JulPo

Thesis

Shift4 Payments, Inc.’s (NYSE:FOUR) integrated payment and software solutions eye an addressable market of over $3.5 trillion, offering a growth runway with share gains from legacy point-solution providers and processors. The company has prospects for growth beyond core verticals- restaurant, hospitality, and specialty retail- and the US provides levers for new business while cross-selling end-to-end processing to legacy gateway clients may bring sales up. I am optimistic on the company’s long-term growth prospects and assign a buy rating to the stock.

Q3 Review and Outlook

FOUR reported gross revenues of $675 million, marking a 23% year-over-year increase but falling short of the $703 million consensus estimate. Gross profit stood at $171 million, with a 34% margin and a 34% year-over-year increase, but this was lower than the $180 million consensus estimate. Adjusted EBITDA was $125 million, up 32% year-over-year, with a margin of approximately 48%, surpassing the $116 million consensus estimate.

Taking a cue from 3Q, I believe Shift4 is well positioned to achieve guidance of 30-35% gross-revenue growth in 2023. Still, gains have decelerated from 78% in 2021. Payments-based revenue is on track to deliver more than 30% growth this year, fueled by the 23,000 SkyTab point-of-sale systems installed since last fall and SpendTrend data showing strong 3Q consumer spending on leisure and restaurants.

The company’s forward Adjusted EBITDA and Free Cash Flow guidance for the full year were positive, as FOUR has raised its fiscal year outlook at both the lower and upper ends of the range. The management explained that the upcoming fourth quarter will benefit from significant factors like winning large customers, executing implementations, and the timing of M&A activities might alleviate concerns.

Shift4 Looks Positioned for Growth

I believe Shift4 Payments seems well-positioned to reach its medium-term target of achieving $3.5 billion in gross revenue by 2024, which represents a net revenue increase of over 35%. This growth is expected to be driven by increased volume in new business sectors and by offering end-to-end payment processing to existing gateway customers.

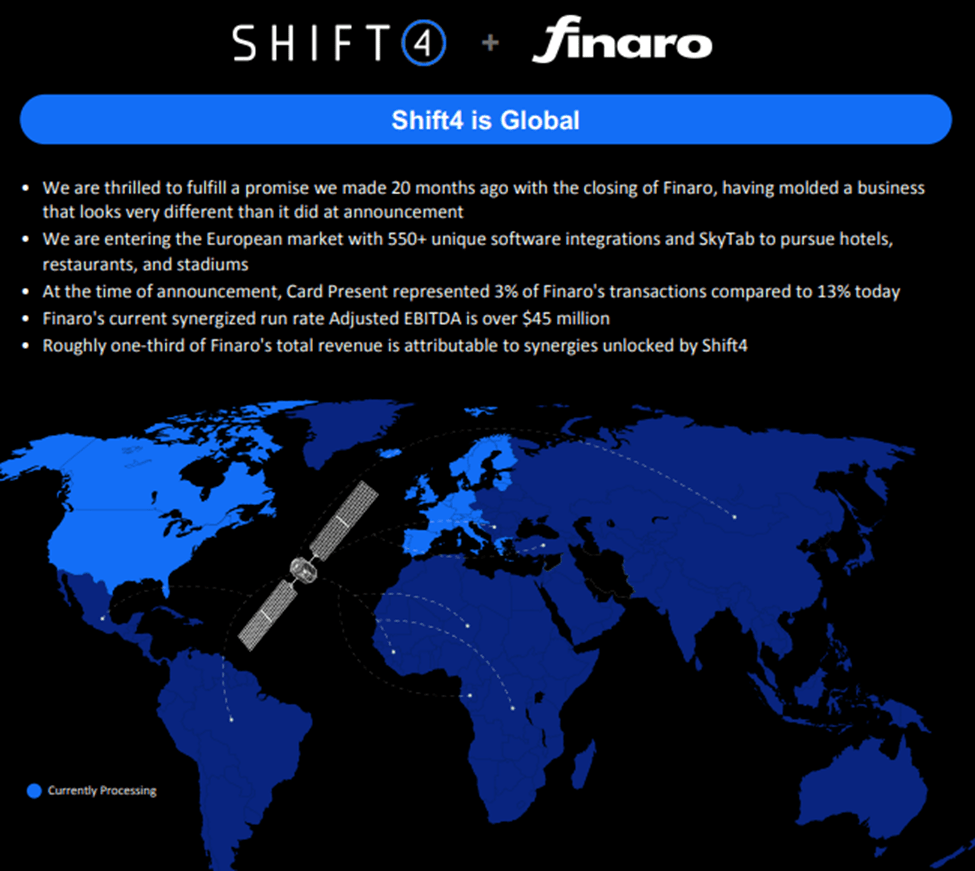

In recent years, Shift4 has established itself as a leading provider of integrated point-of-sale [IPOS] solutions, particularly in the restaurant and hospitality industries (40% of the hotels in the U.S.). The management expects further share gains within this core for years to come, in addition to new opportunities through considerably greater vertical breadth, now servicing gaming, eCommerce, sports & entertainment (i.e., stadiums), travel & leisure and non-profit. While FOUR may not have the same brand recognition of other more visible IPOS providers, with $~110B in annualized E2E volume, growing >50% Y/Y in 23E, I believe the combination of growth and emerging scale is more attractive than any of its closest competitors.

Company Presentation

Financial Outlook & Valuation

I believe Shift4 may deliver net-revenue growth of over 35% in 2024, backed by high volume growth from recent acquisitions and the healthy spending trend in its core verticals. Net payments-based sales are about 80% of the total, with multiyear contracts and over 500 integrations with software and CRM providers enhancing stickiness. Expanding via new verticals could further improve operating leverage. Another opportunity comes from upgrading legacy gateway-only clients to end-to-end processing by replacing other merchant acquirers, which can boost average revenue per client. Shift4’s adjusted Ebitda has stayed in positive territory since the 2020 IPO, and it has delivered a GAAP profit since 2Q22, ahead of peers Toast and Block. I believe the adjusted Ebitda margin of 11-13% could climb to 17-18% over the next three years with the integration of recent deals. The company’s gross margin of about 24% is above Toast’s, reflecting an ability to offer payment solutions at a lower cost profile. Still, its margin is below Block’s, partly due to the hefty share of revenue paid out in network fees and lower portion of higher-margin subscription sales. Taking a cue from Block, with mid-20s gross margins for Square a decade ago, Shift4 is primed for margin expansion over the next 5-10 years as it gains scale largely through cost synergies, but also by winning more favorable network-fee terms.

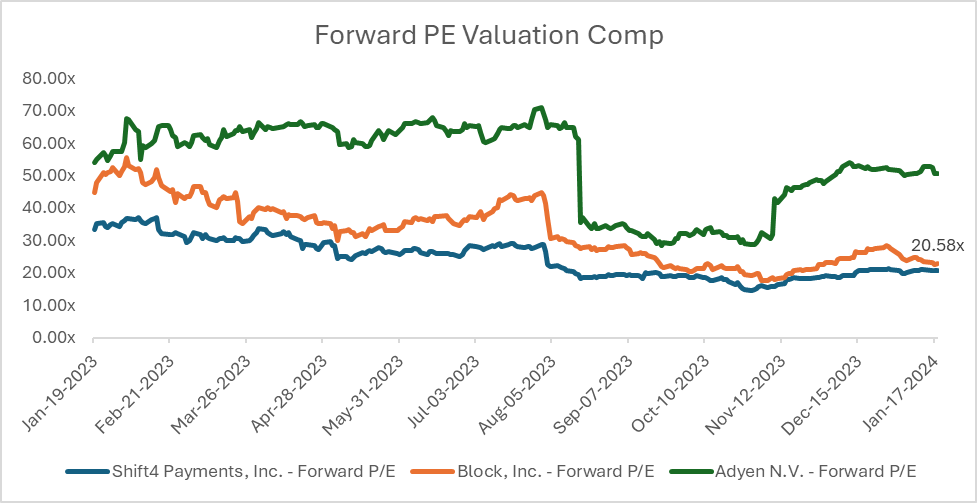

Shares of FOUR have underperformed the broader indices. The stock currently trades at par or lower valuation multiples than the median of payment and fintech peers on EV/Sales and P/E on a 12-month forward basis despite a stronger sales-growth profile. The company went public on June 4, 2020, at $23 a share and trades at around 20x its 12-month forward estimated EPS, based on consensus. I believe a slight haircut to the valuation vs comp makes sense to account for balance sheet leverage (relative to sector peers), however, I believe the stock can re-iterate upwards from current levels as FOUR is very savvy in efficiently acquiring customers and the company has significant greenfield opportunity in existing and new verticals in which Shift4 has demonstrated an ability to take share.

capital iq

Risks

There is significant and growing competition on a global scale within the financial services, payments, and payment technology sectors. Economic disruptions at a broader level may lead to reduced consumer spending in non-essential areas, which could have an impact on overall transaction volumes. Additionally, potential alterations in the regulatory landscape related to the payments industry, particularly concerning interchange rates and network fees, could also bring about changes.

Conclusion

Shift4 is an integrated payments provider which has evolved from a niche SMB payments provider primarily serving the complex restaurant and hospitality verticals to a business which can manage some of the largest enterprise merchants in the U.S. Through integrations with 500 independent software vendors and >7k+ value-added resellers, Shift4 has cultivated a >200k customer base and processes >$200B of volume annually. The stock is currently trading at a multiple lower than its peers, and I believe the stock can re-iterate upward from current levels. I assign a buy rating to the stock.