Investment trust Scottish Oriental Smaller Companies is on a perpetual mission: to find the best businesses across Asia which will keep growing irrespective of what is going on in the wider economy.

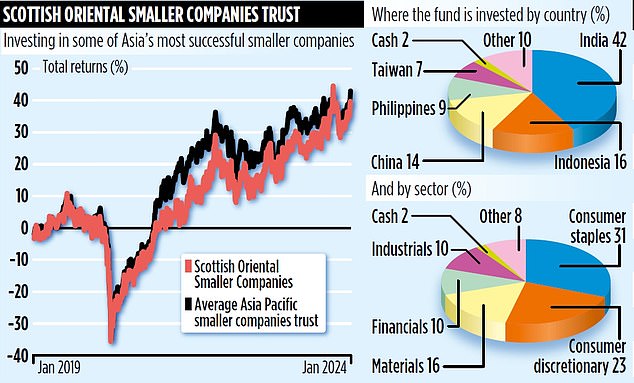

It’s an approach, adopted seven years ago when the investment team running the trust was changed, that has served shareholders extremely well. Over the past one, three and five years, investors have enjoyed returns of 13, 42 and 48 per cent.

More importantly, deputy manager Sree Agarwal believes this continued focus on high quality, market leading companies will reward shareholders long into the future.

‘I’m more excited about the trust’s prospects than I have been for a long time,’ he says. ‘The portfolio is an exciting mix of businesses that have quality managers at the helm, good franchises and are firmly in growth mode.’

Agarwal is part of a three-person team at FSSA Investment Managers that oversees the trust’s portfolio – FSSA being a specialist in Asia and emerging stock markets and part of global asset manager First Sentier.

As the trust’s title implies, the investment managers only target the best businesses that it classes as small – essentially, listed companies with market capitalisations of below $5 billion (£3.9 billion). Agarwal says 350 businesses are on its watchlist, of which 53 have made it into the £322 million fund. It does not invest in unlisted companies.

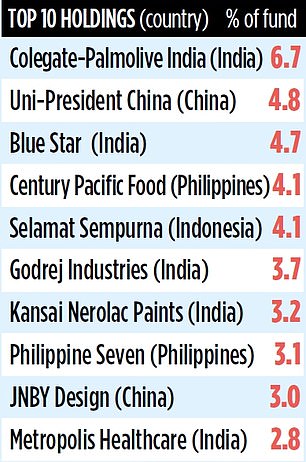

Since Vinay Agarwal (not related to Sree) took over as lead manager in 2016 – Martin Lau completing the team – the fund’s holdings have been trimmed down from 80. Sree says the aim has been to build a more high-conviction portfolio with bigger stakes in the companies they like. For example, the top ten holdings now account for 40 per cent of the portfolio, compared to 25 per cent in 2017.

This combined focus on smaller companies and high quality businesses means the fund has a liking for Indian stocks. ‘We prefer market leaders as investments and in India we can find smaller companies that fit the bill,’ says Agarwal. ‘In China, it’s more difficult because market leaders are bigger.’

So, for example, Blue Star is a leader in the provision of air conditioning units in India, accounting for nearly 14 per cent of sales – the country’s cricketing sensation Virat Kohli is the company’s brand ambassador. Since the trust took a stake in it nine years ago, it has become a top ten holding. ‘We expect Blue Star to get stronger and stronger as demand for its air conditioning units grows. It’s an embryonic market,’ says Agarwal.

But Blue Star remains a smaller company with a stock market capitalisation of £1.8 billion. By contrast, in China, air conditioning giant Gree Electric has a market capitalisation of £19 billion, putting it out of reach of the trust.

A common characteristic among the companies the trust holds is an ability to generate an attractive return from the capital it employs. ‘We like businesses that are capital light, largely debt-free and cash generative,’ says Agarwal.

Many of these firms are found in the consumer goods space, hence the trust’s big positions in Colgate-Palmolive India and Philippines-based food processor Century Pacific Food. The trust is not for dividend-seekers although it does provide a small income equivalent to an annual yield of just over one per cent.

Agarwal says the emphasis on growth companies means that any profits tend to get invested back into the business rather than paid out in dividends.

The trust’s stock market identification code is 0783613 and its ticker is SST. The annual charges are just over one per cent.