akinbostanci/E+ via Getty Images

Snowflake (NYSE:SNOW) isn’t cheap, and given its opportunity set, it will never be cheap by traditional standards. However, the market has put a multiple so rich that it puts a real chill when I think about hitting the buy button on this name. Snowflake is growing rapidly, however, so are its competitors. While it is quite possible that SNOW will retain its leadership position, investors are valuing the stock like SNOW has already won this segment. Let’s dive into what is driving SNOW’s performance and what could be some stumbling blocks down the road.

SNOW is a leader in a rapidly growing market

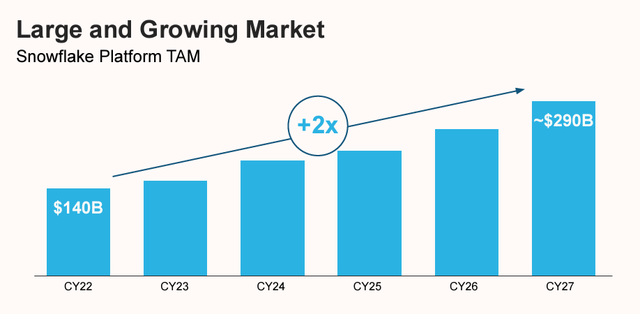

Snowflake’s TAM is expected to be nearly $290B by 2027 according to the company. While this won’t be a winner-take-all type sector, SNOW has the chops to be one of the more dominant players in this segment. Cloud computing remains the pivotal hub for data management. 2023’s trends in optimizing cloud services demonstrate that platforms capable of supporting strategies across multiple clouds will emerge victorious. Ongoing stabilization of these optimization trends is likely to persist through 2024. This positions Snowflake favorably, especially considering its recent efforts in supporting GenAI workloads through various product initiatives.

While Snowflake originally focused on cloud Data Warehousing, it has evolved into a versatile Data Cloud platform catering to diverse data needs beyond just warehousing and embracing data lakes. Its entry into the data lake market via Snowpark is expected to facilitate expansion into machine learning and GenAI applications. It is worth noting that SNOW’s recent quarter witnessed a 47% quarter-on-quarter growth in Snowpark usage, with over 30% of customers utilizing Snowflake for processing unstructured data in October, marking a positive trend.

SNOW’s consumption-based revenue model is working

SNOW’s offerings are not the cheapest but its AI-driven offerings are the key to the customer’s wallets. Although some might argue that Snowflake’s consumption-based pricing could end up being more expensive at scale compared to subscription models, it actually aligns costs with the value customers receive. This pricing method offers transparency, flexibility, and centers on optimizing pricing for performance. By separating compute and storage, customers pay for the specific features they require while enjoying significant scalability. This approach encourages quicker initial adoption and the potential for swift growth in the future. As GenAI use cases gain traction, consumption-based pricing models are likely to become more widespread.

Businesses are recognizing that a successful GenAI strategy hinges on a robust data strategy. Snowflake seems strongly positioned for the long run in the GenAI landscape due to the substantial volume of customer data hosted on its platform. The company has unveiled numerous GenAI-focused capabilities such as Snowflake Cortex, Snowflake Copilot, Universal Search, Document AI, and Snowflake Container Services, among others. These new offerings are expected to boost usage and enhance workload utilization. However, it’s realistic to anticipate a more significant impact on results likely to emerge in calendar year 2025 and beyond as these fresh products gradually reach a wider audience.

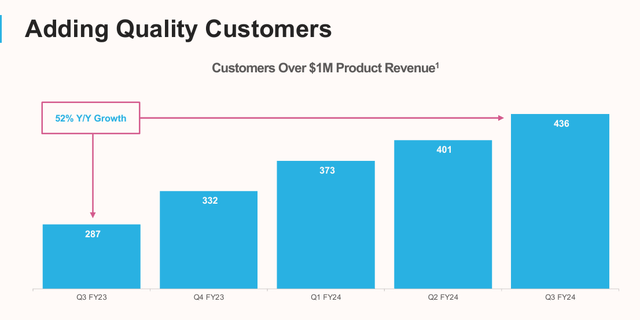

Snowflake’s growth strategy centers on acquiring new customers, especially larger organizations, by capitalizing on the widespread adoption of cloud strategies. Their focus involves investing in sales and marketing to replace outdated database solutions and big data offerings, resulting in the addition of 370 customers in the quarter ended October 31, 2023.

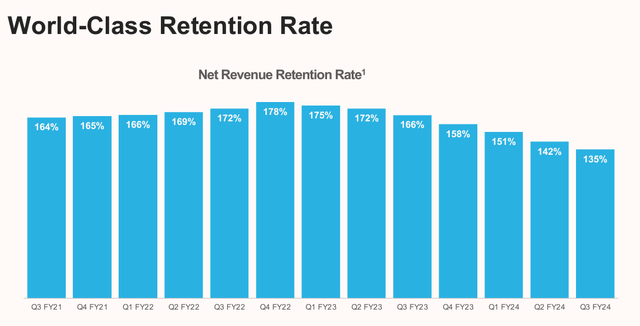

Moreover, Snowflake drives increased usage within its existing customer base by showcasing the platform’s advantages, prompting these customers to process, store, and share more data. This is reflected in a robust net revenue retention rate of 135% as of October 31, 2023. The company aims to further invest in sales and marketing to encourage greater platform usage among existing customers, fostering stronger relationships that drive scalability and operational efficiency in their business model. On this topic, SNOW’s investor presentations often carry a NRR (Net Revenue Retention) metric.

Two things stand out here.

- Existing clients are spending more dollars than in prior periods

- The NRR is starting to flatten out

While this metric might seem too good to be true, it should be noted that DataBricks which is SNOW’s direct competitor had a NRR rate around 150% in 2022 before it stopped publishing this metric.

Product revenue is Snowflake’s primary metric, constituting ~95% of its revenue in Q3. This revenue source stems from charging customers based on their usage of compute, storage, and data transfer resources on the platform, offered as a unified service. Unlike subscription-based models, revenue recognition is tied to consumption rather than being spread evenly over the contract duration, leading to less predictable revenue timing compared to traditional software subscriptions. Nevertheless, with an expanding customer base, forecasting overall customer consumption becomes more feasible.

Customers typically engage through capacity arrangements spanning one to four years, billed annually in advance based on their anticipated usage. Alternatively, they might opt for on-demand arrangements, where charges for platform usage are billed monthly after usage has occurred. It is easy to see how NRR can continue to be robust as long as new customers are being rolled in and these customers begin using more services provided by SNOW’s platform. As the chart below shows, SNOW continues to add large customers and as long as this acquisition rate persists, it is unlikely we will see any hiccups on the growth front.

Good business model, but too bad about the valuations

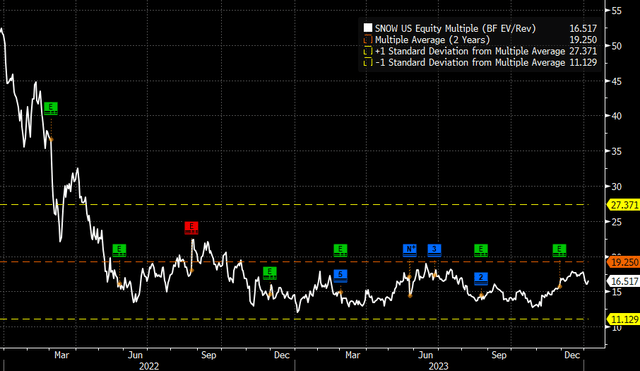

Against this backdrop of rapid growth, SNOW currently trades at a 16.5x EV/Revenue. The denominator is expected to grow by 30% between now and 2026 at which point, the company will “only” trade at 12.5x EV/Revenue. As we have all seen in the years past, small bumps can create large resets in valuations for companies that are trading at such nosebleed valuations. In fact, we have already seen a reset in valuation for SNOW.

When SNOW went public, it did so at nearly 53x revenue. Its shares sold off over 60% from its highs to the 2022 low $113/share.

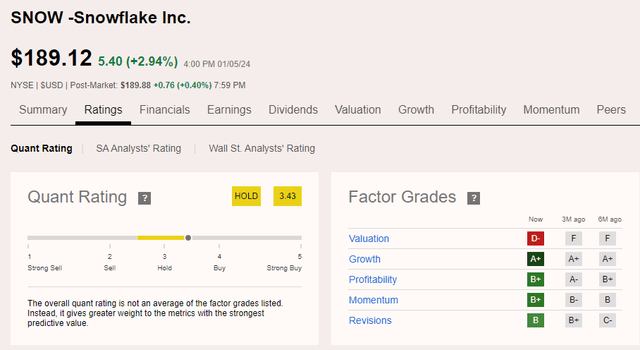

Seeking Alpha’s quant model also appears to agree with my thesis. The model has a rating of HOLD with a score of 3.43. Underneath the broader ranking, while the company gets an A+ on growth and high marks on other metrics, its valuation receives a D- bringing down the overall score for the company.

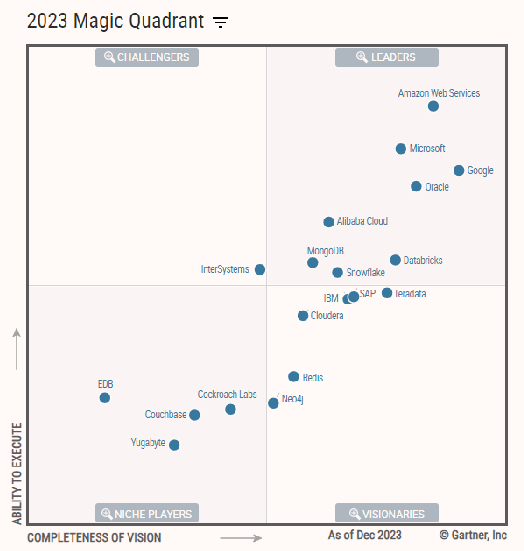

SNOW is not alone in the cloud computing Candyland

Let’s not forget that SNOW is competing in a highly competitive space. Companies are intensifying efforts to maximize the potential of the data stored on their platforms by harnessing AI advancements for deeper insights from both structured and unstructured data. Recent assessments of various cloud data vendors indicate that multiple players are successfully capitalizing on diverse use cases for expanding datasets. Snowflake has been gaining market share by swiftly introducing AI-driven products, yet traditional competitors are also swiftly equipping themselves in this domain. This competition could potentially lead to Snowflake falling short of its growth expectations and trip the company’s shares lower.

Company Filings

There is a belief among some investors that Snowflake can emerge as the sole comprehensive data solution. This belief is unrealistic; an oligopoly, not a monopoly, is more probable. While data warehouses are crucial in modern cloud setups, they don’t solely define the landscape – cloud computing prioritizes using the most suitable tools for specific tasks. Snowflake’s advantage in AI is expected to diminish over time, particularly as major players restructure and introduce competing products. Finally, there is a point to discuss on the macro. The high interest rates have yet take a bite out of equity valuations. As higher rates begin affecting businesses and their profits, high-growth stories like Snowflake might see another valuation reset, potentially offering a more balanced buying opportunity. We have seen the company’s valuation reset from 53x to 16.5x. A reset into the high single, low-double digits would bring an opportunity with a more attractive risk reward.