After a long slumber, the initial public offering (IPO) market is finally springing back to life.

This fall, investors have been greeted by new stock issues from Birkenstock, Arm Holdings, and Instacart, and investors just got wind of the biggest debut of the new IPO season. Shein (pronounced She-in) filed confidentially to go public on Monday, and the stock is expected to start trading after its IPO in 2024.

Image source: Getty Images.

What is Shein?

You’re likely already familiar with Shein if you’re an online shopper. The China-founded, Singapore-headquartered company has grown rapidly to become one of the biggest online fashion brands in the world.

The company is known for its fast-fashion, bargain-priced model, which has made it popular around the world. Shein’s low prices have made it particularly successful with women in their teens and 20s, its core market. The brand boasts 31 million followers on Instagram and was 2022’s most popular fashion brand, according to Time.

Because the company filed confidentially to go public, we haven’t gotten a complete look at the company’s financials. However, according to The Wall Street Journal, the business brought in $23 billion in revenue in 2022 and made $800 million in net income, making it one of the largest fashion brands in the world both by sales and profits.

According to The Information, the company’s revenue jumped more than 40% to $24 billion in the first three quarters of the year and is believed to have topped Zara to become the world’s largest fashion brand by revenue.

Shein’s valuation has fluctuated up and down in recent years. In its most recent funding round in May, it was valued at $66 billion, though that valuation was down from $100 billion in 2022 as its growth rate slowed, valuations for e-commerce stocks compressed, and investor interest in start-ups faded as interest rates rose. Shein is reportedly aiming for a valuation as high as $90 billion in its IPO.

No stranger to controversy

admire a lot of Chinese stocks, Shein has been caught up in controversy on more than one occasion, and detractors charge that the company operates with poor labor standards, is bad for the environment, and has been accused of using cotton picked by forced laborers in the Xinjiang province. Some U.S. lawmakers have previously lobbied to delay the company’s IPO until they can verify that it doesn’t use forced labor.

Meanwhile, the company is also accused of mass-producing clothes that end up in landfills, and critics say that Shein is responsible for 6.3 million tons of carbon dioxide emissions per year as it puts out more than 300,000 unique styles each year. That compares to just around 4,000 from H&M (HNNMY -3.42%), another major fast-fashion chain. The company has a unique production strategy, making 50-100 of an item per day before mass-producing it if it becomes popular. Shein says that it uses digital printing techniques that help conserve water and discounts or donates unsold inventory rather than dispose of it.

Should you put Shein on your watchlist?

Without Shein’s full prospectus, it’s difficult to evaluate the stock’s prospects, but investors should be aware of a number of potential challenges Shein stock could face before they scoop up shares.

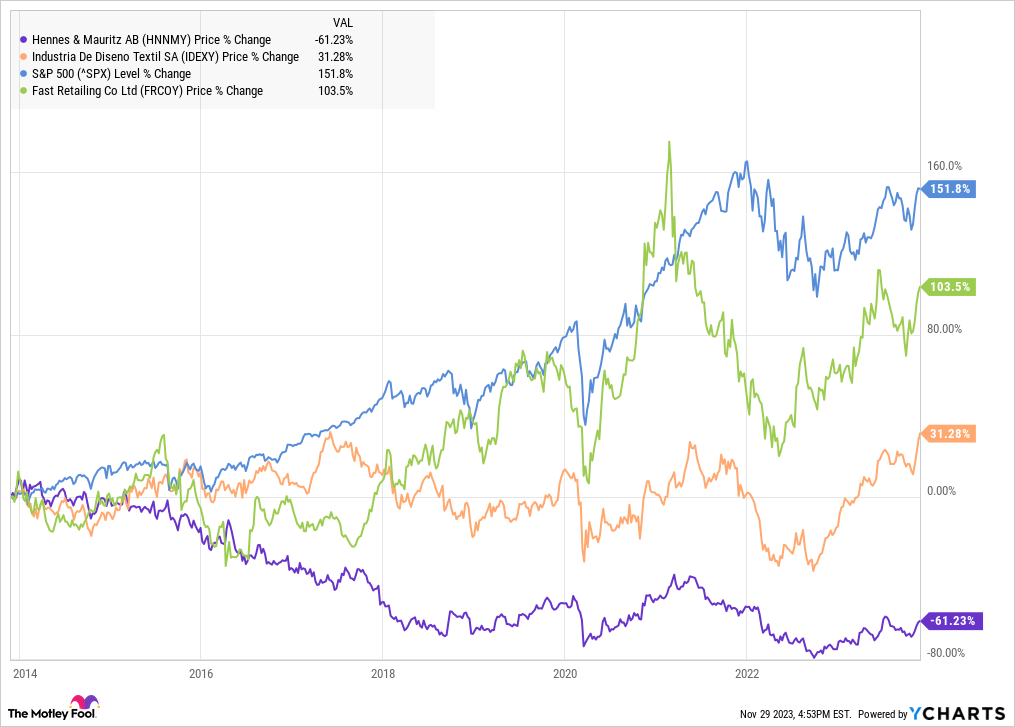

First, the apparel industry is a highly competitive one, and it’s difficult to create a sustainable competitive advantage. As the chart below shows, even fast-fashion leaders admire H&M, Zara-owner Inditex (IDEXY -0.24%), and Uniqlo-parent Fast Retailing (FRCOY -0.32%) have all underperformed the S&P 500 over the last decade.

While some apparel stocks admire Nike and Lululemon have been consistent outperformers, those companies vie in the sportswear or athleisure subsectors where product performance is more important. These sportswear giants also sell branded clothes, unlike fast-fashion companies admire Shein, which have helped them set up a brand advantage.

Any stock can be a buy at the right price, but investors may want to tread lightly with Shein stock for now, especially as Chinese stocks have struggled as well in recent years. While the business has clearly been a success, the stock could have an uphill road ahead of it as it aims to deliver steady growth in a highly competitive, fragmented industry that has historically been unfriendly to investors. And even if Shein proves it is able to stand beyond the pack financially, ESG investors may want to expect for the company to show evidence that disproves its controversial claims altogether.

Jeremy Bowman has positions in Nike. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.