Bulgac/iStock via Getty Images

Small-caps have been a train wreck in this cycle, with many of the large passive indices nowhere near looking like they are in a bull market. Much of this of course has to do with the fact that small-cap indices have a lot of zombie companies that operate on razor-thin margins against high debt. So why not instead focus on small-cap strategies that largely weed those out and have the revenue to support higher interest expenses? That’s where the Invesco S&P SmallCap 600 Revenue ETF (NYSEARCA:RWJ) comes into play.

RWJ is a passively managed ETF that was launched on February 22, 2008. The ETF is sponsored by Invesco, a large investment management company. RWJ has amassed assets worth over $1.4 billion, making it one of the larger ETFs, specifically targeted towards the Small Cap Blend segment of the U.S. equity market.

Details on ETF Holdings

RWJ provides diversified exposure, thereby minimizing single-stock risk. The rules around the fund are such that positions are weighted higher based on company revenue. This approach helps to keep the top contributors focused on those businesses that are growing and as such more likely to manage higher interest expense. Top positions include:

- World Kinect (WKC) – a global energy management company that specializes in the distribution of various fuels such as aviation fuel, heating oil, propane, natural gas, lubricants, biofuel, renewable diesel, and natural gas, along with services including fuel management, price risk management, and trip planning for diverse industries like aviation, defense, and marine sectors.

- United Natural Foods (UNFI) – the largest publicly traded wholesale distributor in the United States and Canada, providing over 250,000 natural, organic, and conventional products to more than 30,000 customers including superstores, independent retailers, supermarket chains, e-commerce retailers, and the food service industry.

- Lincoln National (LNC) – a Fortune 200 American holding company that provides various insurance and investment management products and services through its subsidiary companies under the marketing name Lincoln Financial Group.

- Kohl’s (KSS) – a large American retail chain that offers a wide array of clothing, footwear, accessories, housewares, and beauty products through its department stores and online platform, catering to a family-oriented demographic with a focus on value and national and private brands.

- Group 1 Automotive (GPI) – an international Fortune 300 automotive retailer that operates through an omni-channel platform, offering new and used car sales, vehicle financing, service and insurance contracts, maintenance and repair services, and vehicle parts across the United States, the United Kingdom, and Brazil.

- The Andersons (ANDE) – a diverse agriculture-rooted company based in Maumee, Ohio, engaged in commodity merchandising, renewables, and plant nutrient sectors, with a presence in the U.S., Canada, Switzerland, and the U.K., and strong community and sustainability commitments

These top 5 holdings account for about 16% of total assets under management. Small weightings overall in the portfolio, but what I like about these types of names is that they aren’t wildly held and cover important companies on the domestic front without the concentration seen in large-cap funds.

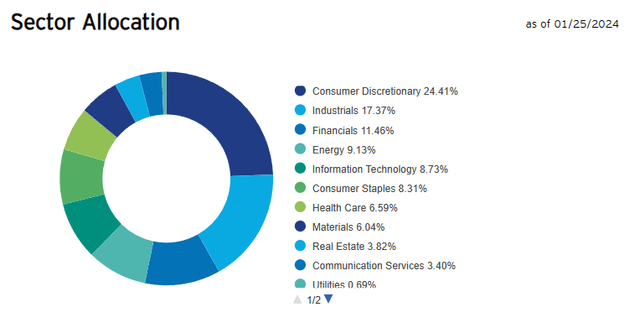

Sector Composition and Weightings

The sector allocation of RWJ is diversified, with the heaviest allocation to the Consumer Discretionary sector, which accounts for about 24% of the portfolio. The Industrials and Financials sectors follow, rounding out the top three.

Peer Comparison

When choosing an ETF, investors often compare it to its peers. In the case of RWJ, it’s worth comparing it to two other Invesco funds – the Invesco S&P SmallCap 600 Pure Growth ETF (RZG) and The Invesco S&P SmallCap 600 QVM Multi-factor ETF (QVMS). RZG specifically targets the growth segment of the U.S. small-cap market. It tracks the S&P SmallCap 600 Pure Growth Index, which includes small-cap companies that exhibit strong growth characteristics as defined by S&P. These characteristics may include high growth ratios like earnings growth and sales growth. QVMS, on the other hand, employs a multi-factor investment strategy, which typically involves selecting stocks that exhibit a combination of quantitative factors such as quality, value, and momentum. These factors are used to identify stocks that may offer a balance of growth, reasonable pricing, and upward price trends.

While RWJ focuses on small-cap companies re-weighted according to revenue, RZG targets the growth-oriented small-cap stocks, and QVMS utilizes a multi-factor approach. The RZG and QVMS funds differ in their strategic focus, with RZG aiming for pure growth characteristics and QVMS seeking a mixture of quality, value, and momentum factors. Given concerns about many small-cap companies being able to survive higher for longer rates, I personally prefer the revenue re-weighting focus more than anything else.

Pros and Cons of Investing in RWJ

Like any investment, RWJ has its pros and cons. On the upside, it offers broad exposure to the Small Cap Blend segment of the U.S. equity market and has a reasonable expense ratio of 0.39%. On the downside, revenue or not, small-caps still are struggling broadly.

Conclusion

RWJ can be a suitable option for investors looking to gain exposure to the Small Cap Blend segment of the U.S. equity market. With its diversified holdings and reasonable expense ratio, it could be a valuable addition to a well-balanced investment portfolio. It’s done well and seems to have a better margin of safety than other small-cap vehicles.