SOPA Images/LightRocket via Getty Images

Last week, Société Générale (OTCPK:SCGLY, OTCPK:SCGLF) (SocGen) released its Q4 and FY 2023 results. The quarter results were better than expected, with a positive RoTE recovery in place and solid performance in the French retail segment; however, we should recall the latest strategic plan, which disappointed investors. Looking back, Wall Street expressed concern over new financial targets, including a RoTE (Return on Tangible Equity) range of 9%-10% and a sales trend of 0%-2%, implying limited portfolio growth. Despite the initial disappointment, we view the new CEO’s intention to reset expectations positively, and we believe bank estimates may be overly conservative. In our forward-thinking view, we anticipate 1) higher revenue growth and 2) a positive spread in earnings thanks to higher-for-longer rates.

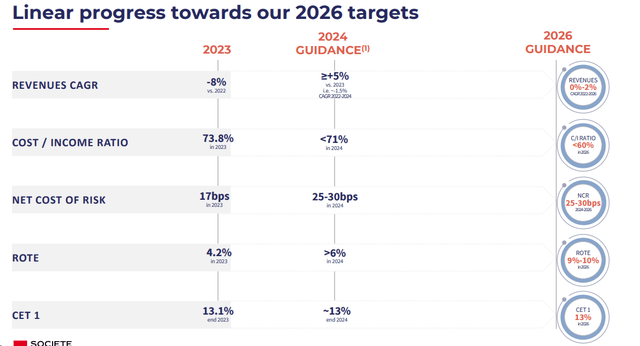

Our internal team questions the revenue CAGR (Compound Annual Growth Rate) below 2% until 2026. In the period, we anticipate a 2.5% revenue growth, driven by CIB revenue normalization and positive trends in BoursoBank, the online French banking arm. This was also supported by SocGen’s new 2024 revenue target of >5% (Fig 1). Aiming to reassure around the achievability of the 2026 targets, SocGen provided new 2024 guidance. In addition, we anticipated a positive evolution of the Net Interest Margin and the expected cost-cutting measures, which should enhance the group profit growth to 2026 (this was already evident in the French retail and insurance segment in Q4). For the above reasons, we decided to maintain our buy rating target price, supported by a valuation gap relative to SocGen’s tangible book value, which we believe is not fully reflected in the current valuation. Our latest analysis of the Italian banks Intesa Sanpaolo and UniCredit confirmed these positive expectations. Following the CMD, we suggest checking our previous analysis.

Q4 Results Overview

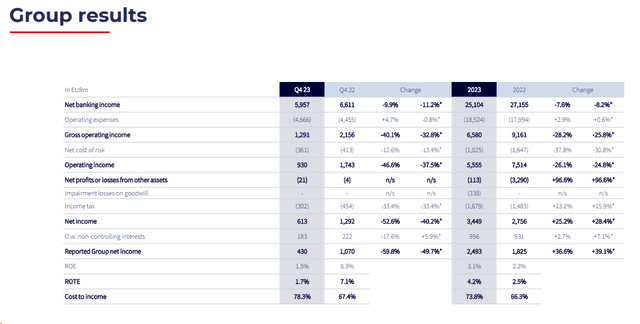

The bank reported strong financial performance in the fourth quarter of 2023 (Fig 1). Here are the key highlights:

- SocGen achieved a 12% pre-provision profit beat, driven primarily by its French retail operations. This segment stood out thanks to a more robust Net Interest Income print in this division, which will likely drive group profit growth through 2026;

- On the financial metrics, the company’s adjusted pre-tax profit stood at €930 million, surpassing the company’s compiled consensus. Revenues were 2% better than expected, while costs were 1% higher. Notably, impairments were 12% lower, contributing to the positive outcome.

- The Common Equity Tier 1 (CET1) capital ratio was 13.1%, exceeding the company consensus of 12.9%. This achievement occurred despite a slightly higher dividend (90 cents per share vs. 87 cents) and an announced share buyback of €280 million.

- To reinforce confidence in achieving the 2026 targets, the French bank provided new guidance for 2024 (Fig 2). Revenue growth, including Global Markets sales, is expected to increase by 5%. The Cost/Income ratio target is set below 71% (consensus at 69%). The cost of risk is likely to be in the 25-30 basis points range (consensus around 33 bps). SocGen anticipates delivering a rebuilt capital base with a 2024 ROTE of >6% and a CET1 of approximately 13%.

SocGen Fiscal Year 2023 Results in a Snap

Fig 1

Fig 2

Positive view confirmed

It is crucial to report the CEO’s latest words.

Drawing on our new strategic and financial plan that was presented in September 2023, we are writing a new chapter in the history of the Group, which, for the last 160 years, has assisted millions of clients by way of responsible, long-term relationships.

2023 was a year of transformation and transition. Looking at the EU market, we believe in a higher-for-longer interest rate environment. The above Fig 2, with a solid revenue target for 2024, supports our upside view and net interest margin forecast. Our estimates confirmed a 6% revenue growth for 2024 and arrived at €26.8 billion in revenue. This is supported not only by rates but also by the positive moment BoursoBank. In addition, 2023 was negatively impacted by the elevated cost of integrating LeasePlan.

Furthermore, the 2024 guidance needs to be reconsidered because there are approximately €0.2-0.3 billion in additional transformation costs. Netting these out, the cost/income ratio would be approximately 200 basis points better. Considering this and after increasing the cost of risk, we forecast a pre-tax profit of €7 billion, arriving at an EPS of €4.5.

To support our downside protection. Société Générale has proposed a total capital return of around €1 billion, with a dividend yield of 8% -approximately 25% higher than consensus forecasts – mainly due to an increased buyback program.

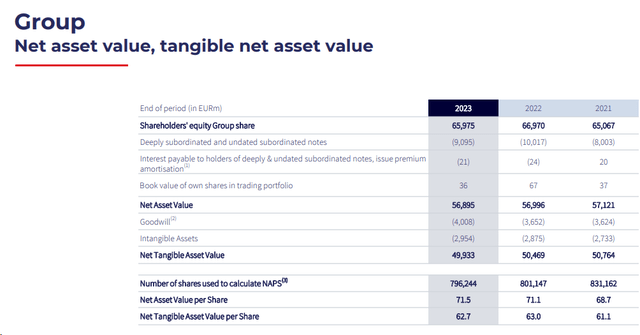

SocGen net asset value per share evolution

Fig 3

Valuation and Risks

Several factors can influence net interest income forecasts, including economic conditions, interest rate trends set by central banks, and the competitive landscape within the banking sector. That said, SocGen’s valuation metrics are incredibly cheap. The company trades at a P/E Ratio (2025E) of 3.9x and a Price-to-Tangible Net Asset Value (P/TNAV) of 0.3x. The forecasted adjusted ROTE for 2025 is 8.7%. Despite the CEO being more cautious, we believe a positive market reaction is expected following these results. Our valuation is supported by an unchanged P/TNAV of 0.5x, and considering the 2023 net asset value per share of €71.5 (Fig 3), we arrived at a valuation of €35.75. On a P/E basis, given lower-than-expected profit and continuing to value the company with a target P/E of 5.5x, we derived a price of €25 per share. Blending our two valuation methodologies, SocGen’s buy target is set at €30.3 per share, maintaining a tactical buy.

The downside risks include weaker-than-anticipated capital market revenues, lower interest rate gearing in the business, execution in cost reduction plans, and Ayvens mobility and normalized earnings power.

Conclusion

While we appreciate the CEO’s cautious approach, the bank has no exposure to Russia, offers a total yield (buyback and dividend) of >6%, and has an upside on BoursoBank development coupled with higher for longer rates (there is now news with no cuts in 2024). With the new strategic plan released in September, the bank allowed itself more flexibility in steering the payout mix. Considering SocGen’s future targets, the company is a safe investment with a CET1 buffer above 13% across the cycle. Therefore, our buy rating is then confirmed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.