Silicom has provided more clarity in its guidance, and while the new picture isn’t ideal, the stock remains a great deal at current prices. MF3d

Updated Investment Thesis

When I previously wrote about Silicom Ltd. (NASDAQ:SILC) in November, one of the primary risk factors I analyzed was a lack of visibility into what 2024 and beyond might look like. After the recent Q4 earnings call, the next couple of years for Silicom are coming into focus. That’s the good news. The bad news is that SILC investors definitely aren’t experiencing the rosiest of timelines.

Nevertheless, I still think it’s a strong investment that’s likely to beat the market over the next five years. Investors may have to wait a bit longer, but the upside should still be there.

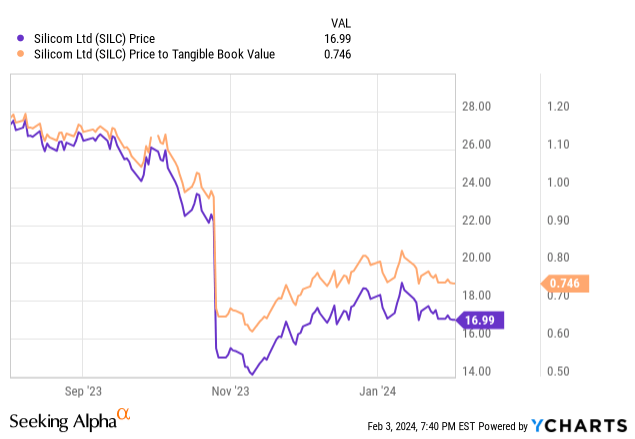

SILC continues to trade at a discount to its tangible book value of $21.20 per share, but it is likely to suffer through an unprofitable year in 2024. After that, profitability and double-digit revenue growth are expected to return and investors should begin to see the payoff.

About Silicom Ltd. and My Original Thesis

As I’ve already written about Silicom, I won’t go too in depth on the company and my original thesis that Silicom is a value stock with growth potential. Silicom, headquartered in Israel with offices in the United States and Denmark, makes server adapters, smart cards, and edge networking products.

When I originally invested in SILC, the tangible book value was $22.74 with a net current asset value of $13.96 per share. I rated it a strong buy and purchased myself at $15.40 per share. The margin of safety remains strong, though the price has risen, and those metrics have dropped off a bit. With a current tangible book value of $21.20 and net current asset value of $13.80, SILC is still enjoying a strong margin of safety, trading at $17.02 as of close on Friday, February 2.

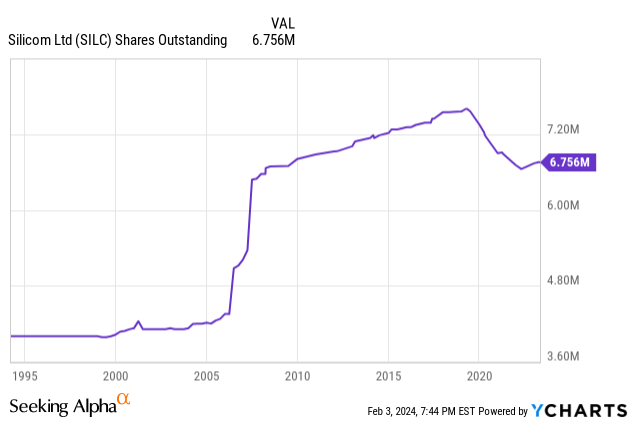

Another area that hasn’t changed much is the return of capital. I projected a buyback yield in the neighborhood of 8%, and on the most recent quarterly earnings call, Silicom gave firmer numbers. CEO Liron Eizenman said they plan to repurchase 1.6 million shares over the next two years, which would continue a recent trend of share count reduction and represent a nearly 24% reduction across those two years.

“The timing and amount of the repurchases will be subject to business and market conditions, corporate and regulatory requirements, share price, acquisition opportunities and other factors,” Eizenman said on the call.

Those numbers would represent a significant improvement over my projection, although an increase in share price could bring the number of shares ultimately repurchased back down. Either way, it’s a win for investors.

So Silicom remains a value bargain that returns capital to investors that is going through a rough year or so, leading to those cheap prices. Originally, it had significant growth potential with multiple growth catalysts, making for an attractive asymmetrical bet. Now let’s get into the significant changes based on the recent earnings call, which offered clarity on the duration and significance of the rough stretch as well as what the growth picture truly is.

SILC Likely To Be Unprofitable In 2024

After the most recent earnings call, it’s pretty clear that 2024 is not expected to be a profitable year for Silicom, as Eizenman projected a “few million,” in losses.

We are facing a tough transition period. However, our very strong balance sheet and cash position allows us to continue its full steam ahead, supporting our broad and deep pipeline as well as continue with our core R&D efforts while not being significantly impacted by a loss of a few million dollars during this transition period.

Let’s see if we can be a bit more precise about the numbers. Eizenman is projecting 2024 revenue at $70 million, and a gross margin somewhere between 27% and 32%. However, he’s guiding towards the lower end in the short-term, “We believe that in 2024 and 2025, our gross margin will be at the lower part of the range and will improve in the years following.”

Taking the 27% number against $70 million in revenue, we can expect $18.9 million in gross profits. Backing out Silicom’s projected $27 million in operating expenses leaves a projected loss of $8.1 million. That corresponds to about $1.20 per share in operating losses in 2024.

Perhaps Silicom will manage to beat their target in operating expenses and hit the 28-29% range in gross margins or beat their projected revenue. It seems unlikely they could turn it into a profitable year, but they may be able to keep the losses smaller.

Regardless, as long as things return towards normal in 2025, the strength of the balance sheet combined with current prices still makes SILC a strong investment.

Refocusing On Smaller Customers

After digesting those numbers, obviously the discussion should turn to why the projections are getting worse. Silicom made some bets on large customers that gave the company significant growth potential, but also gave them some significant risks, with about 35% of their revenue concentrated in three customers as of the third quarter earnings call. This was a risk factor I pointed out previously.

Unfortunately, Silicom is experiencing that downside risk, as Eizenman explained on the fourth quarter call.

First, we won 2 very large design wins in 2021 and 2022. According to the customer’s initial forecast, each of those wins were expected to provide us with annual revenue of $20 million to $30 million. Both customers provided us with very large purchase orders, and we’ve already delivered more than $10 million of each. Both still have very large inventories, which they are digesting at a very slow pace due to poor market success of their full solution. Currently, there are no additional outstanding purchase orders from either of those 2 customers.

That’s a huge chunk of revenue for a company that’s projecting $70 million in revenue this year. They also lost about $10 million in annual revenue from one customer who had a change in ownership and changed their decision-making process. This was a known risk as of my last coverage, and again, unfortunately, SILC is experiencing that downside. Eizenman addressed their planned shift in focus.

We will also return to a marketing and sales strategy that worked well for us in the past. We will once again also focus on the smaller design wins with current annual expected revenues in the $1 million range as many of those types of accounts have the potential to become much larger accounts over the years. This does not mean that we will not pursue and achieve larger design win of an immediate $10 million-plus range. However, the plan is to actively compete on the smaller design wins as well and not focus only on the larger one. This should make our revenues more diverse and long-term growth more robust. The compensation plan of our salespeople have already been adjusted to reflect this approach.

This should lead to much more stable core revenue, and while Silicom can still pursue those bigger ‘home run’ type projects, it appears they’ll be less important to maintaining a successful and profitable business. The fact that they’ve changed their compensation structure for their salespeople to incentivize these types of projects is a good sign that they’re serious about it, and their track record of success on projects of that size should provide a good amount of confidence that they can return to profitability after this current rough stretch and grow from there.

They’ve also trimmed their headcount from 310 to 240 to match current levels of business and their new strategy, which should help them turn the corner to renewed profitability faster.

Projecting The Turnaround

I’ve tried to read between the lines a bit and find out what needs to happen to meet the projected numbers from Silicom’s most recent earnings call.

In terms of our financial objective, the main long-term goal of our plan is to gradually increase earnings per share to about $3 in 2028. Looking towards the near term, we believe that our 2024 revenue will be about $70 million, impacted mainly by the headwinds and issues I mentioned earlier.

Eizenman also mentioned expecting to hit $1.60 in earnings per share in 2027, and that they expected compound annual growth of around 20% starting in 2025 against 2024 baseline numbers. We know the revenue is expected to be $70 million in 2024, but we also know the first half is supposed to be slower than the second half. It appears they need a baseline of about $20 million in revenue per quarter heading into 2025 in order to meet their targets – 20% growth in 2025 against a baseline of $80 million per year would give them revenue of around $96 million in 2025. From there, using their projected CAGR and gross margins gets them to their goals.

Here’s a look at the kind of margins they’d need to hit in order to reach their EPS targets if operating expenses grow by 3% per year. They haven’t specified expected growth in OpEx, but said they plan to keep it near 2024 levels.

| 2025 | 2026 | 2027 | 2028 | |

| Revenue ($M) | 96 | 115.2 | 138.2 | 165.9 |

| Annual Revenue Growth | 20% | 20% | 20% | 20% |

| Gross Margin | 29.0% | 29.0% | 29.5% | 31.0% |

| OpEx ($M) | 27.8 | 28.6 | 29.5 | 30.4 |

| EPS | 0.004 | 0.71 | 1.67 | 3.12 |

So that’s a rough idea that gives us an idea what to look for in the back half of 2024. We want to see quarterly revenue in the $20 million range in Q3 and Q4, ideally the gross margin will be ticking up from 27% towards 29%, and they should be projecting a small profit in 2025 to show that they’re on track for the turnaround.

Remaining Growth Catalysts

There are now a few narratives that I think could lead to significant upside growth if they play out. Obviously, if they are able to hit their targets above off smaller design wins in the range of $1M of annual revenue, hitting one of those $10M annual revenue design wins could be the cherry on top that offers big upside to investors.

In addition, they’re focusing more and more attention on edge networking. As mentioned previously by myself and other analysts, the global edge computing market is expected to grow at a compound annual growth rate of more than 32% between now and 2030. The more of their business that can be concentrated in this high growth area, the better.

I also believe SILC remains an interesting acquisition target for larger companies, given their current price discount relative to book value. I broke this down previously, so I’ll avoid being redundant here.

Likewise, I’ve mentioned buybacks as a growth catalyst here; a significantly reduced share count over the next two years should provide a lot of upward pressure on share prices.

Price Target And Valuation

I tend to keep this pretty simple. I invest at what I believe is a steep discount to fair value, and generally I am looking to sell and move onto another idea when a stock approaches fair value. I’m not looking to identify and push small edges. With that disclaimer in mind, as I previously wrote, SILC has tended to trade for anywhere from 20 to 25 times earnings.

Using the low end with the projected numbers from the table above, we could expect to see Silicom approach $60 to $78 per share by 2028. Even at a more conservative multiple of 15, we’d expect SILC to trade north of $45 by 2028. That broad range would indicate compound annual returns of 21.5% to 35.6% over a five-year period for a patient investor, which is more than enough for me to maintain a strong buy rating.