Iryna Drozd/iStock via Getty Images

Investors in The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD), who picked its steep pullback in October/November 2023, have done relatively well, as SCHD bottomed out resoundingly. I also urged investors to buy SCHD aggressively in November, assessing the ETF as a prime beneficiary in a further recovery as pessimism likely peaked. That thesis has panned out, as SCHD has continued to grind higher, taking out highs last seen in early 2023.

Despite that, SCHD underperformed the S&P 500 (SPX) (SPY) as the market rode the momentum in tech, driven by the AI hype. Notwithstanding the relative underperformance, SCHD investors likely focus on sustainable income-driven opportunities. Consequently, I assessed that SCHD remains a viable dividend-focused strategy that benefits from capital appreciation. Accordingly, SCHD posted a 1Y total return of nearly 8%. Relative to its trailing twelve months or TTM dividend yield of 3.43%, it’s clear that capital gains influence SCHD’s total return. Consequently, I believe it fulfills the hallmark of investing in fundamentally strong companies that pay their investors sustainable dividends.

| Top Ten Holdings | Exposure (%) |

|---|---|

| Broadcom (AVGO) | 5.09% |

| AbbVie (ABBV) | 4.77% |

| Merck (MRK) | 4.71% |

| Home Depot (HD) | 4.46% |

| Texas Instruments (TXN) | 3.98% |

| Verizon (VZ) | 3.91% |

| Chevron (CVX) | 3.91% |

| Amgen (AMGN) | 3.86% |

| Coca-Cola (KO) | 3.83% |

| PepsiCo (PEP) | 3.72% |

SCHD’s top ten holdings. Data source: Seeking Alpha

A glance over SCHD’s leading holdings indicates a strong focus on fundamentally strong companies. These companies comprise more than 40% of SCHD’s holdings. As a result, paying close attention to their operating performance is pivotal to determining the potential outperformance in SCHD moving ahead.

According to Seeking Alpha Quant, the top ten holdings in SCHD are assigned the best-in-class “A+” profitability grade, corroborating my confidence. As a result, I believe SCHD will remain a core holding for dividend investors keen on generating potentially robust total returns.

Notwithstanding the superior fundamental construct of SCHD, the allure of dividend investing has waned over the past year, given the relative appeal of investing in the 2Y (US2Y) yield. While the Fed is anticipated to cut interest rates sometime this year, the timing remains undecided. Moreover, the remarkable strength of the US economy could affect the timing and extent of the Fed’s rate cut cadence, adding another layer of ambiguity to dividend investors.

Furthermore, the hyper-optimism in AI stocks could lead to an even more significant FOMO surge in growth and tech stocks, impacting buying sentiments on SCHD. Notwithstanding the near-term caution, I assessed that SCHD’s attractive valuation (normalized P/E: 14.6x) should assure its investors that they aren’t chasing the AI hype, as SPY’s normalized P/E has surged toward the 20.6x level, well above its 10Y average of 17.5x. Consequently, I assessed that SCHD should continue to attract value and income investors to its fundamentally strong thesis and solid dividend yield.

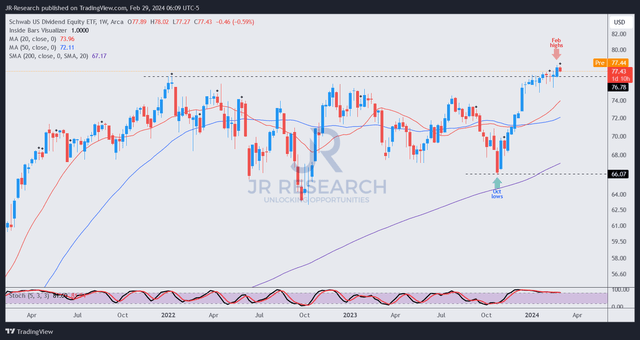

SCHD price chart (weekly, medium-term, adjusted for dividends) (TradingView)

SCHD has performed remarkably well since its bottom in October/November 2023 when adjusted for dividends. Buying sentiments have remained resilient, overcoming the selling resistance at the $75 level. As a result, I didn’t assess red flags, suggesting investors need to be highly cautious and that the upward momentum should continue.

Notwithstanding my positive assessment, I gleaned that the risk/reward appeal of SCHD at the current levels is less attractive than my previous update in November 2023 (peak pessimism). As a result, I believe it’s apt for me to continue leaning bullish but lower my rating down one notch to Buy.

Rating: Downgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!