witsarut sakorn/iStock via Getty Images

SmartRent, Inc. (NYSE:SMRT) is a small-cap stock that offers integrated innovative hardware and cloud-based software solutions for rental property owners and operators. With a strong market presence and an upward revenue trend, SmartRent is expected to reach profitability and generate positive cash flow in 2024. Despite yet delivering profits, the company’s financial position is improving; the stock received positive analyst commentary in May after posting a strong Q1 2023. However, we’ve seen the stock fluctuate this year due to missed revenue expectations in Q2 and Q3 and a tightening of FY2023 guidance. Although cautious of the risks of investing in younger companies that lack sufficient historical data, the company has already installed over 680,000 devices, its solution penetration is less than 10% across its existing customer base, and there is a positive near and long term outlook regarding its top and bottom-line growth. Therefore, investors may want to take a bullish stance on this stock.

Historic stock trend (Seeking Alpha)

Company overview

SmartRent is a business in the home automation industry, specialising in the development of hardware and cloud-based software solutions. These solutions are designed to streamline operations for rental property owners and operators, offering a single point of control for all devices within a property. This not only simplifies management but also reduces utility bills, minimises damage, and allows for higher rental fees. SmartRent’s offerings include third-party hardware products and proprietary software that connects all devices, essentially transforming properties into smart apartments.

Solutions (SmartRent) Customers (SmartRent)

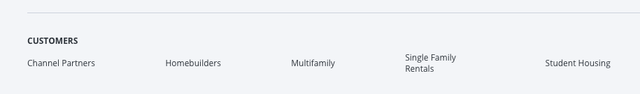

The company operates primarily in the US through three main sectors – Hardware, Professional Services (primarily installation), and Hosted Services (SaaS or subscription services). The company’s primary revenue comes from the sales and installation of smart home systems, particularly smart locks, for large multifamily properties. Additionally, SmartRent offers fully integrated solutions to the real estate industry, bringing smart home technology to the multifamily sector.

Q3 2023 revenue by geography and segment (SEC)

SmartRent has established a strong market presence with an impressive record of 682,632 device installations. The company has significant white space opportunities within its customer base as it adds more devices, and the company is experiencing new customer demand as it continues to add more solutions. The company faces competition from several other players in the industry, including Latch (OTC:LTCH), Dwelo, STRATIS, IOTAS (ADT), Notion, and Vivint (NRG). What sets SmartRent apart is its unique position as a leading smart home operating system provider for various stakeholders, including residential property owners and managers, home builders, home buyers, and residents. The company’s deeply integrated, brand-agnostic hardware and software solutions serve as its competitive advantage in the industry.

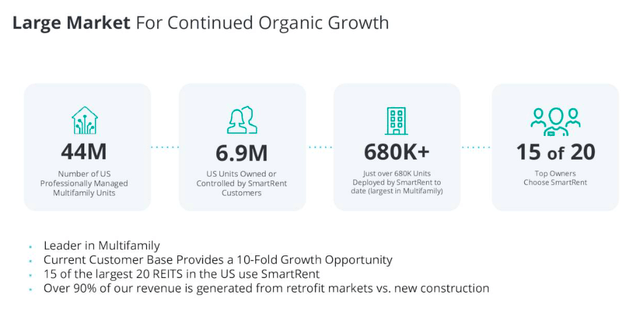

Growth opportunity (Investor presentation 2023)

Financials

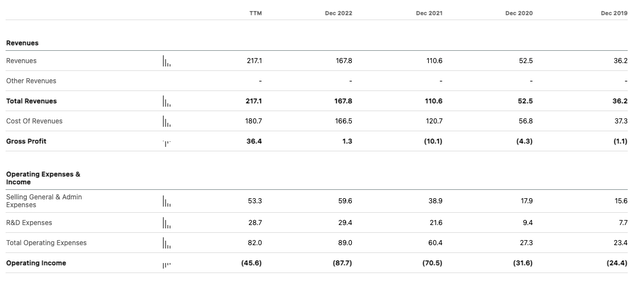

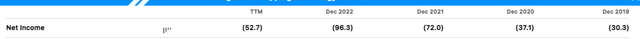

SmartRent has been demonstrating a promising financial trajectory with an upward trend in revenue and a robust balance sheet. The company’s top line has nearly doubled since FY 2021, with a TTM revenue of $217.1 million. Despite the operating income remaining in the negative territory, there has been a significant improvement in TTM, with a reduction to negative $45.6 million from the previous fiscal year. While the company’s performance over the last five years has shown some inconsistencies, it’s important to note that SmartRent has been making strides toward profitability. While the net losses have increased over the last five years, TTM net income at negative $52.7 million, shows an upward trend from the prior two financial years.

Annual revenue and operating income (Seeking Alpha) Annual net income (Seeking Alpha)

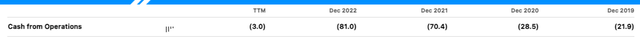

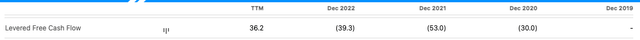

SmartRent’s financial health is further underscored by its improving cash flow. The company’s cash from operations has seen a positive shift over the last three years, improving to a negative $3 million TTM. SmartRent anticipates generating positive cash flow in 2024, a significant milestone for any growing company. The company has also managed to produce a positive levered free cash flow of $36.2 million TTM, a stark contrast to the negative results seen in previous financial years. This positive cash flow not only enables SmartRent to reinvest in the business but also provides the potential for rewarding investors and reducing debts.

Annual cash from operations (Seeking Alpha) Levered free cash flow (Seeking Alpha)

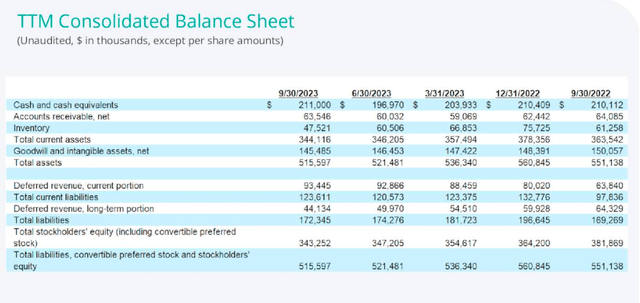

Examining the company’s balance sheet, we see a year-over-year increase in cash and cash equivalents as of the Q3 2023 report. Additionally, SmartRent has a $75 million credit facility at its disposal, with no current borrowings against it.

Balance sheet Q3 2023 (Investor presentation 2023)

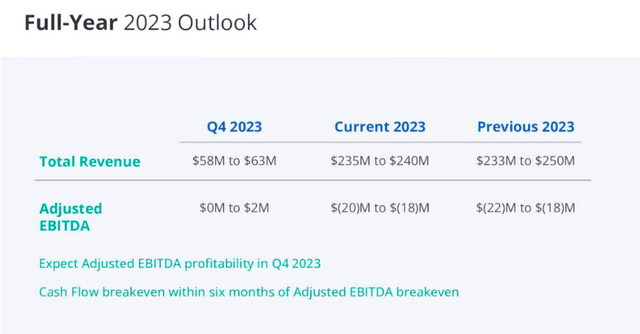

Looking ahead to the upcoming quarter, SmartRent expects to achieve adjusted EBITDA profitability in Q4 2023. The company has also tightened its revenue and adjusted EBITDA expectations for the full year, indicating a focused and strategic approach to its financial management.

Full year 2023 (Investor presentation 2023)

Valuation

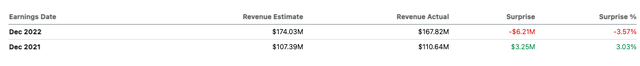

SmartRent has been demonstrating clear signs of financial improvement. Despite not yet turning a profit, the company’s progress and its commentary of nearing profits in FY2024 paint a promising picture for potential investors. In FY2022, SmartRent reported a loss of 49 cents per share on total revenue of $167.82 million. This was an improvement from FY2021 when the company reported a loss of 96 cents per share on total revenue of $110.64 million.

Annual earnings results (Seeking Alpha) Annual revenue results (Seeking Alpha)

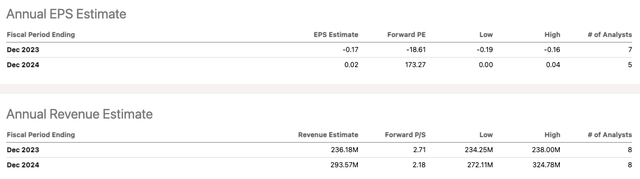

The company’s top line has nearly doubled since FY 2021, with a TTM revenue of $217.1 million. Looking ahead, the consensus among analyst firms on Seeking Alpha is that SmartRent will post a loss of 17 cents per share as sales increase to $236 million. By FY2024, the company is predicted to break even in the second half of the year as sales increase by 14% YoY.

Consensus FY 2023 and FY 2024 (Seeking Alpha)

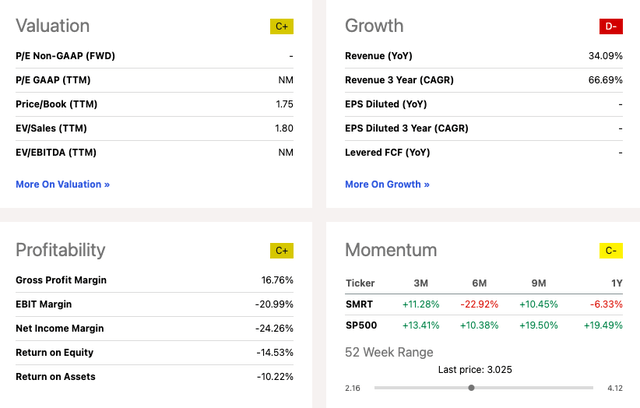

The company’s gross profit margin currently stands at a modest 16.76%, but this figure is expected to improve as the business scales, particularly its software solutions. According to Seeking Alpha’s Quant valuation, the stock holds a C+ grade, reflecting its impressive YoY revenue growth of 34.09%. SmartRent’s financial health is further underscored by its improving cash flow. The company’s cash from operations has seen a positive shift over the last three years, improving to a negative $3 million TTM. SmartRent anticipates generating positive cash flow in 2024, a significant milestone for any growing company.

Quant valuation metrics (Seeking Alpha)

The company has received increasingly positive analyst commentary since releasing a strong Q1 2023 report in May 2023, which demonstrated growing demand and better cost control. However, Q2 and Q3’s missed revenue results and tightening of the FY 2023 guidance decreased this positive sentiment. If we look across Wall Street analysts, the company is rated as a strong 4.5 Buy, and its average price target of $4.59 indicates a potential upside of 45.71% at the current trading price.

Analyst recommendations (Marketscreener.com)

Risks

Investing in SmartRent comes with risks that potential investors should consider. The home automation industry is highly competitive, and SmartRent’s future success depends on its ability to maintain its competitive edge and continue to innovate amidst competition from several other players in the industry, some of which are larger with access to greater resources. Changes in laws and regulations, or failure to comply with them, could negatively impact the company’s operations and profitability. The rapid pace of technological advancement in the home automation industry poses a risk of SmartRent’s current technology becoming obsolete, necessitating substantial investment in research and development.

Final thoughts

SmartRent has been making significant strides in its financial performance. Despite not yet turning a profit, the company’s upward revenue trend and strong market presence are promising indicators of its potential. SmartRent’s integrated hardware and software solutions have already been installed in over 680,000 devices, demonstrating its ability to meet market demand and stay competitive. Furthermore, it has a vast opportunity within its existing customer base and can continue to grow through new acquisitions. The company’s financial position is improving, with expectations of reaching profitability and generating positive cash flow in 2024. While investing in younger companies like SmartRent comes with risks due to a lack of sufficient historical data, the company’s consistent growth in top and bottom-line figures presents a compelling case for potential investors. Therefore, a bullish stance on this stock could be considered.