oxign

Snowflake (NYSE:SNOW) has seen its stock soar as of late, perhaps due to hopes for an easing of cloud optimization trends or simply due to a broader tech rally. The stock has always been among the most expensive stocks in the tech sector and market overall, and this is once again a moment in which one must wonder if the reward is worth the risk. While I can see the stock delivering positive returns over the long term as the company executes against its growth ambitions, I question whether the projected returns will prove adequate, as multiple compression may be a significant long term headwind. It is time to downgrade the stock – I rate SNOW with a neutral rating until the value proposition improves.

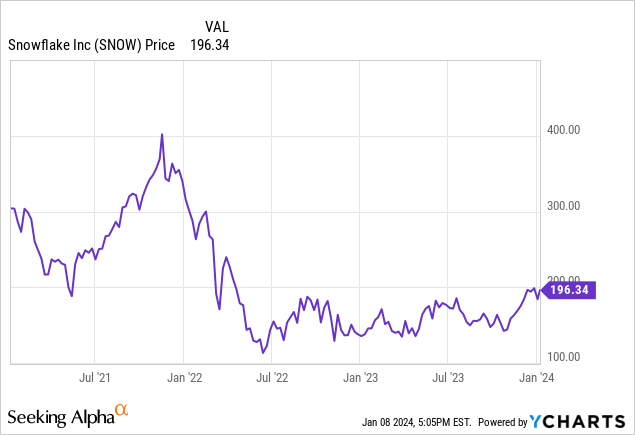

SNOW Stock Price

SNOW was seemingly one of the few tech stocks that did not see a big recovery in 2023 from lows, but that has changed in recent months.

I last covered SNOW in October where I rated the stock a buy due to long-term generative AI tailwinds. The stock has jumped significantly since then, a bit too much for my liking given that the valuation looks stretched unless the company can deliver incredible execution.

SNOW Stock Key Metrics

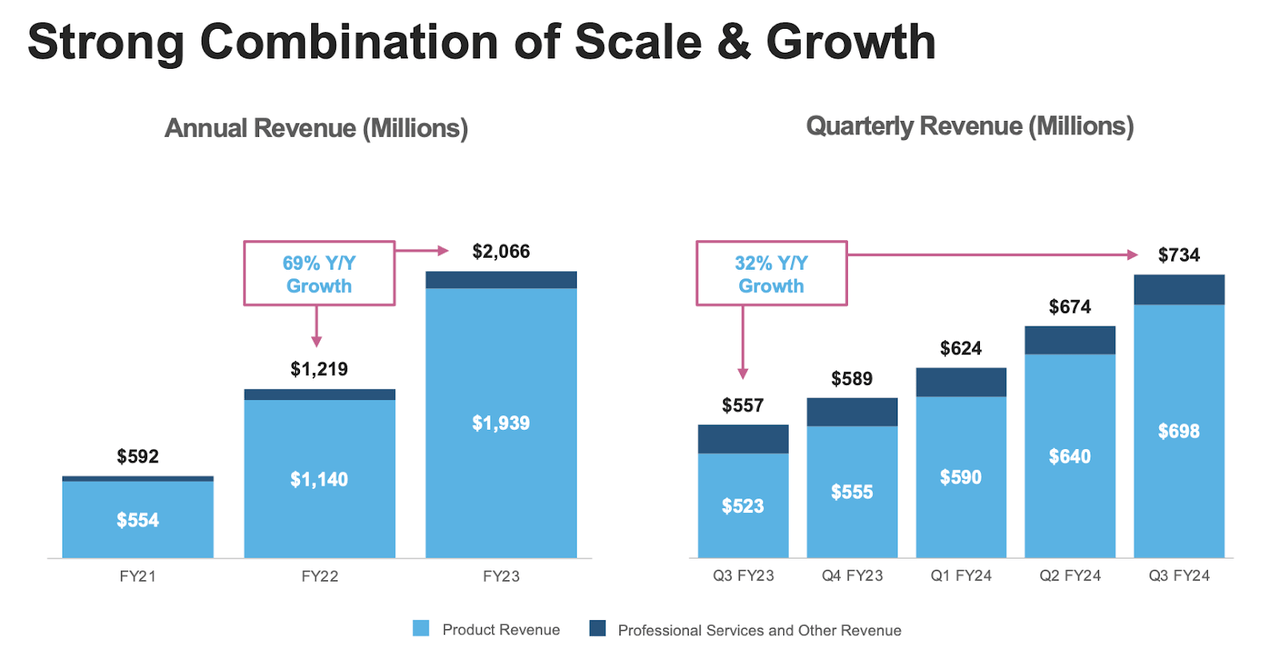

In its most recent quarter, SNOW generated 32% YoY revenue growth to $734 million ($698 million in product revenues). That marks a significant deceleration from the 69% YoY growth shown in the last fiscal year, but came comfortably ahead of guidance for up to $675 million in product revenues. Substantially all tech companies have seen growth rates decelerate due to a tough macro environment, and SNOW continues to post among the strongest growth rates among peers.

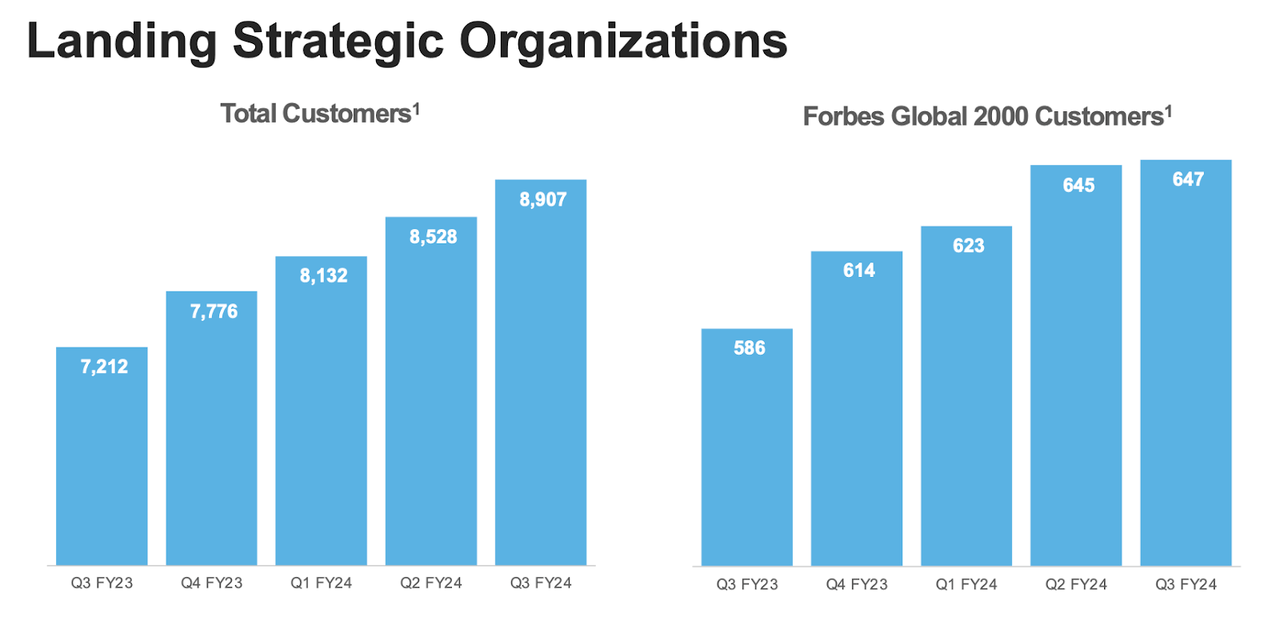

SNOW has continued to show some customer growth, with total customers growing at a healthy 4.4% sequential clip. I am impressed by the company’s ability to sustain such solid growth rates in spite of the tough macro environment.

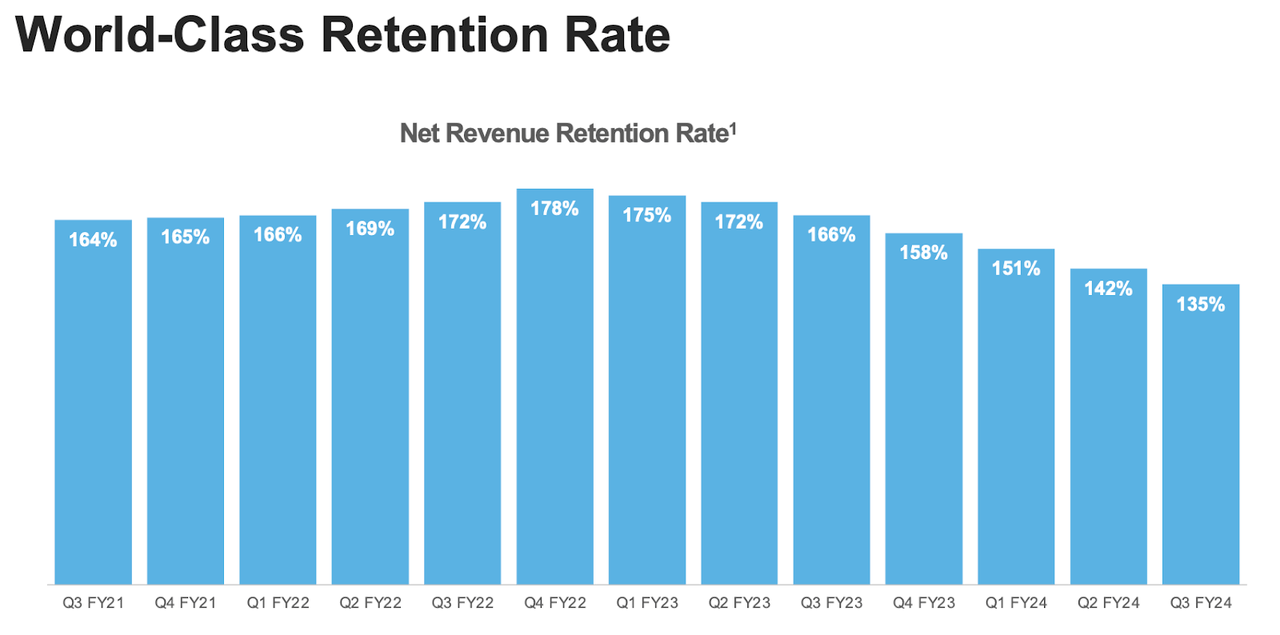

The company has however seen its net revenue retention rate continue to deteriorate, dipping to 135% in the quarter. Customers have been undergoing “cloud optimization” and have shown greater scrutiny on IT budgets. Whereas customers may have previously had a “growth at any cost” mindset in relations to data, those days are now on pause.

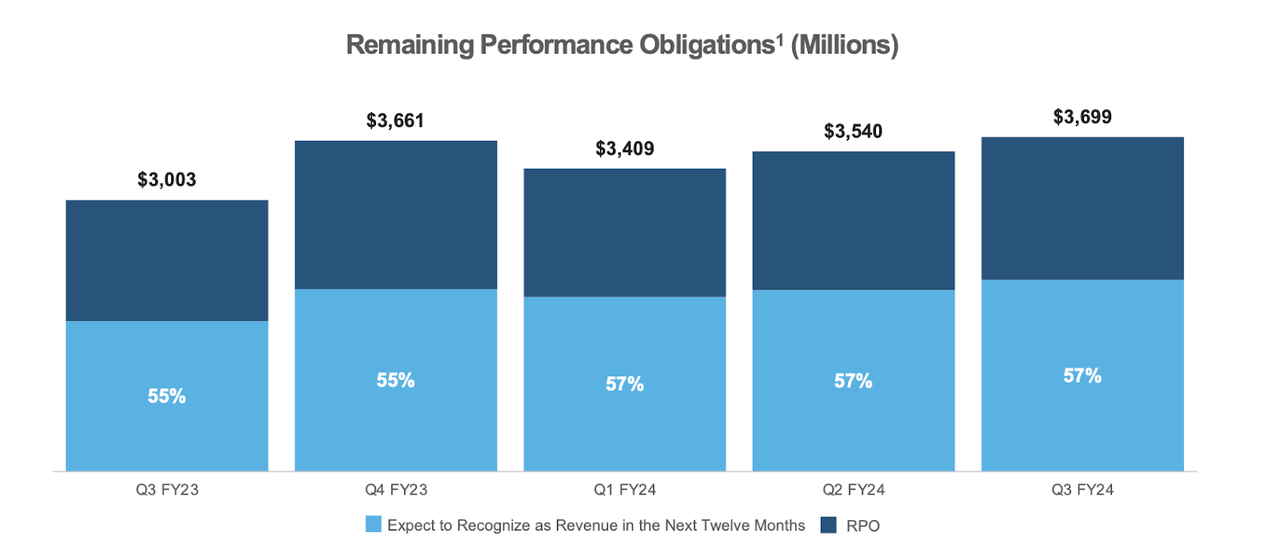

SNOW delivered 23.2% YoY growth in remaining performance obligations (‘RPOs’), but current RPOs grew by 27.6%. Investors should focus more on current RPOs than overall RPO growth due to many customers seeking lower contract durations, perhaps due to the higher cost of capital.

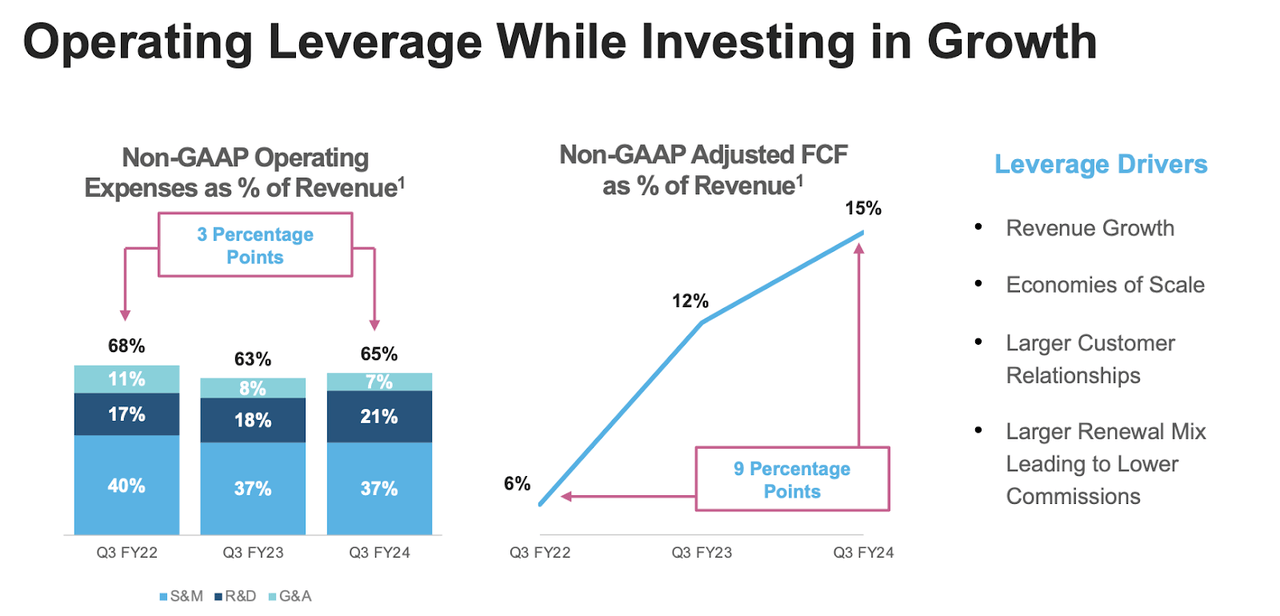

SNOW generated $71.9 million in non-GAAP operating income, for a 10% margin. The company has shown solid margin expansion, though I note that their operating leverage efforts have been more modest compared to peers. This may be due to the stock still trading at lofty valuations even after the 2022 tech stock crash, leading to lesser urgency to deliver on profitability goals.

SNOW ended the quarter with $4.5 billion of cash and no debt, making for a strong balance sheet. The company repurchased $400 million of stock in the quarter, which management stated was possible due to their “strong cash position.” I am of the view that share repurchases are a suboptimal use of capital for the company given the lofty valuation relative to peers.

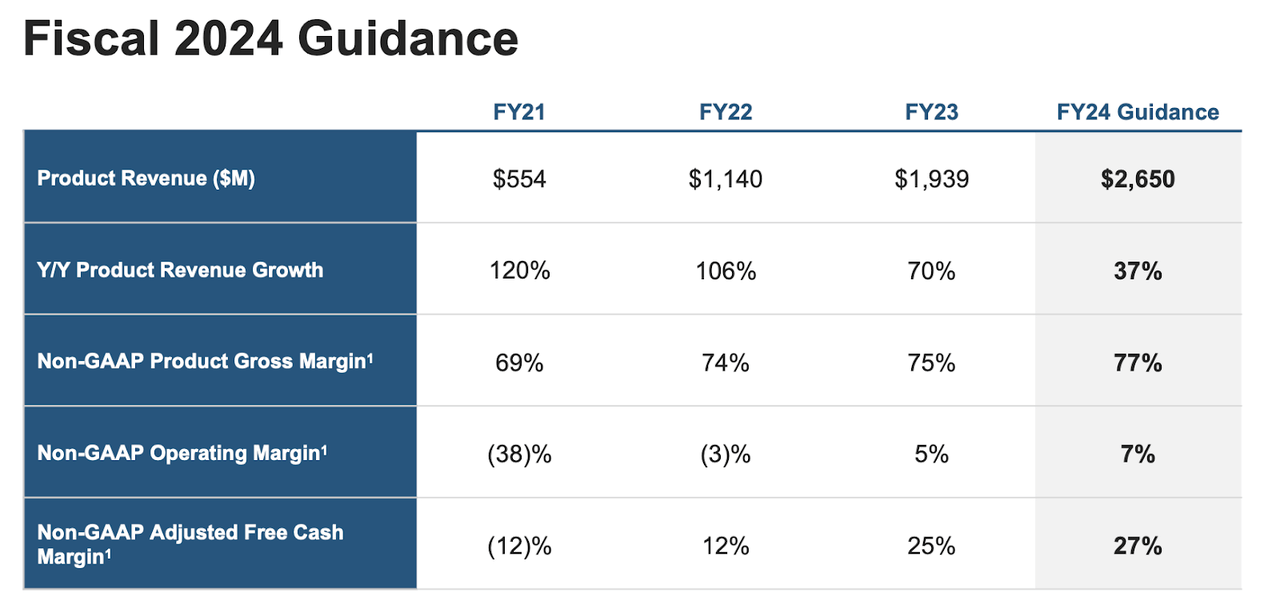

Looking ahead, management has guided for the fourth quarter to see up to $721 million in product revenues, representing 30% YoY growth, and non-GAAP operating margins of 4%. Management is now increasing full-year guidance from $2.6 billion to $2.65 billion in product revenues, and non-GAAP operating margins from 5% to 7%.

On the conference call, management noted that consumption trends in September “exceed expectations” based on observations that “nine out of our top 10 customers all grew” sequentially. The company has been seeing cloud optimization headwinds and this commentary may have raised hopes that these headwinds are easing. In particular, generative AI catalysts may be on the horizon. An analyst noted on the call that “conversations are starting with generative AI and they’re stopping at data, because they find their data estates aren’t in good enough shape.” Against that backdrop, one might assume that SNOW may play an integral role for broader adoption of generative AI due to being a necessary prerequisite for organized data. Management also expects new products to help drive near term growth – it appears that the company may see top-line growth accelerate at some point in the future.

Is SNOW Stock A Buy, Sell, or Hold?

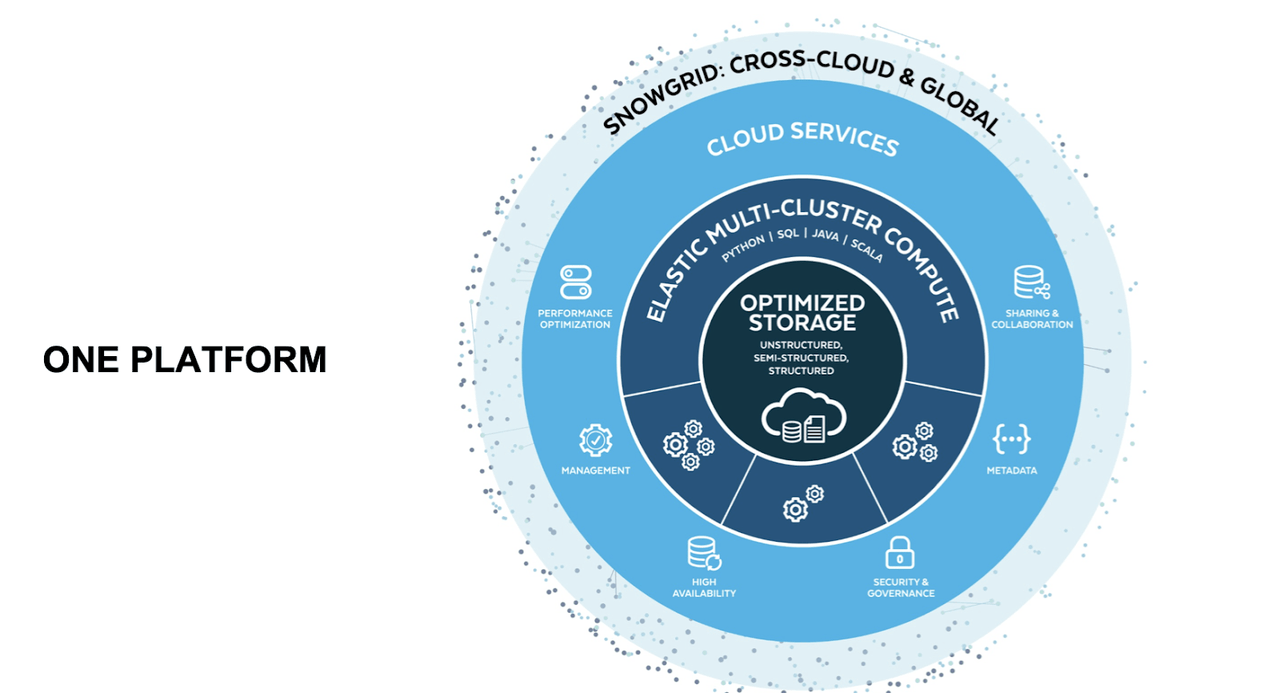

SNOW is an enterprise tech company which helps customers to manage structured and unstructured data.

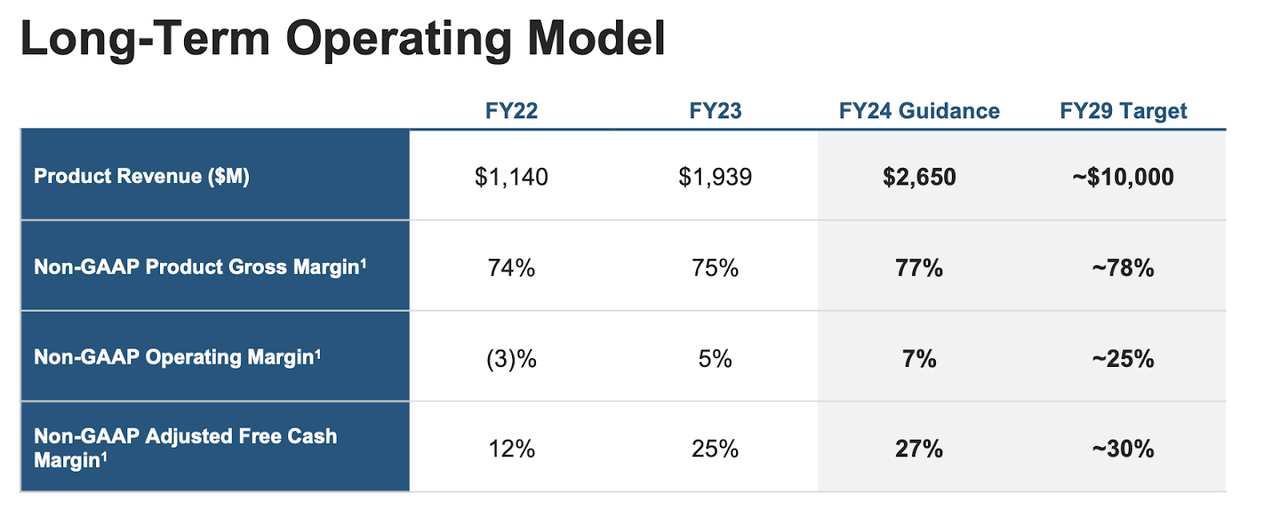

SNOW faced headwinds post-pandemic as customers sought to rein in spending. Whereas customers might have taken a more liberal approach to the growth of data (and its associated costs) up through the pandemic, since 2022 customers have been instead preferring to proactively delete old data. An improving macro environment as well as Generative AI may eventually help to reverse those headwinds and reignite the growth engine. Management has given FY29 targets of $10 billion in product revenue and 25% non-GAAP operating margins.

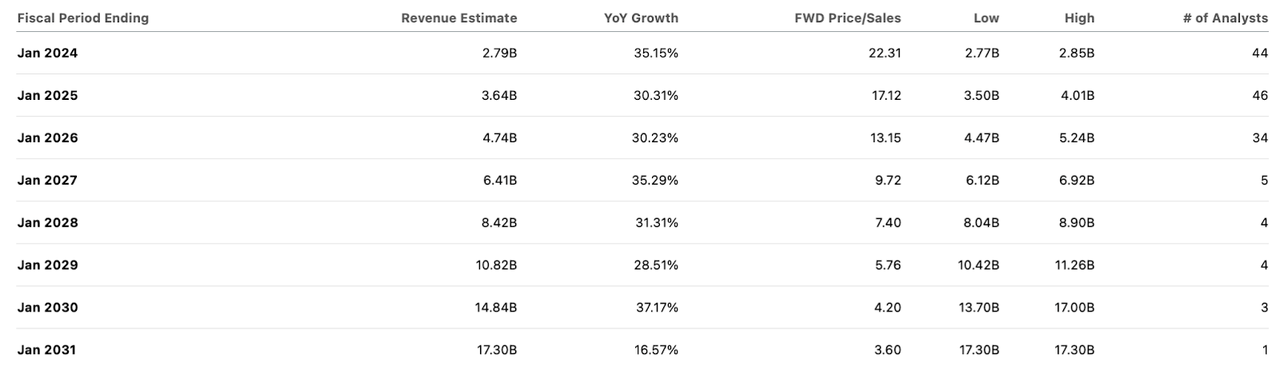

Consensus estimates appear confident in that projection with the company expected to sustain over 30% growth over the next 6 years.

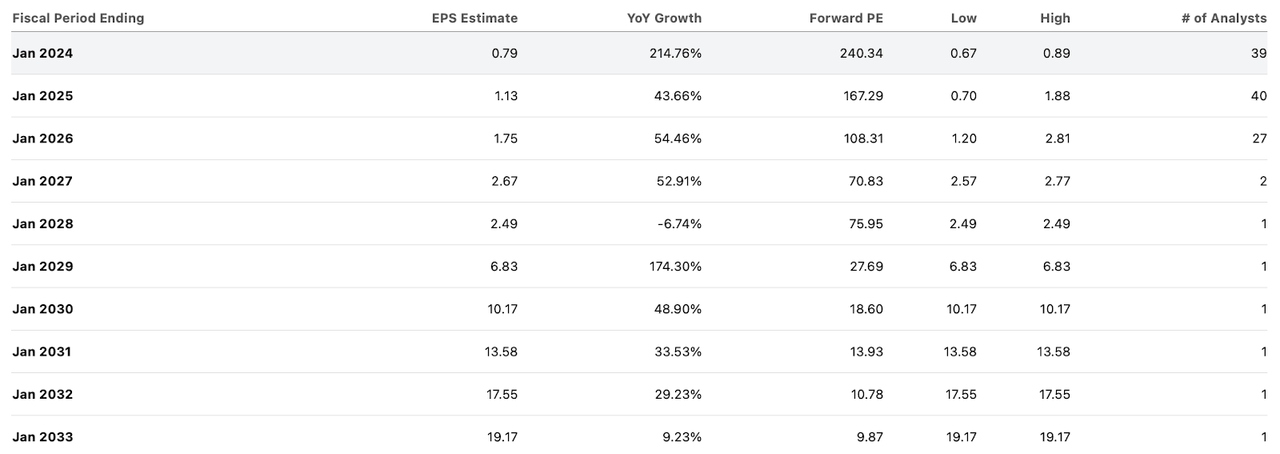

The stock currently trades at a nosebleed 240x earnings, but operating leverage is expected to allow for incredible earnings growth over the coming years.

Based on my same assumptions of 25% growth exiting fiscal 2029, 30% long-term net margins, and a 1.5x price-to-earnings growth ratio (‘PEG ratio’), we arrive at a fair value of around 11.3x price-to-sales in FY29, or a stock price of $385 per share. That implies around 14.4% annual upside potential over the next 5 years. I had projected around 17% annual upside potential in my last report – the lower number today reflects the higher stock price. I view 15% to be the appropriate hurdle rate for this stock. On the one hand, the company’s strong growth story, net cash balance sheet, and positive cash generation help to push that hurdle rate lower, but the aggressive assumptions made over long multi-year periods offsets that. At current prices, SNOW is trading just below that hurdle rate. While some investors may be tempted to lower hurdle rates due to the rising valuations in the tech sector and the market overall, I do not find such behavior appropriate given both the prevalence of undervalued opportunities elsewhere as well as the lack of key characteristics. Those key characteristics mainly center around shareholder returns and GAAP profitability. With SNOW trading at 240x non-GAAP earnings and not yet profitable on a GAAP basis, the main driver of the quality thesis is the secular growth story, but using that to justify lowering hurdle rates could prove disastrous if the company ends up failing to deliver on the ambitious targets laid out by both management and consensus estimates.

I am downgrading SNOW to a neutral rating given that the stock appears to already be pricing in the next 5 years of growth.