customers may be experiencing issues when insuring their new BYD car.’

Thatcham Research, the UK-based automotive risk intelligence company, which is funded by insurers, said the issue is not with the cars as a product, but instead a failure by Chinese brands to provide a stream of replacement parts and repair information to make them most cost-effective to fix following an accident.

Ben Townsend , head of automotive at Thatcham told us: ‘From what I have seen, the automotive quality coming from China is very good, and there is an opportunity to provide great choice to UK consumers.

‘Their vehicle designs follow known standards, exceed regulatory demands, and achieve five-star Euro NCAP safety ratings.

‘However, we are beginning to see issues around market-specific elements of their vehicles’ lifecycles.

‘In the UK, an insurer’s job after any accident is to return the vehicle to pre-accident condition, if this cannot be achieved (safely or economically) then the vehicle needs to be written off; whilst this may seem obvious, China and other global markets follow a different approach.

‘A combination of focusing on repairing cosmetics over certain structural elements and significantly lower labour rates can affect their repair approach.

‘Replacing a whole vehicle side, or complete boot floor and rear section is not unusual in China, and therefore body repair manuals, and the type of spares provided, reflect that.

‘In the UK, time is of the essence in vehicle repair, so we look to manufacturers to optimise the way repairs are done and the provision of spares.’

The automotive risk intelligence firm says owners might face higher premiums for some time while a better supply chain on parts and repair instructions are shared from China.

‘Thatcham Research is already working with new manufacturers to build their understanding of designing safe, secure, and sustainable vehicles, and to ensure when vehicles come to market in the UK, they fit into our well-established ecosystem,’ Ben explained to us.

‘Reassuringly, we are beginning to see results, but need to remember that the cars currently launching in the UK started their design life up to four years ago, so it will take some time for these changes to filter through into our local market.’

Other Chinese EV that Auto Express highlighted as becoming problematic to affordably insure is the GWM Ora 03 – formerly called the ‘Funky Cat’ when it arrived in the UK in November 2022

Martyn Rowley, executive director of the National Body Repair Association, says repairers have been forced to write-off some UK examples for ‘stupid reasons’ because repairers couldn’t source parts to replace following an accident

Martyn Rowley, executive director of the National Body Repair Association, says repairers have been forced to write-off some Chinese cars simply because they are unable to source components.

He singled out the the GWM (Great Wall Motor) Ora 03 supermini – formerly called the Funky Cat – is one example of a Chinese EV that’s proving difficult to fix.

The small hatchback costs from £31,995 in the UK and has been on sale for over a year, arriving in November 2022.

Rowley told Auto Express that some UK examples have already been written off for ‘stupid reasons’, including damage caused in accidents that would usually ‘fly through a bodyshop if it were a Ford or a Vauxhall’.

He added: ‘Unfortunately you just can’t get parts; they’re not available for that vehicle, which I think is ridiculous considering that these are multi-million-pound businesses.’

Speaking to This is Money, he said: ‘Limited data on reliability and repair costs often results in higher initial premiums as insurers await further information to assess risk confidently. The scarcity of parts and a smaller network of suppliers contribute to extended repair times and increased costs for vehicle owners following accidents.

‘Additionally, the absence of established supply chains for Chinese vehicle parts is worsened by the difficulties faced by accident repair centres in obtaining comprehensive repair manuals and training for these vehicles, raising concerns about repair quality and vehicle safety post-accident.

‘Collaboration among insurers, repair centres, and manufacturers with organisations such as Thatcham Research is crucial.

‘Thatcham’s partnership with new Chinese manufacturers is indispensable for devising effective repair methods and enhancing parts accessibility.

‘Moreover, there’s a pressing need for investments in training and equipment upgrades for repair centres to address the rising demand resulting from the growing influx of these vehicles.’

We also approached GWM Ora UK to find out what is being done to find a solution to provide repairs and bring down escalating premiums for owners.

A spokesperson told us: ‘We are aware that a number of insurance companies in the UK market are providing limited options when it comes to insuring products from new automotive brands.

‘GWM ORA is currently working with key industry partners, like Thatcham Research, on this topic to provide transparent insight into its parts, aftersales and retailer operations.

‘After just over one year of operations, GWM ORA has set up over 30+ customer service points across the UK and appointed 18 high quality retail partners.

‘Additionally, the brand is supported by International Motors Limited (IML), an established distributor that operates across multiple markets, providing in-house technical expertise, next day parts delivery and central warehousing in the midlands.

‘IML has a long history of supporting a host of well-established automotive brands across all areas of business including aftersales, import, marketing, parts stocking, sales and more.’

To provide further reassurance to customers and industry partners, the Chinese car maker has also committed to implementing a number of immediate measures, including an ‘industry first mobile battery inspection team’ to inspect and assess batteries after a collision or reported accident.

‘This preventative measure will provide guidance and recommendations from technical experts on the safety of the battery and its repairability status,’ it says.

It will also have an express delivery service for parts that are required to be shipped outside of the UK and provide full access to repair manuals and associated technical material for all third party repairers.

‘GWM ORA hopes that these new measures, existing aftersales infrastructure and retailer network will prove to be effective at showcasing the brands commitment to providing an efficient, quality and transparent aftersales service to customers and industry partners,’ the spokesperson added.

The Ora 03 is a small hatchback that costs from £31,995, which is pricey given it’s compact size. GWM Ora sold just 911 examples in 2023

While Range Rover’s parent company Jaguar Land Rover has tried to rectify owner headaches around sky-high premiums due to the number of thefts by providing its own insurance product, Chinese makers are unlikely to be in a position to do the same.

And the issue could escalate further as more Chinese makers enter the British new car market.

Brands including XPeng and Chery’s Omoda are set to break into the UK market this year, and others are due to follow having already setup shop in mainland Europe.

The hope is that they arrive with robust aftercare solutions and a strong bank of replacement parts to supply UK models.

Auto Express’ exclusive report is another warning shot to the Government and motor industry about a lack of preparedness for the switch to EVs.

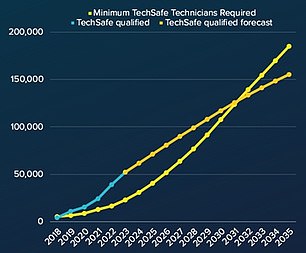

The latest data from the Institute of the Motor Industry (IMI) – the professional body for those working in automotive – has just revealed a shift in the point when the number of technicians qualified to work on EVs falls below the minimum number required.

The Institute of the Motor Industry warns in 2032 there will be a skills gap for EV-qualified mechanics to work on the growing volume of electric cars on the road

Previous projections suggested a shortfall would appear in 2029 and reach 13,000 by 2032.

However, its updated analysis predicts the skills gap will now materialise three years later in 2032, with a gap of 5,670.

At the end of January, there were 52,000 qualified EV technicians in the UK – up from 45,300 in July 2023, representing 22 per cent of all technicians in the country.

With over one million fully-electric cars now on Britain’s roads, it means there are 18.5 times as many EVs on the road than there are trained mechanics who can fix them.

Emma Carrigy, research manager at the IMI, said: ‘Attracting new talent and training technicians to work safely on electrified vehicles does take time, so the industry must not be complacent or take its foot off the recruitment or training pedals.

‘After all, a skills gap is still forecast and could have a significant impact on drivers’ ability to maintain and repair their electric and hybrid vehicles safely.’

The IMI predicts that by 2030 the sector will need more than 107,000 EV trained technicians, increasing to 139,000 by 2032, and 185,000 by 2035.

If current training trends continue, it is expected that there will be a shortfall of 30,000 EV qualified technicians by the time the ban of new ICE vehicle sales comes into force in 2035.

‘As the EV parc increases – and ages – drivers and fleet managers need to have the confidence that their chosen garage is able to service, repair and maintain their electric and hybrid vehicles.,’ Emma added.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.