Anyone taking out a mortgage at the moment will likely be pondering the same questions – how long to fix for? Should they fix at all?

It is a decision that could save them – or cost them – thousands of pounds, depending on what they choose.

Back in the days of predictable rock bottom interest rates, it was a relatively easy decision to make – after all, every option was cheap.

More than a decade of steady interest rates also lulled many into believing that mortgage rates were unlikely to change dramatically in the future.

To fix or not to fix: We asked a dozen mortgage brokers what they would personally do right now if they were either remortgaging or buying a property

Between March 2009 and March 2022, the Bank of England base rate remained below 1 per cent.

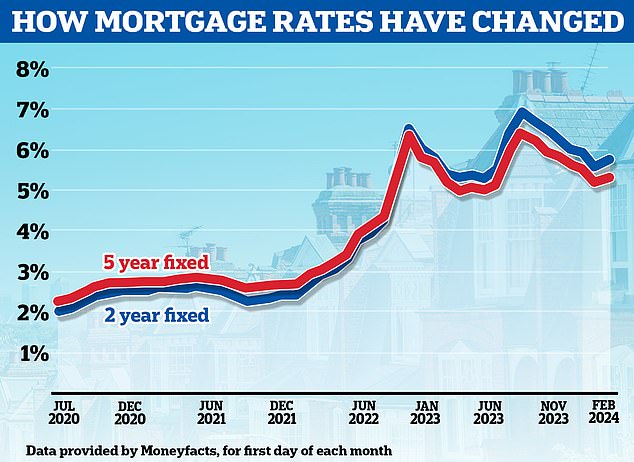

This kept mortgage rates predictably low for a long time. For example, according to Moneyfacts, in the six years between the start of 2016 and 2022 the average two-year fixed rate mortgage remained between 1.99 per cent and 2.58 per cent.

Now, with mortgage rates far higher and the market more erratic, it will be proving much more of a headache for borrowers.

In January, more than 50 mortgage lenders cut residential rates sending the cheapest fixed deals below 4 per cent.

But this month, lenders have mostly been increasing rates, with all the sub-4 per cent fixed rates having now disappeared.

– What next for mortgage rates?

Looking further ahead, some experts think the base rate will fall to 3 per cent next year, bringing mortgage rates down further.

However, there are many who think that although the Bank of England will cut base rate later this year, the cuts will be marginal, meaning that current mortgage rates may be close to becoming the new normal.

As Mark Harris, chief executive of mortgage broker SPF Private Clients, puts it: ‘The future, and what will happen to mortgage rates, is increasingly difficult to predict.

‘Mortgage rates have come down from recent highs but what is harder to predict is the pace of future reductions, particularly as they have edged upwards again in recent weeks with a number of lenders repricing higher.’

So what do borrowers do?

Some will opt for a two-year fix hoping that interest rates will fall over the next couple of years.

They are essentially banking on the expectation that once inflation subsides, the base rate – and then mortgage rates – will come down, allowing them to fix at a cheaper rate.

Others will be fixing for five years. These currently offer the cheapest rates whilst also providing certainty over monthly payments for the next five years.

This will no doubt appeal to some borrowers, given how much interest rates have shot up over the past 24 months.

Hard to predict: After two years of high and volatile mortgage rates, it’s hard to predict what comes next

As for those that are confident of rates falling faster and further than expected, they may be trying their luck with a tracker mortgage.

Trackers follow the Bank of England’s base rate, plus a set percentage.

For example, someone could be paying base rate plus 0.75 per cent on top with a tracker. With the base rate at 5.25 per cent, they’d pay 6 per cent at present.

But if the base rate was cut to 4.5 per cent, for example, their rate would fall to 5.25 per cent.

The main benefit of tracker deals is that they typically don’t come with early repayment charges.

This means if mortgage rates fell over the coming year or two, someone with a tracker deal could switch to a cheaper fixed deal as and when they feel it’s the right time.

What are mortgage brokers doing?

We asked a dozen mortgage brokers what they would personally do right now if they were either remortgaging or buying a property.

On the basis they could afford the monthly payments in all scenarios we wanted to know, would they fix for two years, five years, ten years or take a tracker without an early repayment charge?

The caveat here is that this is not to be taken as advice. This is just the opinion and personal preference of each mortgage broker at this given time.

Akhil Mair, director at Our Mortgage Broker

The two-year fixers

Akhil Mair, director at Our Mortgage Broker replies: Considering the current trends in the money markets and forecasts pointing towards a downward trajectory from year two to three, I would opt to fix for two years.

The short-term stability provided by a two-year fixed rate would offer security during this period of uncertainty while allowing flexibility to reassess the market conditions afterward.

It’s a balance between locking in a favourable rate and retaining the ability to adapt to potential changes in the mortgage rate market.

Gary Bush, financial adviser at MortgageShop.com replies: This is the all-important question that is forever being asked of financial advisers at the moment.

The general answer is if there is a two-year fixed rate that you can afford then you should take it, if not we suggest a decent low tracker rate with no early redemption fees due for the tracker period.

Amit Patel, adviser at Trinity Finance replies: I’d go for two-year fixed rate all day long.

Each borrowers circumstances are different so a two-year fix will not be the best option for everyone.

Amit Patel, adviser at Trinity Finance

A two-year fixed-rate mortgage offers short-term peace of mind and means you’re not tied down for a long time.

It gives the borrower flexibility to get a better deal if rates have gone down after two years and if you plan to move house.

Graham Cox, founder at Self Employed Mortgage Hub replies: My view is the base rate is likely to ‘settle’ at around 4 percent in about a year’s time.

If I’m right, and it’s a big if, a two-year fix with low Early repayment charges could be a good option right now.

Trackers in theory make sense, but they are mostly priced at much higher rates than fixed-rate equivalents. So even a few base rate cuts may not bring them down to where fixes are now.

Nicholas Mendes, mortgage technical manager at John Charcol replies: As a parent with two young kids and the main breadwinner it’s important for me to have stability in my payments and the ability to plan.

Based on current pricing and best assumptions for future rates I would opt for a two-year fixed.

The margins between two and five years fixed rates based on today’s pricing aren’t exactly going to be life changing, currently Halifax have a five-year fixed at 4.18 per cent product fee £999 also a two-year fixed 4.52 per cent product fee £999.

Mortgage rates are forecasted to reduce over the next two years, as market and wider economy data improves.

I am certainly not expecting to see sub 2 per cent deals but feel confident that I will be in a better position financially, rather than opting for a five year fix and paying a higher rate for longer than necessary.

Five-year fixers

David Hollingworth, associate director at L&C Mortgages replies: I don’t have any foreseeable plans to move home so I don’t have to think too carefully about how long to lock into a new deal for.

David Hollingworth, associate director at L&C Mortgages

If I was thinking of moving I’d be looking to avoid early repayment charges at the point that I envisaged a move being on the cards to keep my options open at that time.

That could shape the length of deal that I would go for but I have more flexibility around that.

At certain points in time I think I would have favoured the shorter term two-year fixed rates but since rates have come down I could see the appeal of fixed rate for five years or even more.

Although rates could ease over time there is also an element of comfort in knowing what you will pay irrespective of what happens. That could help me as I edge closer toward the end of the term in years to come.

At the right price I therefore think a medium to longer term fixed rate would suit.

Simon Bridgeland, broker and director at Release Freedom replies: I would be jumping onto a three or five year fixed deal without hesitation.

The products on offer are still very good. Forget ultra low deals, they’re as long gone as the lazy work from home days you had in lockdown.

The new landscape for fixed money is roughly where we are now. Sure they may reduce slightly, but nothing like what many are hoping for.

The clue is in the rate, look at the difference between two, three and five year deals at the moment.

The short term deals are higher as it is predicted that money will cost more in two years time. If you like paying more than you need to and then want to fix again at a similar rate, go for a two-year deal.

If you really dont give a stuff about mortgage shopping regularly to get an up to the moment deal then a 10 year bobby dazzler can still be found.

Samuel Mather-Holgate, independent financial advisor at Mather and Murray Financial

Take a tracker

Samuel Mather-Holgate, independent financial advisor at Mather and Murray Financial replies: If there weren’t such lunatics with their fingers on the big red monetary button this would be a simple decision.

With inflation plummeting and the economy in the toilet the only sensible thing to do would be for interest rates to come down fast, so opting for a tracker would see your payments falling.

Unfortunately, two of the decision makers in the looney bin actually voted to increase rates at their last meeting.

Making a decision on your mortgage in these circumstances proves very difficult, but rates should still fall over the course of the next 24 months, so a good tracker may be the way to go if you can handle the absurdity of the Bank of England.

Rhys Schofield, brand director at Peak Mortgages and Protection replies: Well put it this way, I recently took a two year tracker in December with no early repayment charges.

Rhys Schofield, brand director at Peak Mortgages

My thought process was that I’m happy to roll the dice, it looks like base rate may come down and mortgage rates for new fixes at the time were not looking too attractive.

Ashley Thomas, director at Magni Finance replies: I would go for a two year fixed or tracker, depending on the difference with the rate. I recently changed my mortgage to a two-year tracker as it was similar to the two-year fixed.

I would not look at a five year fixed rate as it is very likely that base rate will reduce in the next five years.

If you lock in for five years now, it is likely there will be lower rates within that period and if you wanted to come out of the fixed it would have a significant early repayment charge.

Fix, but don’t fix for 10 years

Mark Harris, chief executive of SPF Private Clients replies: If I were taking out a mortgage now, I would lock into a fixed rate for certainty and peace of mind but monitor the situation regularly until a month before completion or the rate expiring on my existing deal, and be prepared to switch.

Michelle Lawson, director at Lawson Financial

I would certainly avoid ten-year fixes. A two- or five-year fix would be my preferred option but I would keep this under close review.

It all depends on you

Michelle Lawson, director at Lawson Financial replies: There is no blanket response to this as it all depends on an individual’s situation.

Morgages are not a one box fits all otherwise there would be one lender offering one product.

The best advice to give anyone is to speak to a good, reputable, qualified broker who will have a rounded review as the market is volatile and yo-yoing all over the place.

Good brokers will have the borrowers back completely and ensure a good outcome based on their information and discussions.

However, most of my clients I am helping are locking in for either two-years or three-years max, so they can review in the shorter term.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.