Emanuel M Schwermer/DigitalVision via Getty Images

While it is an exaggeration to argue that the wheels have come off Tesla, Inc. (NASDAQ:TSLA) the electric vehicle, or EV, pioneer, it’s certainly true that the shine has come off:

Although the company has regained the crown of being the biggest EV producer in the world from BYD Company Limited (OTCPK:BYDDF) in Q1, which it had lost in Q4/23, this looks like only a reprieve to us as we argued in our article about BYD.

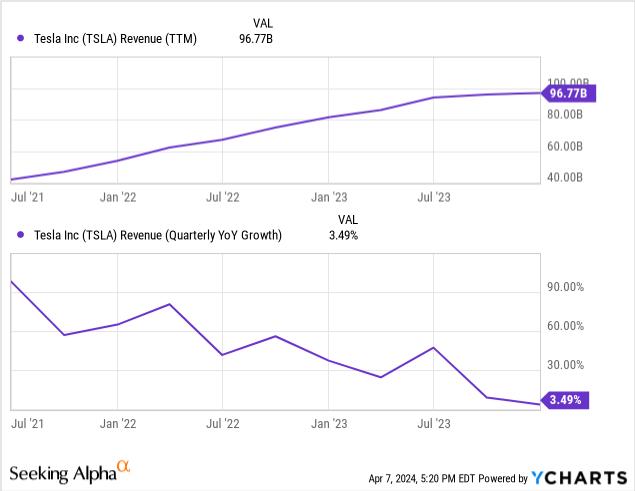

In any case, whether Tesla’s the biggest producer or not, the steep decline in growth from 90% three years ago to growth coming to a screeching halt and then going into reverse in Q1/24 (which isn’t in the graph above) with a whopping 20% revenue decline isn’t inspiring as the company faces a number of problems and threats:

- Market saturation by first adopters.

- Difficult transition to mass-market products.

- No new models.

- Price competition.

- The rise of Chinese competition.

- Geopolitical and trade tensions.

- Fuel economy regulation.

- Lack of charging infrastructure.

U.S. Market saturation

There is a marked slowdown in the adoption of EVs in the U.S. (our emphasis):

Nearly 269,000 electric vehicles were sold in the United States in the first three months of this year, according to Kelley Blue Book. That was a 2.6 percent increase from the same period last year, but a 7.3 decrease from the final quarter of 2023. And amid the quarter-to-quarter slowdown in the industry, Tesla’s market share has fallen from 62 percent at the start of 2023 to 51 percent now… Tesla sales fell more than 13 percent compared with the first quarter last year, while most of its emerging competitors saw double or even triple-digit growth.

Not only is the market slowing down markedly, Tesla is losing share, a double whammy. Other developed markets aren’t doing much better (March 2024 versus March 2023):

In Germany, sales plunged by 28.9pc in March, while they were down by 41.4pc in Ireland, 35.6pc in Finland, 34.4pc in Italy and 33.7pc in Sweden.

For the first three months, EV sales were still up in Europe, but only 3.8% versus a growth of 43.3% in the first quarter of 2023.

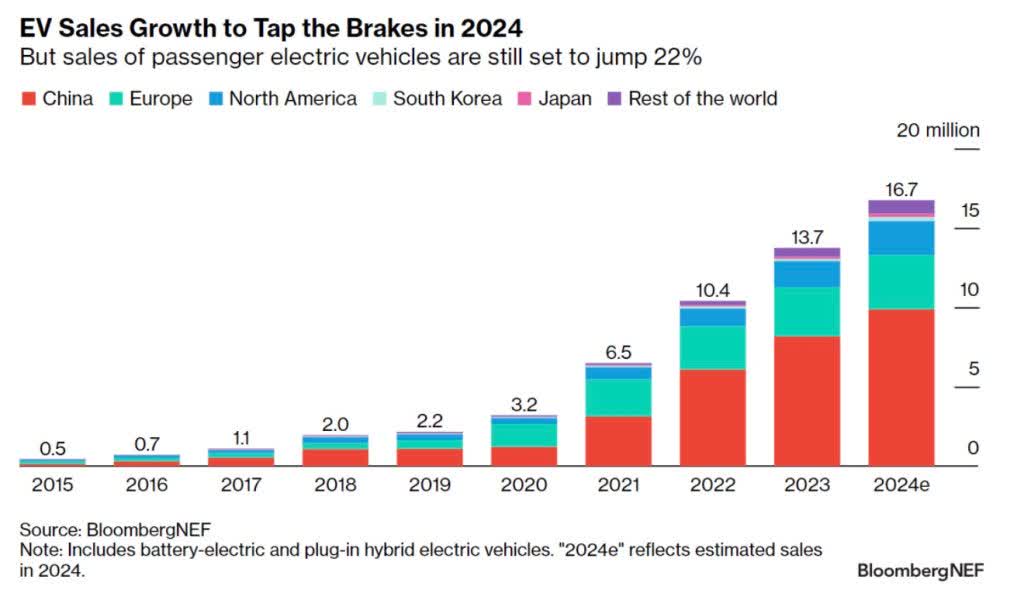

The first models of EV were quite pricey and taken up by a more wealthy, less price-sensitive clientele. China is by far the largest market for EVs, the U.S. EV market is much smaller and even considerably smaller than the European market:

Electrek

Of all new EVs sold globally in December last year, 69 percent were in China, according to the research firm Rystad Energy.

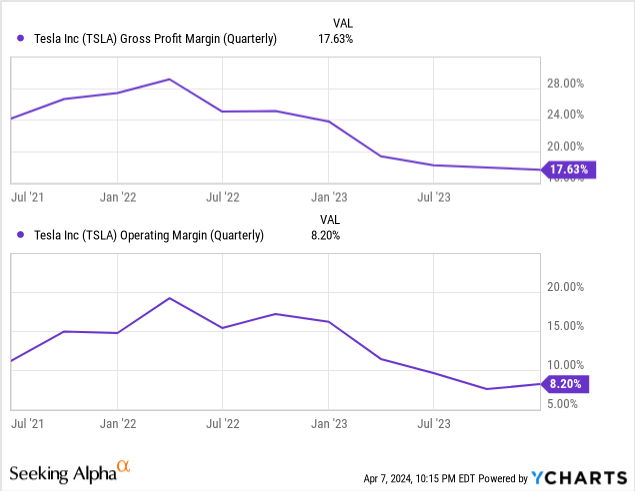

This has two quite nasty consequences, declining growth and price competition that led to a 25% price cuts for Tesla last year. These not only reinforce the revenue slump, it also eats margins, which were already on a downward slope:

This isn’t surprising, as more EVs have entered the market and Tesla’s market share has declined from around 80% in 2019 to 56% last year.

One might wonder whether Tesla is hurt, especially as most of its U.S. competitors can at least fall back on their internal combustion engine (“ICE”) sales, which are profitable (contrary to their EV efforts).

On the other hand, Tesla is profitable with its EV production while we’re not aware that any of its domestic competitors are, as Tesla enjoyed a huge first-mover advantage.

But the combination of increasing competition and a marked slowdown in market growth is a pretty nasty one as well for Tesla, leading to a growth slowdown (even negative growth in Q1/24) and margin erosion.

While the Chinese EV market is also slowing down (from 36% in 2023 to an estimated 25% this year), it’s still growing considerably faster compared to the U.S. market, giving Chinese producers some advantage, and China just introduced a 4-year 520 billion yuan ($72.3B) package of tax breaks.

Not to mention the charging stations:

China is rapidly expanding its EV charging infrastructure; as of August 2022, it accounted for 65% of global public charging points. In May of 2022, China added 87,000 new charging stations, reaching a total of 1.419 million stations… a January 2022 announcement revealed plans to establish 20 million EV charging facilities by 2025.

That’s quite a difference with the U.S. (our emphasis):

Two years ago, the U.S. government provided $7.5bn to create a national network of electric vehicle (EV) charging stations. To date, seven have been built.

That date was not long ago, March 29, 2024! And what’s behind the slowdown?

the biggest barrier to widespread adoption of EVs is cost, which remains too high for most consumers. The average electric car sells for just under €70,000 (£59,900) in the US and about €65,000 in Europe, according to research by Jato Dynamics. That compares to a typical cost of just over €30,000 in China

Transition to mass market

EV’s made up 7.6% of new car sales in the U.S. in 2023, selling 1.2M cars with Tesla taking 55% of that.

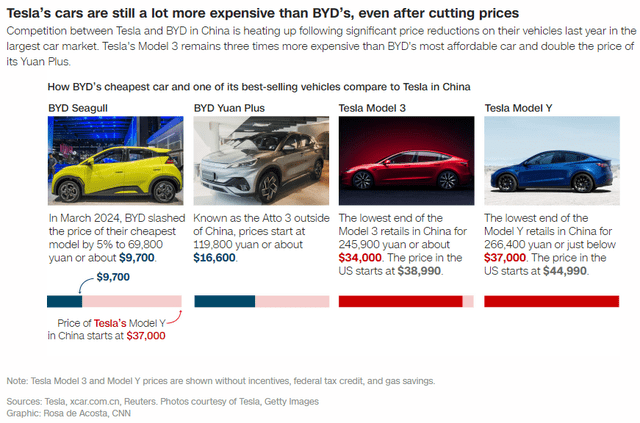

To revive market growth, EVs need to become cheaper, but at present Tesla’s cheapest model is the Model 3, which starts at $38,990 as of April 2024.

While that’s a lot better than its older models, it’s not quite cheap enough, especially given the fact that Chinese competition can produce a host of models that are much cheaper still.

For instance, BYD has several models that sell for far less, like:

- The new Qin Plus DM-i variant is called the Glory Edition, a plug-in hybrid retailing a just over $11K.

- The Destroyer 05 is a hybrid that sells at $11K.

- The Seagull is an EV that costs $9.7K in China (the most expensive version is still only $12K).

- The new Dolphin Honor, which sells for less than $14K.

- The ATTO 3 electric SUV for $16.6K, which was the best-selling EV in Sweden in July 2023.

Some European companies are also planning to come out with cheaper models, like Renault with a new Twingo, although we’ll have to wait until 2026 for that to happen. But it’s mostly the Chinese who are invading the mass market segment.

Chinese competitive advantage

As we argued much more extensively in our article on BYD, its competitive advantage consists of multiple layers that enable it to produce these cheap EVs (and hybrids), like producing its own batteries, its integrated production, and benefiting from a much larger and more competitive home market with plenty of government support.

This is all the more threatening because Tesla is quite dependent on the Chinese market, with about one-third of its global volume being sold in China, where it also has a plant.

Indeed, Tesla’s Q1 miss (as well as BYD’s Q1 disappointment) might very well have been mostly the result of its sales in China., where the market is also slowing down and plagued by a price war. What’s more concerning is:

CEO Elon Musk appears to have backed away from the price-cuts strategy this year, however. Goldstein said that’s a sign he knows Tesla can’t win the price war and remain profitable.

Too few models

Another headwind is that Tesla has only 4 models, and these are all quite old. The two best-selling Tesla models, Model 3 is 7 years old and Model Y is 5 years old. Compare that to BYD:

Tesla gets undercut at the low end by the Chinese, where Tesla doesn’t have an offering. One could argue that this isn’t necessarily a problem, as the low-end segment tends to be much less profitable. However, it’s where most of the growth is.

So Tesla could do well to offer a product there and there were plans to introduce a $25K Model 2, but these plans seem to have been canceled, which prompted Tesla cofounder Martin Eberhard to express concerns:

We’ve both read in the news, Tesla delaying or eliminating their low-end Model 2 program, which is a shame for them, but it’s a sign that China has a chance to really spread there

Could it be that, just as they gave up on price cuts, Tesla realized it couldn’t compete with the Chinese in the low-end segment?

But even in the higher segments, Tesla is facing increased competition, including the Model 3 from BYD’s Seal (also note how BYD introduced 3 new EVs in one year and how that compares with Tesla).

But Model 3 is already facing competition from the likes of BMW (the i4), Polestar 2, and Hyundai with its Ioniq 6. Then there is the Xiaomi SU7, introduced in March with a starting price of $30K receiving a whopping 89K firm orders in the first 24 hours. This indicates a whole new dimension of competition:

Similar to the success of Huawei‘s Aito M7, the disruption brought about by Xiaomi EV goes beyond the product itself and stems from an effective combination of successful marketing, branding, and to a greater extent, an established ecosystem, the team said. Thus, competing with tech veterans appears to be an uphill, but inevitable, battle for auto OEMs.

Even Tesla’s Cybertruck is getting competition from BYD (and it’s not the only one).

While there is something to say for Tesla to stay in its lane and not try to compete with the Chinese head-on in the lower segments, it is facing increasing competition in the more profitable higher segments as well, and most of the growth is in the lower segments.

Another illustration of that is Apple abandoning its planned EV, where its Chinese counterpart Xiaomi apparently succeeds.

So, while some have suggested Musk may need to abandon one of his key 2024 strategies – prioritizing market share over profitability – that strategy is facing plenty of obstacles as well.

Trade Tensions

At present, at least the U.S. market is relatively shielded from Chinese competition as a result of a 25% tariff on Chinese EVs. But Tesla can’t survive on the U.S. market alone as Chinese EVs are moving aggressively into a host of third countries, so Tesla isn’t shielded from Chinese competition.

And even the U.S. shield isn’t impermeable, BYD has plans for a plant in Mexico, which by virtue of the North American Trade Deal would enable it to sell cars from that plant evading the tariff.

And the trade tensions could very well escalate. EV production capacity in China is well above what their domestic market can bear, and Treasury Secretary Janet Yellen has warned China that it can’t export its way out of overcapacity and decimate new industries like alternative energy and EVs.

It doesn’t seem likely she has met a receptive ear, and things could very well escalate further should Donald Trump, who threatened across-the-board tariffs on Chinese goods, become President again in November (emphasis added):

By setting universal baseline tariffs on a majority of foreign goods, the former president said Americans would see taxes decrease as tariffs increase. His proposal also includes a four-year plan to phase out all Chinese imports of essential goods, as well as stopping China from buying up America and stopping the investment of US companies in China. Trump also said in February that he would consider imposing a tariff upward of 60% on all Chinese imports if he’s reelected.

That would open up Tesla to retaliatory actions and/or a Chinese consumer boycott.

Elon Musk brand

Some analysts argue that Musk has sullied his Tesla brand, as one could argue that he rails against a perceived “liberal elite” who were more likely to buy Teslas.

It’s difficult to measure this, but there is something concerning. Tesla sales have slumped more than other EV brands in the U.S. (our emphasis):

But, upon closer inspection, what seems like widespread disinterest in electric vehicles may reflect, largely, less interest in Tesla. Some automakers, including Audi, BMW, Mercedes, and Rivian, are reporting EV sales growth of more than 50% over the past year, noted Stephanie Valdez Streaty, an analyst with Cox Automotive, in a presentation summarizing industry trends in the new year. Ford later said its EV sales were up 86%… Between the first quarter of 2023 and the first quarter of 2024, US electric vehicle sales grew an estimated 15%, according to a recent report by Cox Automotive. But, if you leave out Tesla, sales of other electric vehicles, as a group, were up 33%.

So it does like Tesla was disproportionately hit. Whether this has anything to do with Musk’s antics scaring certain buyers off is not something we can establish here, but it’s not likely to have helped.

Culture wars

Apart from the possibility that Musk is estranging some of his most likely buyers by plunging into the deep end of the culture wars, EVs themselves have become a ping pong ball in the culture wars.

The tone about the slowdown of EV sales in the reporting of some of the conservative press borders on the jubilant.

What is curious is that Musk has associated himself with Trump, which from a Tesla business perspective is odd as a Trump government is liable to throw quite a bit of sand in the wheels of the energy transition, should he get elected in November.

Trump is likely to morph these cultural headwinds into actual policy, for instance by reversing much of Biden’s IRA:

Goldman Sachs analysts have also argued that any reduction in the number of vehicles eligible for purchase credits tied to the Inflation Reduction Act could affect between 5% and 15% of total EV demand, while an outright repeal “could affect 10% to 30% of demand.”

Then there is this:

Trump has promised to roll back new car pollution rules at the Environmental Protection Agency that could require electric vehicles to account for up to two-thirds of new cars sold in the US by 2032.

This could really slow down the adoption of EVs in the U.S., and could even bifurcate the world’s car market into an ICE block and an EV block, at least until the arrival of next-generation batteries swings the economic advantage definitely towards EVs.

How Tesla would fare in such an environment is anybody’s guess, we certainly don’t underestimate its capacity for reinventing itself, but the environment in which it operates could become substantially more problematic than it already is today.

U.S. protection

Even though Tesla is losing market share in its home market as Detroit is in on the game, it has some protection against the Chinese in the form of a 25% import target.

While Elon Musk has been “begging” for high trade protection, it runs afoul of US climate policy, it’s futile to a considerable extent as the Chinese can build plants in Mexico which of course has recourse to the North American free trade agreement with the U.S.

And Chinese plants in Mexico would run afoul of another goal of the Biden administration (and presumably also of any incoming Trump administration) to build up domestic manufacturing capacity in industries of the future.

There are other tricks possible, like keeping Chinese cars out by considering their internet connection a national security risk, it risks making EVs more expensive in the U.S. compared to elsewhere.

As the experience with the emergence of Japanese car manufacturers from the 1970s onward has shown, ultimately it’s better to adapt to the competition (which Detroit did by largely copying the Toyota production methods).

Finances

As we have seen above, growth has come to a screeching halt and increased competition and price wars have reduced margins.

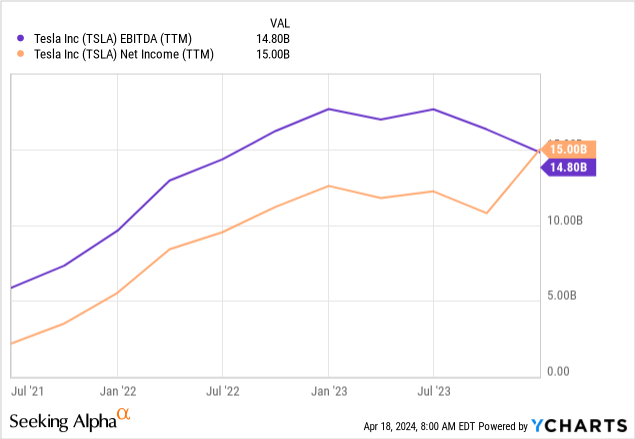

The situation is serious enough for Musk to realize that he cannot win a price war with the Chinese, so he has given up on market share and concentrates on profitability instead, where growth is also topping out, although Q4/23 produced a sharp revival at least in net income:

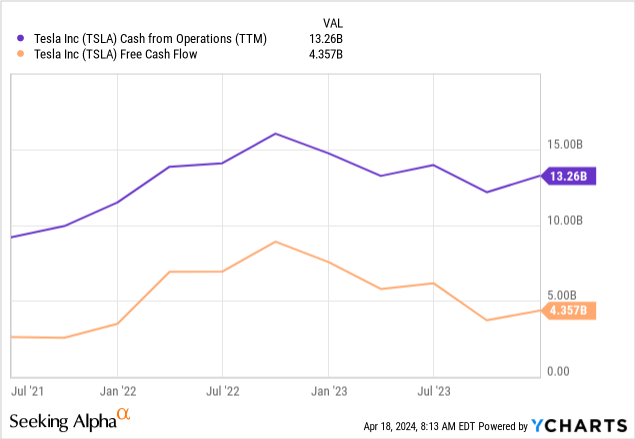

We always find that cash flow usually delivers a better picture as it’s less fungible:

But things are sufficiently dire for Tesla to embark on a significant cost-cutting program, laying off 10% of the workforce (even if at the same time it’s asking shareholders to accept Musk’s $56B pay package).

Valuation

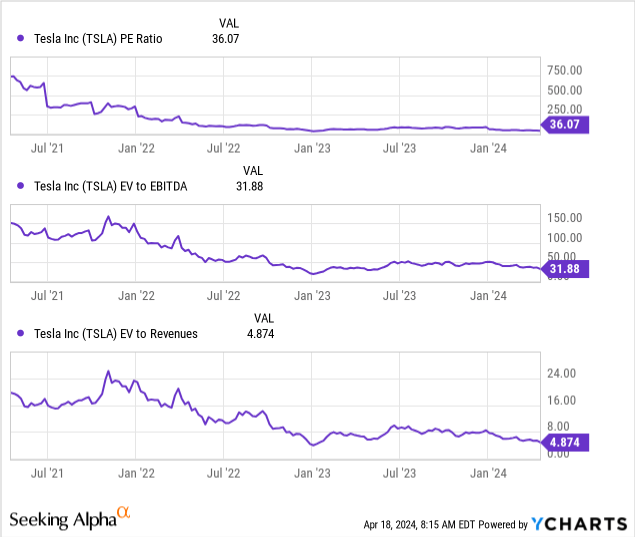

Valuation metrics have come down from what can only be considered extreme heights, but these are still pretty lofty given the growth slowdown and margin contraction.

Conclusion

The company is facing a barrage of obstacles, few of which it has much, if any, control over:

- No recent new models.

- No low-segment model, where most of the growth is.

- Disappointing growth and losing market share.

- Increasing competition, especially from the Chinese.

- A price war.

- Brand problems.

- Trade tensions with China.

Basically, where they compete is an increasingly crowded place where growth is disappearing in large parts and competitors gaining on Tesla’s market share.

With the delay or even cancellation of the Model 2, there will be no move towards the segment of the market that is still growing, and even with such a move, success is far from guaranteed given the strength of the competition, particularly the Chinese.

Management argues that they are “between” two growth waves, which might very well be true, but the next growth wave will come when infrastructure has been rolled out more fully and especially when a new generation of batteries extends the reach, improves safety, and reduces charging times.

Tesla was the main driver of the first wave, there are no guarantees it will be a main driver of the second wave, but it’s still valued as if it will be, hence our sell rating on the stock. That second wave is also likely to be multiple years out.

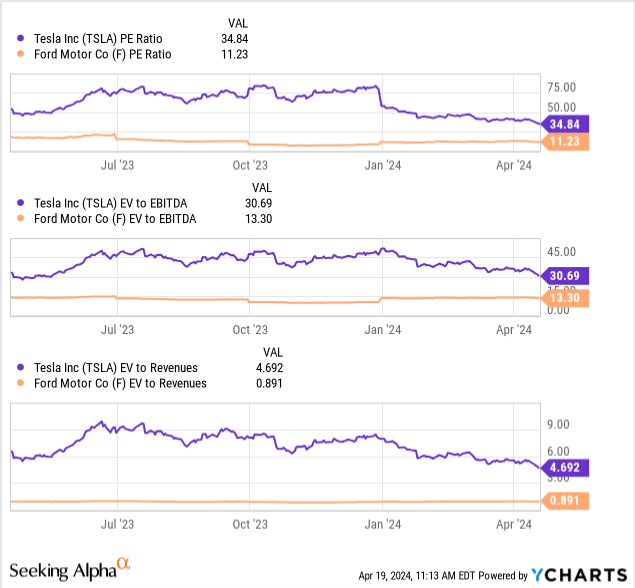

We don’t see much reason for Tesla to hang onto much of its premium valuation, and a simple comparison with Ford shows that the downside could be considerable:

We don’t think it’s impossible for Tesla, Inc. to fall below $100, and we’re not inclined to buy until it does, unless something fundamentally improves. We await the Q1 earnings release post-market on Tuesday, April 23rd.

Tesla still has some things going for it, but that will be the subject for another article. For now, it’s too little for us.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.