Javier Zayas Photography/Moment via Getty Images

Since my last update on Seneca Foods Corporation (NASDAQ:SENEA), the investment narrative has shifted from having a primary focus on the value on its balance sheet to a focus on its earnings power. Bulls are looking at the more favorable industry structure to support their view that Seneca’s recent higher margins are sustainable and that the elevated inventory and resulting NCAVPS creates a margin of safety for investors, while bears are looking at declining volumes and declining FIFO margins to support their view that its high margins are unsustainable and that the elevated inventory on its balance sheet, along with the high debt incurred to acquire it, will lead to financial instability. There are credible arguments to be made for both sides.

Q3 earnings continued the trend from Q2 as yoy sales volume declined 11% and yoy FIFO earnings declined 40%. These financial results look bad, but I don’t think they confirm or disprove either perspective. There are many pieces of evidence to gather from within the canned vegetable industry, and these pieces can be put together in a few ways to create bullish or bearish stories. Time will tell which story is correct, but I find the more optimistic narrative to be more compelling.

I see a credible case for the stock to reach $70, Seneca’s FIFO adjusted NCAVPS, given my interpretation of this evidence. I did spend some time trying to estimate FY2025 FIFO EPS in order to develop a price target, but ultimately I think using its NCAVPS will end up being just as effective of a method for a 12-18 month price target despite the renewed focus on Seneca’s earnings. It’s easy to get deep into the weeds with Seneca’s accounting when trying to estimate its true earnings power, but sales volume will likely drive the stock over the next 12–18 months. I think the factors driving this metric should be the focus for investors, not trying to precisely estimate next year’s EPS, especially considering the lack of sell-side expectations.

As a note, the company and the stock are attracting quite a bit of attention online, despite its relatively small market cap and its operations in the unexciting canned vegetable industry. The stock doesn’t have any sell-side coverage, but this online coverage is akin to it and is leading to more of a focus on quarterly results. A look through the company’s annual letters to shareholders will show that management has a much longer-term mindset and is focused on growing book value per share over a long period of time. This has likely created some dissonance between new and old shareholders, and it may lead to more volatility in the stock. On top of this, these bullish and bearish narratives can run to extremes given the lack of earnings calls and the lack of access to management.

Q3 Results

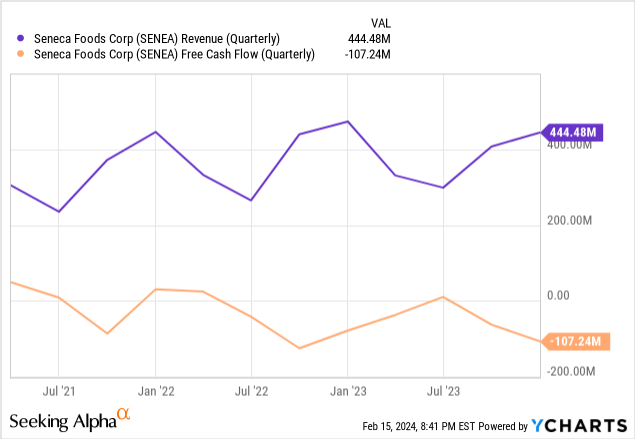

Q3 sales fell 6% yoy driven by an 11% decline in sales volume which was partially offset by higher selling prices. Reported earnings rose 55% yoy, but FIFO adjusted earnings declined 40%. This divergence can be attributed to high inflation that is now decelerating, which created a large gap between LIFO and FIFO COGS. Free cash flow was -$107mm for the quarter.

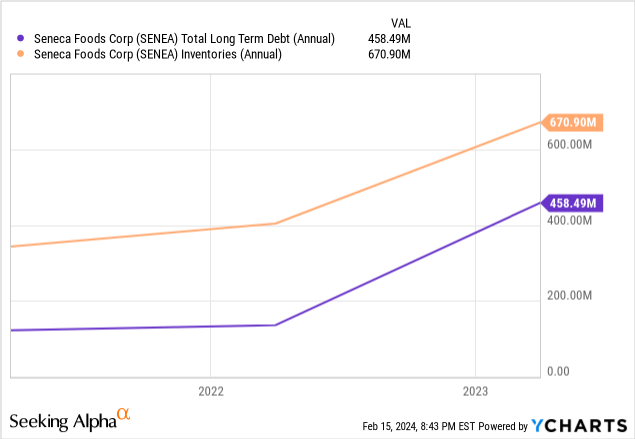

These are poor results, especially given Seneca’s rising debt and inventory. Inventory climbed $190mm yoy but fell sequentially due to the seasonality of the business. Net debt rose $180mm yoy and $120mm sequentially. Net debt to TTM FIFO EBITDA sits at 3.2.

The explanation for these poor results is key to one’s view on whether sales volume will continue to decline or improve over the next year. Based on a look at the rest of the canned vegetable industry, I think there is a good chance that sales volume will stabilize in FY2025.

Industry Context

The main difference between the bull and bear case for Seneca lies in perspective on whether the disappointing results are due to a falling industry tide that will bring Seneca down with it or company specific issues for Seneca’s competitors.

If they are a result of industry issues stemming from declining consumer demand and an overstuffed channel, it follows that Seneca’s inventory will be a burden and the inventory isn’t worth what it’s carried at on its balance sheet. This will lead to declining margins and poor returns on invested capital, and it justifies the stock’s discount to its NCAVPS. If the poor results are due to specific competitor issues, specifically Del Monte, it follows that Seneca’s declining volumes may be temporary. In this case, Seneca’s inventory should be worth the value on its balance sheet, creating a case for the stock to trade at or at a premium to its NCAVPS.

I think there is a strong case to be made that Seneca’s volumes will stabilize in FY2025, due to commentary from Del Monte Pacific on its most recent earnings release and anecdotal evidence from store visits. Further, a look at Del Monte’s balance sheet indicates that Seneca is under less financial stress relative to its competitors, which will allow it to maintain pricing as it will be better able to avoid an inventory fire sale.

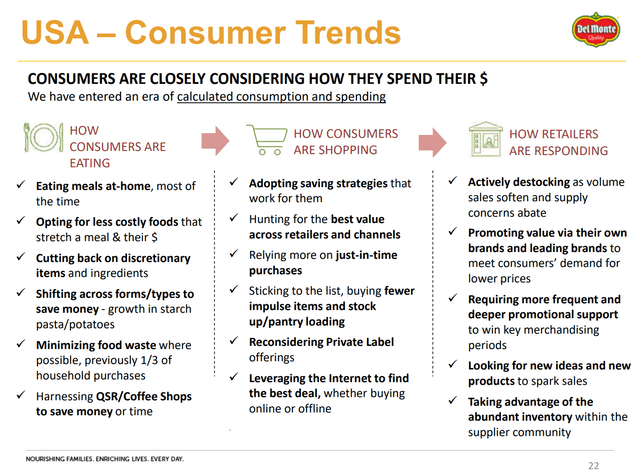

Del Monte Pacific also had a weak quarter and noted higher costs and deteriorating consumer demand as reasons. Unlike Seneca, which primarily sells private label canned vegetables, Del Monte sells a variety of branded products which trade at premium prices. Declining economic conditions should benefit Seneca’s volumes as consumers trade down, but this has not been occurring. Del Monte’s inventory reduction plan is a plausible explanation for this dynamic.

US Consumer Trends (Del Monte Pacific Q2 Earnings Deck)

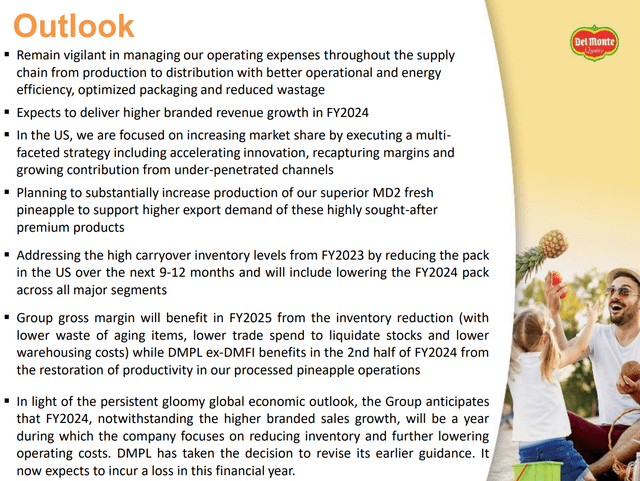

Del Monte provided some color on this plan in their most recent earnings press release:

The Group is addressing the high carryover inventory levels from FY2023 by reducing the pack in the US over the next 9 to 12 months and will include lowering the FY2024 pack across all major 5 segments. Groupwide gross margin will benefit in FY2025 from the inventory reduction plan (with lower waste of aging items, lower trade spend to liquidate stocks and lower warehousing costs) while DMPL ex-DMFI benefits in the second half of FY2024 from the restoration of productivity in its processed pineapple operations.

Del Monte Pacific’s Outlook (Del Monte Pacific Q2 Earnings Deck)

While this quote doesn’t address price cuts specifically, price cuts would accomplish the goal of clearing excess inventory, and anecdotal evidence suggests that price cuts occurred over the 2023 holiday season.

Price cuts and inventory reduction also make sense given the company’s financial stress. For the past few quarters, Del Monte has had negative working capital, its interest expense has surpassed its operating income, and its net debt/TTM EBITDA sits above 7.

It seems that these price cuts have undercut private label prices. As Del Monte’s inventory comes into balance, price cuts should end, which will lead to an improvement in Seneca’s volumes. This should happen in FY2025 based on Del Monte’s outlook and, paired with less inventory destocking by retailers, should provide a boost to Seneca’s volume in FY2025.

Green Giant Inventory

Outside of Del Monte, B&G Foods, Inc. (BGS) selling its canned vegetable inventory to Seneca for below cost could be viewed as bullish or bearish depending on perspective. It could confirm the idea that consumer demand is declining and that the channel is overstuffed, further validating the idea that Seneca’s inventory is less valuable, or it could confirm that Seneca is benefiting from its relative balance sheet strength by buying inventory at bargain prices.

I think it could be a bit of both given B&G’s financial stress (net debt/EBITDA of 6.5) and the current state of retailer inventory. Whatever the case may be, Seneca is using its stronger balance sheet to further consolidate the industry which is in a down part of its cycle, a typical move in cyclical industries. Demand for canned foods is generally not very cyclical (outside of pandemic periods) but supply changes are often induced by yearly crop outputs.

Price Target

My $70 price target is based on Seneca’s FIFO adjusted NCAVPS as the stock has historically traded around this metric. Of course, the true value of the business is based on its long-term earnings power, but over the next 12–18 months, I think sales volume will drive the stock. I am also assuming that the change in industry structure and Seneca’s improved position that has been widely covered is the correct story. Exact FIFO margins are difficult to estimate given the lack of company guidance, but if volumes stabilize and Seneca can maintain pricing, the company’s ballooning inventory will look more like an asset and less like a liability, in the general sense.

I am optimistic that volumes will stabilize based on commentary from Del Monte Pacific and anecdotal evidence of Del Monte’s recent price cuts. Additionally, I think B&G Food’s decision to sell its canned vegetable inventory to Seneca for less than cost has more to do with B&G Foods’ balance sheet than it does with the value of that inventory. This acquisition has contributed to Seneca’s NCAVPS and investors will see this as value creation if sales volume stabilizes.

Seneca’s CFO has also purchased around 3500 shares over the past few months, and as recently as February 13, after Q3 results were released. This could provide some confirmation in the margin improvement thesis and that sales volume has started to stabilize.

If volume continues to decline, the stock trading at a discount to its NCAVPS makes sense. How steep of a discount is difficult to determine but based on a 30% haircut (based on increasing COGS as FIFO inventory is worked through and continued volume declines) to my estimate of FY2024 FIFO adjusted earnings and a 5-6x multiple, I think the stock could trade around $40 in a bear case, or about 60% of its current FIFO adjusted NCAVPS.

However, I am applying a greater weight to my $70 price target due to how I see the evidence from the industry and I think SENEA currently provides an attractive expected return over the next 12–18 months.