Talaj/iStock via Getty Images

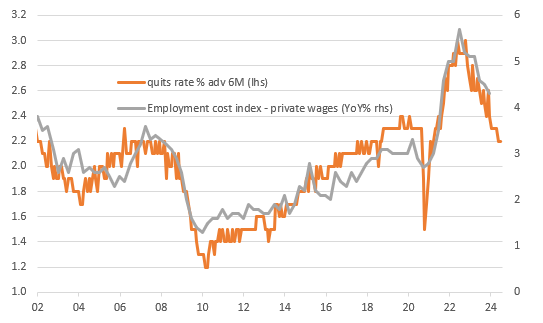

Employment costs are cooling broadly despite the tight jobs market. Nonetheless, with the quit rate falling, it suggests the jobs that are on offer are not especially attractive, implying less incentive to pay more to retain current staff. This cooling labour cost environment offers the Fed the room to cut interest rates meaningfully to neutral levels.

We have had a really impressive US employment cost index, that will reinforce the view that we will see substantial Federal Reserve interest rate cuts later in the year. Employment costs rose 0.9% quarter-on-quarter in 4Q versus 1.1% in 3Q23, and below the 1% consensus prediction. This is the weakest increase in employment costs since second quarter 2021.

It is one of those indicators that the Federal Reserve pays very close attention to as it is the broadest measure of all-in costs of employing people – including benefits such as health care and pensions as well as wages and salaries. Yesterday’s quits rate, which was part of the JOLTS report, has a really good lead quality for predicting the ECI. The quits rate has plunged – there may be jobs available, but they aren’t attractive enough for people to want to quit their current job and move employer. Therefore, if new jobs aren’t offering good enough pay, there is less incentive for employers to offer bumper pay rates to retain staff, and you get this cycle of slowing pay and benefits. It may not be great news for our pay checks, but it is good news for inflation and the prospect of meaningful Fed policy easing.

Falling quit rates points to more subdued labour costs ahead

Macrobond, ING

We are currently saying 150bp of Fed rate cuts this year, starting in May, and 100bp in 1H 2025. This is one of the more aggressive calls in the market, but remember the Federal Reserve tells us their long-run projection for the Fed funds rate is 2.50% – suggesting scope for 300bp of rate cuts merely to get us to a ‘neutral’ level. Ongoing subdued core PCE inflation readings, softening ECI and if we do start to see the unemployment rate tick higher and growth cool, then it is a possibility at some point in 2025.

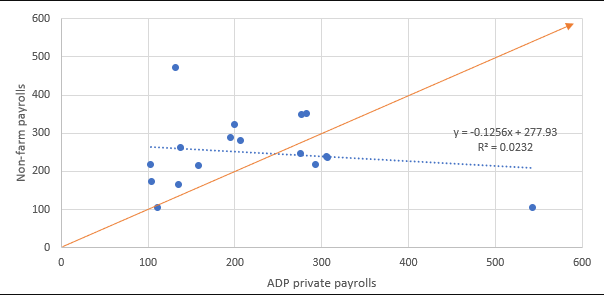

ADP is not a reliable guide for non-farm payrolls

We also had the ADP private payrolls series this morning, and it was weak. It came in at 107k versus a downwardly revised 158k in December (previously reported as 164k). Consensus was 150k. However, the regular reminder is that ADP is a poor non-farm payrolls predictor – which is what that market focuses on. In fact they are inversely related in that the stronger the ADP, the weaker non-farm payrolls, and vice versa. The chart below shows the relationship over the past 18 months. It suggests ADP of 107k historically implies non-farm payrolls growth of 266k on Friday. The current consensus for non-farm payrolls is 185k, with the most optimistic forecaster in Bloomberg’s survey predicting 296k.

ADP private payrolls versus non-farm payrolls (000s)

Macrobond, ING

Content Disclaimer

This publication has been prepared by ING solely for information purposes, irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.