Integrated mining and refining operation Albemarle (ALB 4.45%) was early to pick up on the impending demand for lithium — a key ingredient in lithium-ion batteries used in smartphones and electric vehicles (EVs). The company got new supply up and running ahead of spiking demand for EVs over the last few years. But as an EV battery needs orders of magnitude more lithium than a small smartphone, global supply was inadequate, causing lithium prices to spike. Albemarle stock performed in much the same way through the end of 2022: It soared.

As is the case with cyclical businesses tied to manufacturing, though, lots of new competing lithium supply has come online in 2023, just in time for EV sales growth to slow dramatically. Booming lithium prices have fallen, dragging Albemarle stock with it. Shares are down more than 60% from all-time highs late in 2022 and are now up a meager 30% over the last five-year stretch.

With Albemarle down on its luck, is now the time to buy?

Are EVs really the problem?

In recent months, some legacy automakers appreciate GM (GM 0.70%) and Ford (F 0.85%) have tapped the brakes on the electrification of their vehicle lineup. With the economy slowing and interest rates at multidecade highs, financing a new and higher-priced car is out of the question for many consumers, so some of these companies have shifted their focus a bit back to their old tried-and-true combustion engine models.

Additionally, China — the world’s largest auto market, and thus EV market — continues to struggle to reignite economic growth in the wake of the pandemic. China recently ended some subsidies on consumer EV purchases. That has also slowed sales for EVs a bit.

But make no mistake, though the rate of expansion has slowed, global EV purchases remain on the rise. This is a point Albemarle management wanted to make crystal clear on its third-quarter 2023 earnings call.

Chart source: Albemarle.

Clearly, the long-term trend propelling vehicle electrification isn’t the primary issue for Albemarle and the lithium mining market. Rather, Albemarle has pointed out two issues, at least two affecting itself.

First, perhaps in dealing with slowing economic growth and the effects of higher interest rates, Albemarle points out that many lithium battery manufacturers have been lowering their inventory by buying less new refined material. Sparse inventory can’t last forever, though, and eventually, some of these manufacturers — particularly those in China, where much lithium battery manufacturing takes place — will need to rebuild inventories.

The second is an effect of Albemarle being an integrated mining and refining operation. Albemarle earns a profit at each stage of the lithium mine-and-refine process it’s involved in. But there’s currently a six-month lag from a large initial raw material sale from its Greenbushes Talison project (a joint venture majority-owned by Chinese giant Tianqi Lithium) in Western Australia and the eventual refined product sale that should be finalized through the next couple of quarters (through the first half of 2024).

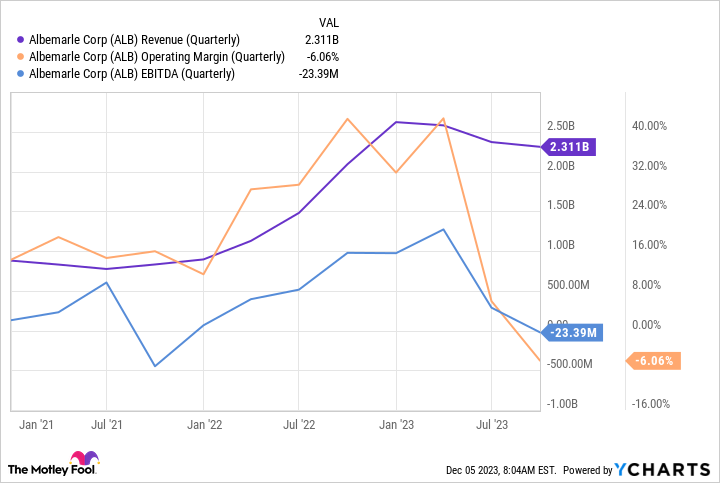

In the meantime, Albemarle carries this product on its balance sheet as inventory and also records it as a cost of goods sold. This has temporarily reduced the company’s earnings before interest, tax, depreciation, and amortization (EBITDA) and profit margins.

Data by YCharts.

A top mining stock buy for 2024

Is Albemarle’s dip into red ink a permanent situation, though? Management doesn’t think so. As the aforementioned inventory at the Talison mine is sold, Albemarle expects its lithium sales EBITDA profit margins to rebound back into the 30% to 40% range next year.

And though the picture looks ugly right now for this vertically integrated operation, Albemarle thinks it holds strategic business advantages over competition. It was able to get multiple sources of affordable raw lithium online before the EV boom really started to take hold, giving the company the ability to turn a healthy profit even in tough times. Management also has established long-term supply agreements with customers that set a price floor on its product, preventing it from having to sell lithium at a loss for extended periods of time.

Of course, all of this is theoretical, and Albemarle’s lithium empire will continue to be tested in 2024. At this juncture, the stock appears to be highly speculative, and the market is pricing it as such. Shares trade for 4.3 times trailing-12-month earnings per share and just 5.5 times next year’s expected earnings (which is subject to change, given the extreme volatility ongoing in the lithium market right now).

For me, Albemarle is a top lithium stock to buy on the dip. But owning this company isn’t for the faint of heart. Share prices will be wild, and an eventual recovery isn’t a given either. Nevertheless, given the long-term growth in demand for lithium from the EV and other energy storage markets, Albemarle looks well positioned to benefit, so I’m willing to bite after an ugly 2023.

Nicholas Rossolillo and his clients have positions in Albemarle. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.