Sean Gallup

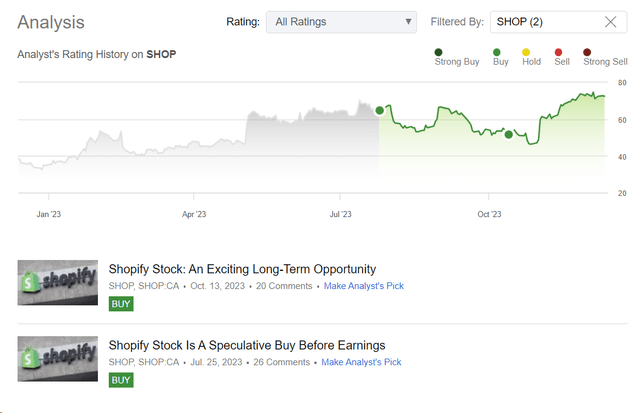

I’ve been covering Shopify Inc. (NYSE:SHOP) stock here on Seeking Alpha since July 2023, initially starting coverage as a speculative idea (which didn’t work out) and shifting focus to a longer-term success story for the company that eventually bore fruit in a very short period:

Seeking Alpha, author’s coverage of SHOP stock

Since the last call, the stock is up 40%, while the S&P 500 Index (SPX) (SP500) is up ~7%. Previously I had written that the stock is undervalued in the long term. But to what extent is the stock still a ‘Buy’? Let’s find out together.

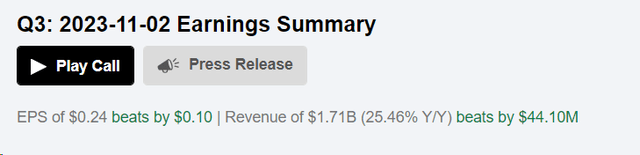

On November 2, 2023, Shopify stock experienced a significant 22% surge, attributed to the company surpassing revenue and non-GAAP EPS expectations for Q3 FY2023 by 2.64% and 65.76%, respectively.

Shopify achieved profitability on a GAAP basis for the second consecutive quarter and the second time in its history.

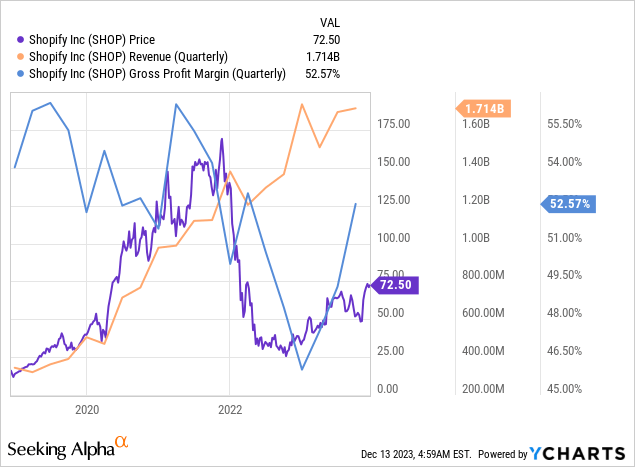

In Q3 FY2023, Shopify delivered a robust financial performance across several key metrics. Gross merchandise volume (GMV) increased by an impressive 22% to $56.2 billion, up $10.0 billion compared to the third quarter of 2022. Total revenue increased by 25% to $1.7 billion, demonstrating an impressive 30% YoY growth when adjusting for the impact of logistics business sales by ~500 basis points. Merchant Solutions revenue increased by 24% to $1.2 billion, driven by the expansion of GMV and the positive contribution from Shopify Payments.

Gross payment volume (GPV) showed significant growth and reached $32.8 billion, representing 58% of GMV processed in the quarter. Subscription solution revenue increased by 29% to $486 million, driven by more merchants joining the platform and pricing changes for existing merchants on standard subscription plans. Monthly recurring revenue (MRR) increased by an impressive 32% to $141 million as of September 30, 2023, driven by continued growth across all subscription plans. Shopify Plus contributed $44 million, or 31%, to MRR, demonstrating its significant impact on the company’s subscription revenue.

The company’s financial health and operational efficiency were underscored by robust gross profit growth of 36% to $901 million and a corresponding gross margin of 52.6%, an improvement from 48.5% in Q3 2022. Overall, I appreciate how much the gross profit margin has increased against the backdrop of continued sales growth thanks to the strong unit economics and key figures discussed above.

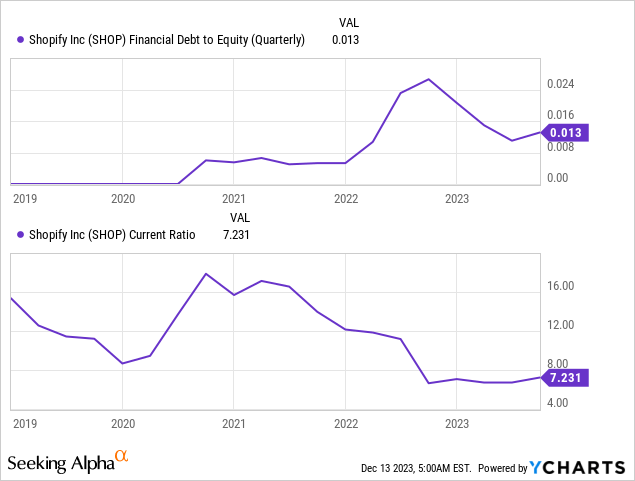

EBIT turned significantly positive and amounted to $122 million or 7% of sales, in contrast to the operating loss of $346 million or 25% of sales in the prior-year period. Free cash flow was positive at $276 million and a margin of 16%, a significant improvement from the negative FCF of $148 million and a negative margin of 11% in Q3 FY2022. The company ended the quarter in a strong financial position: It had $4.9 billion in cash and marketable securities and net liquidity of $4.0 billion after taking into account the outstanding convertible bonds. I don’t see SHOP having problems with liquidity or leverage.

Summing up on this part, with a 22% year-over-year enhance in gross merchandise volume (GMV) on its platform, Shopify displayed robust business activity ahead of the crucial holiday season. The sale of its delivery and logistics business to Flexport is bolstering margins and allowing the company to focus on enhancing merchant services in the era of artificial intelligence. Despite a workforce reduction of about 30% in response to a post-pandemic slowdown in online sales in 2022, Shopify is now positioned to thrive as the online retail environment seeks a sustainable model in 2023, with consumer spending on lower-priced purchases driving increased activity on its platform.

Then why am I in favor of trimming the stock?

Shopify’s Valuation Became A Bit Stretched

In my last article, I pointed out that it makes no sense to look at SHOP’s high valuation multiples. After all, they will remain high for some time as long as the company still has room for growth. However, I think it makes sense to differentiate a company’s long-term valuation multiples with those of its peer group.

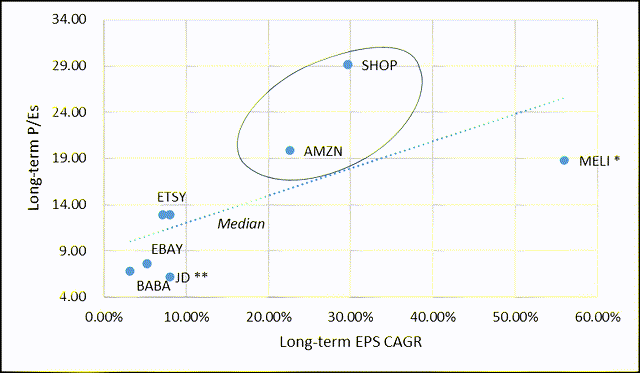

So I again plotted the long-term EPS growth rates [SA consensus data] on the x-axis and the long-term P/E multiples [FY2027] on the y-axis. Logically, the growth rates of the business should explain the ‘height’ of the multiple. Last time we saw that Shopify was compared to MercadoLibre, Inc. (MELI), and that was logical because both companies were in the same business development cycle. But now we see that SHOP is more likely to be compared to Amazon.com, Inc. (AMZN), even though the latter is much larger and more diversified and should (in theory) be more reliable.

Author’s work, Seeking Alpha data

The companies I have selected are not growing very strongly; except for a few outliers, this is a characteristic of the industry. However, we can clearly see that SHOP is significantly more expensive than Amazon with relatively similar EPS growth rates.

For the current indicators to achieve equilibrium, we need a correction of 10-20% of the current price level to close the gaps.

The Bottom Line

I really appreciate Shopify and the development of the company in the last few quarters. The firm is reaching new heights, and actively expands GMV and key margins, focusing on what matters the most for their future corporate development. However, I see that the too-rapid rally in recent months has made the valuation of the company a bit more stretched than I would appreciate to see for potential investors today. The same can be said for MELI if we stay within the peer group, which is 35.5% cheaper in terms of the long-term P/E ratio, while showing growth that should be almost double that of Shopify over the next five years.

So we definitely need a 10-20% downward ‘wellness correction’ to buy Shopify at a relatively reasonable price. I’m not advocating selling Shopify outright, but reducing the increased stake in the investment portfolio makes sense today, in my opinion.

Thanks for reading!