Monty Rakusen

RTX Corporation (NYSE:RTX) reported better-than-expected earnings for its fourth-quarter last week and the aerospace and defense company submitted a strong earnings/free cash flow outlook for FY 2024 as well. RTX Corporation benefits from a strong post-pandemic recovery in the aviation industry which is driving record passenger volumes. Demand for the firm’s engines is very strong, supporting solid growth projections. The company repurchased more than $10B worth of its shares in the fourth quarter as part of an accelerated stock buyback plan. With strong earnings/FCF guidance in place for FY 2024, RTX Corporation represents solid income value for investors.

Previous rating

I recommended RTX Corporation ahead of the Q3’23 earnings release back in October — RTX Corporation: Engine Issues, Middle East Turmoil, And A Low P/E — after a power metal issue affecting its engine business caused the grounding of a number of planes. This negative sentiment created an attractive entry opportunity. Considering that RTX Corporation reported very strong Q4’23 results, driven by demand from aviation, I am reiterating my buy recommendation.

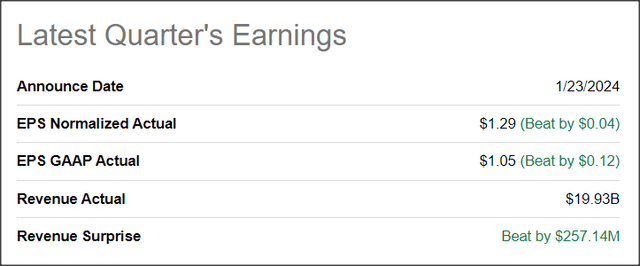

RTX Corporation beats earnings estimates easily

RTX Corporation beat top and bottom line estimates last week with its Q4’23 earnings coming in at $1.29 per share, beating the consensus estimate by $0.04 per share. Revenues also came in ahead (+$257.1M) of the average prediction which is chiefly related to strength in the aviation industry.

Seeking Alpha

RTX Corporation benefits from strong demand from the aviation industry

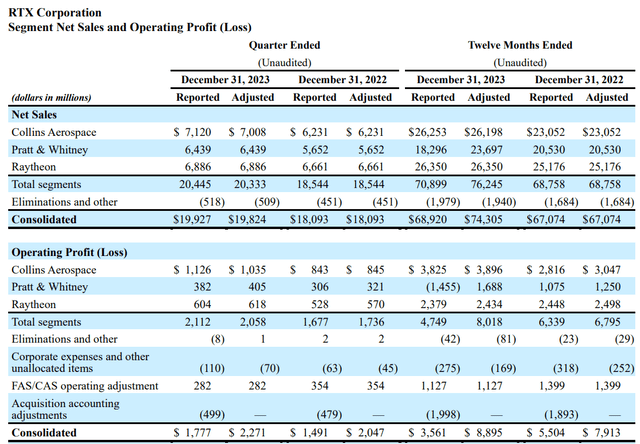

RTX Corporation saw a sizable revenue boost across its businesses and reported revenues of $19.9B in the fourth quarter, showing a 10% year-over-year growth rate. Total FY 2023 revenues were $68.9B, +3% Y/Y and both the Aerospace and the Pratt & Whitney engine segments generated double-digit top line growth.

RTX Corporation benefits from strong demand for engines from the aviation industry. Airline companies like Delta Air Lines (DAL) and United Airlines (UAL) had exceptionally strong quarters in Q4’23, driven by a large-scale return of passengers after the pandemic as well as a strong holiday season. This recovery in air travel has led to soaring demand for new aircraft and their engines as well as aftermarket services.

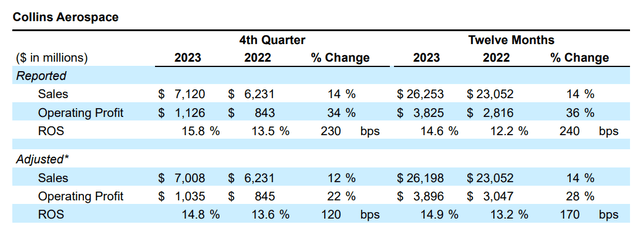

Collins Aerospace is the largest segment for RTX Corporation and contributes approximately 35% of total segment sales, but 53% of operating income. The segment chiefly deals with the development of higher-performing airplane structures, avionics, interiors, mission systems, and power and control systems. Raytheon, a defense contractor, has revenue and operating income shares (as of Q4’23) of 31% and 29% while Pratt & Whitney, which designs, manufactures, and services engines and auxiliary power units, had corresponding shares of 31% and 18%. Therefore, given its very high operating income share, operating income growth in the Aerospace division is much more valuable for the company and its shareholders than anywhere else in the business. Aerospace’s operating income was up 34% Y/Y compared to 25% for the engine segment and 14% for the defense business.

RTX Corporation

The margin situation at RTX Corporation is also looking better, especially in Aerospace: the operating income margin expanded 2.30 PP year over year and Collins disclosed a margin of 15.8%, the highest of all segments. Pratt & Whitney had an OI margin of only 5.9% (+0.5 PP Y/Y) and Raytheon pushed ahead with an 8.8% operating income margin (+0.9 PP Y/Y).

RTX Corporation

Looking into FY 2024, RTX Corporations’ outlook

According to the latest projections made by the International Air Transport Association, the industry widely expects a record year in terms of passenger volumes which implies growing demand for RTX Corporations’ core products, especially in Aerospace and in the firm’s engine business, Pratt & Whitney.

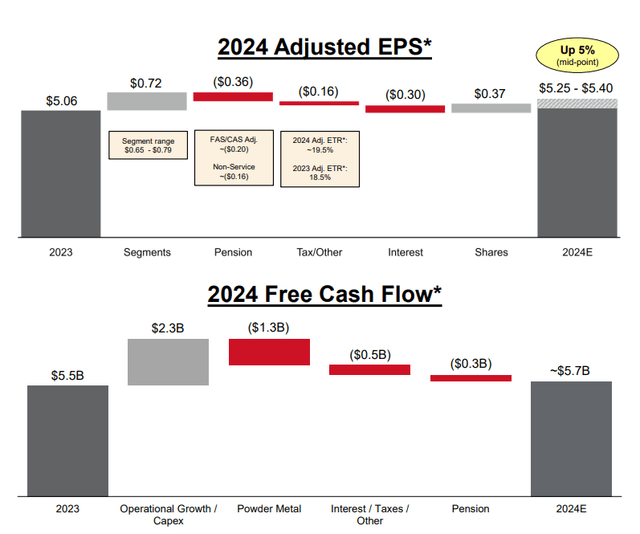

An optimistic forecast for demand from the aviation industry especially is the reason why RTX Corporation is projecting high-single digit top line growth for FY 2024 as well. The company has stated that it sees $78-79B in revenues in this year, which implies a top line growth rate of 7-8%. Earnings are expected to increase 5% Y/Y this year while free cash flow is projected to grow by $200M. Given the strong demand situation currently presented by the aviation industry, I believe that RTX Corporation could outperform its guidance. The U.S. economy also provides some crucial support here, with the latest reading of GDP growth saying that the economy advanced at an exceptionally strong 3.3% in Q4’23.

RTX Corporation

RTX Corporation’s valuation

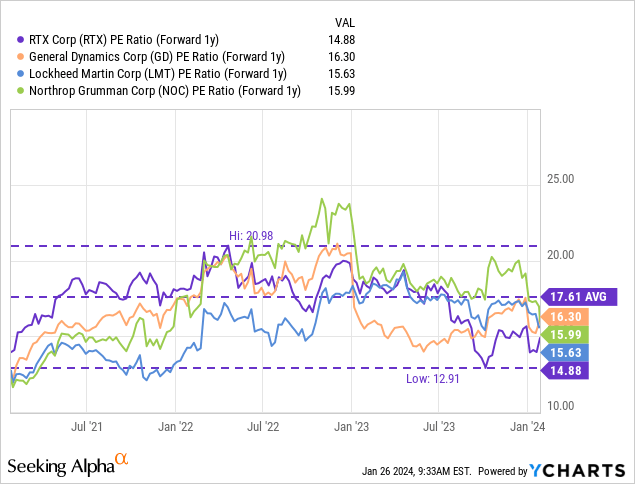

I like the combination of a low valuation based off of earnings and a company that is spending money aggressively on its shares. RTX Corporation, based off of its most recent cash flow statement (Source), spent $10.3B on stock buybacks in the last quarter and a total of $12.9B in FY 2023. This was part of an accelerated $10B share repurchase plan announced last quarter. Shares of RTX Corporation are priced at 15X forward earnings, which is about 5% below the industry average and 16% below the 3-year average P/E ratio. Rivals like General Dynamics (GD), Lockheed Martin (LMT), and Northrop Grumman Corp (NOC) trade at only slightly higher P/E ratios. I consider a 15-16X P/E ratio fair given the cyclical earnings profile of RTX, its solid top line growth, and margin expansion. Based off of consensus EPS of $6.13, RTX Corporation has a fair value range of $92-98 as opposed to my previous range of $84-89.

Income investors may find value in RTX Corporation

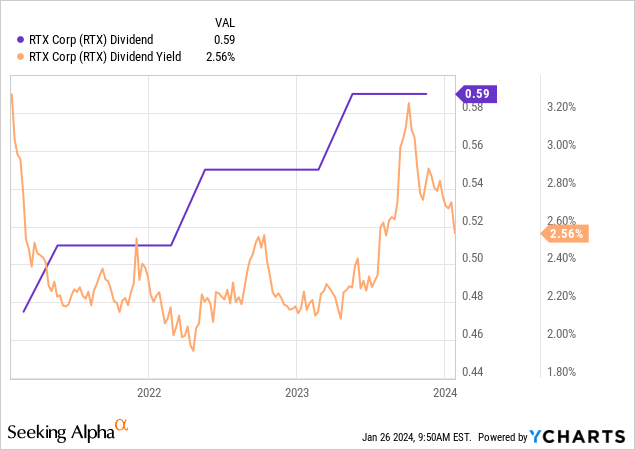

RTX Corporation is paying a $0.59 per-share dividend quarterly and shares currently trade at a 2.6% yield. Without dividend growth, RTX Corporation is set for a 44-45% payout ratio in FY 2024. The odds are overwhelmingly for a dividend increase this year given the optimistic outlook for the aviation industry.

Risks with RTX Corporation

Given the reliance on the aviation industry, I believe that RTX Corporation’s cyclical earnings profile does not make the stock suitable for all investors. RTX Corporation’s biggest risk, as I see it, relates to its reliance on operating income growth specifically in the Aerospace segment… which is currently where all the action happens. I am monitoring both RTX Corporation’s operating margin trend as well as its revenue trajectory.

Final thoughts

RTX Corporation reported better-than-expected fourth-quarter earnings, largely because the Aerospace business continued to shine and delivered impressive operating income growth. Since RTX Corporation is dependent on the strength of the aviation industry and the industry outlook is generally positive, I believe the company could be set for a record year in FY 2024 and surprise a lot as long the U.S. economy is growing as robustly as it did in Q4’23. Additionally, RTX Corporation submitted a very decent forecast for the current fiscal year that calls for mid-to-high single digit top line, earnings, and free cash flow growth!