SOPA Images/LightRocket via Getty Images

SolarWinds (NYSE:SWI) recently reported its Q4 2023 earnings, in which the company beat EPS and revenue expectations for the fourth consecutive quarter. In 2022, I previously recommended a hold rating because the company was still early in the transition phase of moving its customers to a more profitable subscription-based revenue model, and the company was yet to generate profits. Furthermore, I was also still cautious of the long-term reputational damage to the company’s well-documented hack in 2020. Since my first article, the stock value has increased by 60.46%.

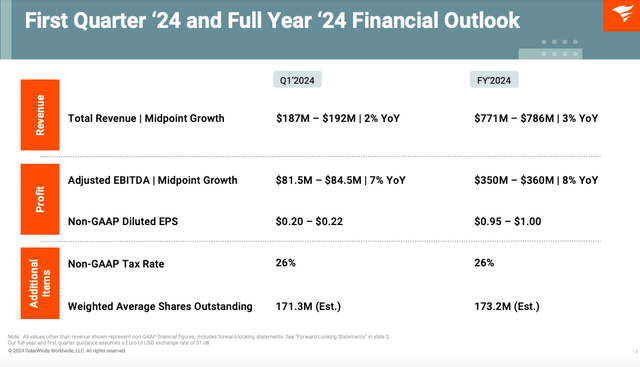

Company highlights (Investor presentation 2024)

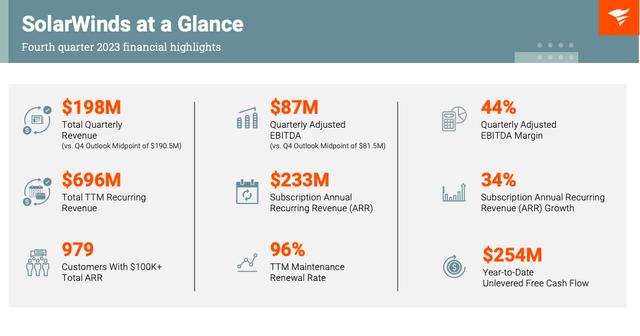

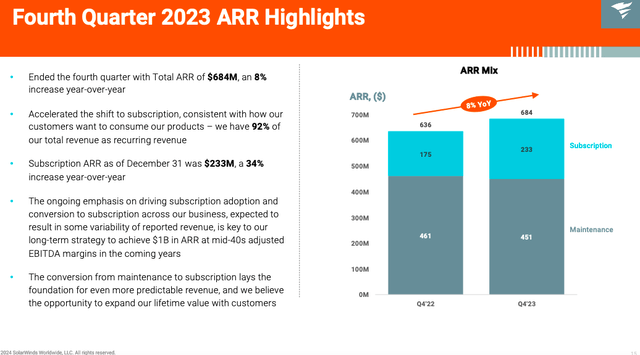

The majority of the company’s revenue still comes from non-recurring maintenance customers. However, the annual recurring revenue (ARR) has increased by 34% YoY. Looking into the long term, the company aims to have over 90% of contracted customers and increase ARR revenue to $1 billion. With significant adjusted EBITDA improvements, a 10% YoY increase in levered FCF, and a high gross profit margin of 90.34%, alongside its focus on larger enterprise customers, this is a business that is improving across key metrics. Its ambitious growth plan is backed up by a solid history of performance. Additionally, the company’s products have received positive online reviews, and its reputation appears to be solid. The company’s stock is trading at a TTM EV/EBITDA of 12.47, well below its five-year average of 25.91, indicating that the stock is undervalued and attractive. Therefore, I recommend upgrading to a buy rating.

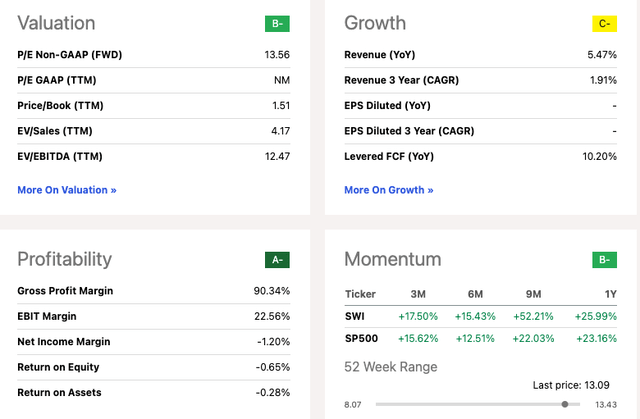

Quant metrics overview (Seeking Alpha)

Company overview

SolarWinds is a well-known brand in the IT industry with a global customer base of over 300,000. The company provides a unified platform that enhances IT management’s efficiency, effectiveness, and security. The platform monitors networking, databases, applications, systems, and other features. In FY 2023, SolarWinds successfully shifted to a subscription-based revenue model, resulting in 979 customers having an ARR of over $100,000 as of Q4 2023. The subscription ARR grew to $233.2 million, marking a 34% YoY increase. The total ARR increased to $684.1 million, marking an 8% YoY increase. This shift is crucial in the software industry as recurring revenue streams provide more predictable and stable financial outcomes, demonstrating strong customer retention and acquisition strategies.

ARR highlights (Investor presentation 2024)

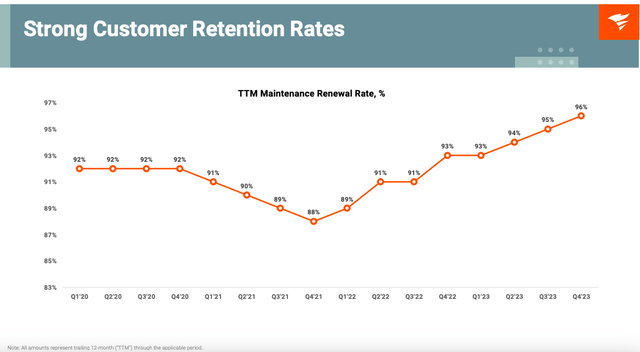

I am concerned about how the major hack that occurred in 2020 may have impacted our company’s reputation in the market in the long run. However, when we look at the company’s retention rate, it appears that customers are satisfied with the services we provide. Moreover, if you search for reviews of our solutions online, the average review scores are satisfactory. This gives me some confidence in the reliability of SolarWinds.

Quarterly customer retention (Investor Presentation 2024) SolarWinds reviews (TrustRadius)

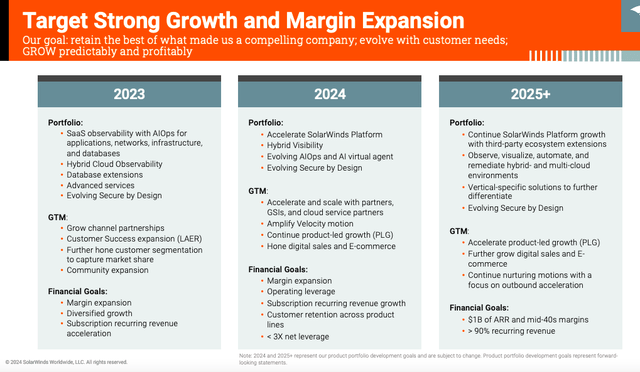

In addition, the company has provided us with an ambitious three-year growth plan. This plan includes increasing the adjusted EBITDA by 8% in FY2024 and achieving a positive non-GAAP diluted EPS between $0.95 to $1.00. In the upcoming years, the company aims to invest in solutions for large enterprise customers and increase its ARR to $1 billion, with a target of 90% in recurring revenue.

Growth targets (Investor Presentation 2024)

Earnings highlights

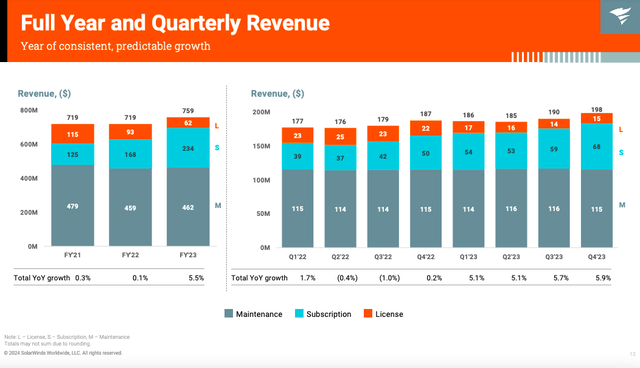

SolarWinds’ revenue growth has been relatively stagnant since FY2020, when the company reported $716.8 million in revenue. However, in the last year, there has been a slight improvement, with a YoY growth of 5.5% to reach $759 billion due to an increase in the number of subscriptions. In Q4 2023, SolarWinds achieved $198.14 million in revenue, marking a 5.9% increase compared to the same period last year. The company aims to onboard 90% of its customers onto its subscription model, which is expected to continue driving growth.

Full year and quarterly revenue overview (Investor presentation 2023)

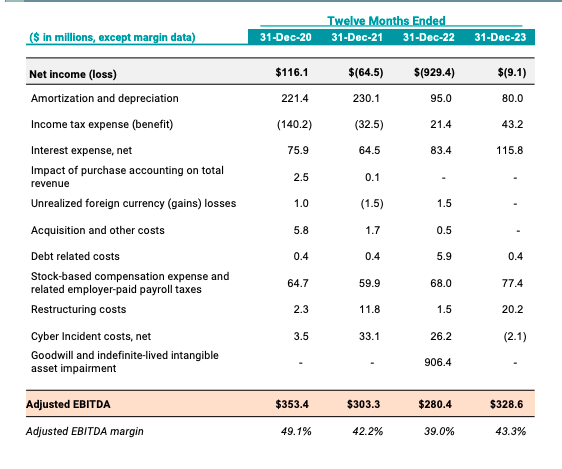

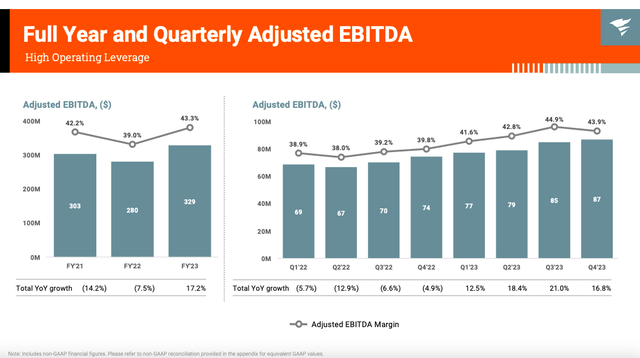

We can see that the company has greatly improved its losses YoY to negative $9.1 million from negative $929.4 in FY2022. We can also see that the adjusted EBITDA margin is at a three-year high of 43.3% and is forecasted to improve, with adjusted EBITDA forecasted to grow by 8% in FY2024.

Annual net income (Investor presentation 2024) Annual and quarterly adjusted EBITDA (Investor presentation 2024)

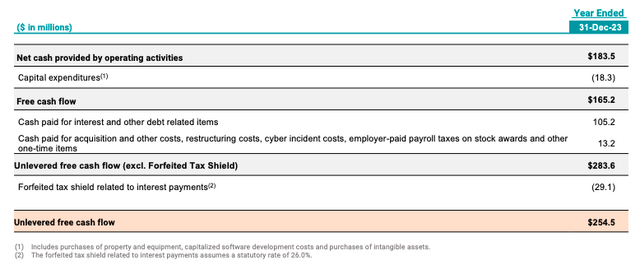

If we examine SolarWinds’ free cash flow, we can see that it generated $254.5 million in unlevered free cash flow. This surplus liquidity allows the company to reinvest in innovation, reduce debt, and reward its valued investors.

FY 2024 unlevered free cash flow (Investor presentation 2024)

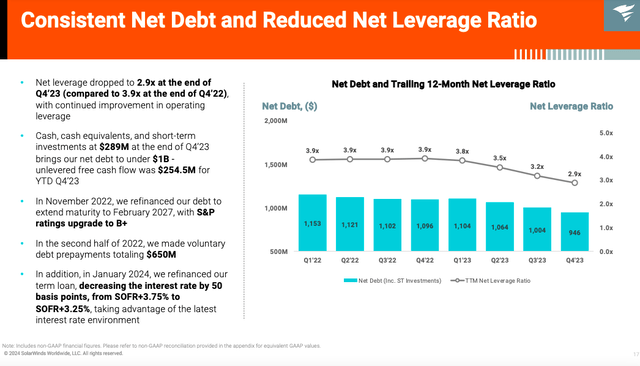

SolarWinds has a total cash and cash equivalents of $289.2 million, along with short-term investments, as per its balance sheet. However, the company’s total debt amounts to $1.2 billion. Although the company has been working towards reducing its debt, it still carries a significant amount. The next maturity date for the debt is not until 2027. Nevertheless, the company’s subscription-based model improves cash flow and provides greater financing predictability.

Debt overview (Investor presentation 2024)

Valuation

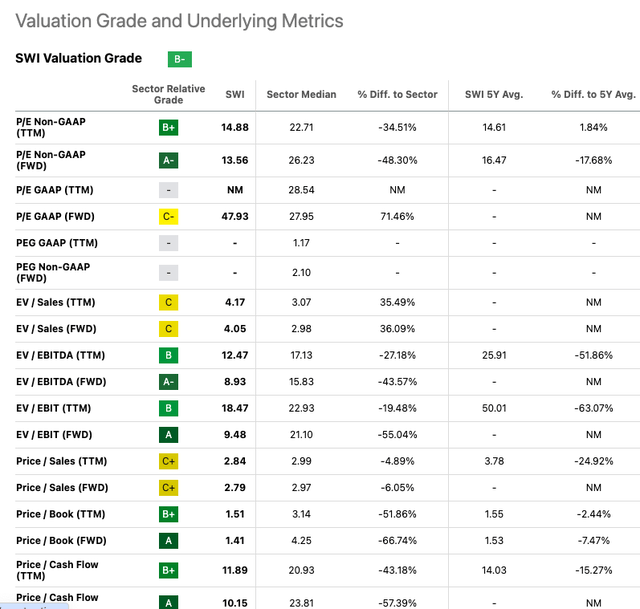

SolarWinds’ stock has shown strong growth momentum this year, outperforming the S&P index in all four quarters. For value investors, the company’s strong adjusted EBITDA margins and recurring revenue base may be attractive, as they suggest a stable and growing business model. The company’s proactive measures to refinance its debt and reduce the applicable margin for its borrowings also demonstrate a commitment to improving its financial position. According to Seeking Alpha’s Quant valuation, the company has a B-grade. Looking at its EV/EBITDA TTM ratio of 12.47, we can see that it is significantly lower than its five-year average of 25.91, indicating that it may be undervalued. Furthermore, the same ratio looks attractive when compared to the Information technology sector median of 17.13. Additionally, the company is attractive when we consider its TTM price-to-cash-flow ratio of 11.89, which is lower than its five-year average of 14.03 and significantly lower than the Information Technology sector median of 20.93.

Quant valuation (Seeking Alpha)

Risks

When considering investing in SolarWinds, potential investors should take into account both its promising aspects and the associated risks. SolarWinds is an IT company that provides crucial software solutions for businesses. In 2020, SolarWinds suffered a severe cybersecurity breach, which had a significant impact on its reputation and financials. The investigation into this breach is still ongoing and could continue to affect the company. Additionally, SolarWinds faced allegations of misleading investors about cybersecurity risks. Furthermore, the industry it operates in faces stiff competition, particularly from cloud-native vendors. SolarWinds’ ability to maintain its position and adapt to changing market dynamics will determine its future growth prospects.

Final thoughts

SolarWinds has reported its Q4 2023 earnings, and it has exceeded expectations. The company has achieved significant year-over-year growth in both revenue and adjusted EBITDA. This growth has been attributed to the company’s transition to a subscription-based revenue model, which has resulted in a surge of 34% in annual recurring revenue. SolarWinds aims to secure over 90% of contracted customers and increase ARR revenue to $1 billion. With impressive financial metrics, a strong forecast for FY2024, and an attractive EV/EBITDA ratio relative to the industry median and its five-year average, I recommend upgrading SolarWinds to a buy rating.