- Andi Case received a bonus of £10.4m

- It makes him one of the highest paid bosses of any firm listed on stock market

- Clarksons is a little-known business outside the world of ship-broking

The boss of shipping services group Clarksons is facing his eighth shareholder rebellion in a row after receiving a blockbuster £12 million pay packet last year.

Andi Case, who has led the firm since 2008, received a bonus of £10.4 million. It makes him one of the highest paid bosses of any firm listed on the London stock market.

But Clarksons is a little-known business outside the world of ship-broking. It is listed on the second-tier FTSE 250 index because, with a value of just over £1.2 billion, it is too small to make it into the elite Footsie.

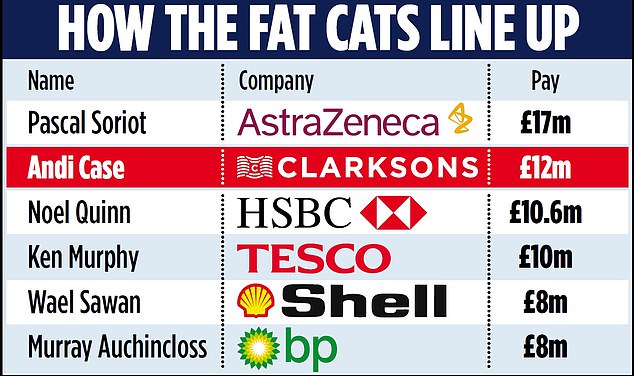

Despite this, Case is paid more than some of the best-remunerated bosses of much bigger household names.

His rewards outstripped those of HSBC’s Noel Quinn, who made £10.6 million, Tesco’s Ken Murphy, who is set to collect £10 million, Wael Sawan’s £8 million at Shell and the £8 million made by Murray Auchincloss at BP.

Troubled waters: Clarksons is a little-known business outside the world of ship-broking

His £12 million payday was almost triple the amount handed to Vincent Clerc, the boss of the world’s largest shipping company Maersk, who made £4.6 million. Maersk is valued at £19.3 billion.

Case was paid less than several leading FTSE 100 bosses, including AstraZeneca’s Pascal Soriot, who made £17 million last year.

Four out of ten shareholders voted against Case’s pay at the 2023 annual meeting, putting Clarksons on the official ‘list of shame’ for greedy bosses. This is a register run by trade body, the Investment Association, listing firms where more than 20 per cent of shareholders voted against executive pay.

AstraZeneca, Pearson, Unilever and Smith & Nephew have all been embarrassed by investor revolts in recent years.

But leading voices, including that of London Stock Exchange boss Julia Hoggett, argue big pay packets are crucial to keeping talented bosses in the UK.

Clarksons says it needs to lavish large sums to stop its top dogs going to competitors.

In the money: Clarksons boss Andi Case

Case and finance chief Jeff Woyda receive uncapped bonuses linked to the group’s profits. A married father-of-two, Case has received £50 million in the past decade.

He receives a salary of £550,000 and £17,000 in benefits, including a private car and membership for an unspecified number of private clubs. Critics said handing him such sums despite repeated revolts showed the firm had a problem with its ‘moral compass’. Case, 57, joined Clarksons in 2006 and became its chief executive in 2008.

Two shareholder advisory groups, Pirc and Glass Lewis, have recommended investors reject the pay report at its annual meeting this week.

Glass Lewis said that although Case and Woyda have waived part of their bonus in previous years, a company’s pay policy ‘should not rely on the goodwill of its executives to mitigate excessive payouts’.

Andrew Speke of the High Pay Centre think tank said: ‘Clarksons’ clear disregard for the views of its shareholders shows a company sorely lacking in terms of its moral compass.’

Tim Miller, a board director who leads the company’s pay committee, defended Case’s rewards.

He said the company is a ‘UK success story’ and that shareholders had benefited from ‘and an increase in value under Andi’s tenure of over 1,800 per cent’ taking the company’s market value ‘from £62 million to over £1.2 billion today’.