NicoElNino

Aerospace start-ups are intriguing companies, but in many cases, the investment case for such companies tends to be rather complicated due to high capital needs to penetrate the market. We are seeing more and more moves into commercializing space, so there is a huge addressable market but with many actors on the scene and high capital requirements, investments can go south. In this report, I will be discussing the prospects of Satellogic and explain why I do admire the business but not its prospects in the coming years.

What Does Satellogic Do?

To know whether a company might be interesting for investment, it is important to comprehend its activities. Satellogic provides Constellations-as-a-Service, which simply means that companies but mostly governments on various levels could control a constellation of low-Earth observation satellites to be fulfilling the needs of the customer. Furthermore, the company offers 1-meter multispectral imaging and aims to produce a searchable database of the Earth.

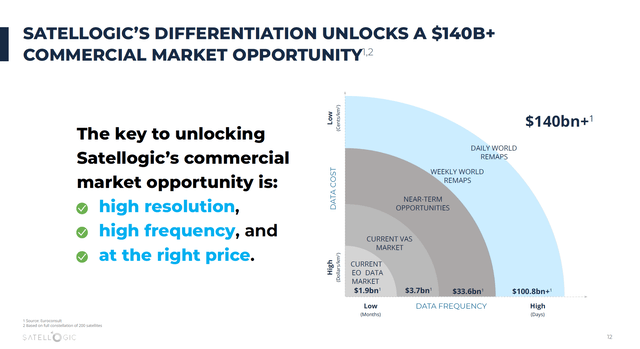

Satellogic Sees A $140 Billion Market Opportunity

There is no denying that there is demand for multispectral imaging and geospatial analytics and I would also agree that Satellogic has the key drivers for the $140+ billion opportunity right. High image resolution can significantly help with analysis and decision making while a growing number of satellites allows higher sampling frequency to service the demand for daily world remaps. Application fields include energy, forestry, forest fire detection, and infrastructure. I think those include some “hot topics” for the 21st century.

Unlocking The Marketing: Scaling Is The Key

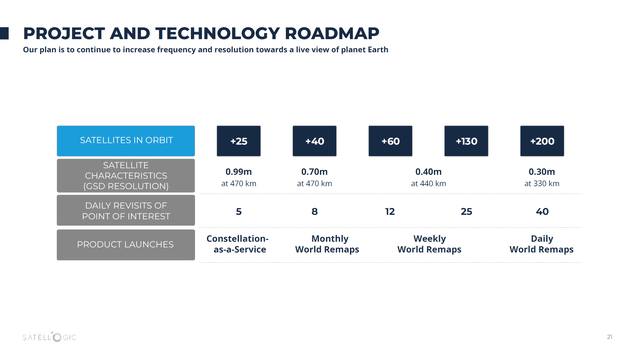

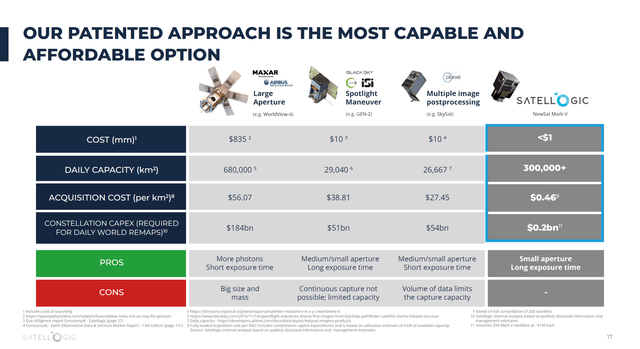

The way for Satellogic to unlock the weekly and daily world remap market opportunity is by increasing its network of satellites. Currently, it seems there have been a total of 43 launches plus three prototype launches, which would suggest monthly remap capability. Next year, the company is expecting 8 to 12 launches, which brings the constellation size to 51 to 55 followed by reaching the 60 satellites required for weekly remapping by 2025. However, by 2025 the company will not have achieved the daily world remaps which likely carry a significant portion of the market opportunity. In my view, absent a constellation size able to supply daily remaps, Satellogic has no strong competitive advantage over competitors such as Maxar Technologies, BlackSky (BKSY), or Planet Labs (PL).

While daily remaps seem to be a major selling point, that is something that will not be achieved at the current rate of launches as by 2025, there still will be 140 launches required. I would say that it is somewhat odd that Satellogic claims to have the lowest constellation CapEx for daily remaps but it is really not able to get to that point for years at the current rate.

The Reality Of The Satellogic Business and Market

I think the reality is that the market for geospatial data is a highly competitive one and building a constellation is still capital intensive. To give you an impression, by mid-2023 Satellogic had $42 million in cash and was facing lower-than-anticipated revenue growth. While this is a company that should be growing, it actually reduced its headcount to accommodate the lower-than-expected revenue growth. Moreover, its cash pile that is used for more than just launching satellites would only allow for 42 launches putting the constellation size shy of the 200 required for daily remaps.

For 2023, the company expects a negative adjusted EBITDA of $45 million to $35 million followed by a $15 million loss to $5 million profit in 2024 and $5 million to $25 million in profits for 2025. The way I am looking at it is that the math is simply not adding up. The CapEx requirement to accomplish daily remap capability is another $160 million, but the company won’t even be cash flow positive in the years to come meaning that with its current cash levels, it cannot even accomplish the daily remap capability that it provides as a unique selling point. Perhaps that is also the risk of a company such as Satellogic. The company went public in 2021 via a Cantor Fitzgerald SPAC and while I don’t want to make a case against SPACs, I do consider them to be riskier. The companies that go public via a SPAC often tend to demand significant capital to build the business and quite often banks are not quite accommodating of financing the high growth and high risk phases of these businesses leaving capital raises via SPACs, essentially transferring a significant amount of risk to shareholders, as one of few available options. In case the high growth phase is disturbed, or cash burn is higher, that leaves the same shareholders at risk of advocate dilution as banks might still not be willing to step in.

Given that Satellogic has $42 million in cash and is expected to burn cash in 2023 and likely in 2024, I don’t quite see where and when the business can look into scaling to the required constellation of 200 satellites. It seems that the company will stabilize on weekly remap capability and hope that from there its revenues and profits grow before daily remap capabilities are added and it will be a multi-year trajectory.

What Is Satellogic Stock Worth?

Given the challenges the company faces to extract value from the market and accomplish required scale, I am inclined to value Satellogic stock according to its book value. That book value would be $0.88. Applying the price-to-book ratio of 2.5x that is typical for the industry I would get to a fair value of $2.21 which is more or less in line with the $2.30. that the company currently trades on. So, there is no compelling entry point here, and the only reason why I would even consider buying is an extremely speculative buy assuming that in the coming two-three years Satellogic’s business does indeed take off.

Conclusion: No Compelling Investment Opportunity For Satellogic

While I most certainly do admire companies active in the geospatial data segment and I do believe that commercialization of space and Earth imaging has significant growth ahead, Satellogic seemingly does not have the funds available at this point in time to scale its business to achieve its unique selling point while its revenue growth has been overwhelming. As a result, I don’t deem the stock a buy. If you want results now, it is best to sell and deploy funds elsewhere. I am marking the stock as a very speculative hold. If it doesn’t work out, you don’t lose much and if it does work out against all odds then you will see upside running in the multiples of the current stock price. For me personally, this would not be a stock that I would admire to hold as the timelines and financials are simply not coming together.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.