After Shell posted its second biggest annual profit of all time this week, attention will turn to BP and its new chief executive.

Murray Auchincloss took over after Bernard Looney was forced to stand down in disgrace last year over personal relationships with colleagues.

While Auchincloss was seen as the continuity candidate, having worked closely with Looney, his appointment has not pleased everyone.

Shareholders have expressed concerns about the green agenda devised by Looney which his successor has vowed to stick to.

This week it emerged that London-based activist investor Bluebell Capital Partners has written to bosses at the energy supermajor to demand an end to the firm’s ‘irrational’ net zero commitments.

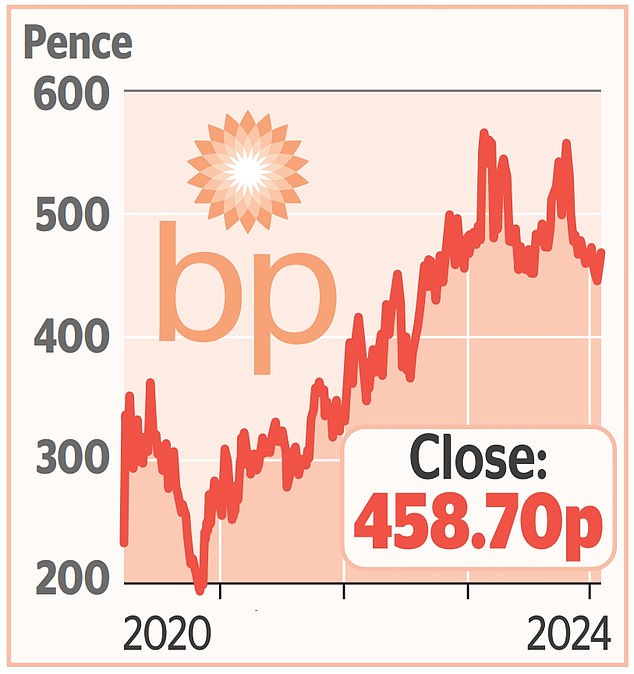

The hedge fund argued that the FTSE 100 giant’s strategy has depressed its share price and presumed a ‘drastic decline in oil and gas demand, which we consider to be utterly unrealistic’.

BP is targeting a 25 per cent reduction in oil and gas output by 2030, though Looney’s initial plan was a 40 per cent cut.

However, most of the other energy majors are planning flat output.

Analysts at investment platform AJ Bell said more clarity on BP’s strategy will be needed – especially in light of the group’s ‘poor share price performance relative to its oil major peers

AJ Bell’s Russ Mould said attention is likely to switch towards shareholder returns as opposed to simply profits.