Natee127

Similarweb (NYSE:SMWB) has always been a company we liked. Even for investor intelligence, its tools have been useful, and over the years they’ve been improving their product and perfecting their monetisation scheme. The key strategic considerations are to have a lot of action at the top of the funnel, and then effectively upsell customers to turn them into bigger more strategic tickets. Additionally, they’ve used the slower sales environment in 2023 to do major cost cutting, and their operating structure is now a lot more efficient. Sales cycles are beginning to speed up again, and a rapid approach to profitability, still winning strategic customers and retaining the current base is going to see revenues continue to inflect upwards to match customer growth.

Looking at the Q4

Revenue increased 11% YoY in Q4. Of course, this is a subscription business, so timings of the closing of deals within the quarter matter a lot for how those wins contribute because of subscription revenue recognition. Customer growth increased by 16%, outpacing revenue, although larger, more strategic (large) accounts only saw customer growth of around 8%.

Yes, we’re very encouraged by what we’re seeing with the 3.0 pricing. When we look at the 360-some-odd customers that are over $100,000 the overwhelming majority of those customers historically started well below $100,000. And what we’ve done over the years is take customers through that journey starting with one solution good going to better, going to best and then going from one solution to a second solution to third solution. And that’s how you take somebody from being a $10,000 customer to getting tens of thousands to hundreds of thousands and even multimillion.

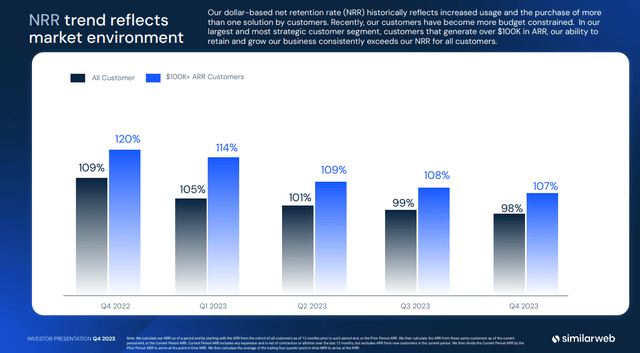

However, the Similarweb monetisation strategy is that customers come in on much lower payment plans, and then as their needs scale so does the size of the contract. Smaller accounts are driving customer growth, and many of those smaller accounts are going to convert into larger accounts. Although not all of course, attrition happens higher up the funnel, and overall NRRs are 98%, but the cadence shows a deceleration in these rates sequentially. Importantly, customers that become strategic, more than $100k in ARR, have strong NRRs at 107%. Strategic customers are naturally going to be a group that are receiving demonstrable value from the product, so as that continues to be the segment that burgeons, overall NRRs should also be drawn upwards since these customers are less likely to fade out.

NRRs (Q4 Pres)

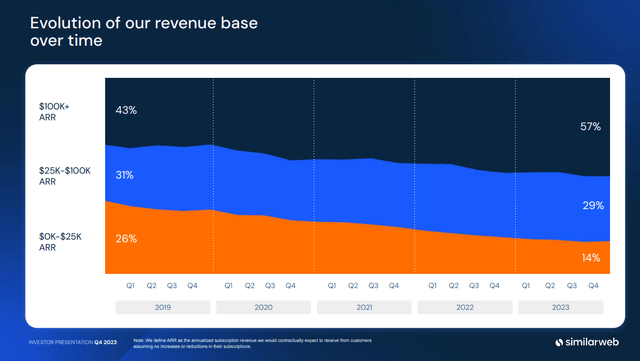

The benefits from upselling customers more than compensates for people lost from the top of the funnel, and customer growth is likely a decent leading indicator of upcoming revenue growth. Looking at the evolution of the customer base, we can confirm some of this as well. Smaller accounts have been shrinking a little because of retention issues, but also because of the effectiveness of the upselling, where all the larger customer segments are seeing growth in the mix. With the smallest accounts now stabilising in the mix, that’s pointing to momentum into next quarter thanks to a larger base to upsell.

Customer Size in the mix (Q4 Pres)

It also seems some major wins happened at the back of the quarter, and given the economic environment which is still relatively tentative with customers being quite tight-belted, it also reduces the risk of closes at the end of the quarter being associated with budget flushes, but more of an organic indicator.

Yes, we did see some more back end of the — on the linearity, particularly with some of the bigger deals that were closed in the latter half of the quarter. So you do see some difference on the linearity over there. But we’re really excited with the results that we had. And think this is a good indication of what we should see going forward.

Jason Schwartz, CFO

Importantly, management is seeing that the slower sales cycles of 2023 seem to be coming to an end. With NRR declines decelerating, and major startegic wins signed this quarter, things look to be inflecting upwards. NRRs are likely troughing.

Closing out the longer sales cycles, we have seen in 2023, customer acquisition and logo retention were steady in the fourth quarter. And as Or mentioned, an area of strength for us was in our strategic accounts where we closed 10 seven-digit contracts during the quarter, an outstanding result that is fueling our positive momentum.

Jason Schwartz, CFO

More of the ARR is also coming under multi-year commitments thanks to the growth of large customers in the mix, currently at 42%, reflected also in record remaining performance obligations or RPO, indicating outstanding subscription value to service.

Looking Forward

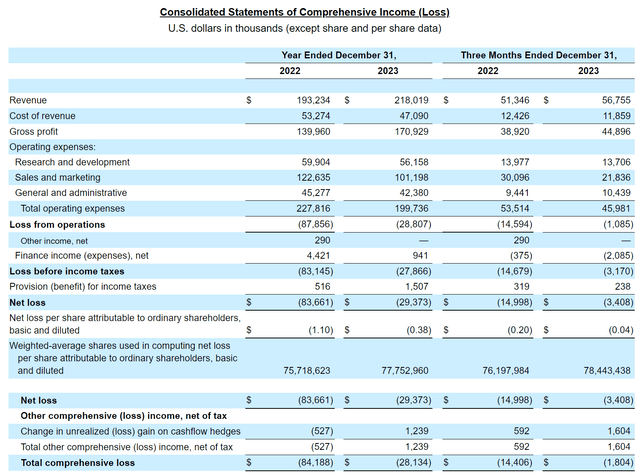

IS (PR Q4/FY 2023)

Wall Street analysts definitely liked what they saw in the quarter because the cash burn is coming to a more definitive turning point. Like many other tech companies, they’ve been taking measures to increase the efficiency of their cost structure. Revenues are up YoY, but costs of revenue are down, meaning that they’ve likely got more productivity out of their sales force and managed to obtain better terms in other areas like support. In the fixed cost structure, they’ve managed to take a chunk out of their general sales and marketing expense, bringing down the fixed operating costs. That fact that they were able to grow much more profitably this quarter indicates that they’ve achieved a new order of scaling benefits. Concerns around reflexivity can now be retired, which is a major change in the prospects and health of the company.

The fact that SMWB is the end of their own cost cutting journey is also a bellwether for how their customers are thinking about budgeting, where looking to responsibly grow likely sees SMWB capture more wallets.

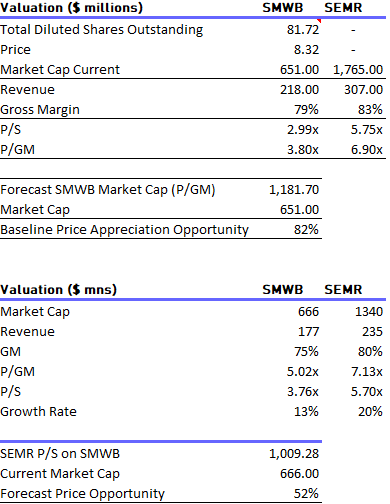

Looking forward, we can expect that given their is still plenty addressable market, and we’ve always felt that SMWB’s products are better than Semrush (SEMR) having used both. Sales should scale in line with whatever investments the company makes in generating leads. Let’s assume around 13% growth going forwards, on a relatively secular basis.

Taking Q4 3M figures and other run-rate calculations, annualising for SEMR which still hasn’t released, we get the following valuation. SMWB remains undervalued at least compared to SEMR. Doesn’t mean it’s actually absolutely undervalued though.

SMWB Valuation (VTS)

We’re not sure if run-rate GMs are going to improve that much more from current levels. Although they might for the next Q1 just because of quite a lot of customers having already entered the funnel. We think that fixed costs are likely to stay incrementally stable. Management is guiding to FCF positive levels within 2024. Just based of the 13% growth forecast and fixed GMs, on top of a fixed cost structure, that seems very achievable, and a decent amount of operating leverage should be entirely possible as the business focuses on strategic sized customers, which can be more productively serviced. Operating losses are almost zero in Q4 now.

Whether it’s absolutely undervalued or not depends on how profitable the business ends up being. GMs have possibly started to peak for a business like this, but operating margins can still probably improve a lot. Other subscription services businesses that are used in corporate cost centres like Salesforce (CRM) have gotten operating margins to around 18%. We think those kind of margins are achievable. It would only require a couple years of GP growth without much growth in the fixed costs to get run-rate margins to that level. We think it’s possible to keep a lid on expenses, particularly when somewhat discretionary expenses like R&D are still a bit less than a third of operating expenses. CRM margins on revenues two years from now would imply a forward multiple a little below 10x EV/EBITDA (two years of around 10% growth, then an 18% EBITDA margin on current EV). That’s not too bad at all for a company that will likely keep growing decently. SMWB doesn’t look too bad even after the increases.