Дмитрий Ларичев

Schwab International Dividend Equity ETF (NYSEARCA:SCHY) is an interesting fund that’s been around for only a few years and it has the potential to be successful if it plays its cards correctly. The fund will try to do what Schwab U.S. Dividend Equity ETF (SCHD) is doing in international level and try to replicate its success but its job will be a bit trickier.

The fund which was launched in April of 2021 mostly invests its money into foreign stocks (basically companies headquartered outside of the US) that have a history of paying dividends for at least 10 years nonstop. The fund also looks at financial health of each company to make sure that they are sustainably profitable with healthy levels of cash flow so that their dividends are safe and well-covered. Finally, the fund looks at volatility and keeps out any company that showed too much volatility in the last year.

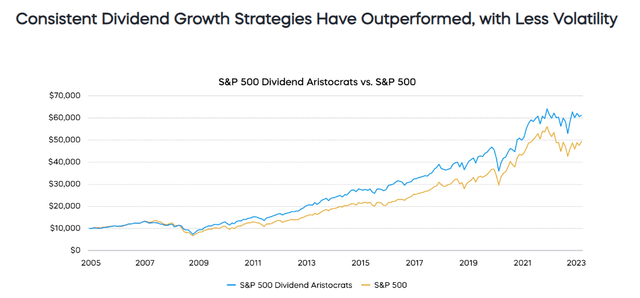

In return the fund gets a portfolio of 120-130 foreign stocks that have a well-covered high dividend yield which also show low volatility. You will notice something important missing from the fund’s stock inclusion criteria which may make it difficult to for it to replicate SCHD’s success. SCHD’s criteria includes stocks that have a history of dividend hikes. We know from historical data that companies with a long history of dividend growth outperform the markets in the long term because they boast stability, predictability and safety for investors. Many of the dividend growth companies have a proven business model that has worked over many years and many of them are dominant in at least one industry if not more. For example Coca Cola (KO) is a dominant player in the global beverage industry whereas The Procter & Gamble Company (PG) is a global player in many household items.

Dividend Growers vs S&P 500 (ProShares)

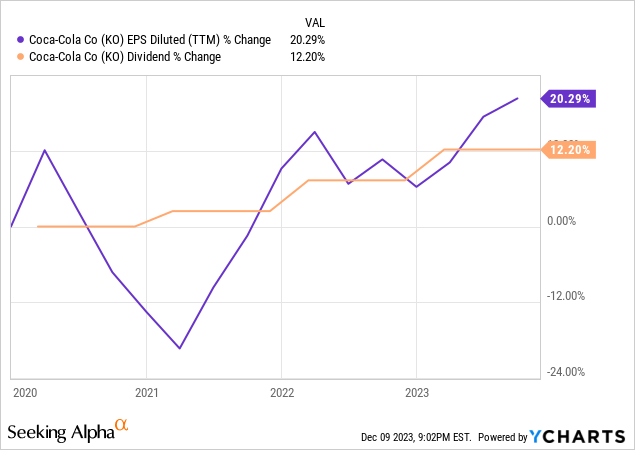

The problem with applying this approach to international stocks is that it limits your pool of stock selection significantly. There aren’t as many dividend growth companies in foreign markets. In many countries companies will only distribute their profits and if they made a loss one year they will either suspend or cut their dividend significantly. In America many companies feel pride in raising their dividends year after year, which means sometimes we see companies hiking dividends even when their profits are down. For example, Coca Cola’s EPS was down close to -20% in 2020 but the company still hiked its dividends.

This doesn’t mean that foreign stocks never hike their dividends. Many of them hike their dividends when their business is doing well but they don’t feel obligated to raise their dividends every year no matter what. This is why it is difficult to find many dividend aristocrats outside of the US.

Another thing American companies often do that you don’t find in foreign companies is aggressive stock buybacks. Many American companies buy their own stock back year after year. This helps reach two goals. First, by reducing the number of diluted shares, a company can boost its EPS (earnings per share) metric even if its net income stays flat year over year. For example if a company buys 5% of its shares back and its net profit is flat next year, its EPS will still rise by 5% because there are fewer shares. Second, it gives these companies more room to hike their dividends. If a company is paying $1 per share in annual dividends and it suddenly reduces its share count by 5% by buying its shares back, now it can hike next year’s dividend by 5% even without increasing its profits.

That kind of “financial engineering” behavior is also rare outside of the US which means there is less room for dividend hikes. It may be even legally restricted or strongly discouraged in some countries. This is why investors often prefer American stocks for consistent dividend growth.

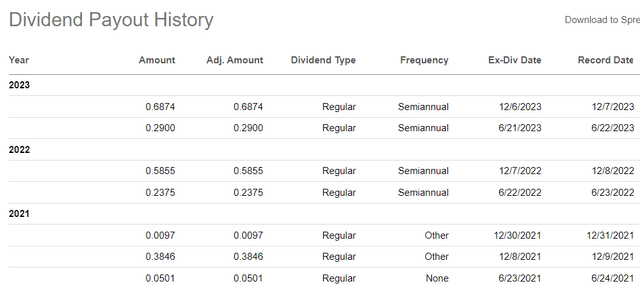

Even though, SCHY doesn’t use dividend growth as a criteria, the fund has still posted dividend growth in the last 2 years. After paying a total of 44 cents per share in 2021, the fund boosted its dividend distributions to 82 cents in 2022 and 98 cents this year. This represents a growth of 85% in 2022 and another 18% in 2023 but keep in mind that the fund launched in April of 2021 so it only participated in two thirds of the year. After adjusting for that, we see 22% dividend growth in 2022 and 18% in 2023 which is pretty good for a fund that doesn’t use dividend growth as part of its stock selection.

SCHY Dividend History (Seeking Alpha)

There is no assure that the fund will keep growing its dividends at the current rate every year but if it can at least keep some level of dividend growth, it can reach strong results. Even a 5-10% dividend growth rate would put this fund in top tier in terms of dividend growth.

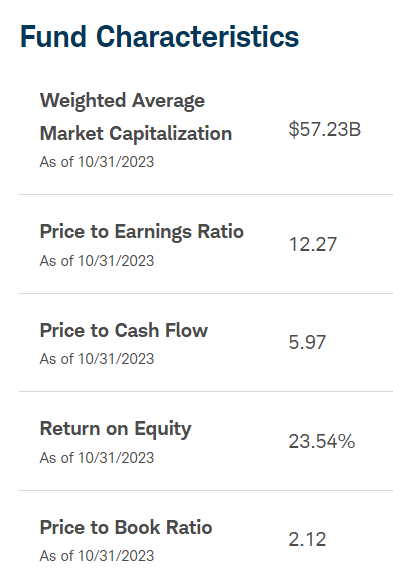

If we can say one thing about this fund’s holdings, a good word would be “cheap” because its holdings have low valuations on average. The fund’s holdings have an average P/E of 12, average price to cash flow of 6, average price to book ratio of 2.1 and average Return on Equity of 23.5%. differentiate this to S&P 500 with its average P/E of 24, average price to book value of 4.3 and so on.

Fund Fundamentals (Schwab )

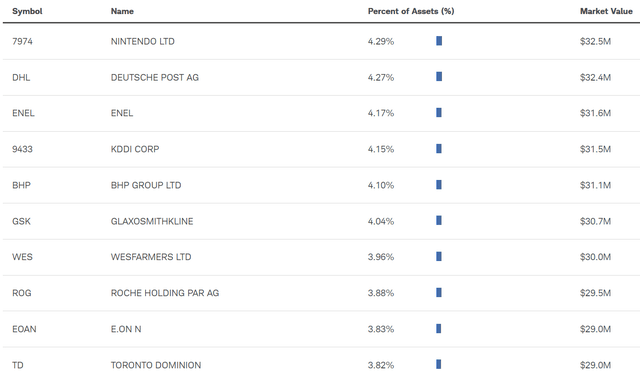

Let us look at some of the fund’s top holdings. The fund’s top holding is Nintendo (OTCPK:NTDOY) which is a Japanese gaming company followed by Deutsche Post (OTCPK:DPSTF) which is a German mailing company. We are seeing a good representation from different industries including entertainment, mining, healthcare and financials. While not all of these companies have a history of dividend growth, the average dividend yield of these companies is 4% which is significantly higher than the average dividend yield of the S&P 500 index which currently yields 1.6%.

Top 10 Holdings (Schwab)

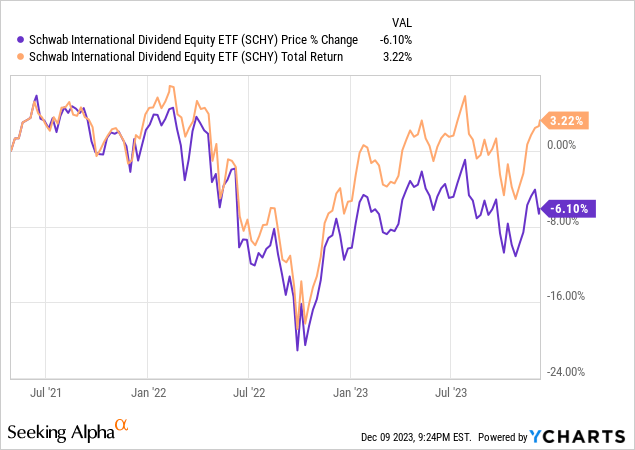

The fund has only been around for 2.5 years and so far its results haven’t been great with price return of -6% and total return of 3.22%. A pessimistic “glass half-empty” guy would look at these results and say that this must be a bad fund with bad holdings. An optimistic “glass half-full” guy would look at these results and say that this indicates that the fund is still cheap and has a lot of room to grow.

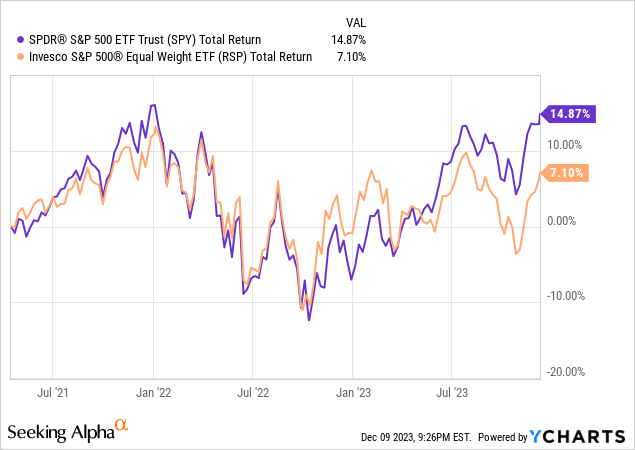

Below is a chart showing how US stocks performed during this time. Notice how S&P 500 (SPY) was up 15% while equal index fund (RSP) was only up 7% during this time. It indicates that most of SPY’s performance was driven by a select number of stocks which carry the biggest loads. We all know which companies those are (big tech, also known as the Magnificent Seven). Without the help of the big tech, American indices probably would have performed poorly too.

When investing in foreign stocks or funds that hold foreign stocks, one factor to keep in mind is the currency risk. If you are an American investor, your investment results will be measured by the US dollar and this could play a big role in your overall returns. If we have a year where the US dollar is up 10% against other currencies, your overall performance will be dragged down (as well as your dividend growth) but when the opposite scenario happens where the US currency actually drops by 10%, your foreign gains and dividends will suddenly become more valuable.

All in all, this is a new fund that has cheap valuation, a nice dividend yield of 4.15% and 20% annual dividend growth so far. It looks tempting even though its overall performance has been lagging since inception. The optimistic in me says that the best time to buy an asset class is when it’s in a bear market or when it’s underperforming, especially if its valuation is compellingly cheap. My only worry about this fund is if it can keep its dividend growth intact in the future considering that it’s not holding many dividend aristocrats as opposed to SCHD. This will be interesting to expect and see.