eAlisa

I’ve highlighted the problem with small-caps multiple times – there are a lot of zombie companies that may not survive higher for longer rates. What’s one possible solution to avoid this? Find companies growing their dividends. After all – dividend growth should mean companies are not at risk from cash flow problems, right? On the surface this seems appreciate a reasonable approach. The problem is how the sector allocation plays into it. That’s why, although the ProShares Russell 2000 Dividend Growers ETF (BATS:SMDV) seems interesting to position into, it’s also challenging to be confident in.

SMDV is a unique ETF that focuses exclusively on dividend growers within the Russell 2000 Index. It targets companies that not only pay dividends but have also grown them for at least ten consecutive years. This focus on consistent dividend growers is what sets SMDV apart. The fund began its investing operations on February 3, 2015, and has $711 million in assets under management (AUM).

Top Positions

Top holdings include:

-

Cambridge Bancorp: This financial institution offers a variety of banking services and has a strong record of dividend growth.

-

HNI Corp.: A provider of office furniture and hearth products, HNI Corp has consistently increased its dividend payments over the years.

-

Kadant Inc.: Kadant is a global supplier of high-value, critical components and engineered systems used in process industries worldwide. It has a robust history of dividend growth.

-

Horace Mann Educators Corp.: As an insurance holding company, Horace Mann has a strong record of increasing its dividends.

-

SpartanNash Co.: A multi-regional grocery distributor and retailer, SpartanNash has demonstrated consistent dividend growth.

It’s worth noting no single position makes up more than 1.22% of the fund, so it’s highly spread out and diversified from that perspective.

Sector Composition and Weightings

SMDV has a diversified sector composition. As of September 30, 2023, the fund’s sector weightings were as follows:

- Financials: 30.98%

- Industrials: 23.08%

- Utilities: 17.75%

- Materials: 8.56%

- Consumer Staples: 7.17%

- Real Estate: 3.82%

- Health Care: 2.89%

- Communication Services: 2.86%

- Information Technology: 1.86%

- Consumer Discretionary: 1.02%

And here’s the problem. This is nearly a third in small-cap Financials. Sure, these companies grow dividends, but do you want that much exposure into a potential credit crunch?

Peer Comparison

When compared to other similar ETFs, SMDV holds its own. For instance, the WisdomTree U.S. Quality Dividend Growth Fund ETF (DGRW), the iShares Core Dividend Growth ETF (DGRO), and the Vanguard Dividend Appreciation Index Fund ETF (VIG) are all large-cap ETFs. Since SMDV’s inception in 2015, it has lagged behind these large-cap ETFs in terms of performance. However, it’s important to note that SMDV offers exposure to small-cap stocks, which these other ETFs do not.

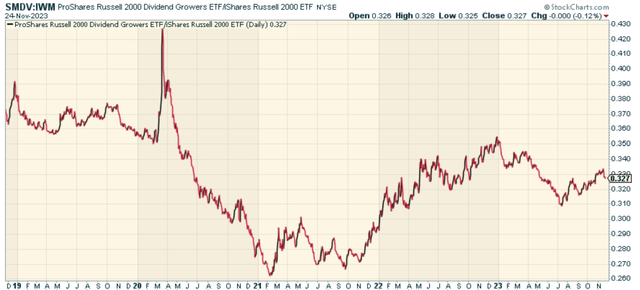

It’s also worth noting that relative to the iShares Russell 2000 ETF (IWM), the ratio doesn’t have any convincing trend movement, meaning SMDV really hasn’t generated relative performance.

Pros and Cons of Investing in the Theme SMDV Tracks

The main advantage of investing in SMDV is the exposure it offers to companies with a consistent record of dividend growth. This could potentially supply a stable income stream for investors. Additionally, the fund’s focus on small-cap stocks provides a unique investment opportunity that isn’t available in most large-cap dividend ETFs.

However, SMDV does have its drawbacks. It’s heavily weighted towards the financial sector, which can be risky. Furthermore, small-cap stocks are generally more volatile than their large-cap counterparts, which could direct to larger price swings.

This is a pass for me. Interesting approach but the sector allocations are a problem.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The direct-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to infer whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).