Magdalena Wygralak

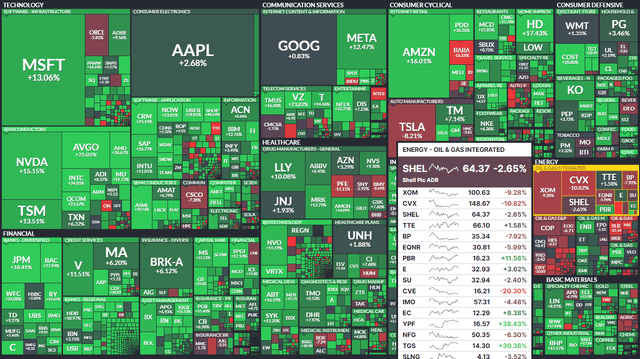

The last three months have been a bull’s paradise across global markets. Most sectors are easily in the black after a late-year surge driven by some of 2023’s biggest laggards and an overall risk-on environment. The Energy sector, however, has been left out of the party.

I see shares of Shell plc (NYSE:SHEL) as undervalued today, despite weaker global oil and gas prices. With high free cash flow and a solid technical view, I see further upside ahead.

Global Equity Market 3-Month Performance Heat Map: Shell & Energy Lag

According to Bank of America Global Research, Shell is engaged in the business of producing, refining, storing, transporting, supplying, and distributing petroleum and petroleum products. The operating companies of the group are engaged in various activities related to oil and natural gas, chemicals, power generation, renewable resources, and other businesses in over 135 countries.

The London-based $207 billion market cap Integrated Oil and Gas industry company within the Energy sector trades at a low 8.0 forward 12-month non-GAAP price-to-earnings ratio and pays a high 4.1% dividend yield. Ahead of Q4 earnings results due out early next month, shares trade with a low implied volatility percentage of 21% and there is no listed short interest on the stock.

Back in November, Shell reported a somewhat soft set of Q3 results. Quarterly non-GAAP EPS came in at $0.93 while revenue of $76.4 billion was down 20% from the same period a year earlier. Cash flow from operations totaled $12.3 billion in the quarter on the heels of higher oil prices compared to Q2, though working capital increased by just $400 million. Net debt ticked up modestly sequentially.

Perhaps the biggest piece of bullish news was the management team’s announcement of a $3.5 billion buyback program which brought FY 2023 share repurchases to $6.5 billion, above what the company had forecast at its Capital Markets Day last June. Along with a yield now above 4%, shareholder accretive activities are high. With a healthy balance sheet and important cost-cutting measures, the outlook looks strong, particularly if we see an uptick in oil prices later this year.

Key risks include weakness in its Chemicals segment – the firm took a non-cash impairment charge in the range of $2.5 billion to $4.5 billion for Q4 following unfavorable macro trends in Singapore. In the same release, the firm said it expects strong integrated gas trading, however. Other risks include weakness in the global macroeconomy along with lower demand, resulting in softer refining margins and lower oil and gas prices. Regulatory and currency risks are always apparent for a large multinational like Shell.

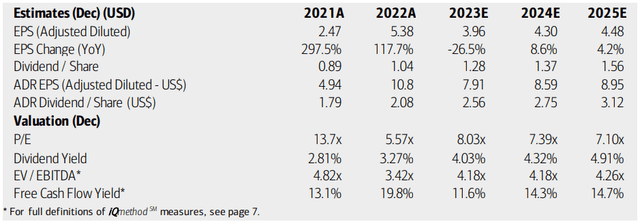

On valuation, analysts at BofA see earnings climbing back by nearly 9% this year after a steep operating EPS decline in 2023 due to much lower oil and gas prices compared to 2022. Per-share profits are then expected to moderate to a 4% advance rate by the out year. The current consensus forecast, per Seeking Alpha, calls for just a 1.5% EPS jump this year but then a 5% rise in 2025. Revenue is seen about flat over the coming quarters on an annual basis.

Dividends, meanwhile, are expected to rise at a steady pace, which could lead to a significantly higher yield over the next handful of quarters. With a very high free cash flow yield, currently just below 10%, there’s room for additional shareholder-friendly moves.

Shell: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume EPS of $8.20 over the next 12 months and apply an earnings multiple of 10 (below Shell’s historical average and near the sector median), then shares should be near $82, slightly below the intrinsic value estimate I previously outlined due to the downturn in oil prices. But with exceptionally low valuation metrics aside from the P/E view, Shell appears cheap from the broader perspective.

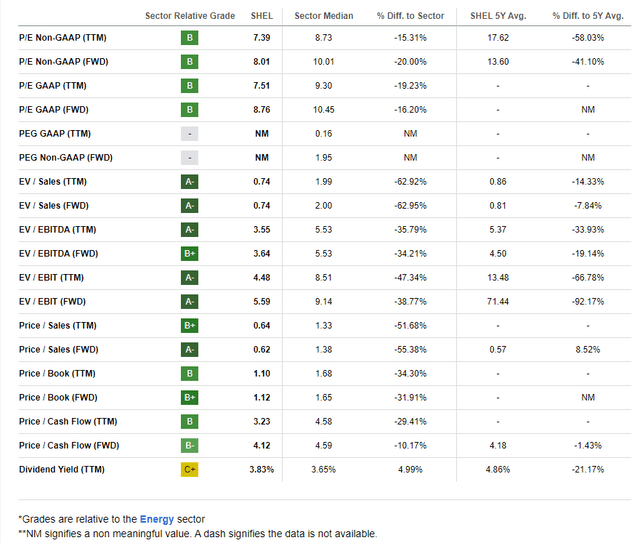

Shell: Compelling Valuation Metrics

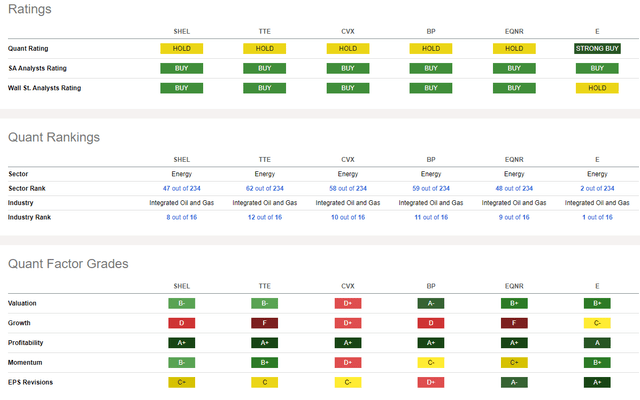

Compared to its peers, Shell sports a strong valuation case though earnings growth is somewhat tepid, though that is not uncommon for large integrated oil companies right now given the weak performance of both WTI and Brent crude oil. Still, Shell’s robust profitability and high free cash flow remain compelling factors even with a less sanguine sector view while EPS revisions on the company have been mixed over the last three months. Share-price momentum is also healthy at the moment.

Competitor Analysis

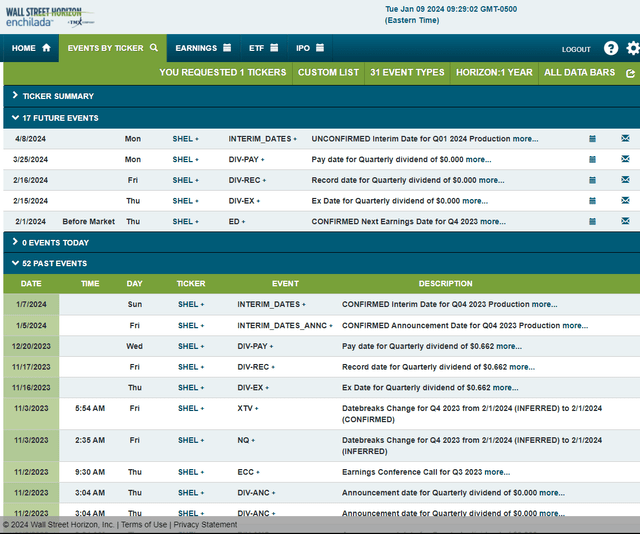

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2023 earnings date of Thursday, February 1 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

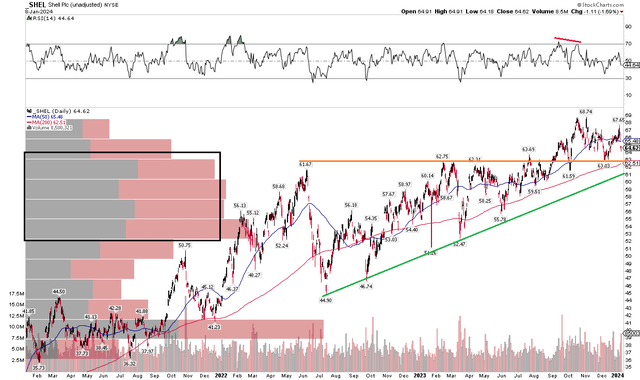

The Technical Take

While I see a lower fundamental value for Shell, its technical picture has held in there if not improved from early in Q4 last year. Notice in the chart below that the stock remains in a solid uptrend, though the RSI momentum oscillator at the top of the graph has turned weaker over the last several weeks. But with a long-term 200-day moving average that is positively sloped and a high amount of volume by price in the $50 to $65 zone, there should be ample cushion on pullbacks, and I would view such opportunities as buying chances.

There’s key support in the low $60s – that was the high from June 2022 when oil rallied to north of $120 per barrel. The stock failed to rise above that spot on several instances over the first half of 2023, but the bulls finally took control by late last year. SHEL peaked near $69 but has since significantly underperformed the global stock market since early November, something technicians do not want to see.

Overall, I see support at $61 – the uptrend support line illustrated below while $69 is apparent resistance.

SHEL: Bullish Uptrend, Stock Consolidating After Nearing $70

The Bottom Line

I reiterate my buy rating on Shell. Despite a lower fundamental price target, technicals remain strong on this still-cheap multinational Energy sector company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.