ArtistGNDphotography

Synopsis

Simpson Manufacturing (NYSE:SSD) is a company that designs and manufactures high-quality wood and concrete construction products. SSD’s 2023 revenue growth was significantly lower than the previous years. However, despite revenue growth fluctuations, its margins remained robust over the years. Looking ahead, SSD has positioned itself well to expand its market share in the fastener market. In addition, the other two key core addressable markets have enough room for SSD to expand into, thus providing it with the tailwind needed to grow its business in the foreseeable future. However, its current share price lacks a sufficient margin of safety. On top of that, SSD also faced challenging macroenvironment in both the US and Europe. On these notes, I am recommending a hold rating for SSD.

Historical Financial Analysis

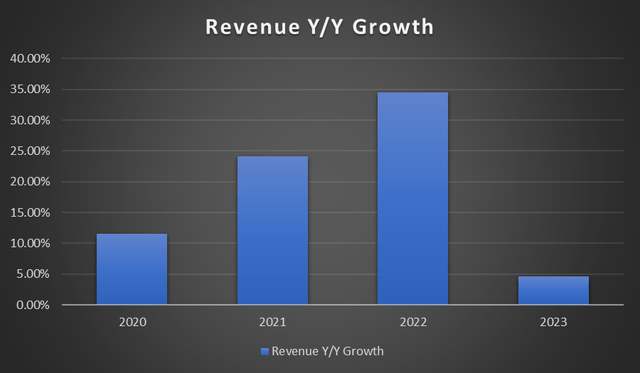

Based on the following chart, it is clear that 2023’s revenue growth has decelerated drastically compared to the previous years. The lower growth rate was driven by challenging environments such as the lower US housing starts. In Europe, it was also facing challenging economic headwinds and lower construction activity.

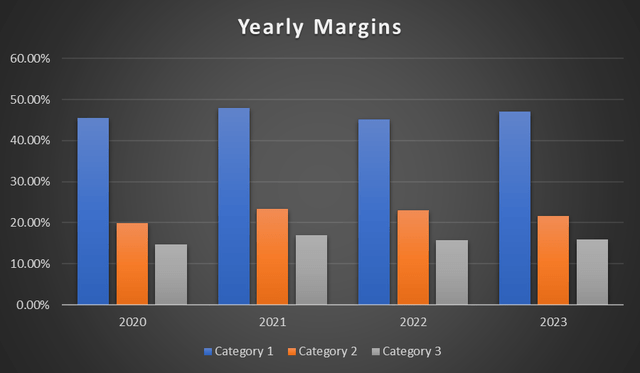

Despite fluctuating revenue growth rates, SSD’s margins have expanded slightly over the years. In 2023, it reported a gross profit margin of 47.1% vs. 2020s 45.5%, an operating income margin of 21.46% vs. 2020s 19.88%, and a net income margin of 15.9% vs. 2020s 14.75%.

When looking at the chart, 2021 was the year that SSD’s margin expanded. From then on, it remained relatively flat year-over-year. The margin expansion seen in 2021 was driven by product price increases and lower labor and factory expenses.

FY2023 Earnings Analysis

For FY2023, SSD’s net sales grew low-single digit of 4.6% year-over-year to $2.2 billion, up from 2022’s $2.1 billion. The growth was mainly driven by its acquisition of ETANCO, a $12.7 million benefit from foreign currency translation as Europe’s currencies strengthened against USD, and share gains in SSD’s end markets and product lines.

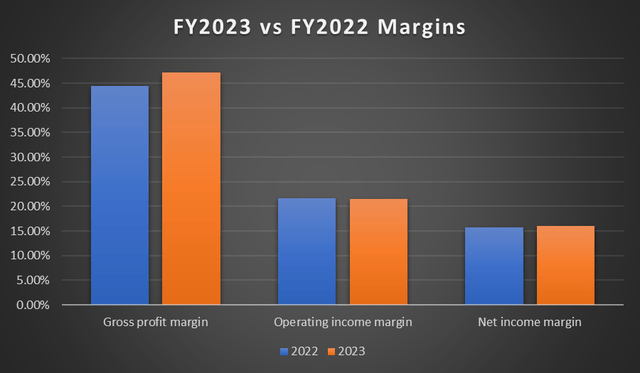

In terms of profitability margins, I will be analyzing its gross profit margin [GPM], operating income margin [OIM], and net income margin [NIM]. In FY2023, SSD’s GPM expanded from 44.5% to 47.1%, and the expansion was driven by the acquisition of ETANCO and also by lower raw material costs. Despite the growth in GPM, its OIM and NIM were almost flat year-over-year.

FY2023’s OIM and NIM reported were 21.46% and 15.9%, respectively, compared to 2022’s 21.69% OIM and 15.78% NIM. The reason behind this is due to the extra expenses incurred that are related to SSD’s growth expansion plans. However, management is confident that these additional expenses are well worth it, as they expect SSD’s future sales volume CAGR to be above market. Lastly, FY2023 reported EPS was $8.26 vs. FY2022’s $7.76, which represents a year-over-year growth of ~6.4%.

Key Addressable Market Still Has Room for Growth

Based on SSD, its net sales’ product groups can be segregated into wood construction, concrete construction, and others. Out of these, wood construction forms the largest share of ~85% of total net sales. Concrete construction comes in second at 14.5%, with other segments forming the remainder.

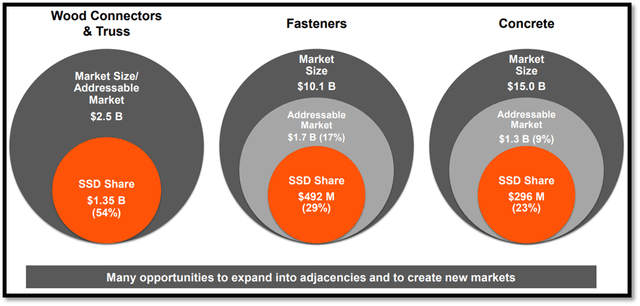

Under wood construction, the main products are connectors, fasteners, and lateral resistive systems. For concrete construction, the products include anchor products and construction, repair, protection, and strengthening products. Based on the following diagram, it is clear that SSD’s key markets are large and still have enough room to allow SSD to continue growing. For wood connectors and trusses, SSD currently only commands ~54% of the market share, at ~$1.35 billion. The addressable wood connectors and truss market size is estimated to be ~$2.5 billion.

For the fasteners market, SSD only commands around 29% of the $1.7 billion addressable market. However, the total market size for fasteners is ~$10.1 billion, which means that SSD’s addressable fasteners market still has the capacity to expand as it currently sits at 17%. Lastly, for concrete, SSD’s market share is ~23% of the $1.3 billion addressable market. Similar to the fasteners market, SSD’s addressable market for concrete is only 9% of the total market size of $15 billion. Therefore, there is still plenty of room for SSD’s concrete addressable market to expand and grow.

Well Positioned to Expand into the $1.7 Billion Fasteners Market

For the $1.7 billion fastener addressable market, SSD is aiming to be the global market leader, given the substantial growth potential this market brings to the table for them. In addition, expanding in this segment will also benefit its connector and lateral products, as they are complementary to each other, thus providing multiple advantages.

SSD’s established channels and customer bases in the building and construction markets provide a strong foundation that can help drive its growth in the fastener market. Moreover, its established manufacturing and supply chain processes position them well and support their expansion goal. Therefore, looking ahead, SSD’s drive to expand market share in this large market, which has substantial growth potential, is anticipated to bolster its growth outlook.

US Annual Housing Starts And Europe Construction Activity Creating Headwind

Although consolidated net sales grew and margins remained relatively robust, it is important to highlight that the annual US housing starts declined by 9%. Despite that, SSD’s FY2023 North America net sales and volume still managed to squeeze a modest growth of 1%. However, we cannot deny the fact that it is creating headwinds for SSD. In Europe, it doesn’t fare well either, as management stated that the region is also facing challenging economic challenges as well as lower construction activity.

On these notes, for 2024, management expects the challenging market condition to persist into 1H24 but gradually subside when transiting into 2H24. Looking at the market estimate for SSD’s 2024 revenue, it is ~$2.32 billion. When compared to 2022, this represents a year-over-year growth of ~5.45%. Although this is an improvement to 2022’s growth, it is still lower than its 10-year median.

Relative Valuation Model

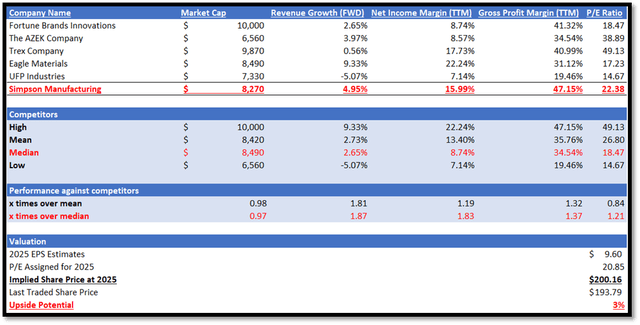

In terms of company size, SSD is similarly sized compared to its peers. It has a market capitalization of $8.2 billion, compared to its peers’ median of $8.4 billion. Despite being similarly sized, it outperformed its peers in terms of growth outlook and profitability. SSD has a forward revenue growth rate of 4.95% compared to peers’ median of 2.65%. In terms of profitability, SSD also has a higher gross profit margin TTM of 47.15% vs. peers’ median of 34.54%. SSD’s net income margin TTM of 15.99% is also higher than peers’ median of 8.74%.

As a result of its better metrics, SSD’s P/E ratio of 22.38 x is trading higher than peers’ median of 18.47x, which is justified. However, it is trading above its 5-year average of 20.85x. Given that its 2023 revenue growth rate and forward growth rate are lower than its 10-year median of 9.41%, it is not justified to be trading above its 5-year average P/E.

The market estimate for SSD’s 2024 revenue is $2.32 billion, while 2025 is $2.45 billion. For EPS, the 2023 estimate is $8.66 and for 2024 it is $9.60. Given the growth catalysts and headwinds regarding the housing market that were discussed above, the estimate is reasonable and justified. By applying a P/E of 20.85x to its 2025 EPS estimate, my target price is $200.16, which represents a modest upside of only 3%.

Risk

The upside risk to my hold recommendation is in relation to the growth potential of SSD in its addressable markets. If the US and Europe’s macroeconomic and housing challenges were to subside, it would provide the tailwind for SSD to grow. In addition, SSD is well positioned to capture growth in the larger fastener market given its established channels and customer bases, along with its robust manufacturing and supply chain processes.

Conclusion

In conclusion, SSD’s 2023 revenue growth rate has slowed down drastically when compared to 2020-2022. The deceleration was due to lower US housing starts and Europe’s challenging economic headwinds. On a brighter note, its margins actually remained robust over the same period despite the revenue volatility.

Looking ahead, SSD’s outlook is mixed. Although its three core markets still have ample room to expand, and it is also well positioned to expand into the large fastener market, management is expecting the challenging market conditions SSD faced in 2023 to roll over into 1H24. However, it is expected to subside in the latter half.

When it comes to valuation, although SSD outperformed its peers, its P/E is trading a little too high. In order to stay conservative, I have adjusted its P/E downward to its 5-year average. At this multiple, my target price indicates modest upside potential. Given the mixed outlook, the upside potential doesn’t provide enough margin of safety. Therefore, I am recommending a hold rating.