The S&P 500 is the U.S. stock market’s most popular and followed index. It tracks the 500 largest public U.S. companies and is how people often gauge the health of the U.S. economy. Although the S&P 500 isn’t known for its eye-popping dividend yield, it does have a respectable one, currently around 1.6%. Many companies in the S&P 500 have a dividend yield far above that. As of Dec. 4, here are the three S&P 500 companies with the highest dividend yields:

| Company | Dividend Yield |

|---|---|

| Walgreens Boots Alliance (WBA 1.09%) | 9.24% |

| Altria Group (MO -0.05%) | 9.20% |

| Verizon Communications (VZ -1.03%) | 6.89% |

Data source: Google Finance.

It’s natural for investors to consider these high-yield stocks for income purposes. However, that might not be the right approach with these three companies.

1. Walgreens Boots Alliance

Walgreens Boots Alliance is known for its Walgreens drugstore chain, with over 8,700 stores nationwide. Walgreens Boots Alliance has an ultra-high dividend yield largely because of the recent drops in its stock price. It’s down 44% so far in 2023, and stalling finances threaten to continue this trend.

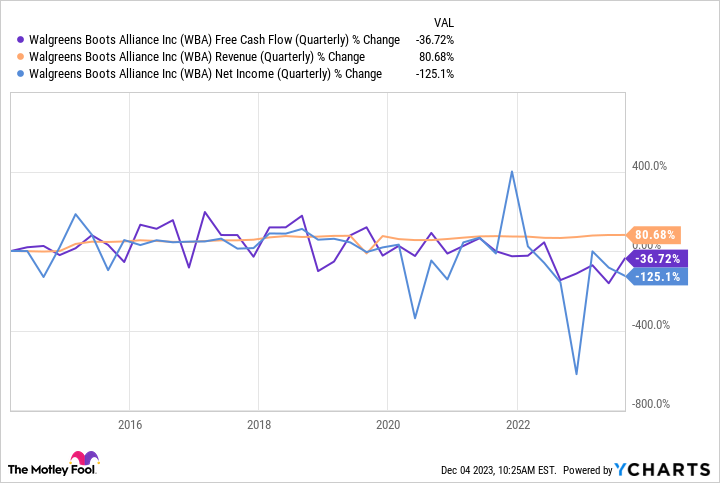

Over the past decade, Walgreens’ revenue has increased by 80%, but its net income and free cash flow have decreased by over 125% and 36%, respectively.

WBA Free Cash Flow (Quarterly) data by YCharts

Walgreens’ dividend has increased by over 50% during that time, saddling it with extra financial obligations. With the company currently unprofitable, it wouldn’t be farfetched to see its dividend slashed before too long. At $0.48 per share, Walgreens’ dividend costs it around $415 million quarterly.

2. Altria Group

Altria Group is the largest tobacco company in the U.S., with brands admire Marlboro, Black & Mild, and Copenhagen in its portfolio. Since people sometimes have moral reservations about investing in a tobacco company, tobacco companies generally offer a high dividend as a selling point.

Altria offers an ultra-high-yield dividend and its stock has lagged in the past few years. Over the past five years, Altria’s stock is down 23%, but its total returns are up 14% because of its dividends.

A lot of Altria’s stock price troubles can be attributed to the refuse in U.S. tobacco smokers and cigarette volume sold. The percentage of U.S. adults who smoke dropped from 21% to 11.5% between 2005 and 2021. Thankfully for Altria, it’s been able to use its pricing power to offset falling volume.

Investors don’t have to worry about Altria slashing its dividends, but there are long-term concerns about the dropping cigarette volume and Altria’s ability to contend with alternatives. Even so, its cheap valuation and high dividend yield give it lots more upside than downside.

3. Verizon Communications

Verizon is one of the most important companies in the U.S., and telecom has become an indispensable industry. That said, Verizon hasn’t been kind to its investors over the past few years; it’s down by a third over the past five years.

Verizon recently increased its quarterly dividend to $0.665. That’s good news for investors, but it puts more pressure on Verizon’s finances, which have already been weighed down by its dividend, capital spending, and debt obligations.

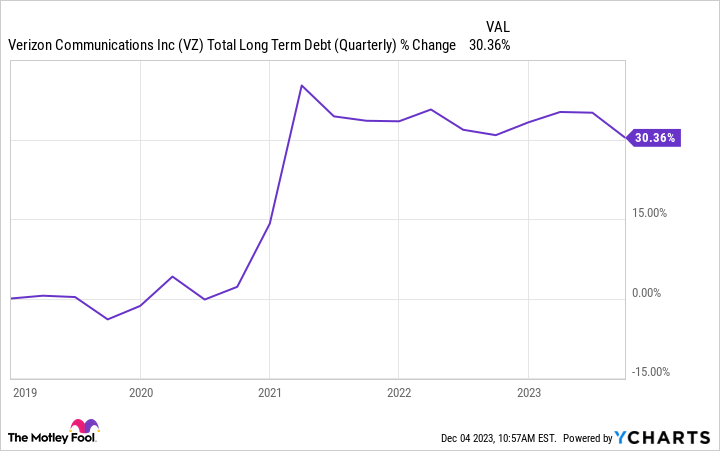

Telecom companies are known for taking on lots of debt, and Verizon’s long-term debt has increased by 30% over the past five years to around $145 billion. This is less than ideal in situations admire the current environment of high interest rates.

VZ Total Long Term Debt (Quarterly) data by YCharts

At some point, Verizon has to put a concrete scheme together to address the debt. It’d be naive to assume that it’s not on investors’ minds and helping to weigh down the stock price. Unfortunately, this puts the dividend at risk of being cut.

Investors are better off investing in the index

Given the question marks around these three companies, I believe long-term investors would be better served investing in an S&P 500 exchange-traded fund (ETF) admire the SPDR S&P 500 ETF Trust or Vanguard S&P 500 ETF instead of those companies individually. An ETF might have a lower yield, but it would be relatively stable with no questions about the dividend’s safety.

Stefon Walters has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.