Next’s third-quarter results on Wednesday will provide some insight into its resilience against the High Street’s woes.

Simon Wolfson’s chain has reported elevated sales this year despite a consumer spending crunch weighing heavily on its rivals.

Next has joined high street stalwart Marks & Spencer in cheerleading a return of shoppers to town centres.

It comes as online fashion brands Asos and Boohoo have struggled to entice consumers amid a cost of living crisis.

Next has also been on a shopping spree picking up beleaguered retailers, acquiring brand FatFace for £115.2m.

Next, which has long been seen as a bellwether on the High Street and sells clothing lines from celebrities such as Myleene Klass, saw revenues rise 5.4 per cent to £2.6billion in the first six months of the year while profits were 4.8 per cent higher at £420m. It expects £875m for the full year, a £30m rise from its prior forecast of £845m. It made £870.4m last year.

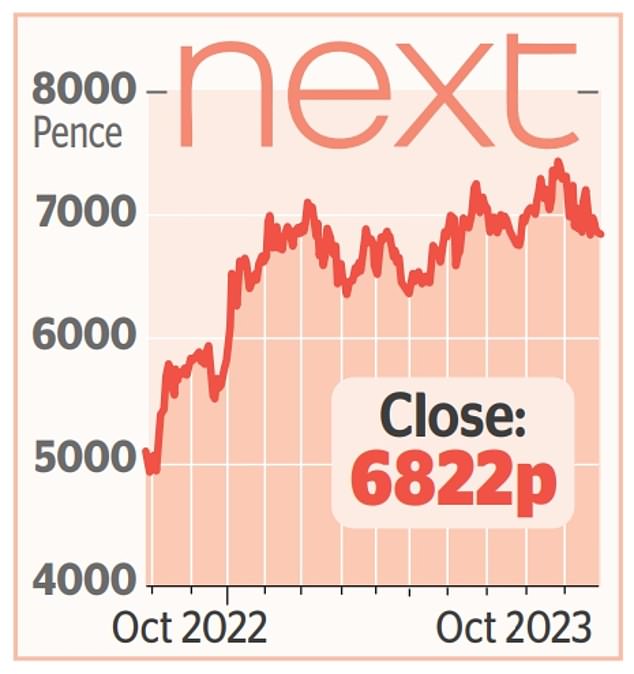

At the last update, Wolfson upgraded profit forecasts for the third time in four months – sending shares to a 20-month high. Investors will be hoping for more optimism next week, as Wolfson’s thoughts on the economy are often followed.

The company may also provide an update into the vision for its Total Platform, which provides a service for third-party retailers to use Next’s online infrastructure.

Aarin Chiekrie, equity analyst at Hargreaves Lansdown, said Next’s full-price sales outlook is also one to watch. ‘If the group can execute well here, it’ll be a clear sign to the market that Next remains a top dog in the UK retail industry,’ he said.