Seven ‘easy’ ways to beat the tax man before April – but ‘be aware’ of certain rules (Image: Getty)

There are several personal allowances people can make the most of to protect more of their cash before the tax year ends, an expert has said.

With less than two months to use them, Laura Suter, director of personal finance at AJ Bell, shares seven tips and things for people to consider before the April 5 deadline.

Use up allowances

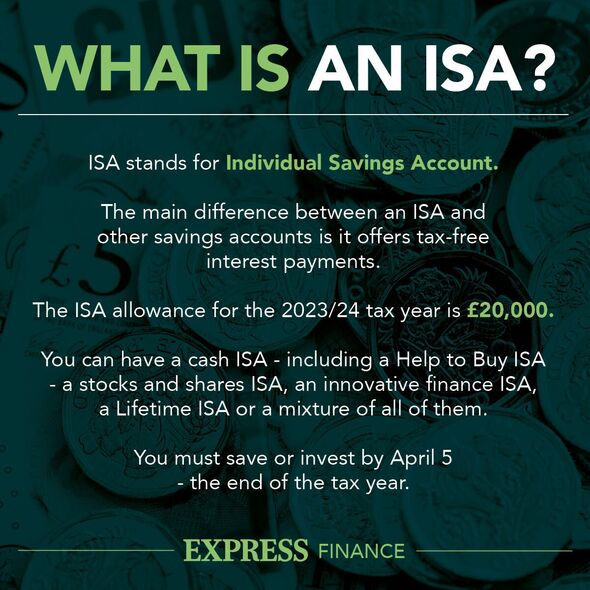

Everyone over the age of 18 gets an annual ISA allowance of £20,000 – split between the different types of ISA.

Ms Suter said: “If you have this much money to set aside, make sure you’re using up your ISA allowance to protect your savings from unwanted tax. An ISA protects your investments from capital gains, dividends and income tax, so it’s the best place for your investments.

There are several personal allowances people can make the most of to protect more of their cash (Image: Getty)

“On top of this, if you are eligible for a Lifetime ISA you could use up to £4,000 of your ISA allowance to pay into your Lifetime ISA. Those aged 18 to 39 can open a Lifetime ISA, and you’ll get a 25 percent Government bonus on any money you pay in, up to £1,000 a year.”

However, Ms Suter noted: “ISA allowances are ‘use it or lose it’, so if you miss the deadline to top-up your account you won’t get that allowance back.”

Additionally, most people can now put up to £60,000 in their pension each year, or 100 percent of earnings if that is lower.

Ms Suter said: “Work out if you want to top-up your contributions and do it before the end of the tax year. This limit isn’t as immediate, as you can carry forward any unused allowances for up to three years, but it’s still worth considering. Just be aware, anyone with a very high income or who has already started to take taxable income from their pension will have a restricted annual pension limit of £10,000.”

Protect cash from tax

AJ Bell estimates that almost 2.75 million people in the UK are set to pay tax on their cash savings interest in 2023/24, with around one in 20 basic-rate payers paying tax on their cash interest, rising to one in six higher rate payers, and around half of the additional rate payers.

Ms Suter explained: “That’s because the Personal Savings Allowance (PSA) has been frozen at its current level since 2016. The PSA currently stands at £1,000 for basic-rate taxpayers and £500 for higher-rate taxpayers.

“Additional rate taxpayers get no exemption. Once savers have breached the PSA they pay income tax on any savings interest over this limit.”

According to Ms Suter, an “easy way” to protect cash from the taxman is to use a cash ISA, assuming the person has allowance remaining. She said: “Many people chose not to use ISAs for cash savings in recent years, with low interest rates meaning interest earned fell within their Personal Savings Allowance.

“In many cases, non-ISA accounts also offered better rates, but for some people, the benefit of fractionally higher rates outside an ISA will now be wiped out by tax.

“An alternative is to share your savings between your partner if they pay income tax at a lower rate or have ISA allowance remaining.”

The ISA allowance for the 2023/24 tax year is £20,000 (Image: EXPRESS)

- Support fearless journalism

- Read The Daily Express online, advert free

- Get super-fast page loading

Beat the Capital Gains Tax cut

For the second year in a row, the amount people can generate in Capital Gains Tax-free is being cut.

Ms Suter said: “While currently you can make £6,000 worth of gains a year before you pay tax on them, from April that is being cut to just £3,000 a year. It means it’s doubly important to consider whether it’s worth cashing in some gains this year, up to the annual limit, so you don’t have to pay tax on them in future years.!

Any gains on investments held outside an ISA or pension above the tax-free limit will be subject to Capital Gains Tax.

Ms Suter said: “Gains are added to income and if they fall in the basic-rate tax band are taxed at 10 percent, while if they fall in the higher-rate tax band are taxed at 20 percent. An additional eight percent is added to the tax rate if the gains are from a second property.

“You can use something called ‘Bed and ISA’ to realise gains and then funnel investments into an ISA and protect them from tax. You need to check you’ve got some of your £20,000 ISA allowance left and then use your investment platform’s Bed and ISA service, which means the investment outside of the ISA is sold, the proceeds moved into an ISA and used immediately to purchase the same investment within the ISA.”

Maximise free money

Whether it’s claiming tax breaks, claiming benefits, getting tax relief due or getting a bonus on a Lifetime ISA – there are lots of ways people can get free money from the Government.

Ms Suter said: “Pensions are a big one – they benefit from tax relief at 20 percent for basic-rate taxpayers, but higher and additional rate payers can reclaim an additional 20 percent or 25 percent tax relief respectively through their tax return. That means for a higher-rate taxpayer every £1 in your pension only costs you 60p.”

Anyone using a Lifetime ISA can also get up to £1,000 of free money from the Government each tax year if they put in the maximum £4,000 contribution.

Ms Suter said: “So if you have some spare cash you were planning to put into your Lifetime ISA, do it before the tax year end and claim that free cash.

“Just be aware that you can withdraw Lifetime ISA money once you’ve reached age 60, or earlier to buy your first property, but if you take the money out for any other reason (apart from severe ill health) you’ll pay an exit penalty of 25 percent.

“You should also check that you’re claiming any Government tax breaks that you’re eligible for, such as the marriage allowance, child benefit or tax-free childcare, which gives a 20 percent top-up to money you use for childcare.”

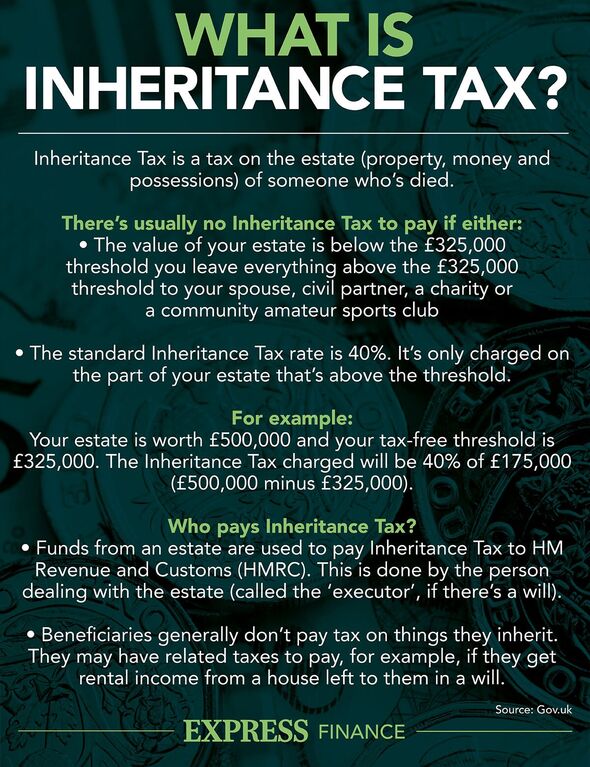

Inheritance tax is charged on a person’s estate if the total value of assets exceeds £325,000. (Image: EXPRESS)

Use gifting allowances

Ms Suter said: “While inheritance tax (IHT) is the most hated tax, it’s actually very easy to reduce the IHT bill your estate will pay when you die.”

There are several gifting allowances that everyone can use each year to move money out of their estate for IHT purposes.

Ms Suter said: “Everyone can give away up to £3,000 a year without it being considered for IHT, but you can also carry this forward if you didn’t use the allowance last year. This limit is per individual, so a couple can double it.

“On top of that, there are extra allowances if certain people get married: £5,000 for a child getting married, £2,500 for a grandchild or great-grandchild and £1,000 for anyone else. You can also gift up to £250 per person each year free of IHT. These gifts can be cash, investments, jewellery, property or other assets.”

The “most generous” gifting allowance is ‘gifts from regular income’, which allows people to make an unlimited amount of regular payments to another person. However, it must come from their regular income, not from assets or investments, and it must be affordable from their regular income.

Ms Suter added: “If you’re doing estate planning, it’s definitely worth locking in some of these gifts before the allowances are reset in the new tax year.”

Work with your partner

While there are many sensible reasons for couples to keep their money separate, Ms Suter said it’s “worth considering” whether it’s worth sharing assets to save on tax. She explained: “Sharing assets smartly between spouses or civil partners can be a good way to reduce your tax bill as a couple.

“If one half of the couple is a lower earner or non-earner, there are tax advantages to moving certain investments or savings into their name, to make use of their lower tax rate. At the same time, if one-half of the couple hasn’t used up their tax-free allowances in a year and the other has, it might be worth shifting assets to benefit from their Personal Savings Allowance, CGT allowance or dividend tax-free sum.

“Equally if you’ve maxed out your ISA or pension allowances and your spouse hasn’t, you should consider whether you want to move money into their name to use those allowances.”

But while sharing assets might be desirable from a tax point of view, there may be other considerations to take into account, such as other family finances, the convenience of joint accounts, wills and potential IHT liabilities.

Dodge a tax trap

Frozen tax thresholds mean more people are being pushed into the next tax bracket or being pushed into a tax trap – where their earnings rise and mean they aren’t eligible for certain tax breaks or benefits.

Ms Suter said: “Anyone who has seen their pay increase in the past year needs to figure out whether they have hit a new threshold that might mean they are paying more tax.

“One clear example is when parents have gone over the £50,000 child benefit high income charge, meaning they aren’t eligible for the full child benefit. Or where they have breached the £100,000 limit to be able to claim tax-free childcare and free childcare hours.

“But there are also simpler examples, like when you move into the higher-rate tax bracket and see your Personal Savings Allowance cut in half, or your dividend tax rate increase. Often a small contribution into your pension or splitting assets with a spouse can save you a lot of money.”