4kodiak

On November 9, 2023, in a Seeking Alpha article on Red Rock Resorts, Inc. (NASDAQ:RRR), I wrote:

RRR’s slogan is “We love locals,” the latest earnings show the growing local population is returning the affection. RRR is a unique casino resort company that caters to an expanding addressable market, deserving a higher growth potential score. The $4.4 billion company has lots of upside after delivering four straight better-than-expected results. The November 1 spike lower may turn out to be a golden buying opportunity and a significant bottom.

On November 9, RRR shares were at the $41.72 level after falling to $38.82 on November 1. The spike lower was indeed a “golden buying opportunity and a significant bottom,” as the shares have exploded higher over the past three months.

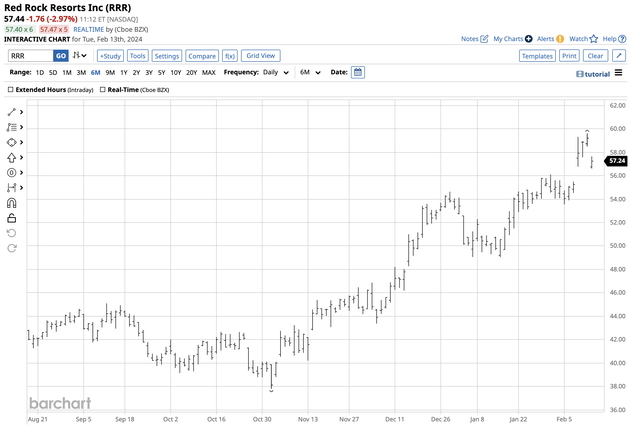

RRR shares rally – The trend remains bullish

Red Rock Resorts shares remain in a significant bullish trend in mid-February 2024.

Six-Month Chart of RRR Shares (Barchart)

As the chart highlights, RRR shares rose to the latest $59.62 per share high on February 12, over 42.9% higher than the price on November 9. The February 12 high came after the company reported Q4 2023 earnings.

Earnings justified the rally

On February 7, 2024, RRR reported a GAAP EPS of $0.95, blowing away the $0.49 estimate. Revenue of $462.71 million was $21.27 million above forecasts. The company beat casino, net, food, and beverage, operating, and room revenue forecasts. RRR declared a special dividend of $1.00 per Class A common share, payable on March 4 to holders of record as of the close of business on February 22, 2024.

The results included the $780 Durango Casino and Resort that opened in late 2023. The earnings pushed RRR shares higher and justified the 56.8% rally since the November 1 $37.82 low.

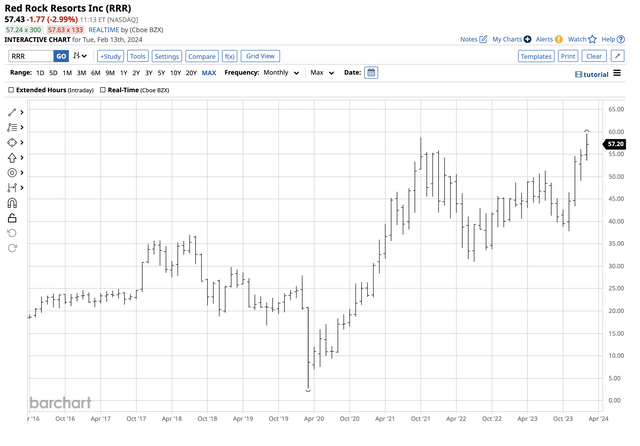

A new all-time high

RRR’s November 1 low turned out to be a “significant bottom,” leading to a new record high for the shares.

Long-Term RRR Chart (Barchart)

The chart illustrates that RRR shares eclipsed the October 2021 $58.74 high on February 8. RRR shares were above the $57 level on February 13.

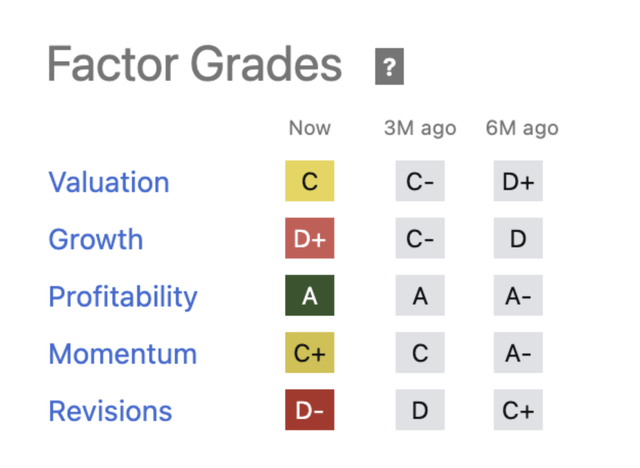

On November 9, 2023, Seeking Alpha had the following factor grades for RRR:

Seeking Alpha Factor Grades- November 9, 2023 (Seeking Alpha)

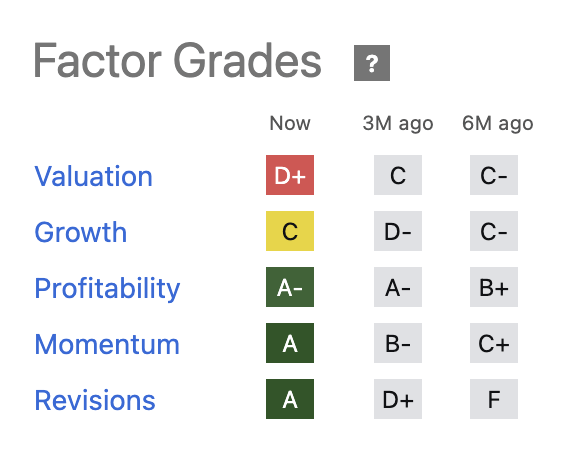

On February 13, the grades were as follows:

Seeking Alpha Factor Grades- February 13, 2024 (Seeking Alpha)

While the higher share price caused valuation to decline to a D+, growth, momentum, and revisions scores rose. Profitability slipped from an A to an A-.

Las Vegas is attracting more and more visitors

Las Vegas has always been a leading destination for conventioneers and vacationers because of its history as a gambling mecca with top-rated resorts, restaurants, and entertainment choices.

Over the past years, the city has become a sports hub. Last weekend, Las Vegas hosted its first Super Bowl after becoming the home of the NFL’s Raiders. The Las Vegas Golden Knights, an NHL franchise, won the coveted Stanley Cup in 2023, a record for an expansion team. The Las Vegas Aces won the WNBA championship for two consecutive years. MLB’s Oakland A’s are moving to Las Vegas. In 2023, the city hosted F-1, in a contract that will bring racing over the next ten years. Las Vegas is also the home of minor league hockey, baseball, and an American professional soccer team, the Las Vegas Lights.

While the local population supports the growing number of professional sports teams, Las Vegas draws fans from all over the United States and the world as fans flock to the city to see their favorite teams compete.

Sports have only increased Las Vegas’s profile as an international entertainment hub, complementing and enhancing traditional shows and concerts.

Las Vegas is attracting more and more residents – Increased demand for local resort and casinos

Nevada is one of only nine states that do not levy a state income tax. Nevada offers no corporate income tax, low median property tax rates, and no estate or inheritance tax.

High tax rates, a lower cost of living, and other issues in neighboring California have caused significant migration over the past years. While Californian migration leads those moving to Nevada, migration is coming from Texas, Florida, Washington, and New York. Las Vegas and Reno are the two top destinations for San Francisco residents, leading their city,

As people move to Nevada, Clark County, the home of Las Vegas, has 2.35 million of the state’s 3.2 million residents.

The bottom line is that Las Vegas is a vacation destination, attracting more residents yearly. The addressable market for local resorts and casinos is growing by leaps and bounds. Stations Casinos is the brand name for Red Rock Resorts. At around $58 per share on February 13, RRR has a $5.73 billion market cap. It trades an average of about 400,000 shares daily, and the recently announced $1 dividend only sweetens the stock’s attraction.

As mentioned in the November 9 article:

According to its website, RRR controls “six highly desirable gaming-entitled development sites consisting of approximately 354 acres in Las Vegas, Nevada.”

Red Rock Resorts, Inc. can grow with Las Vegas’s growing population and benefit from the increasing number of visitors, as sports only enhance the destination’s desirability. Conventions and vacationers will continue to flock to Las Vegas, and the demand for resort and casino amenities will spread from the Strip and Fremont Street area throughout Clark County. RRR is perfectly positioned to grow with the city over the coming years, so Seeking Alpha’s growth factor rating at C could be too low.

Red Rock Resorts, Inc. shares reached a new high after the latest earnings report. Any pullback could offer long-term value for the company that will continue to benefit from Las Vegas’s success.