Yuichiro Chino/Moment via Getty Images

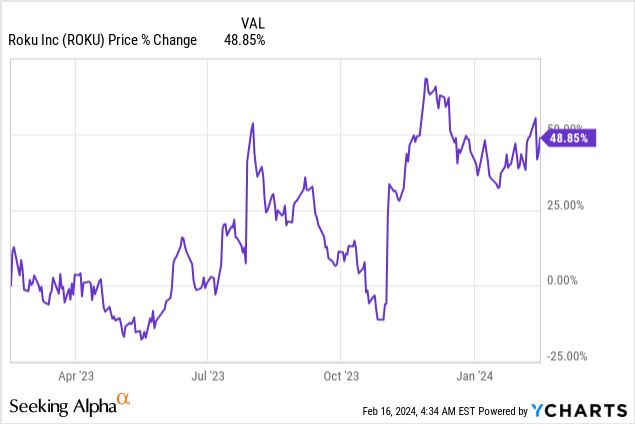

Shares of Roku (NASDAQ:ROKU) tumbled 15% in extended trading after the streaming platform reported better than expected results for the fourth-quarter on Thursday. Although Roku reported a Y/Y drop in its key metric average revenue per user, I believe the market is overreacting to the earnings report: Roku achieved positive adjusted EBITDA for the first time in FY 2023 (one year ahead of the projected timeline), guided for sustained revenue momentum in Q1’24 and is expanding its user base rapidly. While there are headwinds and risks, I believe the 15% drop in pricing is exaggerated and investors have a unique opportunity to load up the truck here!

Previous rating

My previous coverage (November 2023) resulted in a hold rating for Roku due to strong growth in accounts and a negative average revenue per user/ARPU metric. However, the decline in the ARPU figure has moderated and the outlook for Q1’24 is very solid (and beat the consensus estimate by a good margin). As a result, a rating upgrade to buy could be justified, in my opinion.

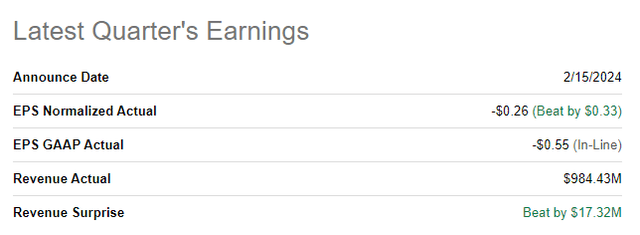

Roku beats earnings

Roku again easily beat top and bottom line estimates for the fourth-quarter: the streaming platform achieved $(0.26) per-share in adjusted earnings on revenues of $984.4M. The bottom and top line came in $0.33 per-share and $27M ahead of the respective consensus predictions.

Key takeaways from Roku’s most recent earnings release

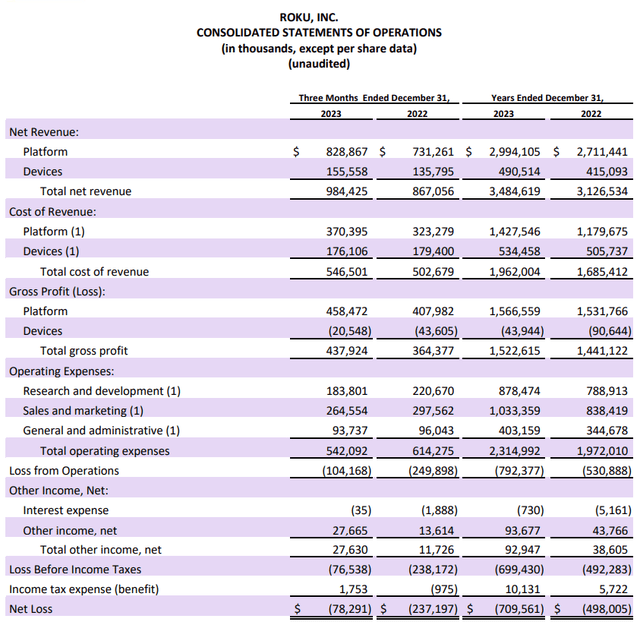

Roku delivered double-digit top line growth (+14% Y/Y) in the fourth-quarter and generated revenues of $984.4M. While the streaming company still reported a net loss of $78.3M for the fourth-quarter and a sizable loss of $709.6M for FY 2023, the streaming company finally achieved positive adjusted EBITDA, for the first time ever, on a full-year basis. Roku’s revenue momentum was supported by a continual recovery in video advertising which has rebounded in FY 2023 after advertisers cut back on spending in a high-inflation world. Since inflation continued to fall in January, I expect these recovery trends to continue.

Roku’s core engagement metrics for its streaming business are showing healthy growth: the number of active accounts grew by 4.2M in the fourth-quarter — which is typically a strong quarter due to customers having a lot of free time during the holiday season — showing a 14% year over year growth rate.

Engagement metrics like streaming hours also saw strong growth of 22% in Q4’23. On the Roku platforms, 29.1B hours of content were streamed during the fourth-quarter, the most in any quarter ever.

What was not great was Roku’s average revenue per user which declined 4% year over year to $39.92. However, the decline somewhat softened compared the prior quarter when the ARPU figure showed a 7% decline Y/Y. Roku’s average revenue per user is dropping due to stiff competition in the streaming market.

|

Actual Results |

Q4’22 |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

Growth Y/Y |

|

Active Accounts (millions) |

70.0 |

71.6 |

73.5 |

75.8 |

80.0 |

14% |

|

Streaming Hours (billions) |

23.9 |

25.1 |

25.1 |

26.7 |

29.1 |

22% |

|

Average Revenue Per User/ARPU ($) |

$41.68 |

$40.67 |

$40.67 |

$41.03 |

$39.92 |

-4% |

(Source: Author)

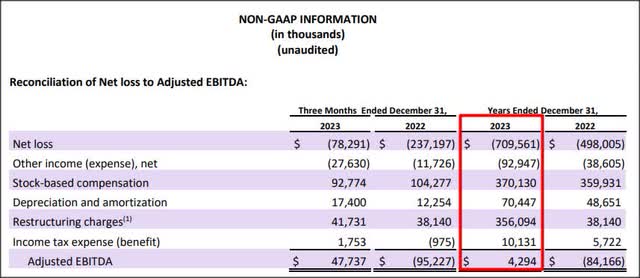

My main reason for Roku’s rating upgrade, however, relates chiefly to the streaming platform crushing its EBITDA goals.

Roku guided for adjusted EBITDA of $10.0M in Q4 which the company smashed by reporting actual EBITDA $47.7M. The strong EBITDA outperformance in Q4’23 was the reason that Roku achieved positive full-year adjusted EBITDA of $4.3M. Roku originally guided for EBITDA profitability in FY 2024, so the company crushed this goal as well. Since investors have been waiting to see Roku achieve this EBITDA milestone for many years, the market’s overreaction on Thursday is truly puzzling and may simply be explained by profit taking.

Outlook for Q1’24

Revenues tend to drop off on a sequential basis in Q1’24, due to the inclusion of the spending-strong holiday season, but Roku’s platform is set to continue to grow in FY 2024. Roku expects double-digit top line growth for its platform business in the first-quarter and projected total revenues of $850M which sailed past the consensus analyst estimate of $834M. The outlook for Q1’24 implies 15% year over year growth.

Roku’s valuation

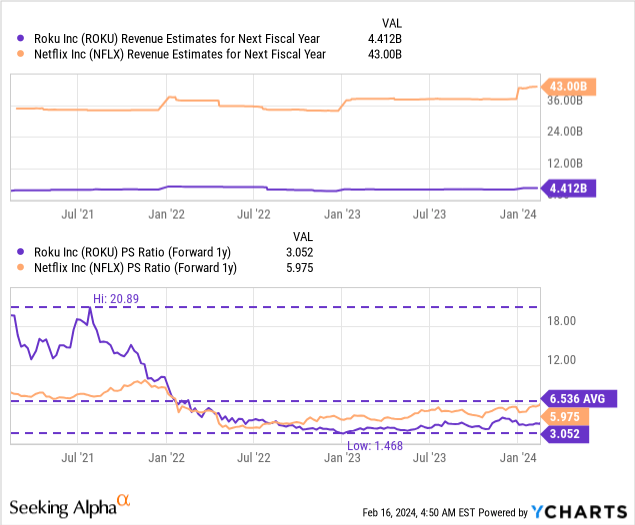

Roku’s share price has consolidated on a high level after the company’s third-quarter earnings report. The streaming company is expected to regenerate $4.0B in revenues in FY 2024 and $4.4B in FY 2025, implying a growth rate of 14% year over year. Estimate may reset higher after the company’s strong Q4 earnings release which could help stabilize the sell-off.

Roku is not profitable on a net income basis, so I am using a P/S ratio to value the streaming company. Currently, Roku is valued at 3.0X forward revenues compared to Netflix (NFLX)’s 6.0X P/S ratio. Netflix itself submitted a blowout earnings report for Q4’23, due to soaring subscriber numbers, which caused me to upgrade Netflix despite a very high valuation. Roku is much cheaper than Netflix, but is also not yet profitable which likely explains why Netflix is trading at a much higher revenue multiplier.

Given the sustained revenue momentum and achievement of the EBITDA milestone ahead of time, I believe shares of Roku could trade at 4.0X revenues, but only if the company doesn’t lose its top line momentum and the platform keeps growing its account base. In this case, a fair value 4.0X P/S ratio implies a fair value estimate of $105.

Risk profile

There is obviously a risk with Roku’s average revenue per user figure which shows weakening monetization on a per-user basis. Although the streaming platform is still growing rapidly in terms of adding new accounts, Roku’s average revenue per user figure is a figure that is worth tracking going forward. What would change my mind about the streaming platform is if the company failed to acquire new customers on a double-digit Y/Y basis and failed to achieve adjusted EBITDA profitability in FY 2024. Slowing ad spending may also be a problem for Roku if advertising markets weaken during a recession, for example.

Closing thoughts

Roku does not have a growth problem: the streaming platform is making solid gains on an account basis and its revenues grew 14% in Q4’23. Roku added a massive 4.2M new accounts to its streaming platform in the fourth-quarter, the outlook for Q1’24 implies double-digit top line momentum and beat the consensus estimate by a considerable margin, and the firm is achieved adjusted EBITDA profitability for the first time in its history on a full-year basis. While slowing ad spending and weakening user monetization are concerns, the ARPU trend actually improved quarter over quarter: Roku’s ARPU dropped only 4% compared to 7% in Q3’23. I believe Roku’s persistent top line momentum, account growth and massive EBITDA improvement make shares a buy after Q4’23 earnings, not a sell. Time to get greedy!