Artur Debat/Moment via Getty Images

The last 10+ years have been dominated by two themes: US only momentum, and growth/capital appreciation. The time for international and dividends will come. Why? Because it always does and cycles are still a thing. If you agree, the Schwab International Dividend Equity ETF (NYSEARCA:SCHY) is worth taking a look at. SCHY is a fund that primarily targets companies outside the United States. These companies are distinguished for their robust dividend yield, enabling investors to potentially earn consistent income besides the usual capital appreciation. SCHY has a diversified portfolio representing a wide range of market sectors and countries, further reducing investor risk through broad-based exposure.

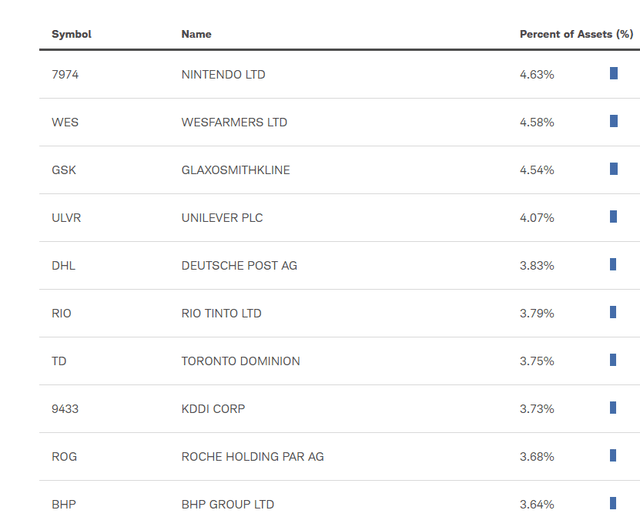

ETF Holdings

The portfolio of SCHY comprises numerous high-dividend-yielding companies. No single holding makes up more than 4.63% of the portfolio, with the top 10 making up 40% of the portfolio. A bit on the heavier side, but I’d argue still diversified.

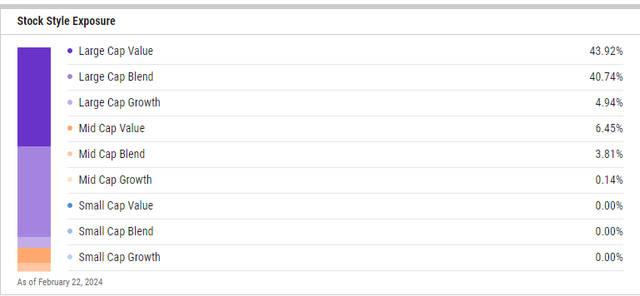

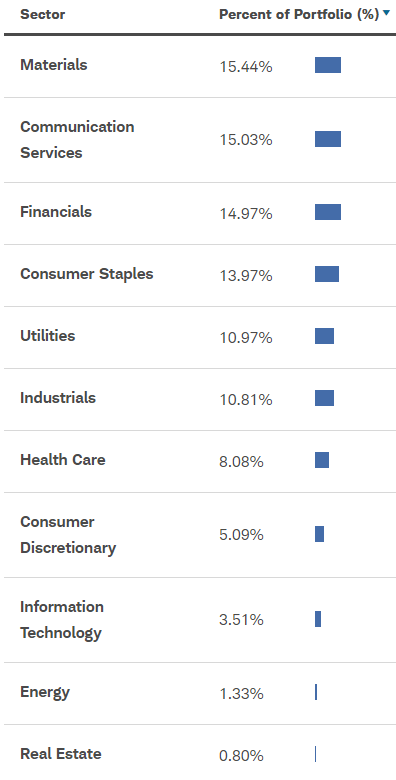

SCHY has a well-balanced sector composition. It includes companies from various sectors, each carrying a different weighting. The Material sector holds the largest weight, followed by Communication Services, Financials, Consumer Staples, and Utilities. This is a VERY different sector composition than what you see in the US. Technology in the case of SCHY only makes up 3.51%. I view this as a feature now of the fund, not a bug.

https://www.schwabassetmanagement.com

Notice that the sector allocations here inherently make this more of a “value” style fund. Characteristically, the value style tends to be heavily focused in Materials and Financials with not as much exposure in Technology. We can see that 43% of the fund is technically characterized Large Cap Value.

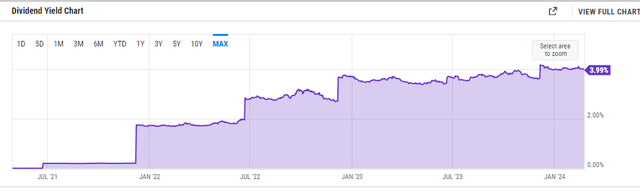

Now what about yield? It’s about 4% now, at the upper end of the range. Not bad at all, with potential upside in the stocks and increased payouts ahead.

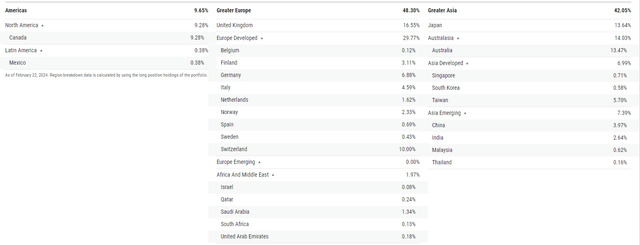

Now because this is an international fund, it’s worth looking at the international mix. I like the global mix here, with 48% in Europe. Yes there are significant challenges, but the country diversification is there. I also like the exposure to Japan and Australia, with a small percentage allocated to China. A solid mix.

Peer Comparison

When compared to similar ETFs focusing on international dividend-yielding companies, SCHY can be comped against the iShares International Select Dividend ETF (IDV). SCHY has outperformed over the last two years, but slightly underperformed IDV since July when we look at the price ratio.

SCHY’s expense ratio sits at 0.14%, with IDV at 0.51%. This alone makes SCHY more appealing for getting roughly the same kind of portfolio exposure to international dividend stocks overall.

Pros and Cons

Investing in SCHY brings several benefits. Its focus on high-dividend-yielding international companies provides a consistent income stream. The fund’s diversified portfolio spreads risk across different sectors and regions, mitigating potential losses. Moreover, its lower expense ratio makes it a cost-effective investment option.

However, potential challenges should also be noted. As the fund invests in international markets, it is exposed to geopolitical risks and currency fluctuations. Additionally, high-dividend companies may not always guarantee capital appreciation. Therefore, investors seeking substantial capital growth may need to consider these factors.

It is worth emphasizing the potential short-term currency risk here. When we look at the Dollar (using the ETF UUP as a proxy), one can argue it’s at a critical juncture in the very short-term. Should it reverse course, that would be a tailwind for international stocks that are unhedged to currency. If it were to continue to rise though, it would detract from performance and potentially even cause broader equity volatility. It’s a question of timing, and your view on it.

Conclusion

The Schwab International Dividend Equity ETF (SCHY) can be a valuable addition to an income-focused investment portfolio. It offers a diversified exposure to high-dividend-yielding international companies while maintaining a lower expense ratio. However, investors must consider potential geopolitical and exchange rate risks associated with international investments. It’s a good fund, and one that I believe has meaningful potential when the cycle comes its way.