‘I’m a savings expert – here’s why fixed rates are falling and what to do to fight back’ (Image: Skipton Building Society)

Average long-term fixed savings rates have fallen for the first time in six months, “signalling a turnaround” for the market.

According to data from Moneyfactscompare.co.uk, the average long-term fixed bond dropped to 5.11 percent this month, its first fall since March 2023 – and this is only forecast to continue.

Maitham Mohsin, head of savings at Skipton Building Society told Express.co.uk: “[Rates] are going to come down.”

Compared to the summer’s high peaks of 6.2 percent, Mr Mohsin said: “I think [the market] is probably going to settle – if things stay constant at the moment – around between 5.5 percent to 5.7 percent.”

Consecutive Bank of England Base Rate rises sent savings rates soaring since the start of last year. As of recent, Britons have been able to capitalise on some of the highest returns seen in decades.

Average long-term fixed savings rates have fallen for the first time in six months (Image: Getty)

However, after the UK’s surprise drop in inflation in August, the Bank decided to hold the Base Rate at 5.25 percent in September, which has had a knock-on effect on the savings market.

Commenting on the drop in fixed rates, Rachel Springall, finance expert at Moneyfacts described it as “not too unexpected” with Base Rate remaining on hold and the markets “expecting rates to drop in the months ahead”.

She said: “This signals a turnaround for the longer-term fixed rate market. Those savers considering a fixed bond or ISA may wish to act quickly to take advantage of the highest rates.”

Delving into why the plateauing Base Rate has negatively impacted savings rates, Mr Mohsin said fixed savings are not really priced on what the Base Rate looks like today. They’re more of a long-term forecast of what the Base Rate might look like, in the future.

With markets anticipating the Base Rate to fall, Mr Mohsin said it’s been getting “costlier” for providers to put in higher fixed rates. NS&I’s 6.2 percent fixed rate “propped up the market” when the Base Rate didn’t increase, but as soon as it was pulled, Mr Mohsin said “a plethora” of providers withdrew their deals.

Although, with the FCA launching its crackdown on low rates at the end of summer, Mr Mohsin said people might expect “some movement” at the end of the year when the review concludes. But generally, Mr Mohsin said rates “are heading downward.”

During this period of interest rate uncertainty, there are ways people can make their money “work harder”, Mr Mohsin said – from “offsetting” bills by moving money from current accounts to easy access accounts, to capitalising on ISA allowances.

He explained: “The first step if you’re really serious about wanting to make your money work harder, come in and see the guys. Our mantra is trying to make people’s money work harder. We offer things like financial advice. You could walk into Skipton Building Society and ask to see a financial advisor to get some advice.

“We don’t charge you until the point of which you say ‘All right, I want to take on what you’ve said’. You could walk in, get that advice and then decide to do what you want to do after that.”

He added: “That’s the first really important thing, to take control of your money. And the first thing to do is to know what you have. Where is it? Ignorance isn’t bliss. You’ve got to know where your money is. What’s it doing for you?”

Skipton Building Society recently launched a campaign about the abandoned billions, where research shows in accounts with balances of £10,000 or more, seven million are receiving zero percent in interest.

The ISA allowance for the 2023/24 tax year is £20,000 (Image: EXPRESS)

- Advert-free experience without interruptions.

- Rocket-fast speedy loading pages.

- Exclusive & Unlimited access to all our content.

Mr Mohsin said: “There’s billions of pounds of interest just being left on the table. We’re now seeing people coming in and moving that money and it’s making a real difference.”

“So, understand what you’re working with, that’s number one. Then think about your expenditure, that’s where it’s really important. Start small and set yourself a few small challenges.”

Mr Mohsin suggested the first challenge people can try is reducing the cost of their weekly food shop. He said: “Keep the receipt after the weekly shop. I would start there. Have a look and see how much you spent. Can you save 10 percent on your next shop?

“Go for that – see if you can set that up. This is the first step in creating a really tight budget and thinking about things. Start saving that money and putting it aside. Before you know it, it’ll become a habit.”

For those with larger balances, Mr Mohsin suggested thinking about how to maximise it. He said: “Consider the tax implications, where that money is held. Consider what you want to do with it in the future. And then, should you be investing it now for some longer-term goals?”

He continued: “You could consider an ISA, rates are still hitting five percent.”

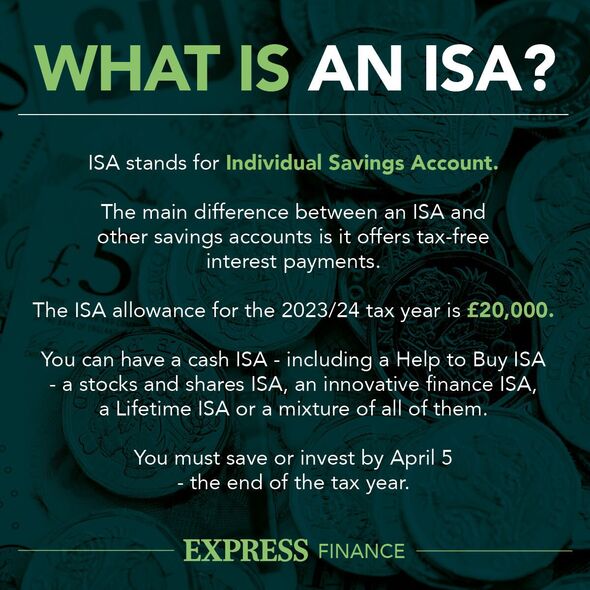

People can save £20,000 a year in a cash ISA without having to pay tax on interest, making for a strategic option for those with larger pots held in traditional fixed savings accounts, which are currently paying out hundreds, or even thousands of pounds in interest.

Without an ISA, basic rate taxpayers can only earn up to £1,000 interest a year without paying tax and higher rate taxpayers can earn up to £500 interest. Additional rate taxpayers do not have a personal allowance at all, making tax-efficient savings tools, such as ISAs, a strategic option while interest rates are high to avoid a hefty tax bill.

Mr Mohsin added: “Think bigger picture. How many of us are there in the house? How do we split our savings? Is one person a lower taxpayer and one a higher taxpayer?”

By figuring this out, Mr Mohsin said people can then decipher who is best to hold the savings, as higher taxpayers have lower personal allowances.

But Mr Mohsin’s biggest savings tip to share is not to let money idle in current accounts.

He said: “My motto right now is if you’ve got money in a current account, take the money out of that account.

“People have this [idea] of what savings used to pay out. But you don’t have to have a lot of money. If you have a £5,000 pot and you put it in a decent instant access account, [the interest earned] will probably cover Netflix.

“It’s a real pain that gas and electric bills have gone up. So what are you doing to try and offset that? Well, some of the interest you earn can offset some of those increases.

“Think of [interest] as saving you money. Use money from interest to pay for things.”